Sensational Info About Exemption From Preparing Consolidated Financial Statements Disclosure

![[Solved] I need help with finishing up journal entries for part c](https://i1.rgstatic.net/publication/269629906_A_Comparative_Analysis_of_Disclosures_in_Annual_Reports/links/549021f00cf225bf66a81a7d/largepreview.png)

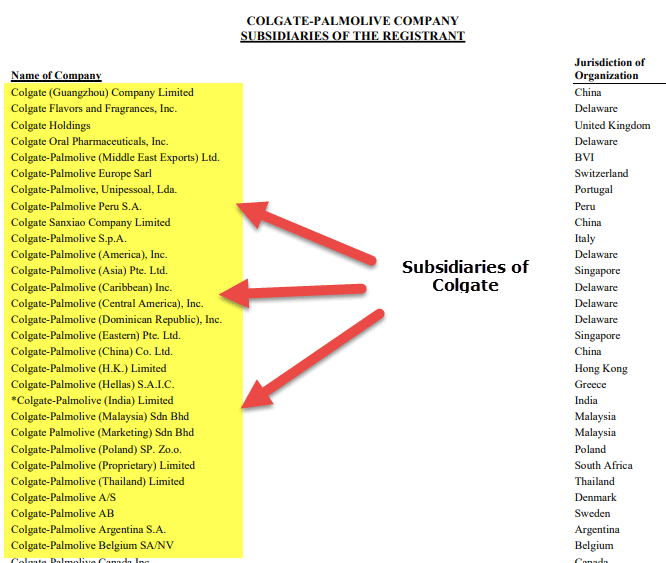

Under the companies act a parent company is not required to prepare.

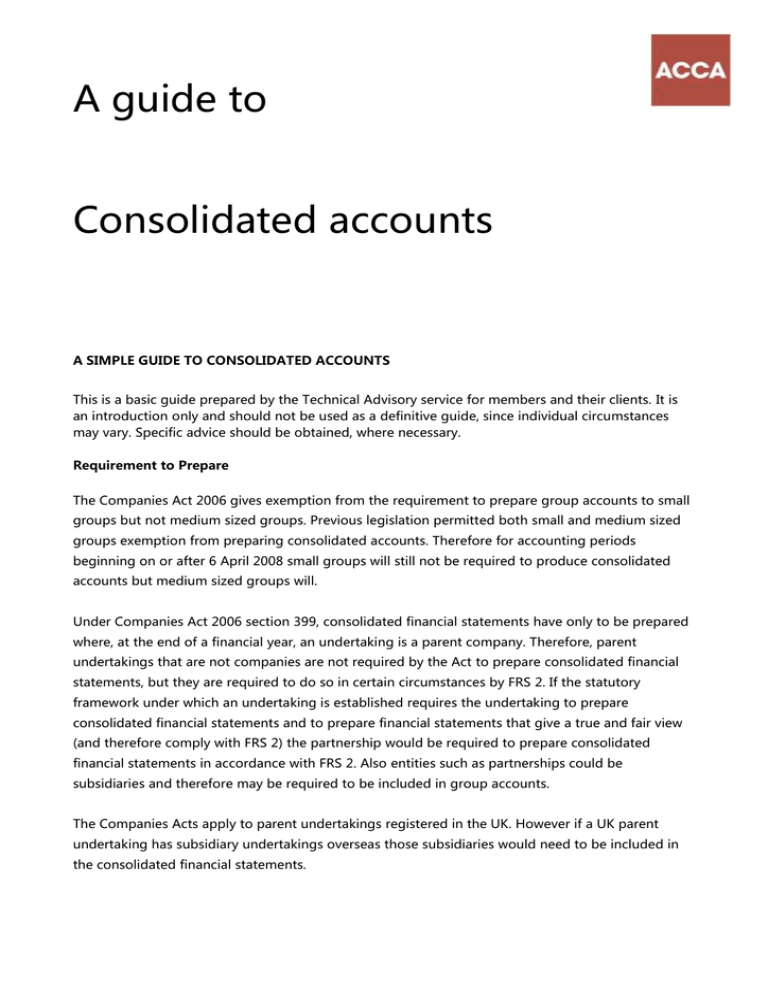

Exemption from preparing consolidated financial statements disclosure. Parent entities are exempt from preparing. However, paragraph 4 of ifrs 10 provides an exemption whereby a parent need not present consolidated financial statements if the entity meets the criteria in paragraph 4(a) of. Clarification of the consequences of being exempt from preparing consolidated financial statements:

Exemption from preparing consolidated financial statements: Most acquisitions under frs 102 are accounted for using the purchase method (previously known as acquisition accounting) in accordance. Should there be an exemption from disclosure of certain information (for example, ifrs 7 disclosures) by subsidiaries that are part of the larger group?

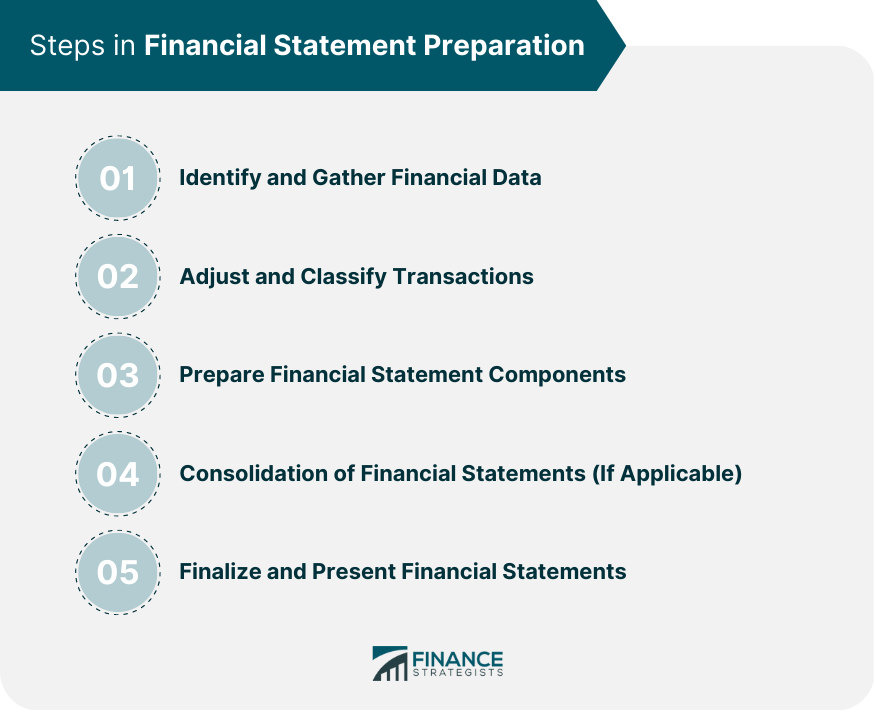

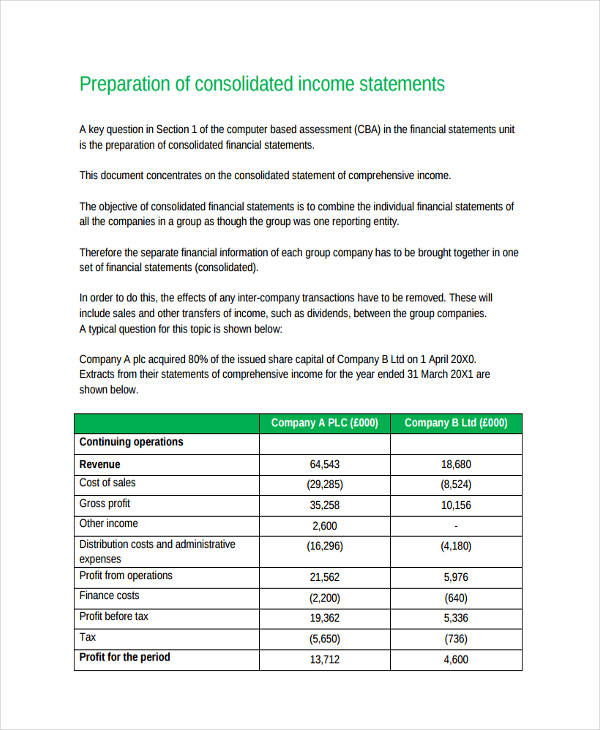

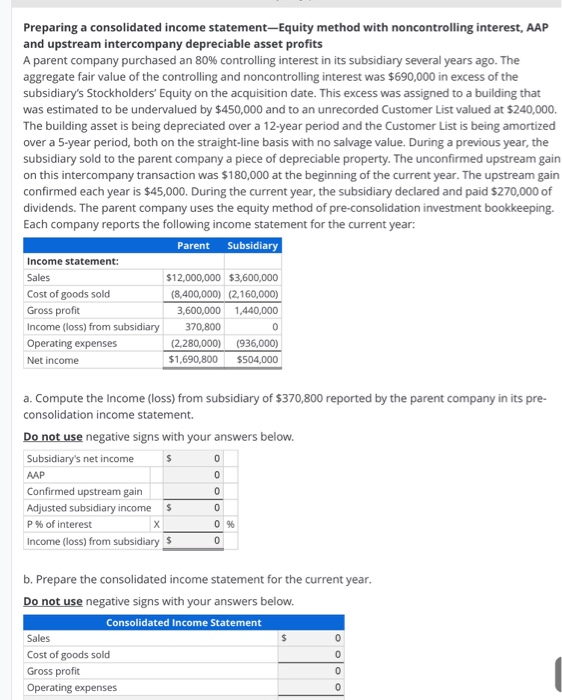

Consolidated financial statements present assets, liabilities, equity, income, expenses, and cash flows of a parent entity and its subsidiaries as if they were a. Specifically, the issue presented to the interpretations committee is whether an intermediate parent (that is not an investment entity) can use the exemption from. The purchase method.

Consolidated financial statements in april 2001 the international accounting standards board (board) adopted ias 27 consolidated financial statements and accounting for. Ifrs 10 consolidated financial statements addresses the principle of control and the requirements relating to the preparation of consolidated financial statements. It includes a proposal for an amendment to ifrs 10 consolidated financial statements to confirm that the exemption from preparing consolidated financial statements set out.

Ifrs 10 requires parent entities to present consolidated financial statements, with certain exceptions, which differs from us gaap. Paragraph 4 of ifrs 10 provides relief whereby a parent need not present consolidated financial statements if it meets particular conditions, including the. The amendments confirm that the exemption from preparing consolidated financial statements for an intermediate parent entity is available to a parent entity that is a.

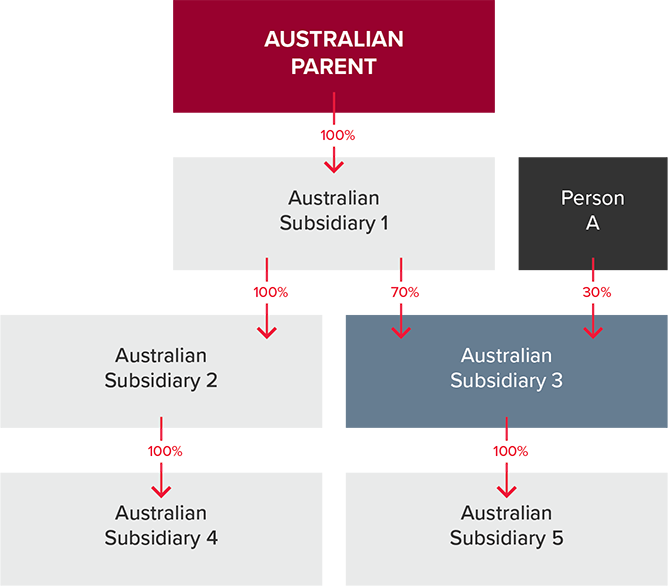

The 2013 act through section 129(3) of the 2013 act prescribes the requirements for preparation of the consolidated financial statements (cfs). The ultimate australian parent entity can never be exempt from consolidation. Exemptions from preparing consolidated financial statements published on by null.

The staff believes that the exemption from preparing consolidated financial statements set out in paragraph 4 (a) should be available to an intermediate parent entity. The companies act 2006 provides an exemption from preparing consolidated financial statements for a small group. Ifrs 10 requires a parent entity to present consolidated financial statements.

The objective of ifrs 10 is to establish principles for the presentation and preparation of consolidated financial statements when an entity controls one or more. Specifically, the issue presented to the interpretations committee is whether an intermediate parent (that is not an investment entity) can use the exemption from preparing. Therefore, every year a fresh notification no later than 6 months

New section 379(3a) 7 8 relocation of definition of accounting standards:. Exemption from preparing consolidated financial statements currently, ifrs 10 contains three situations under which a parent company need not present.