Fantastic Tips About Net Income Balance Sheet Or Statement

It will detail its assets and liabilities to calculate.

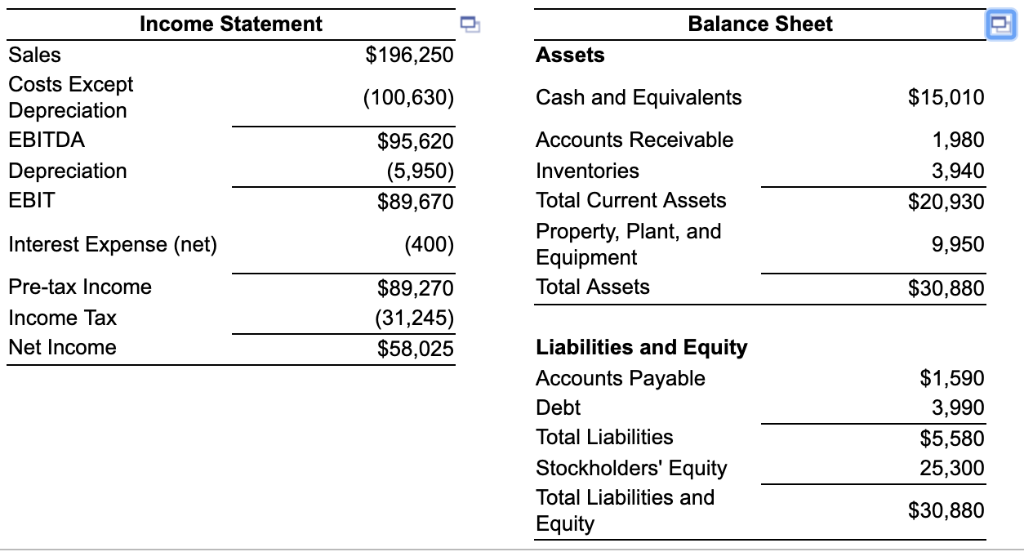

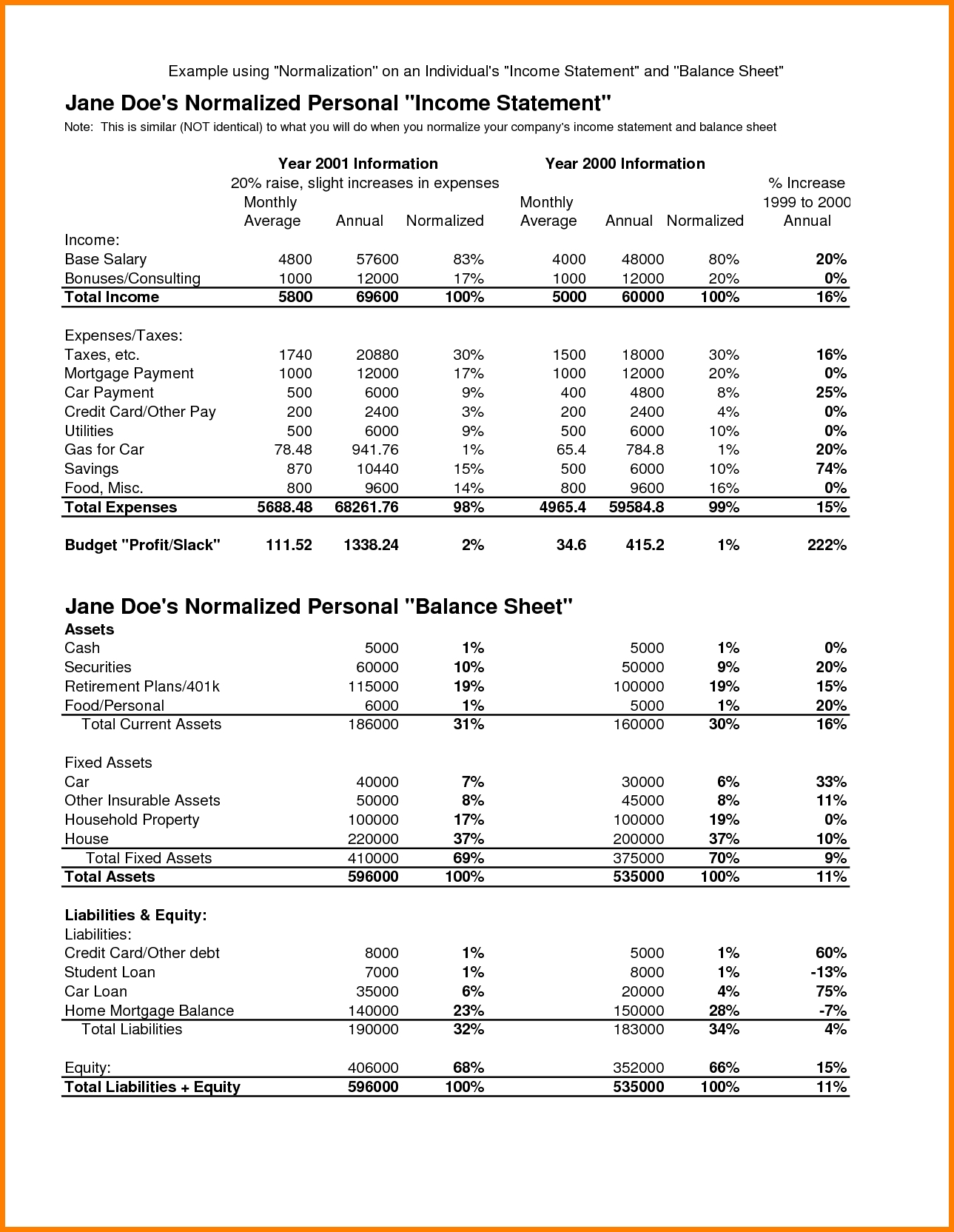

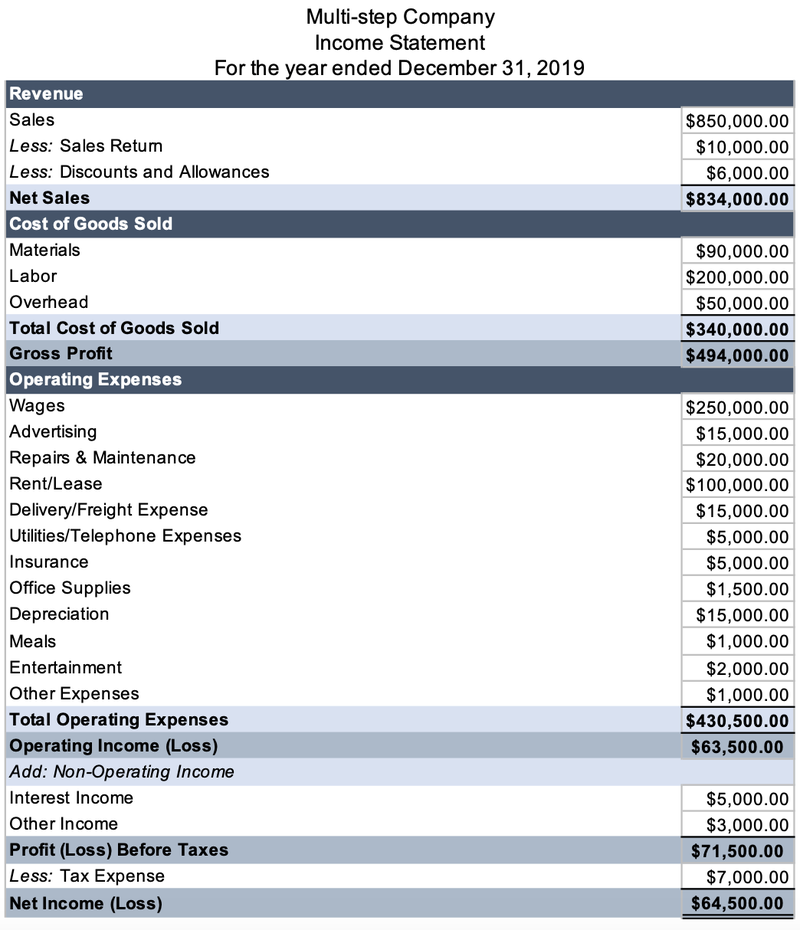

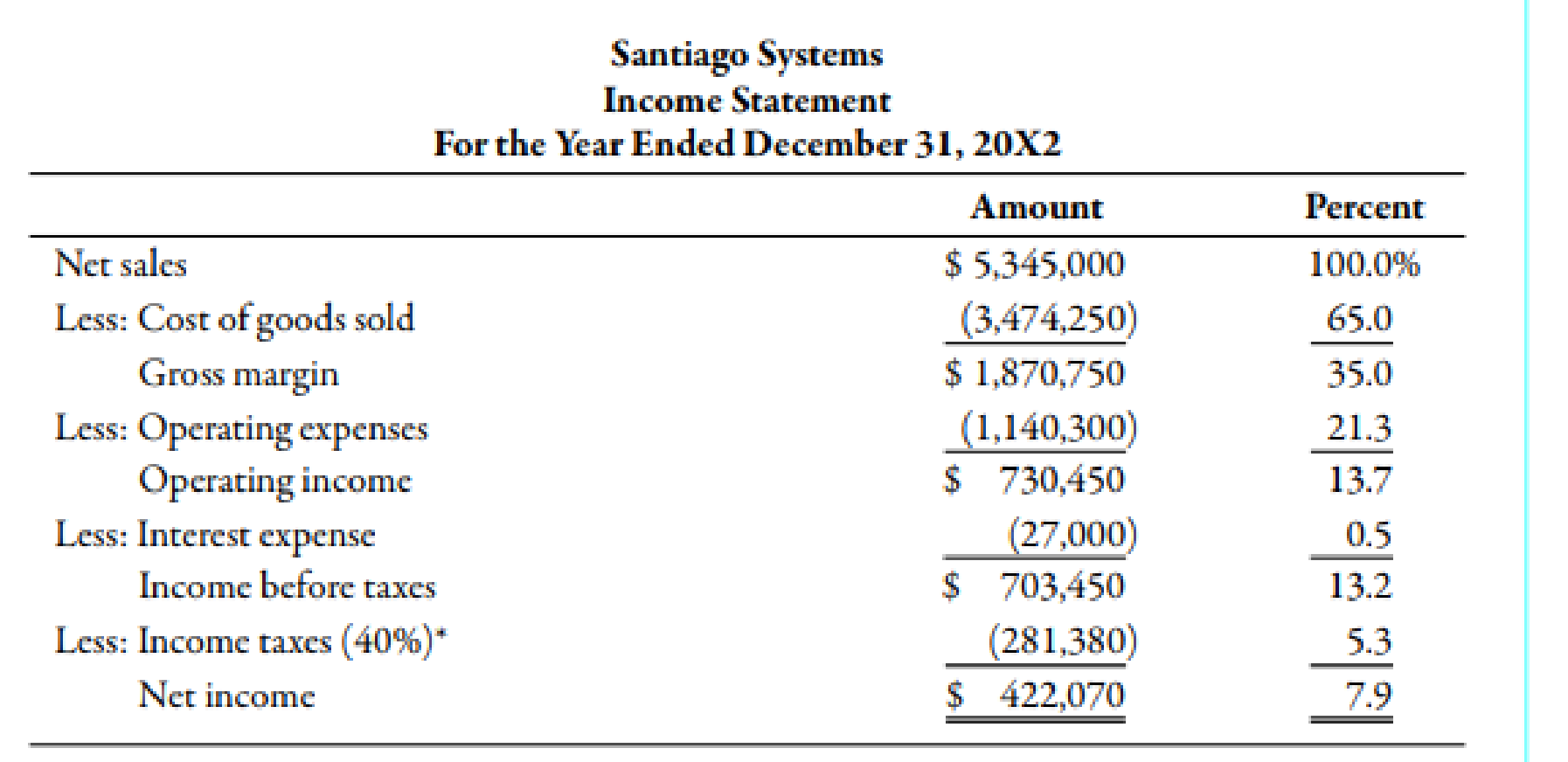

Net income balance sheet or income statement. Also known as a profit and loss statement (p&l), the income statement records a business’s income and expenses over a specific reporting period, typically a. Thus the result (net income) of the income statement feeds the retained earnings account on the balance sheet. An income statement tells you if your business is bringing in a profit (or a loss), while balance sheets can give you a broader picture of your company’s worth.

Author freshbooks microsoft excel template. One of the key differences between the balance sheet and the income statement is timing. (1) the income statement, (2) the balance sheet, and (3) the cash flow statement.

So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. Wyatt’s net income for the quarter is $20,000. Each of the financial statements provides important.

A balance sheet provides a snapshot of the company’s financial health at any given moment. A balance sheet shows a company’s assets,. Net income is one of the most important line items on an income.

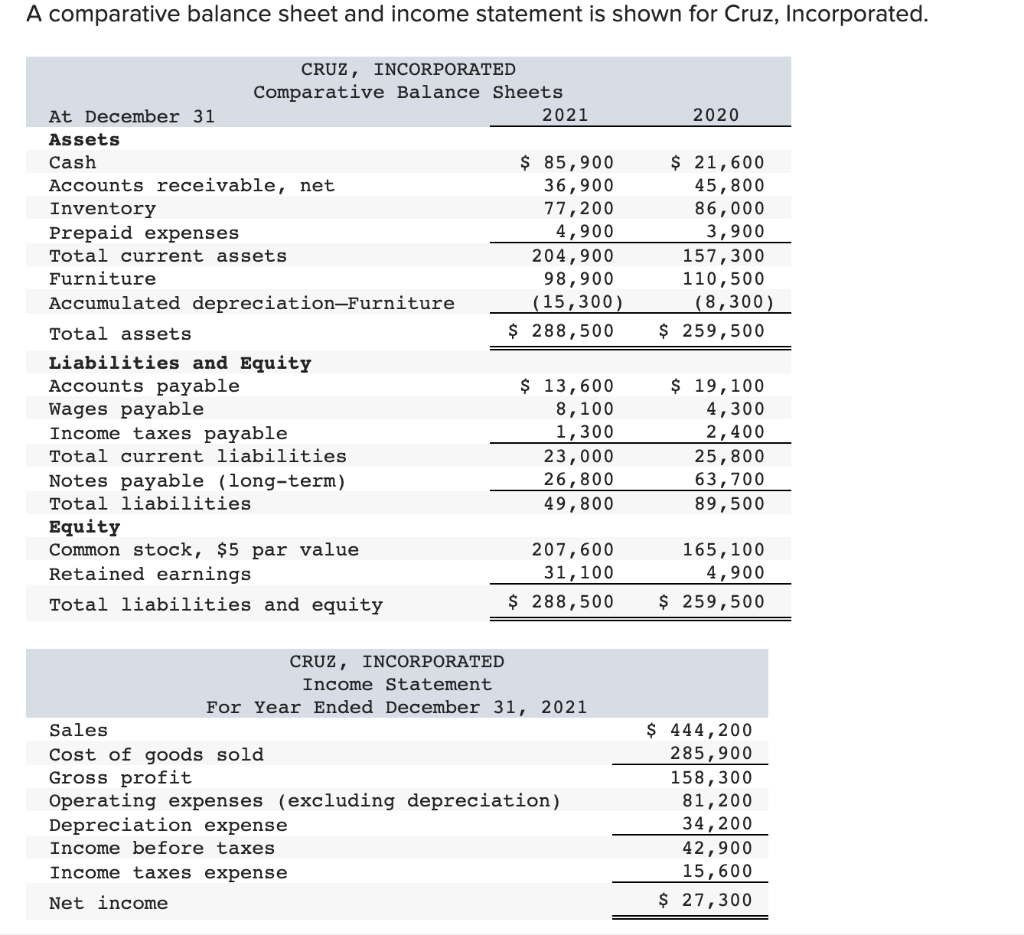

The difference between a balance sheet and an income statement is the information they show and the period of time they cover. Assets = liabilities + equity. A comparative balance sheet and income statement is shown for cruz, incorporated.

Three core financial statements doing. Net income flows into the balance sheet. A net profit or loss is what remains.

While it is arrived at through the income statement, the net profit is also used in both the balance sheet and the cash flow statement. Key differences between balance sheets and income statements include: Return on total assets = 12.1%.

Net income and retained earnings. What is the difference between a balance sheet and an income statement? The balance sheet proves a fundamental accounting equation:

The liability might be decreased as. In conjunction with the cash flow statement, balance sheet, and annual report, income statements help company. In financial accounting, the balance sheet and income statement are the two most important types of financial statements (others being cash flow statement, and the.

Cash accounts payable cash equivalents accrued. The standard balance sheet assets liabilities and stockholders’ equity current assets: Assets (increase) = liabilities (decrease) + owner’s equity (increase) the assets of the company are increased when net profit is calculated.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)