Wonderful Info About Advance From Customers Balance Sheet

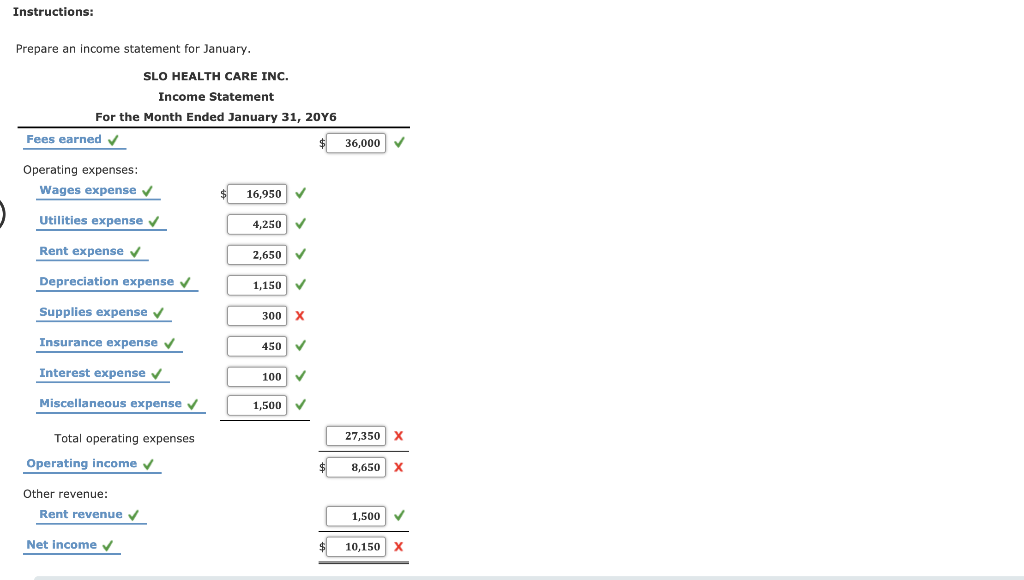

However, advance payments need to be accounted for in order to balance your books and.

Advance from customers balance sheet. When the final product is ready for delivery. As per accrual based accounting the revenue is earned at this step i.e. In other words, the supplier is paid before they commence their service.

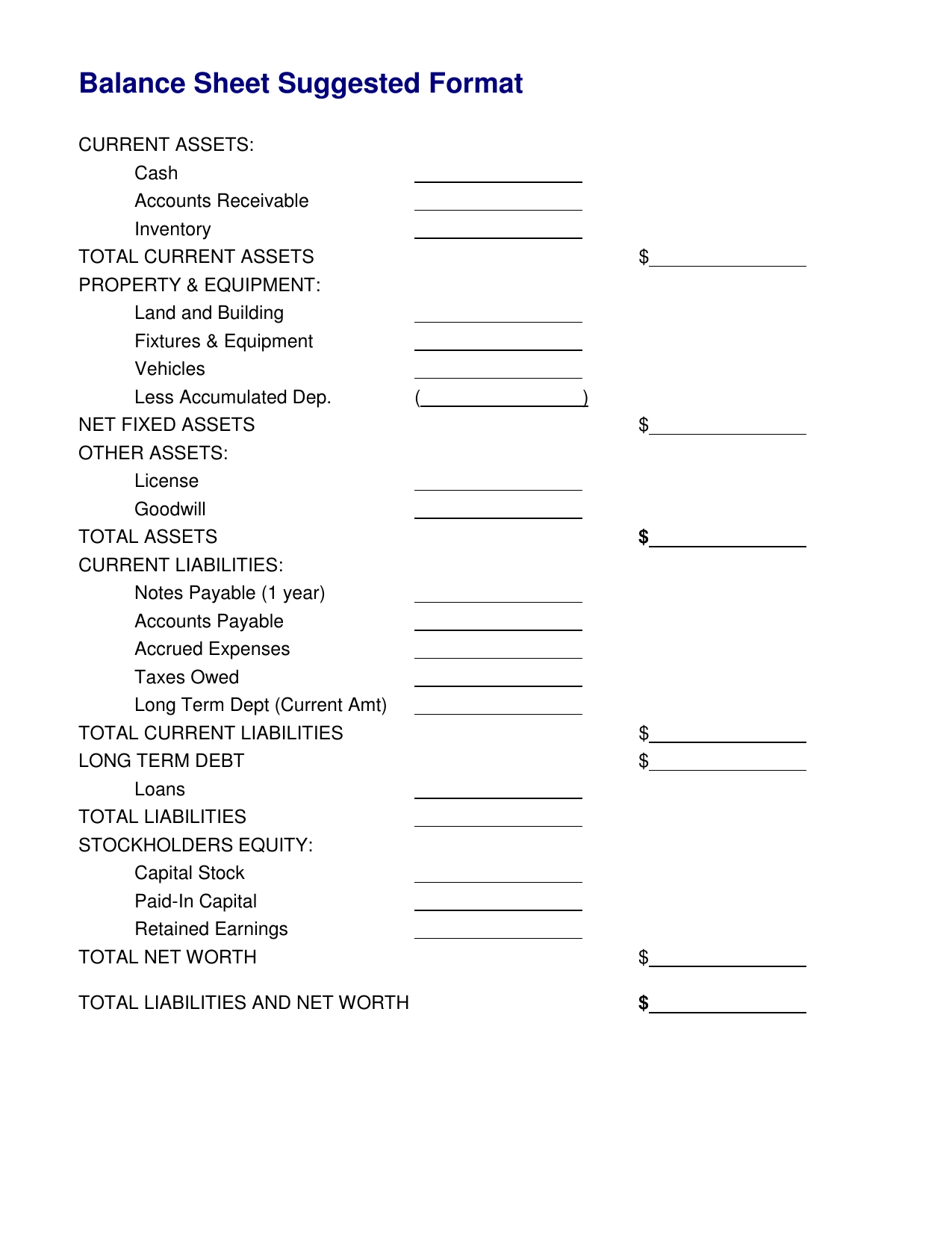

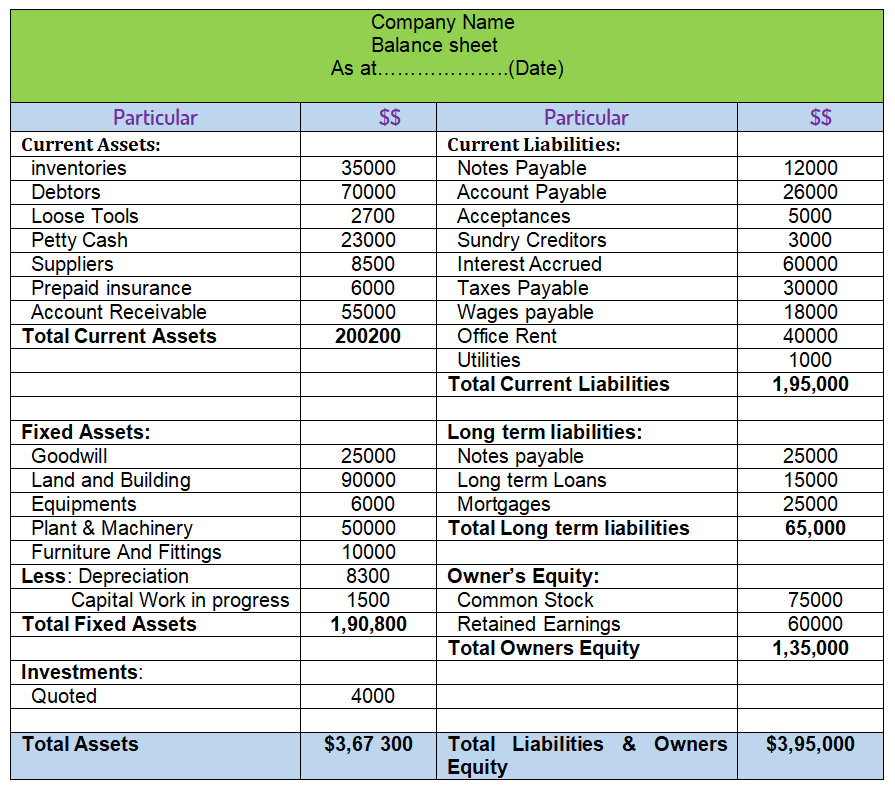

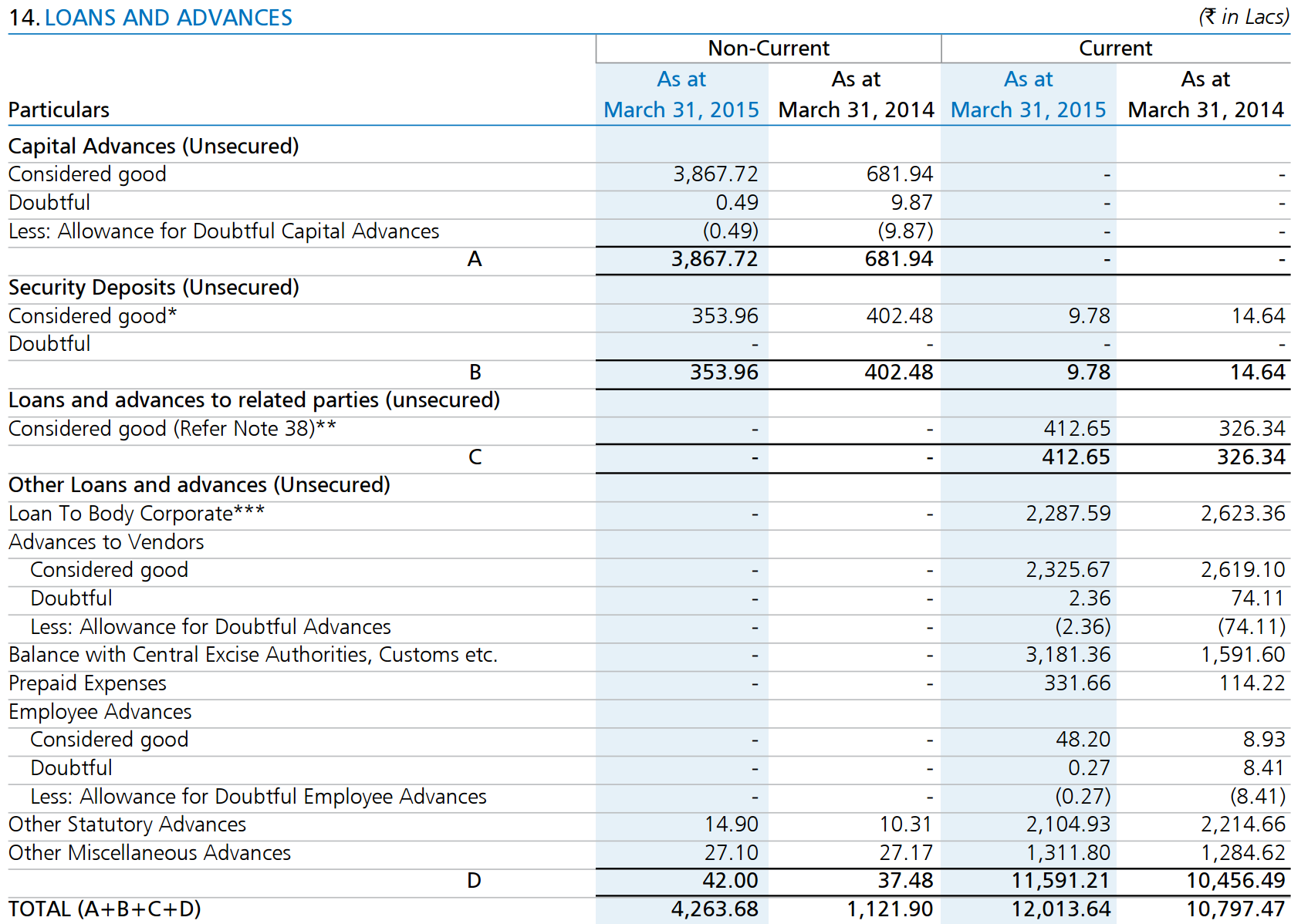

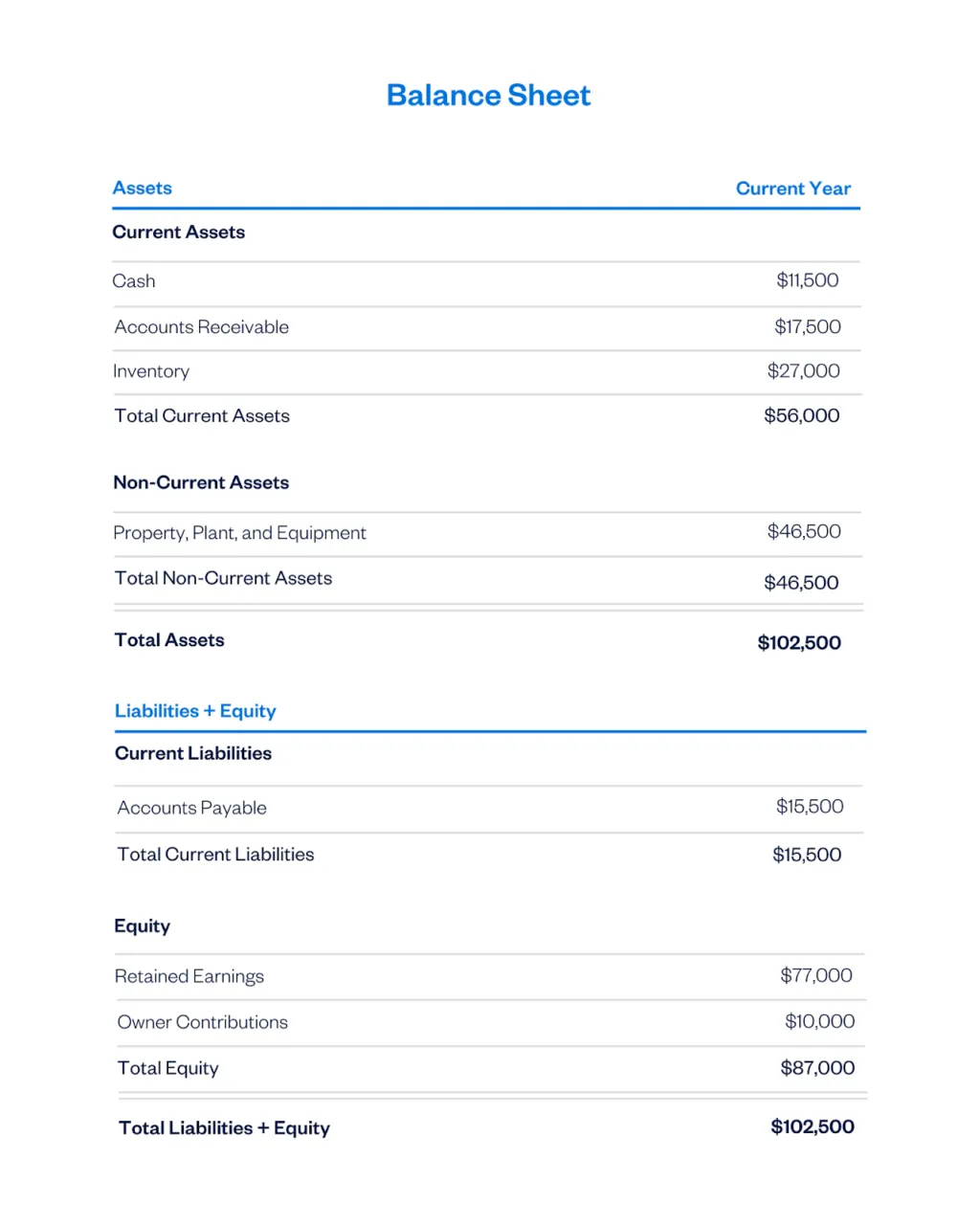

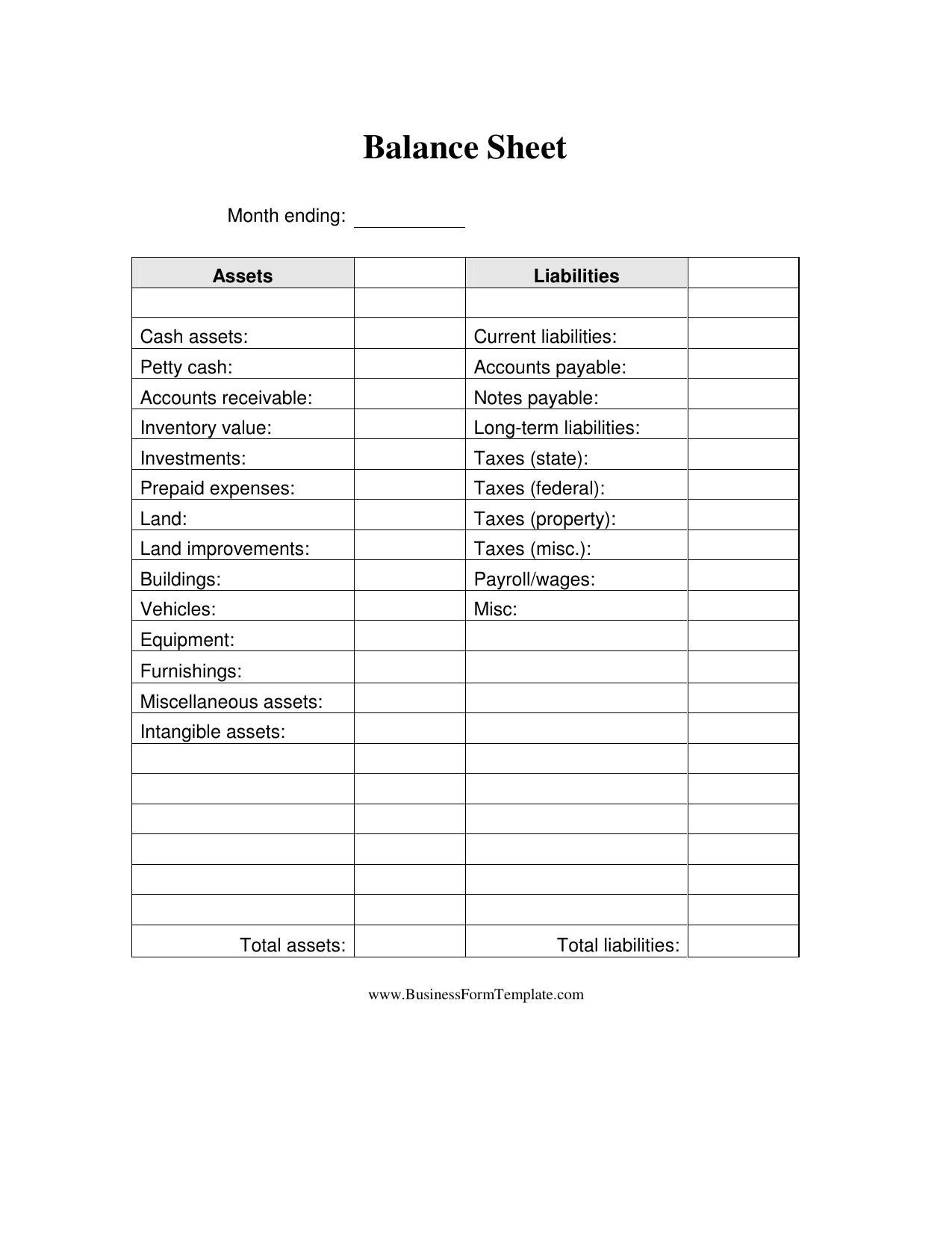

Examples of revenue received in advance. As the goods or services have not been delivered, the revenue from the sale has not been earned, and the cash receipt must be recorded as a liability in the balance sheet. A customer advance is usually stated as a current liability on the the balance sheet of the seller.

Customer does not pay the consideration until march 1. When using quickbooks online to account for advance payment you’ve made to a supplier, you’ll use the expense feature and follow these steps: Introduction running a business in today’s world can be quite challenging.

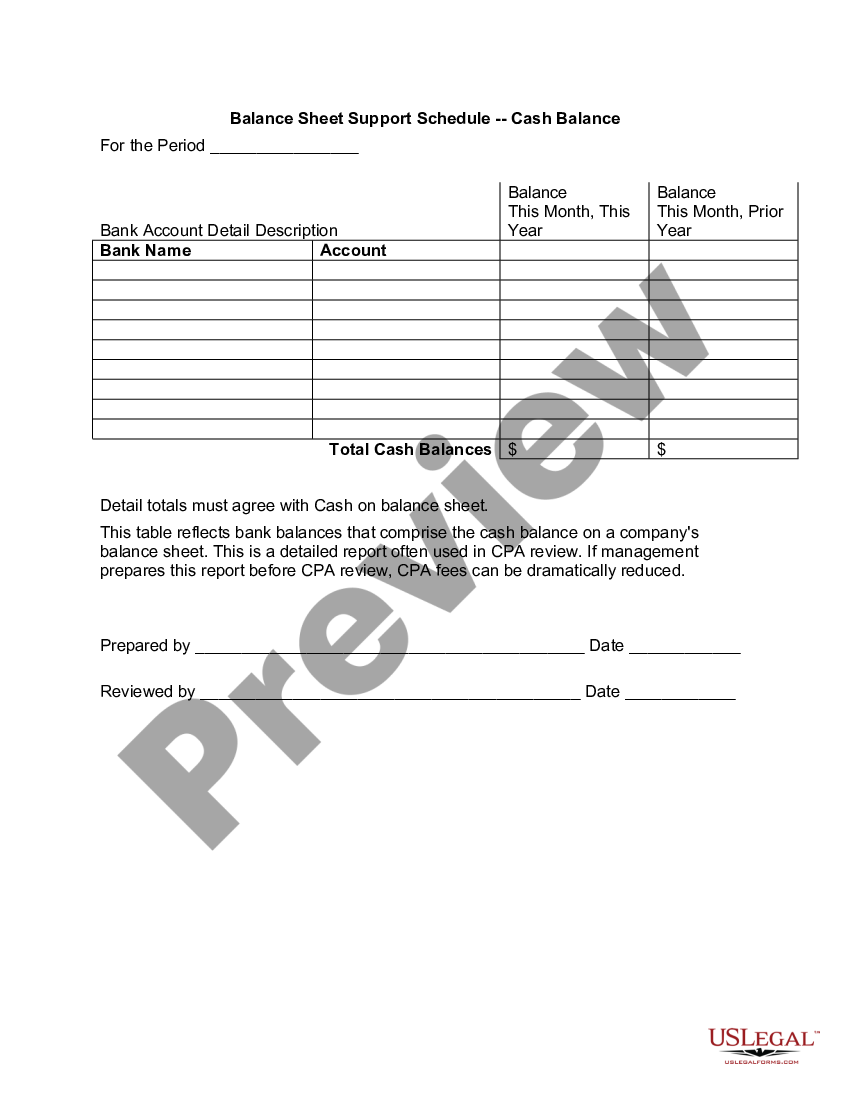

Advance from customer definition. This account is referred to as a deferred revenue account and could be entitled customer deposits or unearned revenues. How to account for an advance payment.

Know more about expenses in the business. Receives $4,000 cash in advance from a customer for services not yet rendered. What are customer advances?

To tackle this problem, there’s a solution called “advance billing.” Advances from customers are oftentimes collected when businesses sell prepaid subscriptions or gift certificates. It is recorded on the liabilities side of the balance sheet until an invoice is sent to the customer.

A lot goes into categorizing your expenses for clear account management. Why is it important to appropriately account for advance payments? Select the income category and enter the amount, discount, tax if any.

Following the receipt of this cash, the company would classify the advance as a current liability on the balance sheet. A liability account used to record an amount received from a customer before a service has been provided or before goods have been shipped. For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it.

As the amount received in advance is earned, the liability account should be debited for the amount earned and a revenue account should be credited. Definition the term advances from customers refers to money collected by a company prior to providing a product or service. The advance payment is classed as earned revenue if the payment is for goods and services that have been partially or completely delivered to the customer, but have not yet been invoiced.

If revenue is earned, it is treated as income. The change to liabilities will increase liabilities on the balance sheet. We know that the company collected cash, which is an asset.