Divine Info About Create Profit Loss Statement

Here’s how to create one for your business.

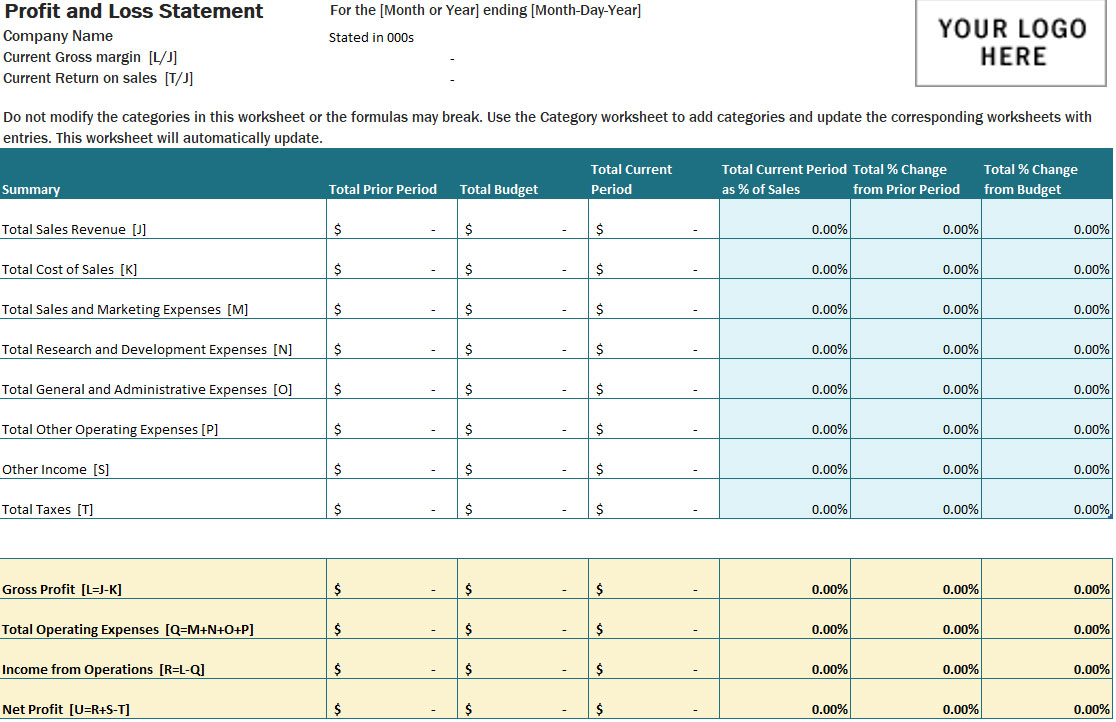

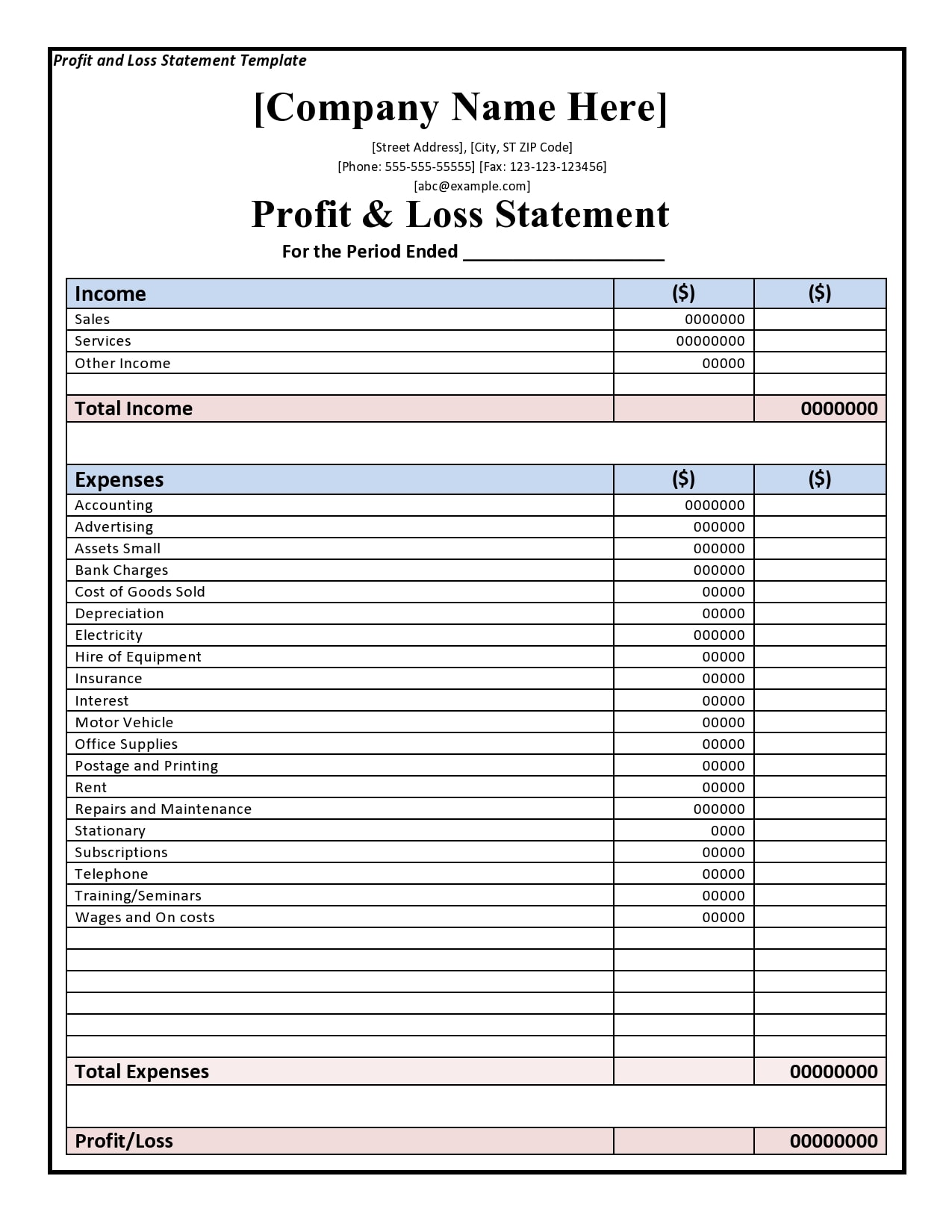

Create profit loss statement. How to create a profit and loss statement. Create your profit and loss statement download our template to help create a profit and loss statement for your business. Choose an income statement format

Here’s how you put one together, how to read it, and why profit and loss statements are important for running your business. Input your company and statement dates; Net profit is commonly referred to as a company’s “bottom.

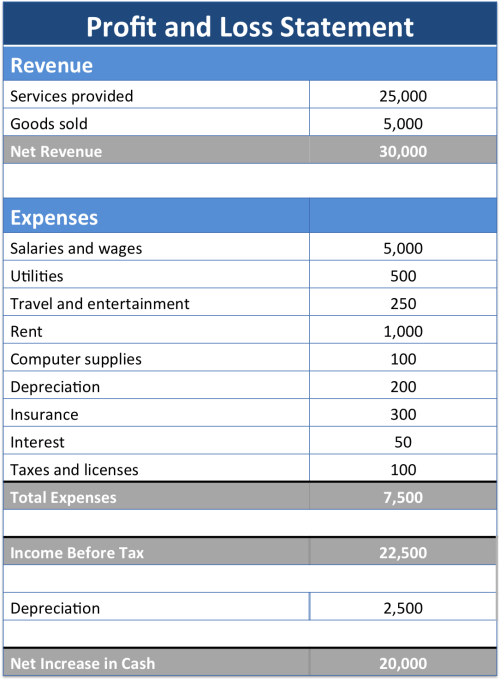

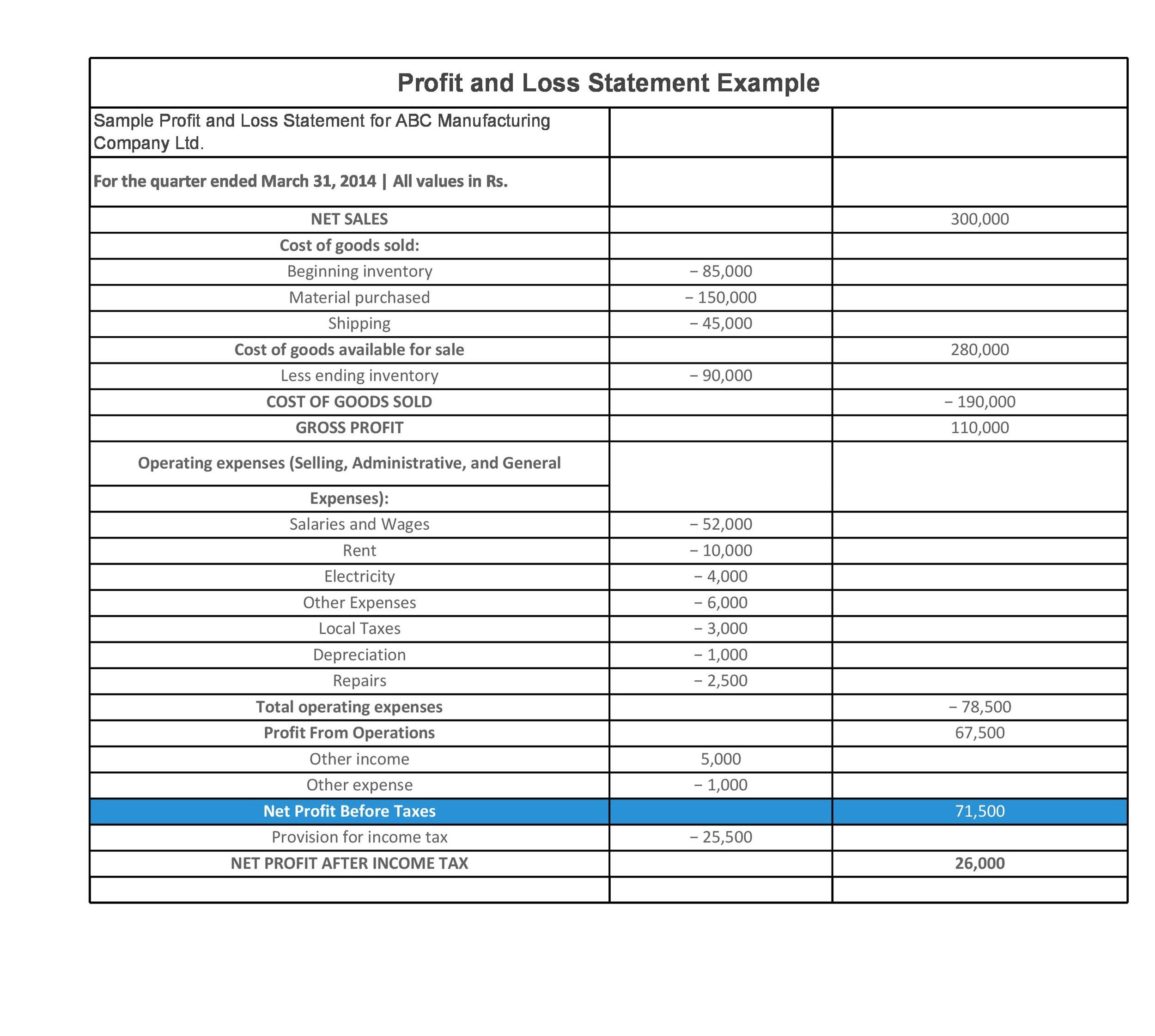

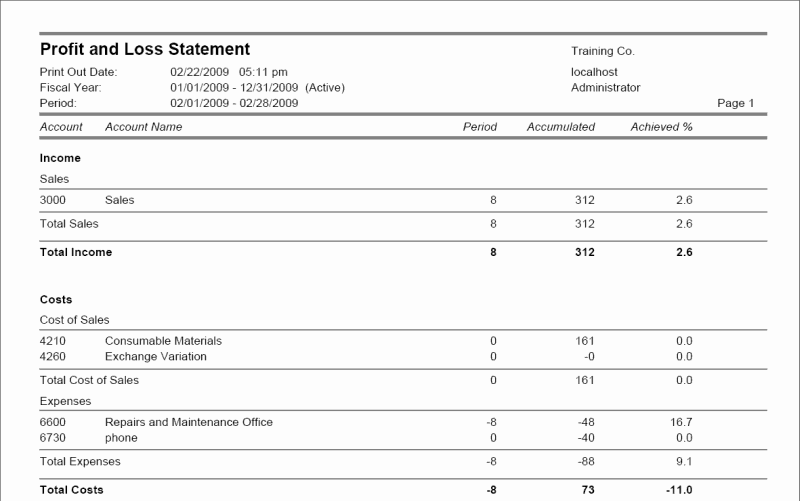

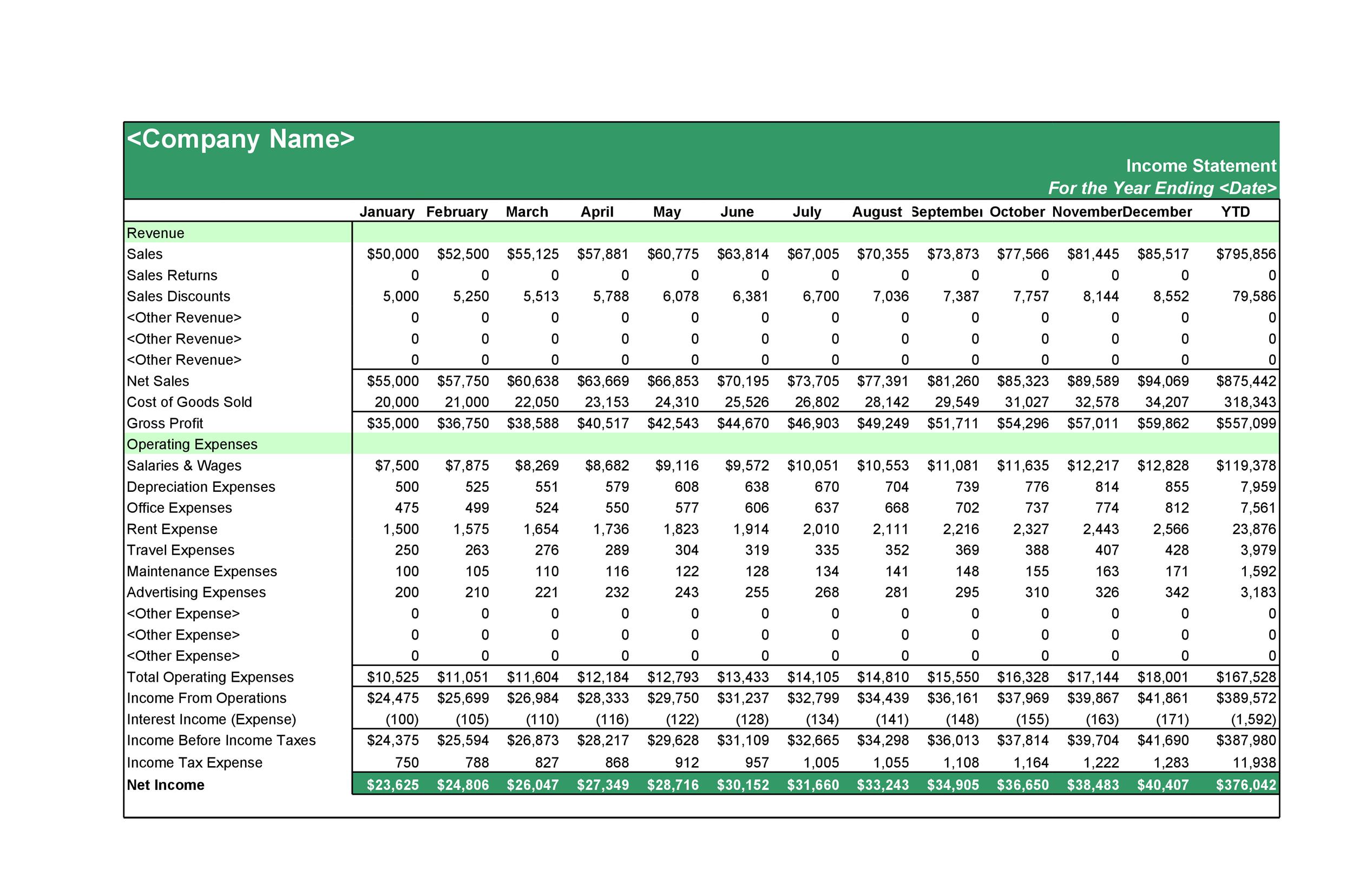

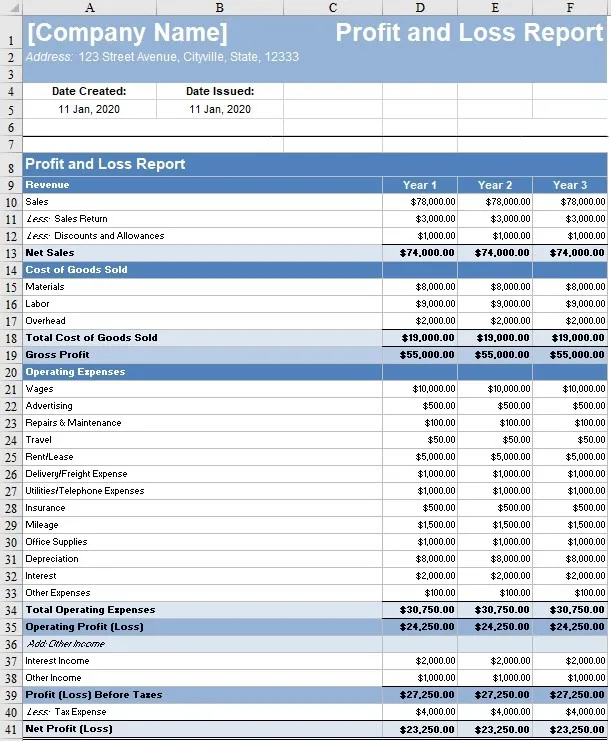

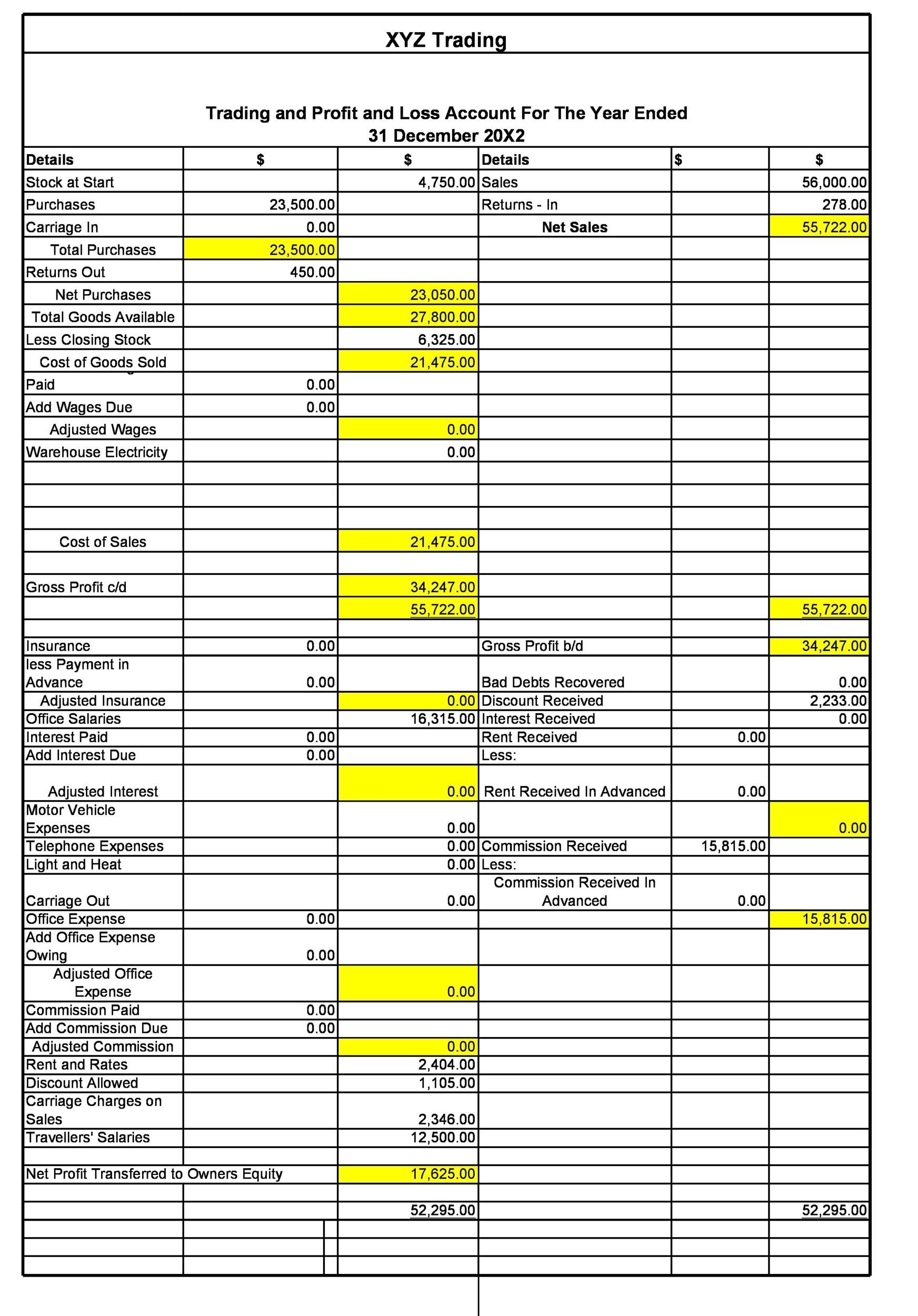

Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a quarter or fiscal year. A profit and loss statement—also called an income statement or p&l statement—is a financial statement that shows a business’s revenue, expenses, and net income over a specific period of time. How to build a profit and loss statement in microsoft excel.

Profit and loss statement template xlsx · 0.04 mb complete your profit and loss statement for each year, you need to fill in actual or forecasted figures against each of the below items. It offers a comprehensive overview of a company’s revenues, costs, and expenses, enabling stakeholders to evaluate its. To make a profit and loss statement, you need to know two essential things:

Has it been a slow year? Add up all your gains then deduct your losses. Subtract operating expenses from business income to see your net profit or loss.

A profit and loss statement, also known as an income statement, identifies a business’s revenue and expenses. Then, you do some calculations to determine if the company made a profit or a loss. Add up the income tax for the reporting period and the interest incurred for debt during that time.

The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. To calculate net profit, also referred to as profit after tax, take your operating profit (step 5) and add other income and interest income (step 6) and subtract other expense and interest expense (step 6) and tax expense (step 7). November 4, 2022 this article is tax professional approved want to know how profitable your business is?

The oil and gas company's earnings statement showed that adjusted net income totalled 513 million euros ($556 million) in. It’s usually assessed quarterly and at the end of a business’s accounting year. Input sales revenue to calculate gross revenue;

Barnes, karoun demirjian, eric schmitt and david e. It’s up to you how frequently you wish to run a profit and loss statement. Calculate your company’s net profit/loss.

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. Establish your revenue figures revenue encompasses any income your business generates. Input the cost of goods sold (cogs) calculate the net income;

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Rental-Property-Profit-and-Loss-Statement-Template-TemplateLab.com_-scaled.jpg)

![17+ Profit And Loss Template EDITABLE Download [Word, PDF]](https://www.opensourcetext.org/wp-content/uploads/2020/07/pal-6.jpg)