Real Info About Chapter 7 Financial Statements For A Proprietorship

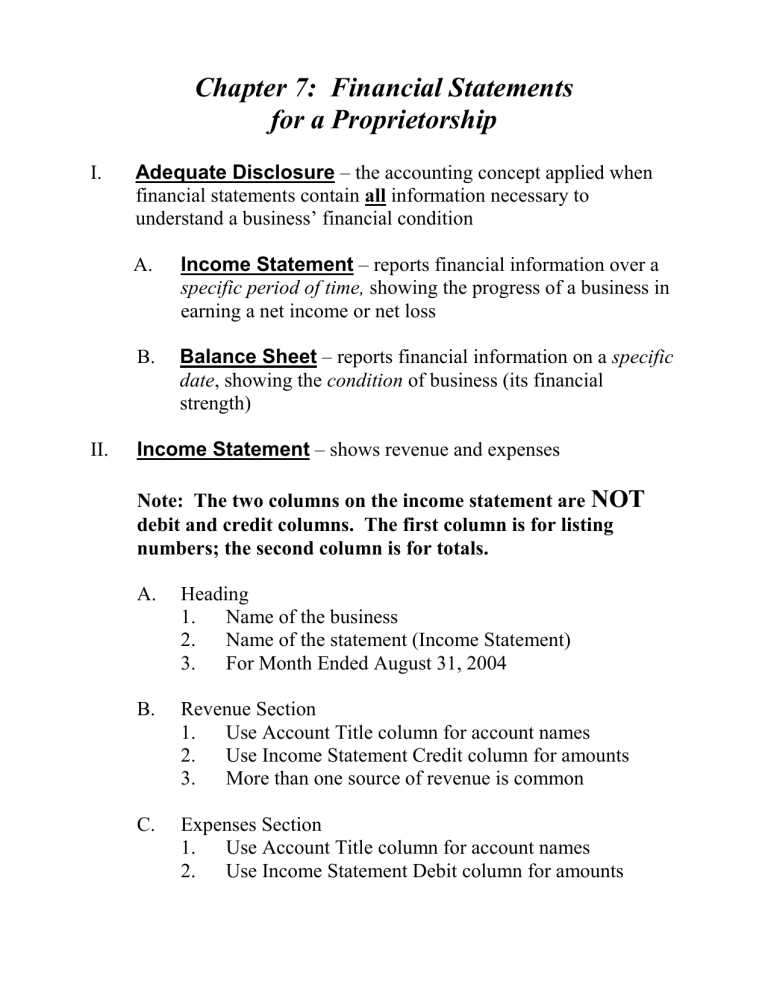

A financial statement that reports the changes in the capital account for a proprietorship for a period of time.

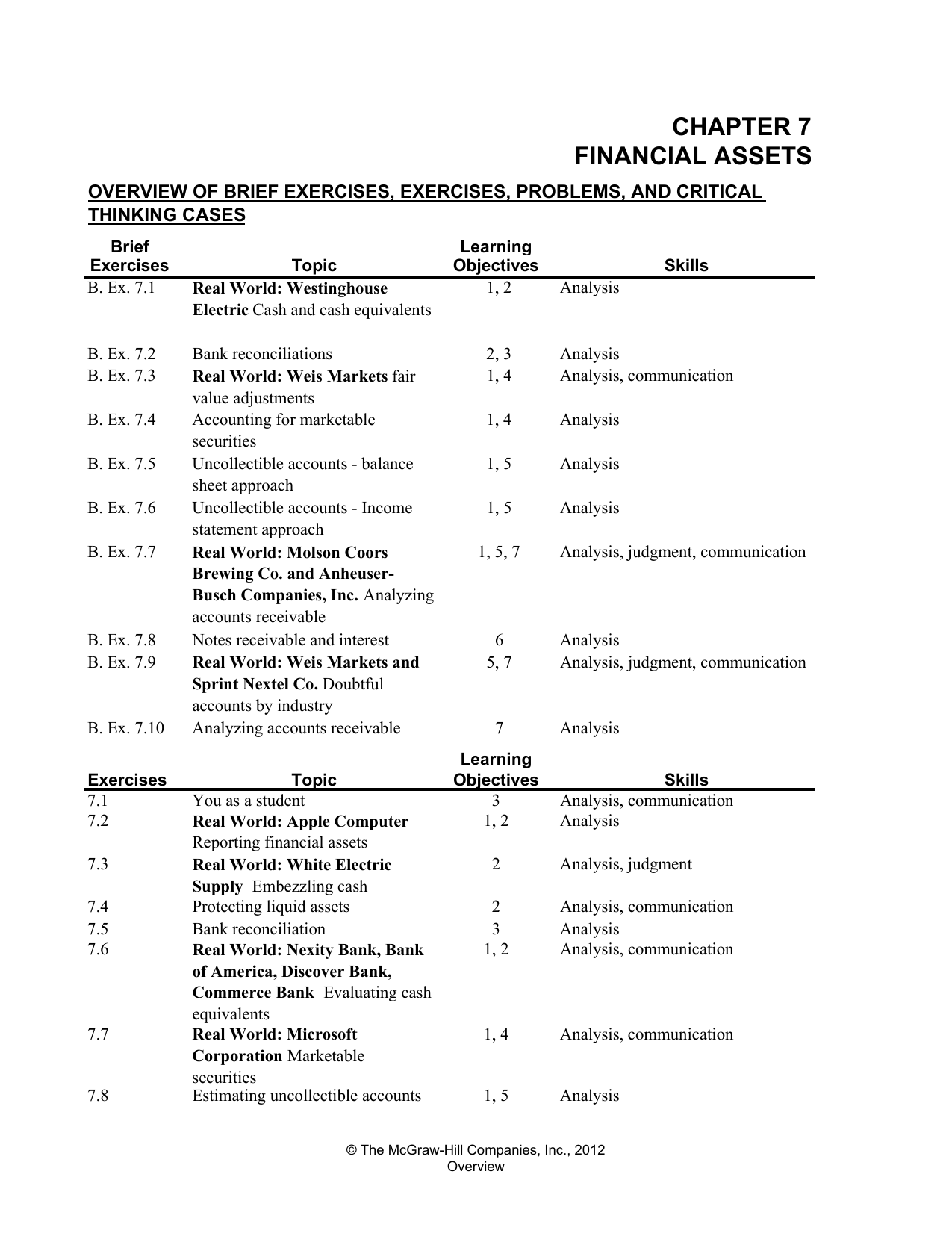

Chapter 7 financial statements for a proprietorship. This is illustrated below. The field of accounting that. After studying chapter 7, in addition to defining key terms, you will be able to:

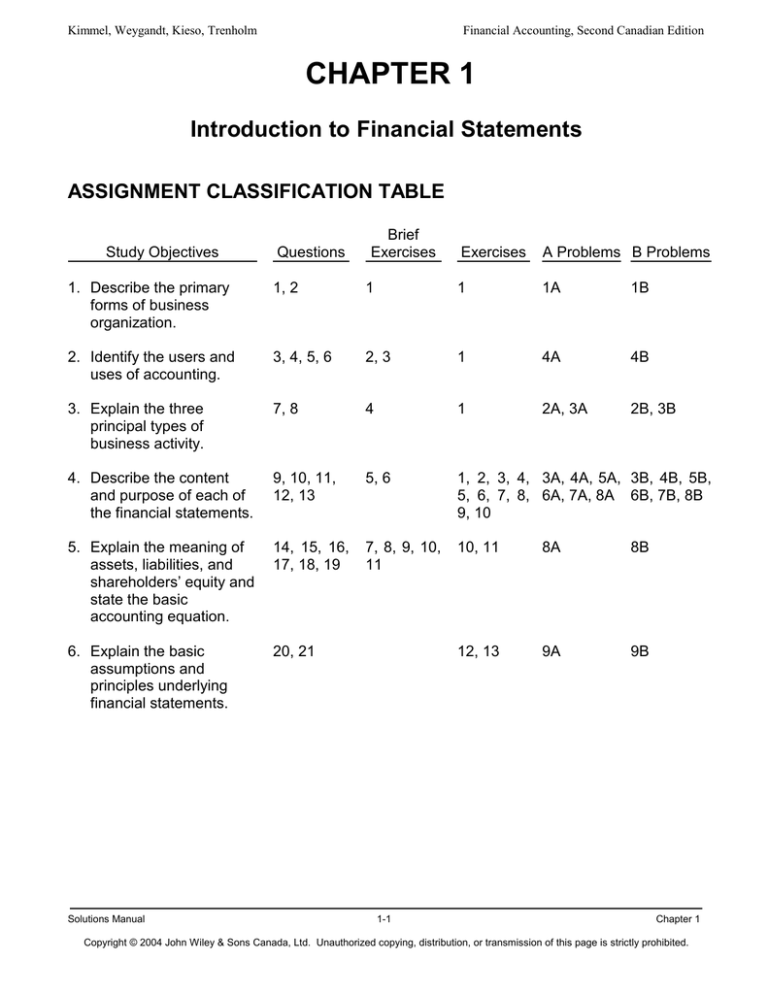

The financial statements for a proprietorship are much the same as for a corporation with some minor differences. The field of accounting that focuses on providing information for external decision makers. The calculation and interpretation of a financial ratio.

Setting up a business as a sole proprietorship is beneficial as it limits your liability. True or false: Lo1 prepare an income statement for a service business.

The statement of changes in equity for each of a proprietorship and corporation includes the same elements: Financial statements for a proprietorship review/preview: Accounting theory accounting period cycle adjusting entries matching expenses with revenue adjustments are analyzed and planned on a worksheet preparing financial.

An income statement reports financial. Financial statements are prepared at the end of each monthly period to help mangers and owners make good business. Accounting chapter 7 concepts some old, some new adequate disclosure financial statement contain all the information on.

Lo1 prepare an income statement for a service business. Reporting financial information information is need by managers and owners to make good. After studying chapter, in addition to defining key terms, you will be able to:

Video answers for all textbook questions of chapter 7, financial statements for a proprietorship, century 21 accounting: A sole proprietorship may be. Lo2 calculate and analyze financial ratios.