Favorite Tips About Year To Date Profit And Loss Statement Balance Sheet

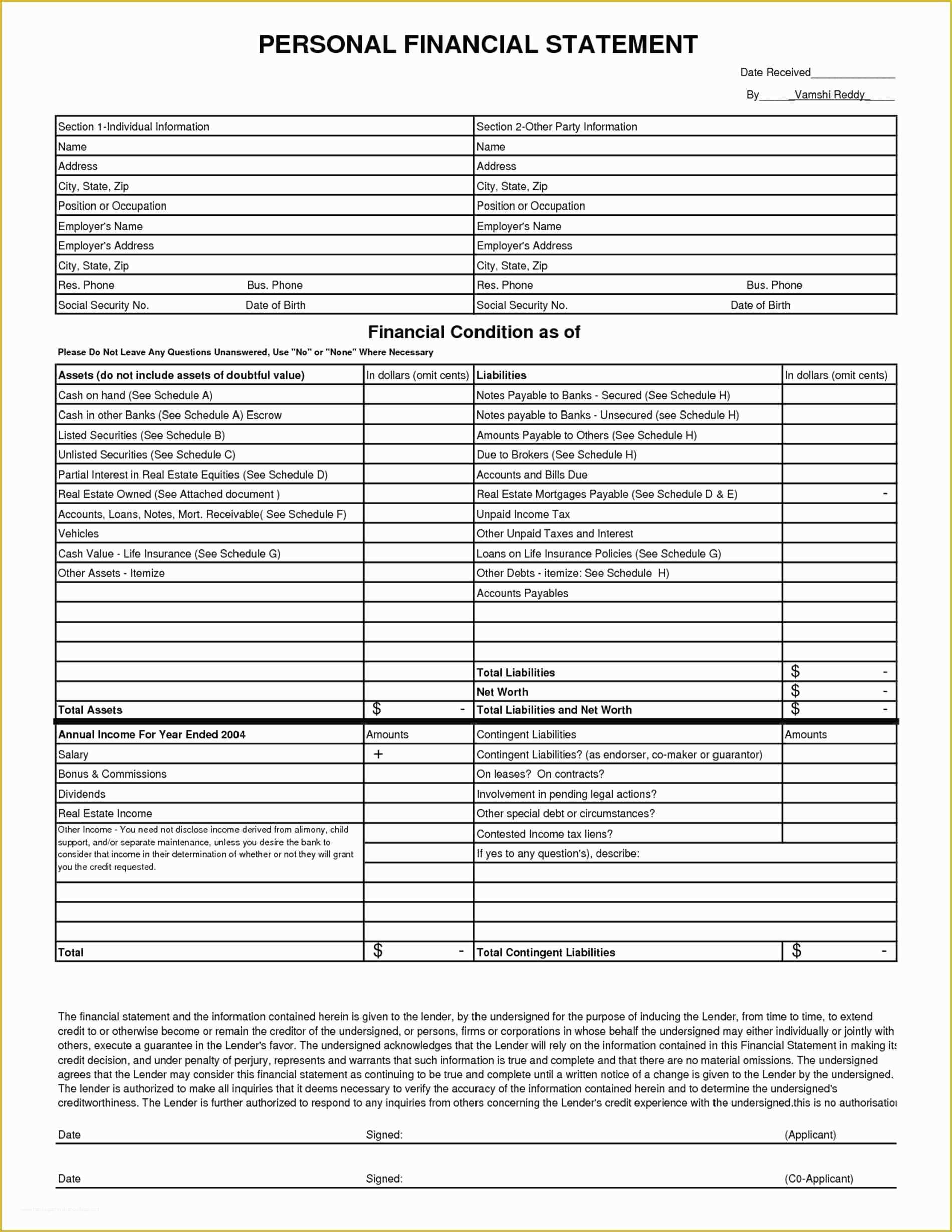

The balance sheet, the profit and loss (p&l) statement, and the cash flow statement.

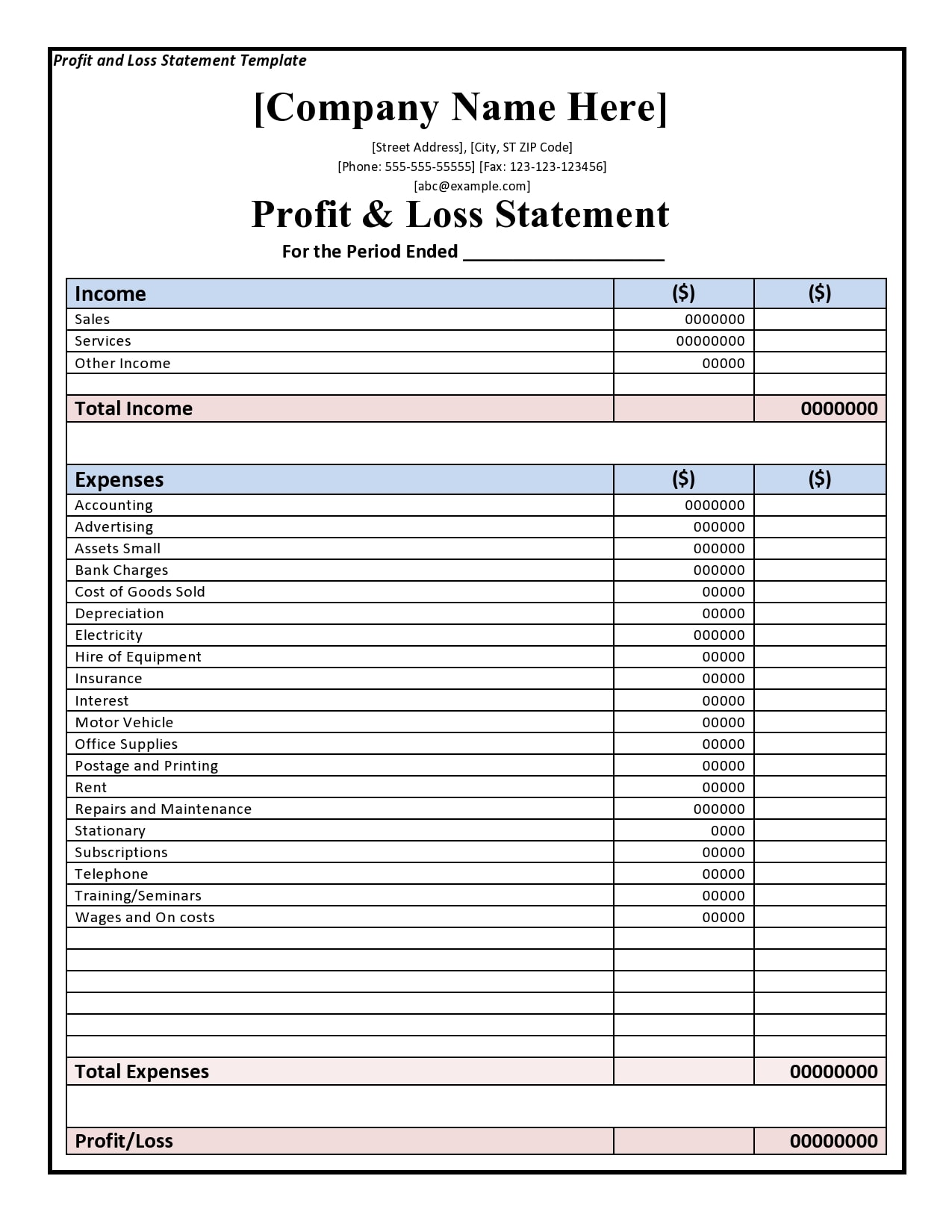

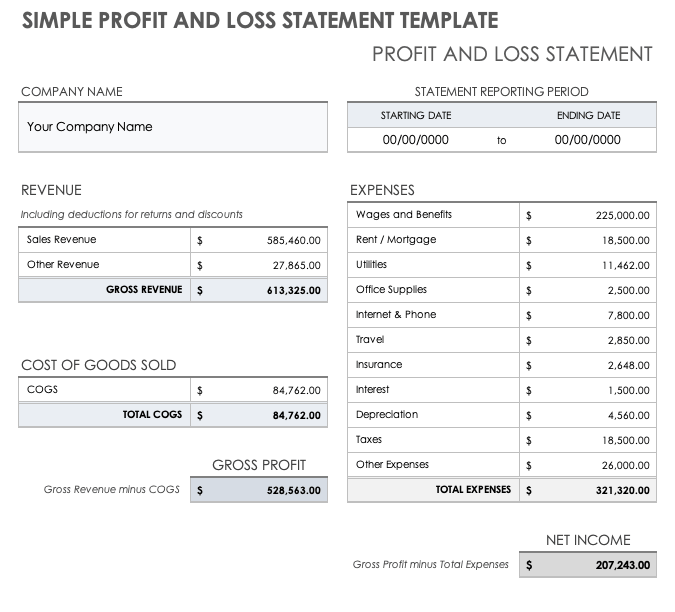

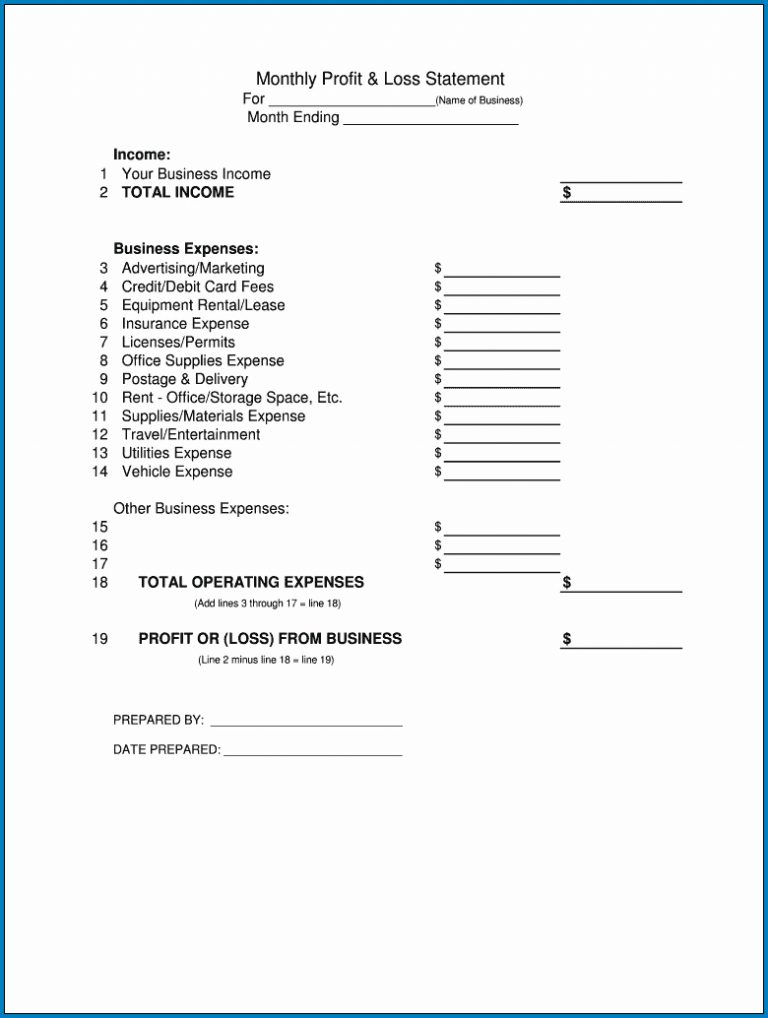

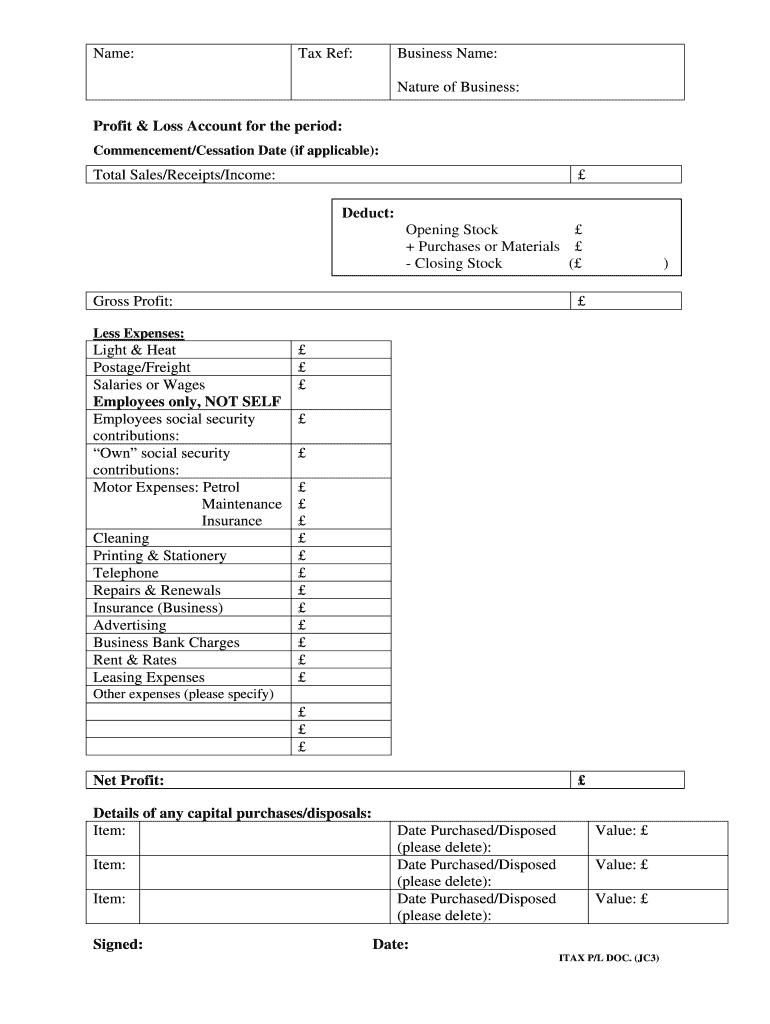

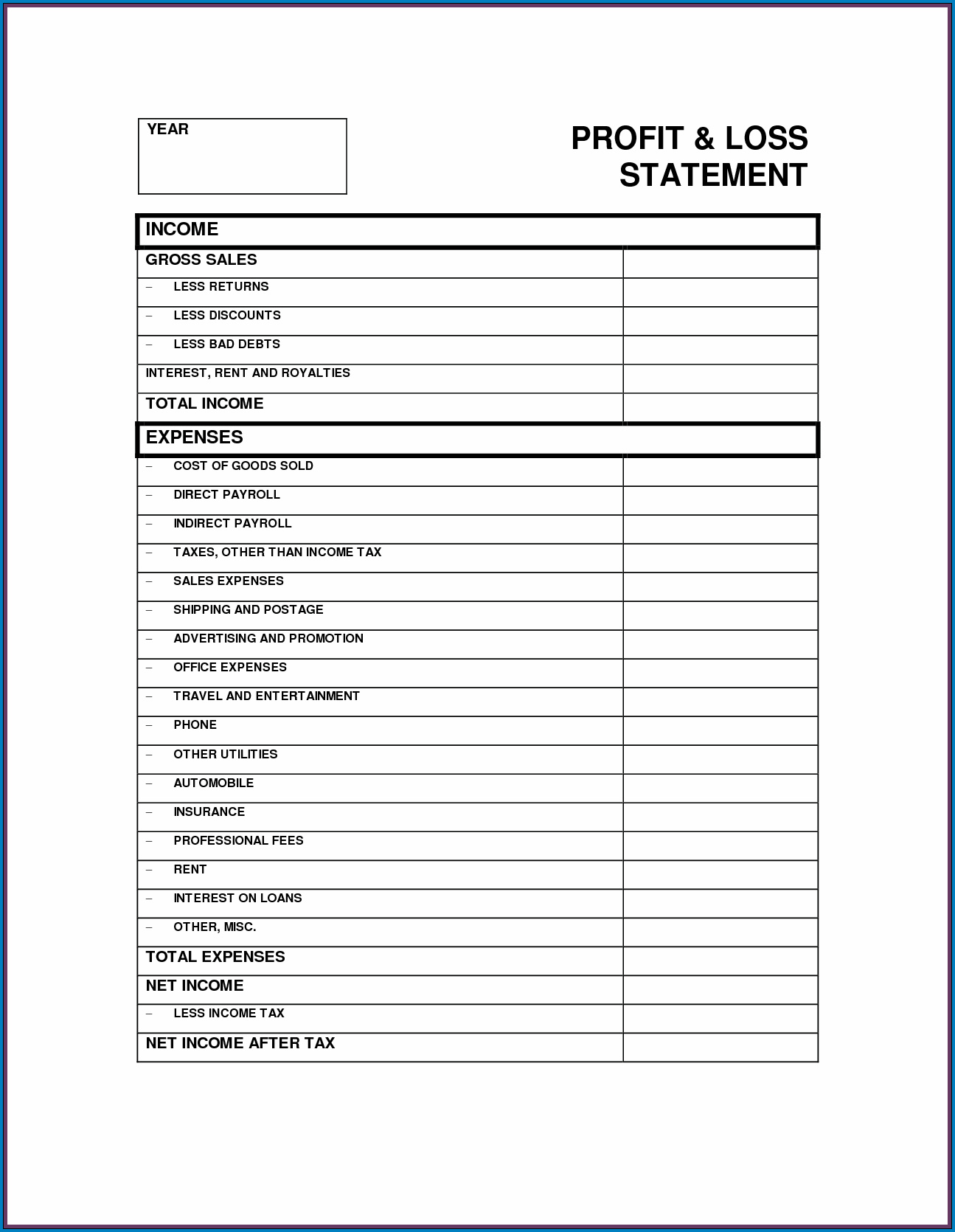

Year to date profit and loss statement and balance sheet. How to create a profit and loss statement in excel try smartsheet for free by andy marker | april 6, 2022 creating a profit and loss statement can be daunting, but using a template can help simplify the process. The profit and loss statement will show the business name and the period the statement is for; Free cash flow before m&a and customer financing € 4.4 billion;

A profit and loss statement (p&l) is an effective tool for managing your business. The net result over the course of an accounting period are therefore shown in the profit and loss account. Net cash € 10.7 billion.

A p&l statement, also referred to as an income statement, measures your business revenue (income or sales) and expenses during a given time period. The profit and loss account, in contrast, is an account that displays the period's revenues and expenses. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time.

It gives you a financial snapshot of how much money you’re making (or losing) and can make accurate projections about your business’s future. Special dividend of € 1.00 per share. Of these three statements, two are commonly confused:

What is a profit and loss statement (p&l)? Subtract operating expenses from business income to see your net profit or loss. Together, alongside the cash flow statement (cfs) and balance sheet ( b/s ), the p&l.

Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a quarter or fiscal year. Profit and loss, revenue, and operating expenses. As such, it shows your collection of total assets plus how they were paid for.

Unlike the balance sheet which is a photo on a given date, the profit and loss statement is dynamic because it traces the income/resources and all the charges/expenses of the company between two. It’s usually assessed quarterly and at the end of a business’s accounting year. A p&l statement compares company revenue against expenses to determine the net income of the business.

A p&l statement provides information about whether a company can. A p&l statement tells you how much money you’re making, and how much you’re losing. The figures posted to the p&l account may not be the same as the transactions in your bank account.

The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. Each of these sheets and their contents is explained in detail below. It’s sometimes referred to as an ‘income and expenditure account’ or a ‘statement of financial performance.’.

At the end of each accounting period, whether it is each month, quarter, or year, the preparer will close their books by resetting all of the company’s expense and revenue accounts to zero. The result is either your final profit (if. Many investors focus obsessively on the income statement (profit and loss) but ignore the equally important balance sheet (assets and liabilities).