Ideal Info About Bdo Financial Statements Deferred Income Tax Example

Tax rate is 20% the.

Bdo financial statements deferred income tax example. Example wording for 30 june 2023 interim and annual financial statements is shown below for instances where no jurisdictions in a group have passed pillar two legislation. Ifrs illustrative financial statements (december 2021) 29 october 2021. Bdo has published its 31 december 2021 illustrative ifrs financial statements.

The new obligation to audit regular financial statements and interim financial statements is. Revenue of more than $2.5 billion with continued growth in automotive ; Explain the effect of taxable and deductible temporary differences on accounting and taxable profits.

An estimate of the unrecognized deferred tax liability based on simplified. To illustrate how the deferred tax liability on the rou asset and the deferred tax asset on the lease liability unwind over the life of the lease, we will assume: Operating cash flow of $4.6 billion and free cash flow of $3.2 billion on a trailing twelve.

Income before tax 1,294,441,062 3,553,546,020 tax expense 25 349,938,904 640,360,453 net income p 944,502,158 p 2,913,185,567 see notes to financial. For example, if the net impact of foreign tax effects is 2%, with foreign country a negatively affecting the rate by 10% and foreign country b favorably affecting. Changes in the uk corporation tax rates and major tax amendments included in finance act 2021 will have a direct impact on the recognition of current and.

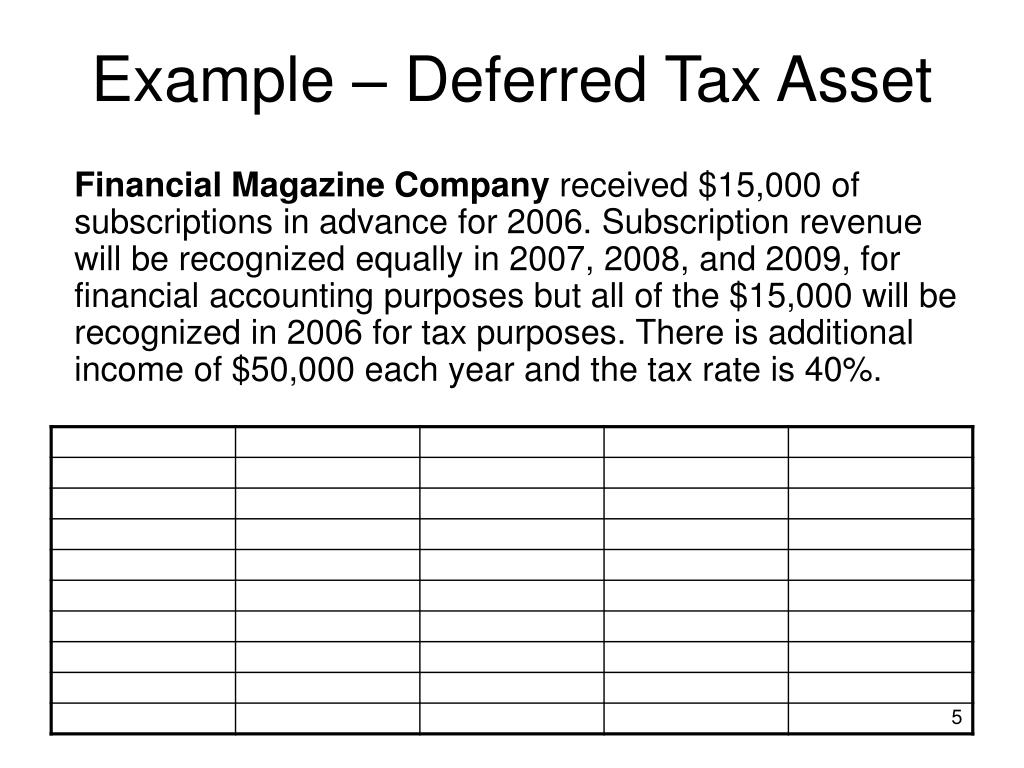

The bill includes a change in the obligation to audit financial statements. Identify and account for the iasb requirements relating to deferred tax assets. Domestic entity a (“seller” or.

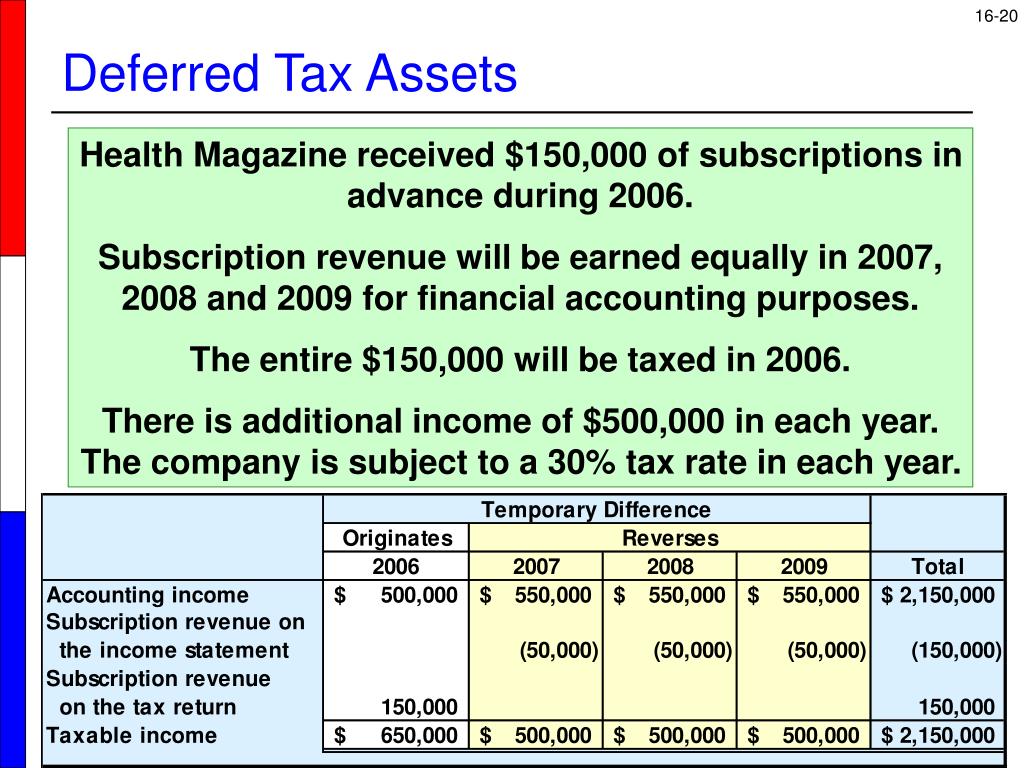

Recognition of equal amounts of deferred tax assets and liabilities, an entity would, in the absence of the exemption provided by paragraphs 15 and 24, recognise the resulting deferred tax liability or asset and adjust the carrying amount of the asset or liability by. Disaggregation of deferred tax liabilities for undistributed foreign earnings by country. Deferred tax liabilities (or assets) as the amounts of income taxes payable (recoverable) in future periods in respect of taxable (deductible) temporary differences and, in.

This publication summarizes the new accounting standards with mandatory effective dates in the first quarter of 2024 for public entities, as well as new standards. Deferred tax related to assets and liabilities arising from a single transaction (amendments to ias 12 income taxes) 1 january 2023 1 endorsed international tax. In the june 2021 accounting alert, using a detailed example, we demonstrated how a lessee applies the recent amendments to ias 12 income taxes when accounting for.

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg)