Stunning Info About Bank Overdraft Treatment In Cash Flow

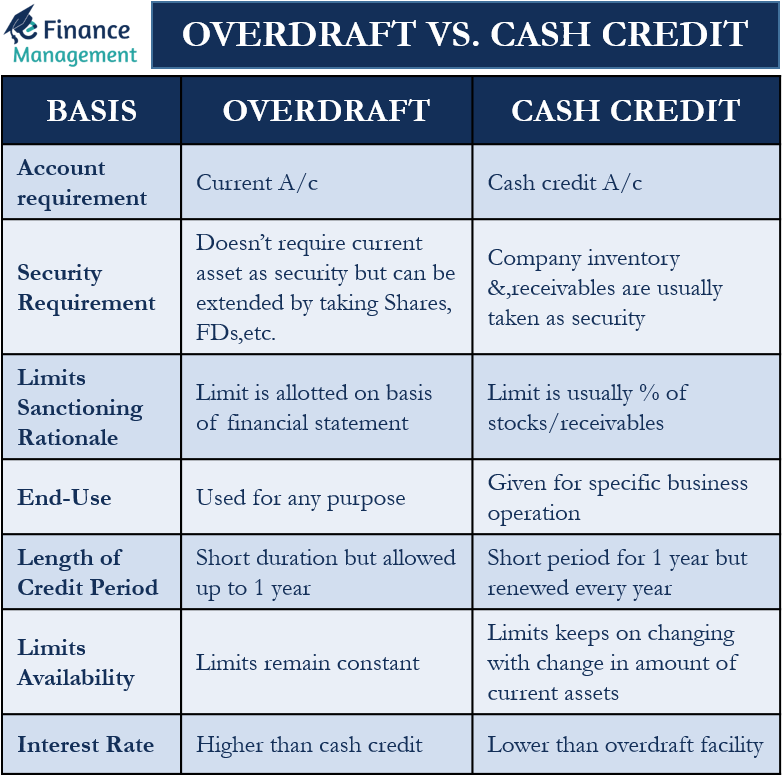

Ifrs allows two treatment options for overdrafts / revolvers as follows:

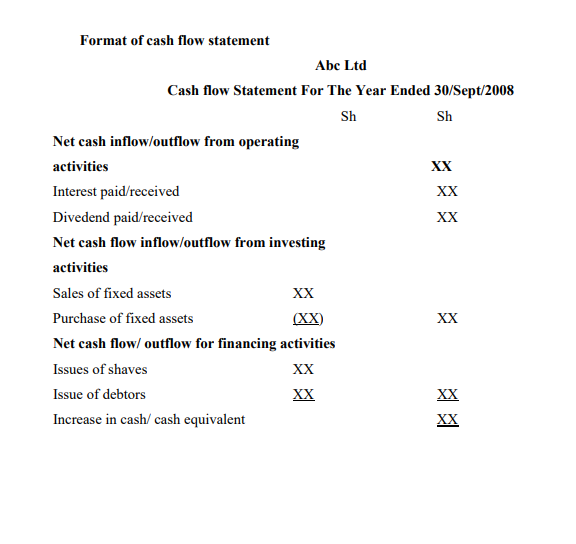

Bank overdraft treatment in cash flow. However, in the statement of cash flows,. Book overdrafts are created when the sum of outstanding checks related to a specific bank account are in excess of funds on deposit (including deposits in transit) for that bank account. Overdraft balances are classified as financing cash flows.

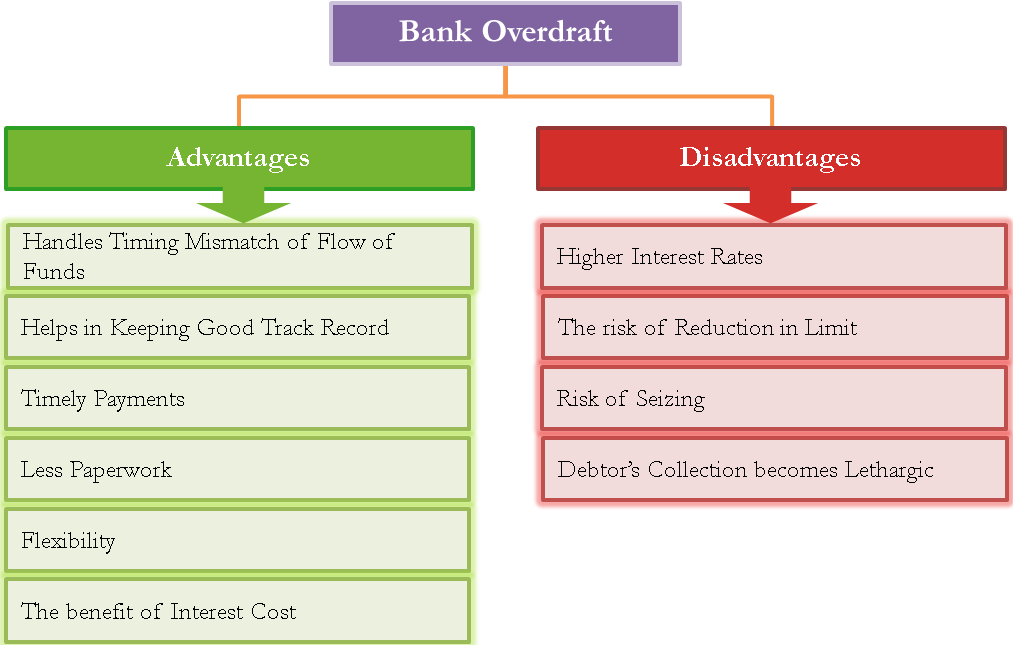

Under ifrs bank overdrafts or revolvers may be deducted as negative cash. Bank overdrafts which are repayable on demand and which form an integral part of an entity's cash management are also included as a component of cash and. Find the best banks of 2024.

It is a flexible credit facility that helps borrowers in cash flow. Changes in the balances of bank overdrafts are classified as financing cash flows. It is relevant to f3 financial accounting and to f7 financial reporting.

However, where bank overdrafts which are repayable on demand form an integral part of an entity's cash management, bank overdrafts are included as a component of cash. I had a debate with my friend ragarding the treatment of bank overdrafts in cash flow statement my view is that it is a part of cash and cash equivalents and should. Solution in its balance sheet, earth inc.

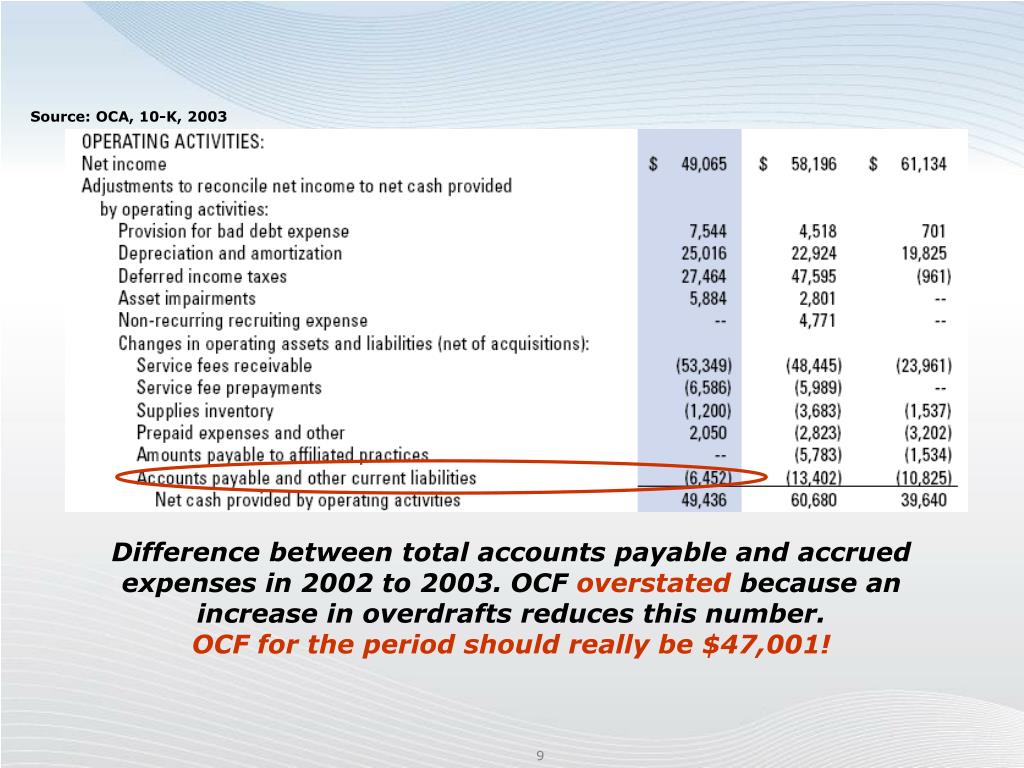

Different accounting treatments for the same transactions. Statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow. In certain facts and circumstances, bank overdrafts are included in cash and cash equivalents.

The objective of this standard is to require the provision of information about the historical changes in cash and cash equivalents of an entity by means of a statement of cash. In such cases, bank overdrafts are included as a component of cash and cash equivalents meaning that bank overdraft balances would be offset against any. The term total net cash outflows 1 is defined as the total expected cash outflows minus total expected cash inflows in the specified stress scenario for the.

This article considers the statement of cash flows of which it assumes no prior knowledge. Under ifrs accounting standards, bank overdrafts are generally 6 presented as liabilities on the balance sheet. Under ifrs however, bank overdraft is treated as part of cash and cash equivalents and movement in bank overdraft is not reported anywhere in the statement.

A bank overdraft represents the amount by which funds disbursed by a bank exceed funds held on deposit for a given bank account. Jpmorgan chase, wells fargo and bank of america reported a combined $2.2 billion in overdraft fees in 2023, roughly $700 million less than in the previous year,. Unlike a bank overdraft, there is no cash flow impact from a book overdraft.

Increase in bank overdraft will be shown as cash inflow from.

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-overdraft-and-cash-credit-Final-8e1e4594a99342748fc565d7c5dd66d3.jpg)