Matchless Tips About Dividend In Balance Sheet

The balance sheet is based on the fundamental equation:

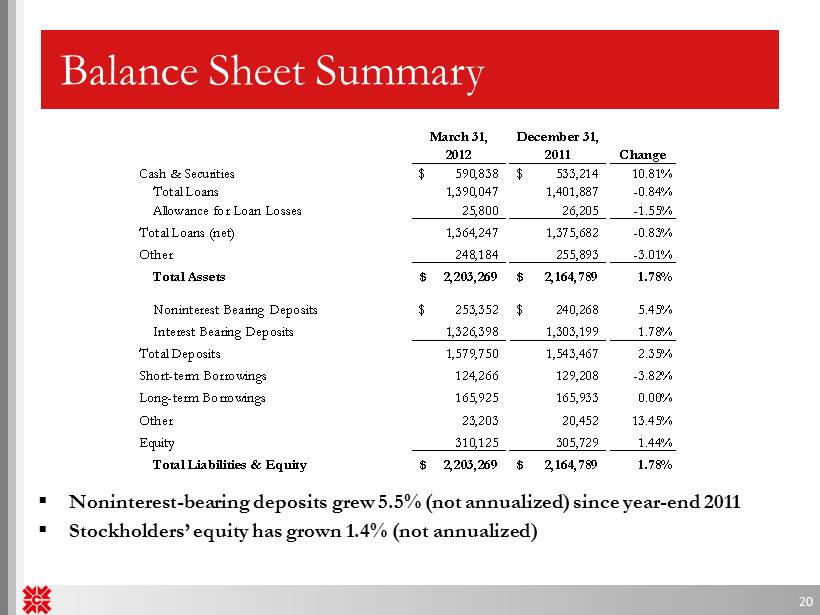

Dividend in balance sheet. Also, dividends are distributed out of a company's accumulated earnings. Dividends are distributions of a company’s profits or retained earnings to its shareholders. Current liabilities (dividends payable) will decrease.

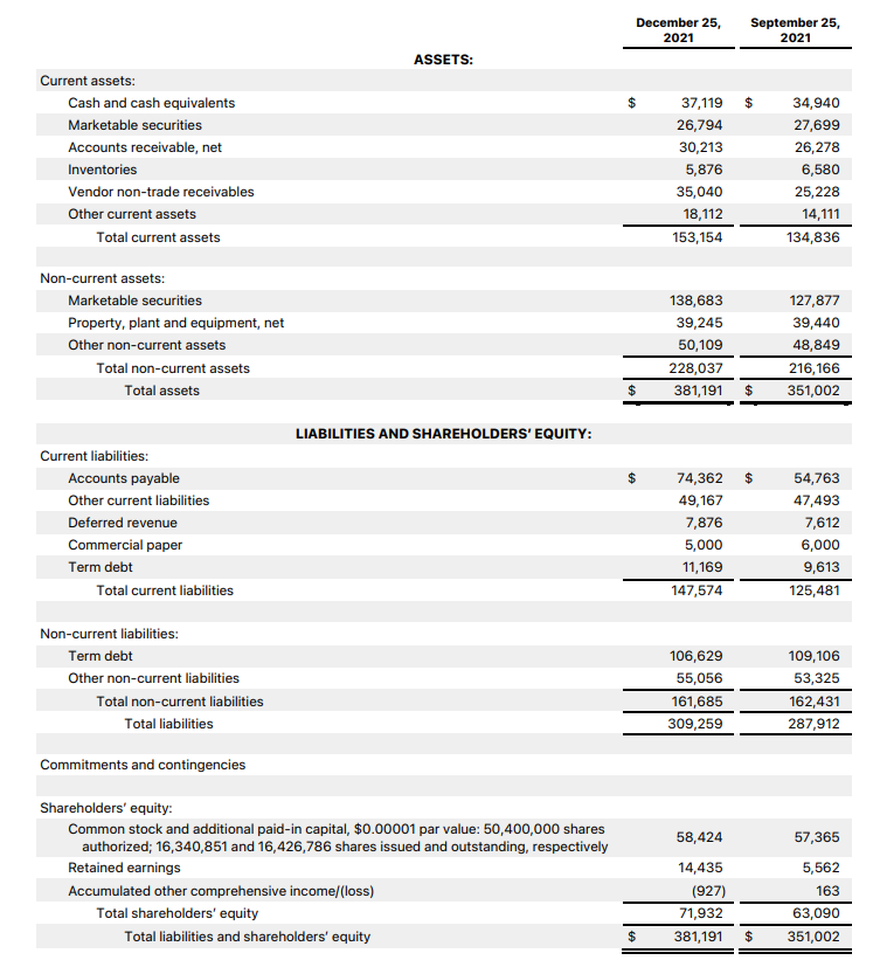

That is an impressive level of growth in the dividend. Stock dividends do not result in asset changes of the balance sheet but rather affect only the equity side by reallocating part of the retained earnings to the common stock. When the cash dividend is paid, the following will occur:

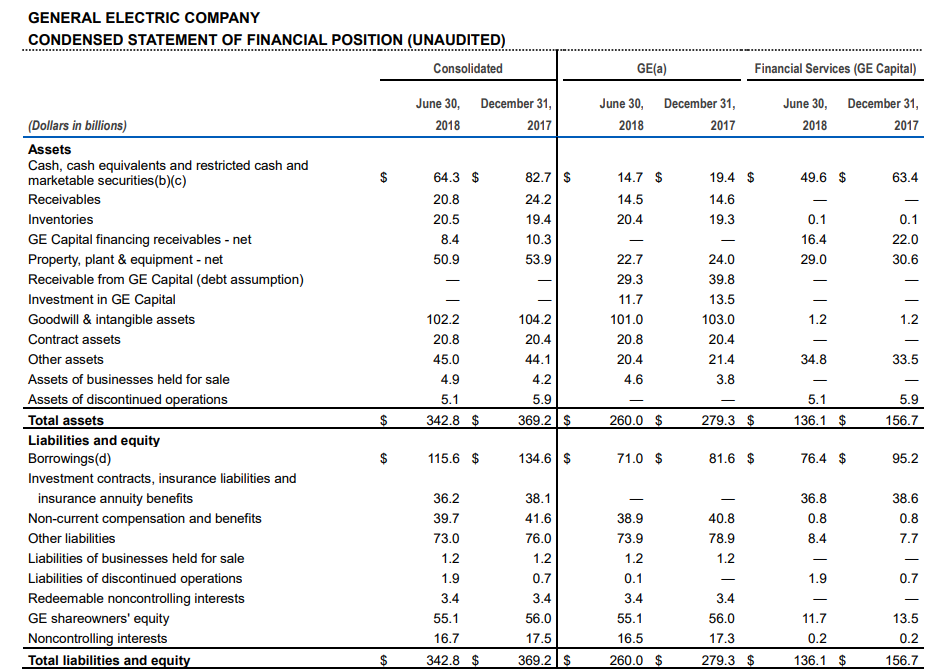

Earnings estimates and the balance sheet. Having a strong balance sheet gives exxon flexibility if there is a downturn. Proposed dividends are shown as current liability in the balance sheet.

Analyst earnings estimates are at $4.13 for 2024, $5.84 for 2025,. Dividends payable is classified as a current liability on the balance sheet, since the expense represents declared payments to shareholders that are generally. All an investor needs are the retained earnings from the past two years and the.

When cash dividends are paid, this reduces the cash balance stated within the assets section of the balance sheet, as well as the offsetting amount of retained. They represent a reward for investing in the company, as shareholders. Dividends that were declared but not yet paid are reported on the balance sheet under the heading.

Current liabilities (such as dividends payable) will increase. Our dividend proposals are a reflection of the strong 2023 financials, our growth prospects in 2024 and balance sheet strength.”. Cfi’s financial analysis course as such, the balance sheet is divided into two.

How to calculate dividends from the balance sheet and income statement to calculate dividends for a given year, do the following: Exxon was able to fund its operations and grow its. On the balance sheet, dividends do not directly impact the asset and liability sections.

Calculating dividend payments from a company's balance sheet is rather easy. The dividend is owed to shareholders on record on 21 july and paid on 30 july. Assets = liabilities + equity.

When a company decides to pay dividends to its shareholders or partners, this must appear in its accounts and be recorded on the balance sheet. A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholders' equity. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset.

Before dividends are paid, there is no impact on the. The company repurchases stock and pays dividends, but not nearly at the. As fixed assets age, they begin to lose their value.

:max_bytes(150000):strip_icc()/FacebookbalancesheetREDec2018-5c73549b46e0fb00014ef630.jpg)