Breathtaking Info About Capital On Balance Sheet

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)

Investors utilize the return on invested capital (roic) ratio to assess the efficiency with which a company uses capital.

Capital on balance sheet. Explore northlink fiscal & capital services financial statements and annual reports. Capital structure = do + tse where: Let's take an example to illustrate this formula.

Northlink fiscal & capital services balance sheet: If the authorized number of shares is. These assets may include cash, cash equivalents, and marketable securities as well as.

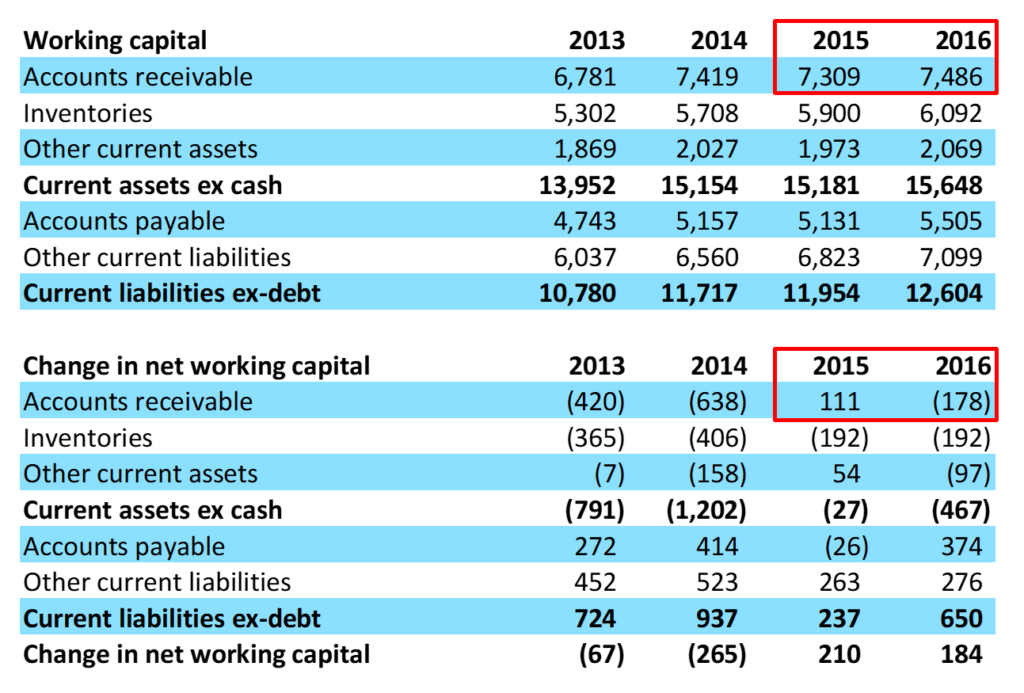

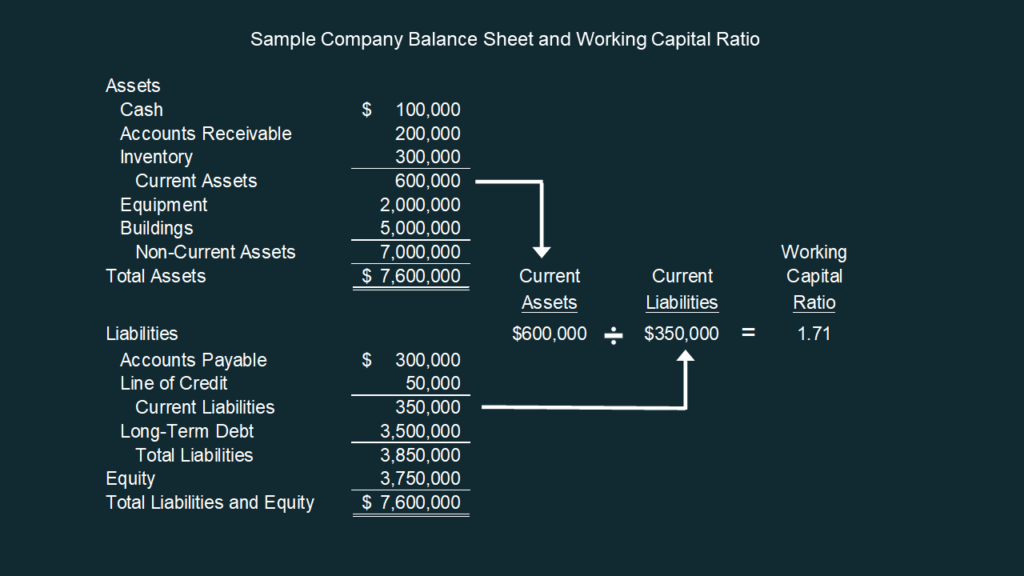

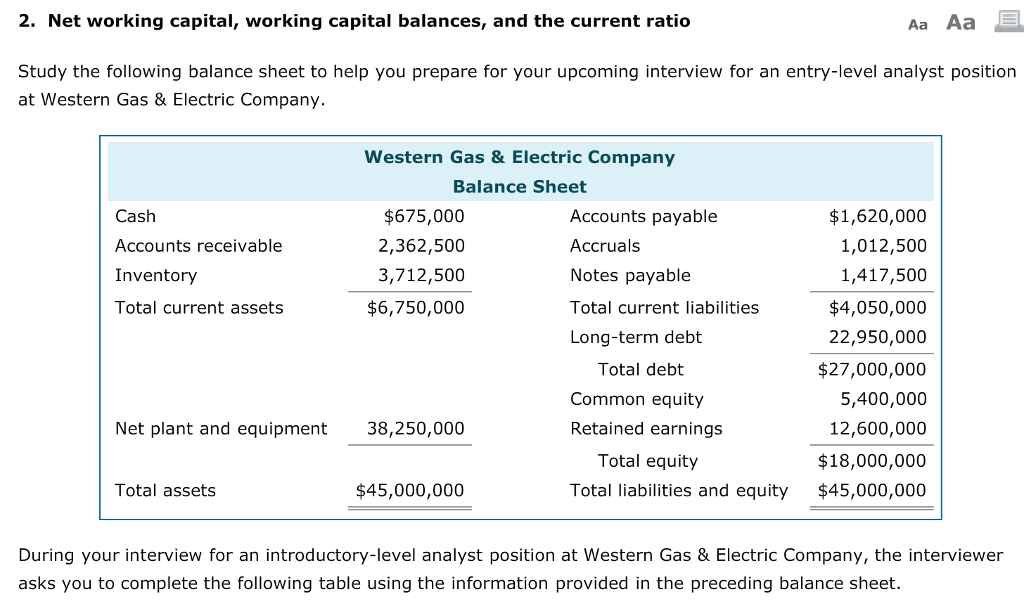

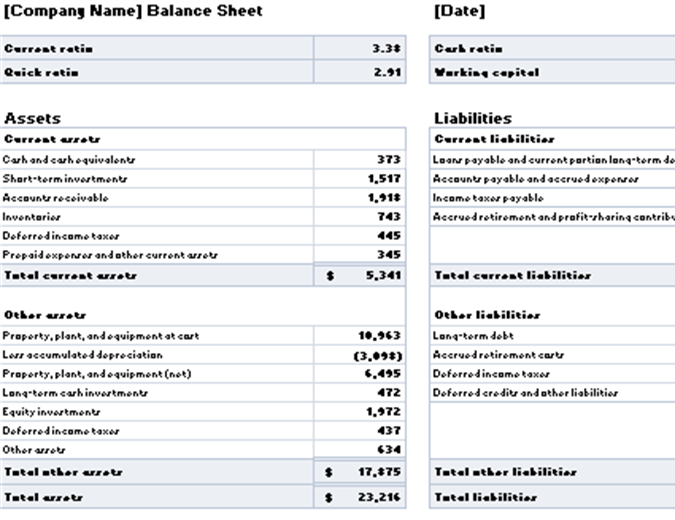

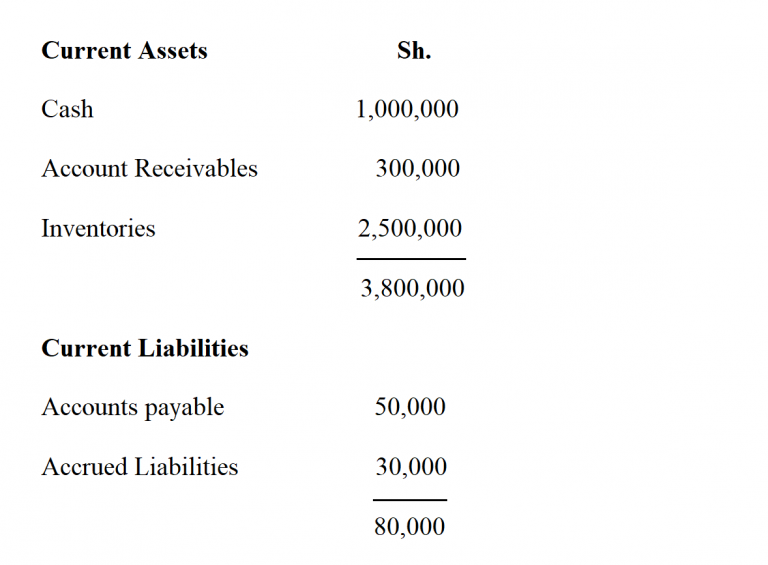

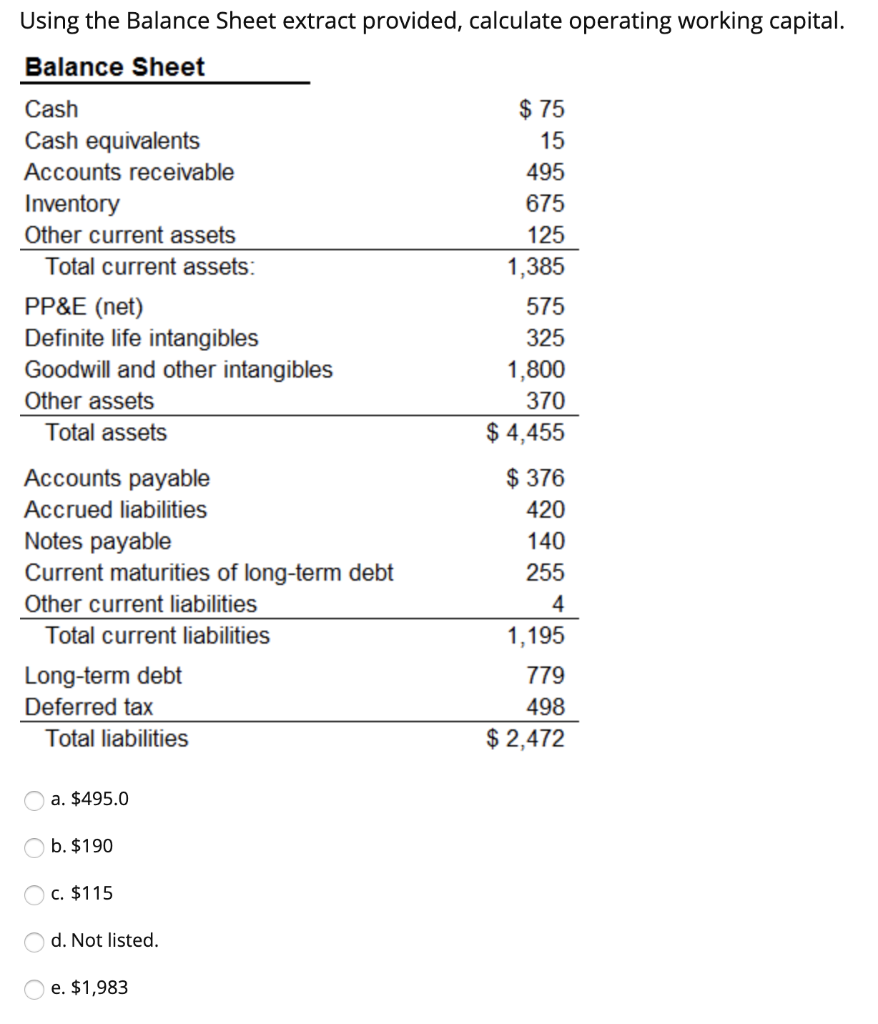

Balance sheets provide the basis for. Starting on the liabilities side of the balance sheet, take any line items that refer to debt and leases and input them into the spreadsheet, under the excluded liabilities tab. Working capital formula the working capital is the difference between current assets and current liabilities, at its simplest definition.

To general fund ‐ state. Show comments ( ) shares in pick n pay crashed nearly 12% after the embattled retailer announced a raft of proposed measures to shore up its balance sheet, including tapping shareholders for r4 billion in a capital raise and separately listing value chain boxer. Capex on the balance sheet.

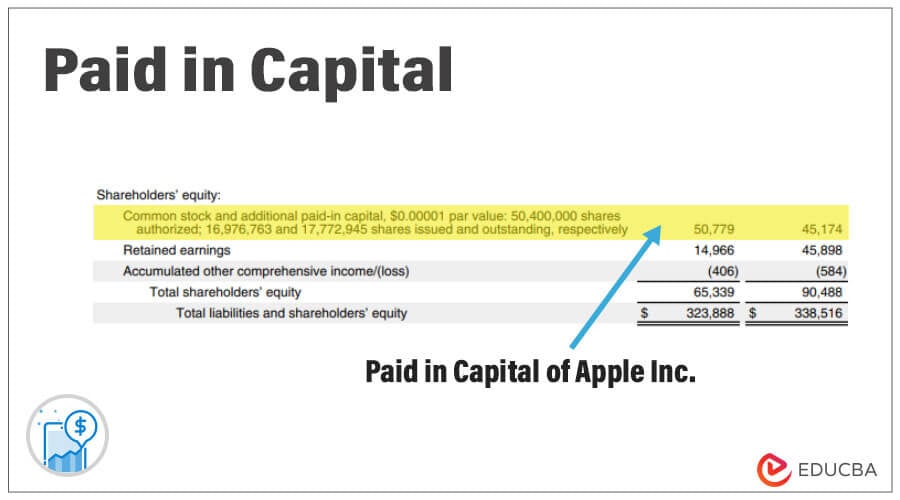

It can also be referred to as a statement of net worth or a statement of financial position. Loans that companies eventually must repay trading capital: Shareholders’ equity is the difference between a.

In your balance sheet, capital will fall under the equity category and have the surplus and reserve classification. Balance sheets include assets, liabilities, and shareholders’ equity. Offsetting these obligations, it had cash of us$221.3m as well as receivables valued at us$1.09b due within 12 months.

In the fourth quarter of 2023, china's current account registered a surplus of rmb 398.3 billion, including a surplus of rmb 1108.8 billion under trade in goods, a deficit of rmb 440.2 billion under trade in services, a deficit of rmb 301.9 billion under primary income, and a surplus of rmb 31.6 billion under secondary income. There are two main ways to calculate invested capital: But, even though the capital reserve will leave a surplus of funds, those funds aren’t.

To calculate capital on the balance sheet, you need to add up the value of all the components mentioned above. Invested capital is one of the main components of the popular return on invested capital, or roic, metric. Once capitalized, the value of the asset is slowly reduced over time (i.e., expensed) via depreciation expense.

Invested capital is the total amount of money raised by a company by issuing securities to equity shareholders and debt to bondholders. As fixed assets age, they begin to lose their value. In simple terms, the capital reserve is a surplus from different transactions and is most commonly acquired when you sell a capital asset.

Axa enters its new strategic plan in a position of strength. Suppose a company has the following balance sheet: Assets = liabilities + equity.

:max_bytes(150000):strip_icc()/how-to-calculate-working-capital-on-the-balance-sheet-357300-color-2-d3646c47309b4f7f9a124a7b1490e7de.jpg)