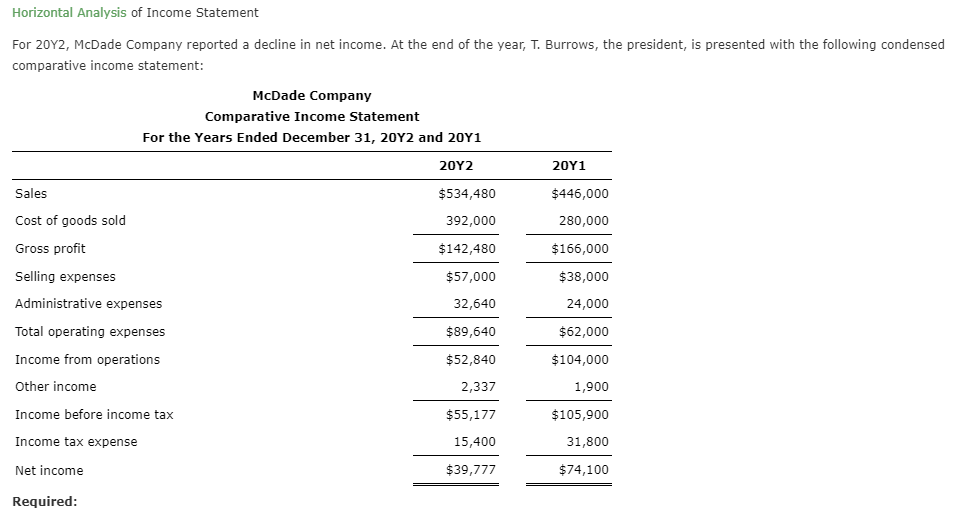

Unique Info About Prepare Comparative Income Statement

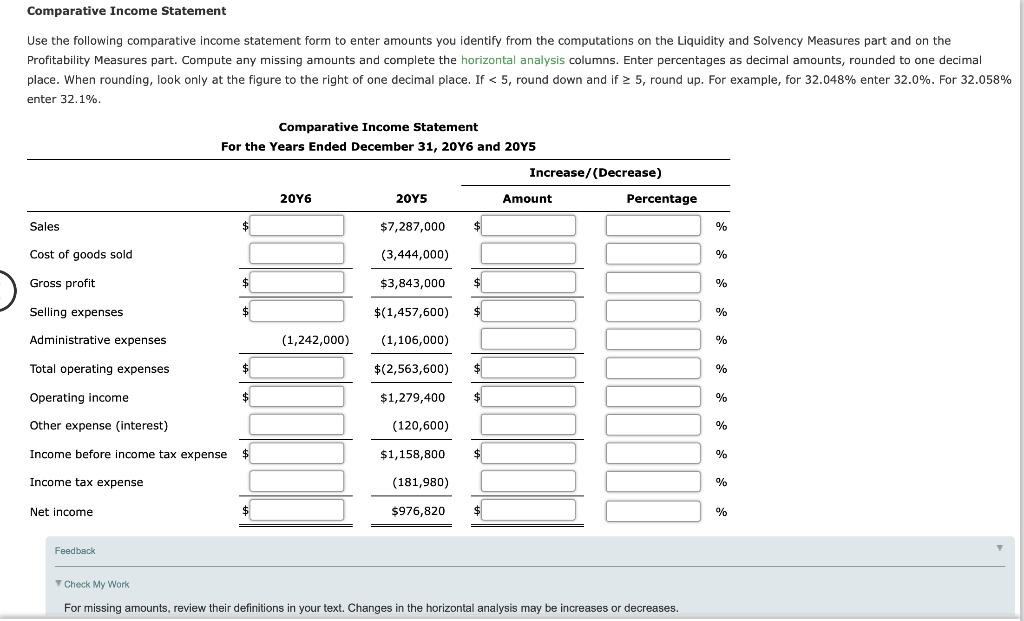

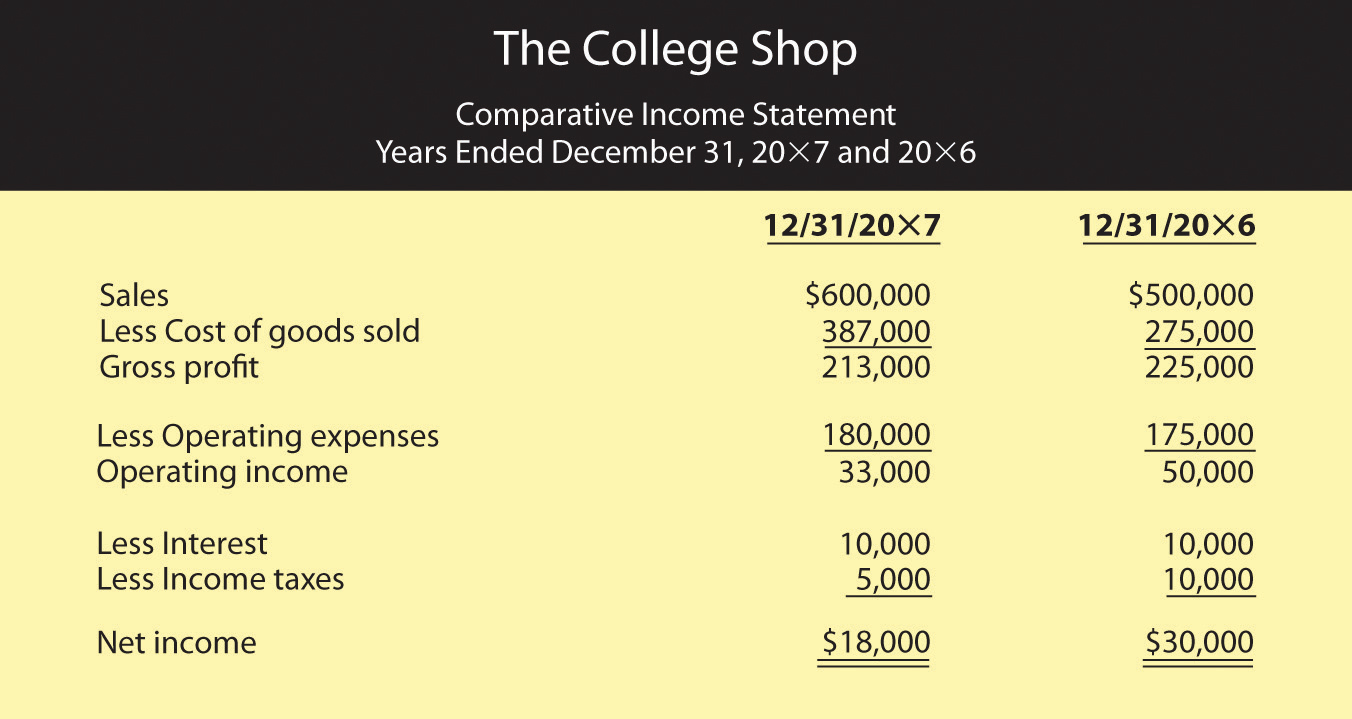

This technique determines the profitability and financial position of a business by comparing financial statements for two or more time periods.

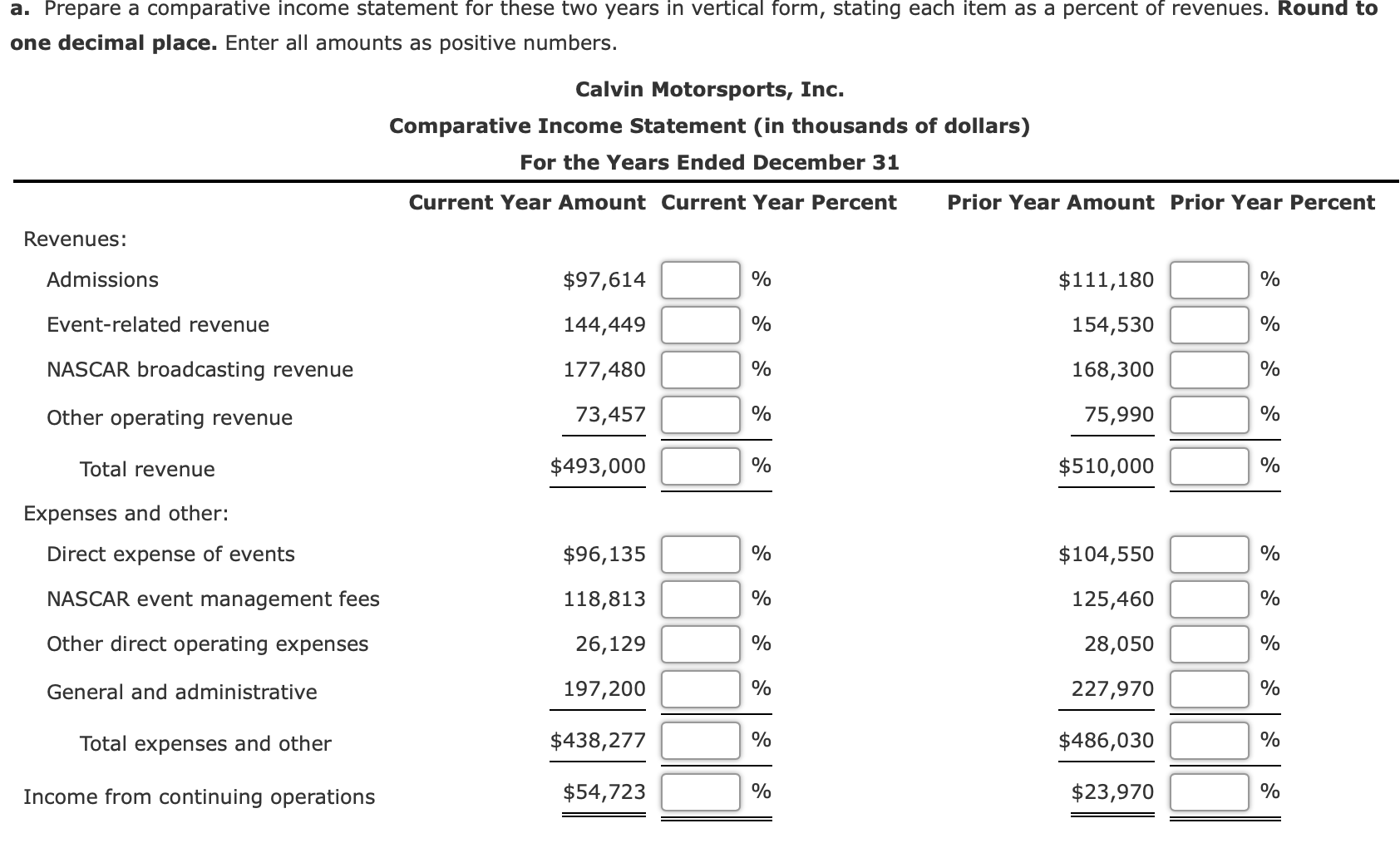

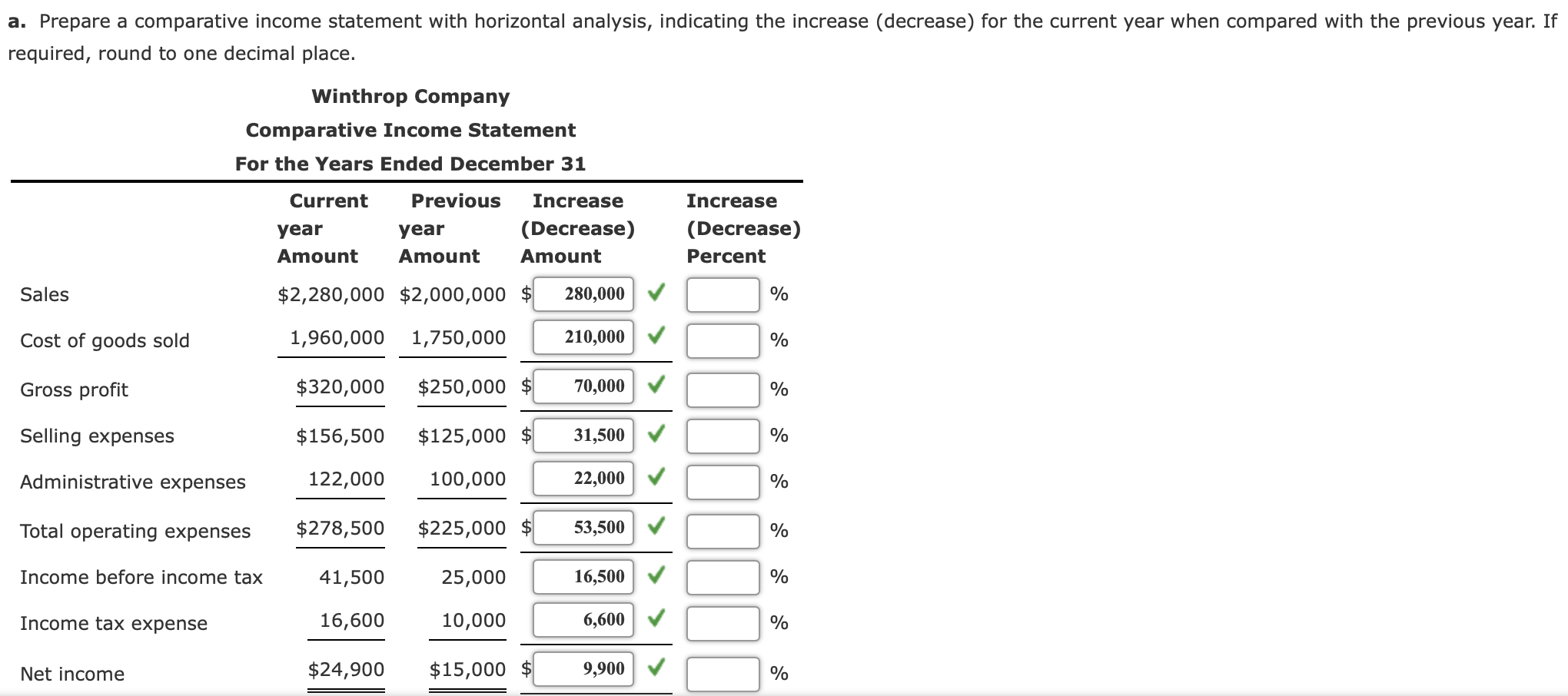

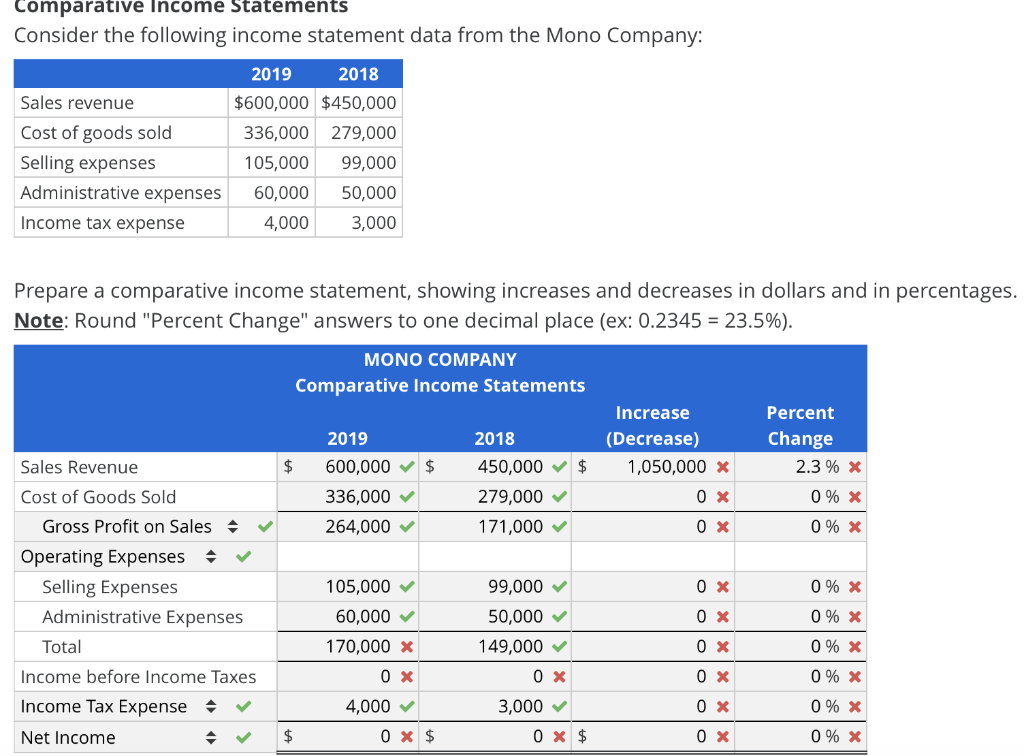

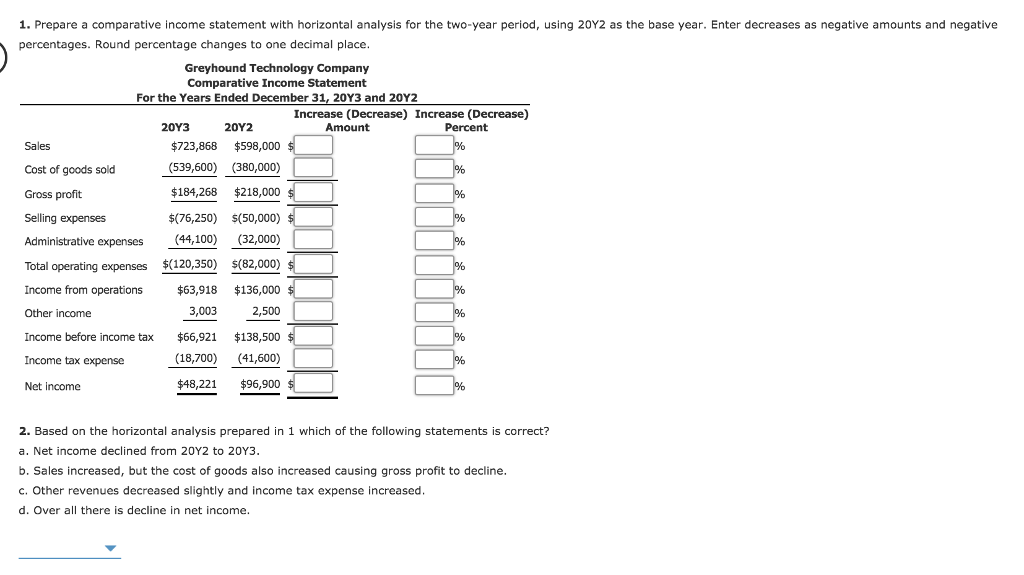

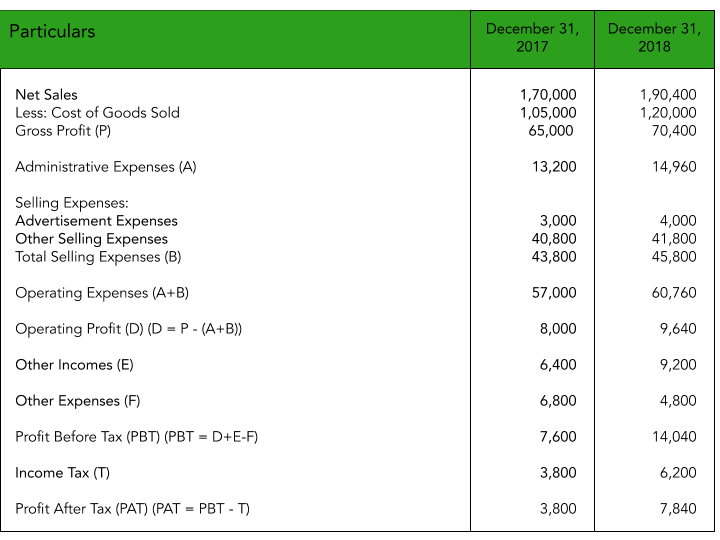

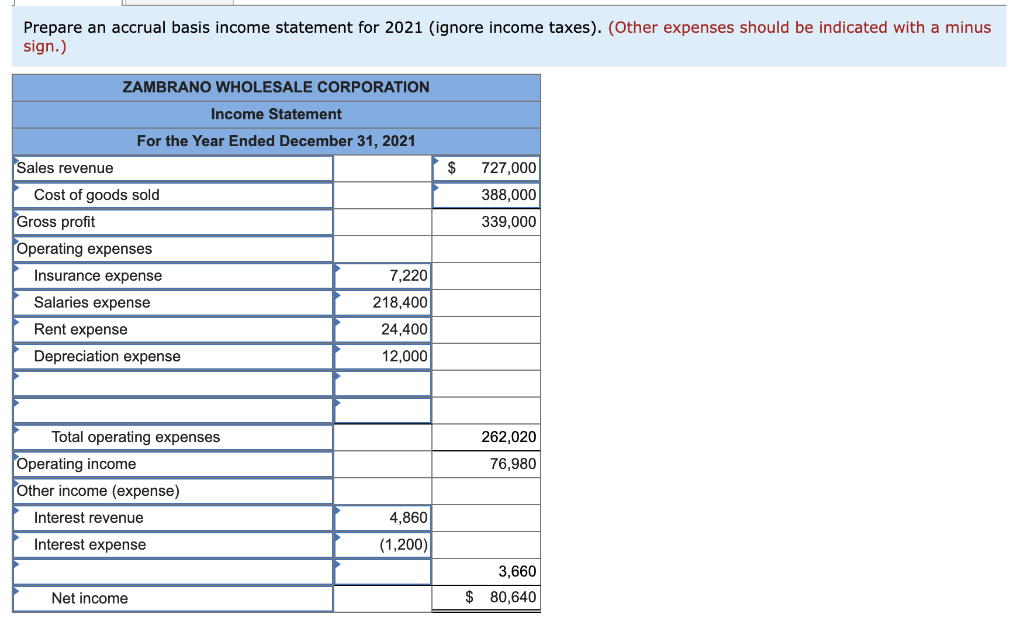

Prepare comparative income statement. It can also be referred to as a profit and loss (p&l) statement and is typically prepared quarterly or annually. The main steps in the preparation of comparative income statement are: Hence, this technique is also termed as horizontal analysis.

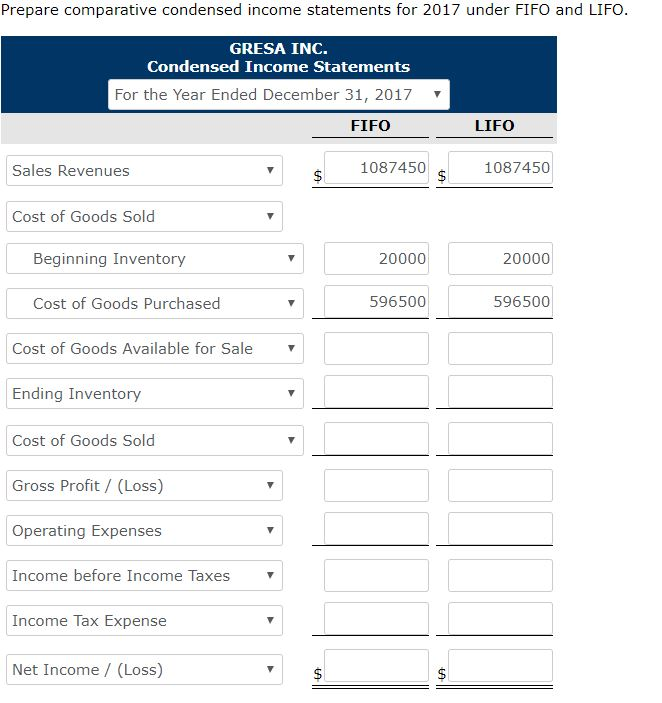

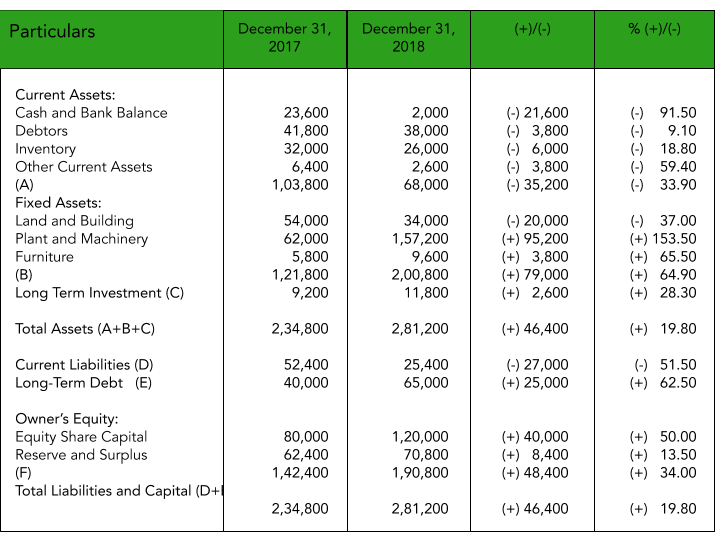

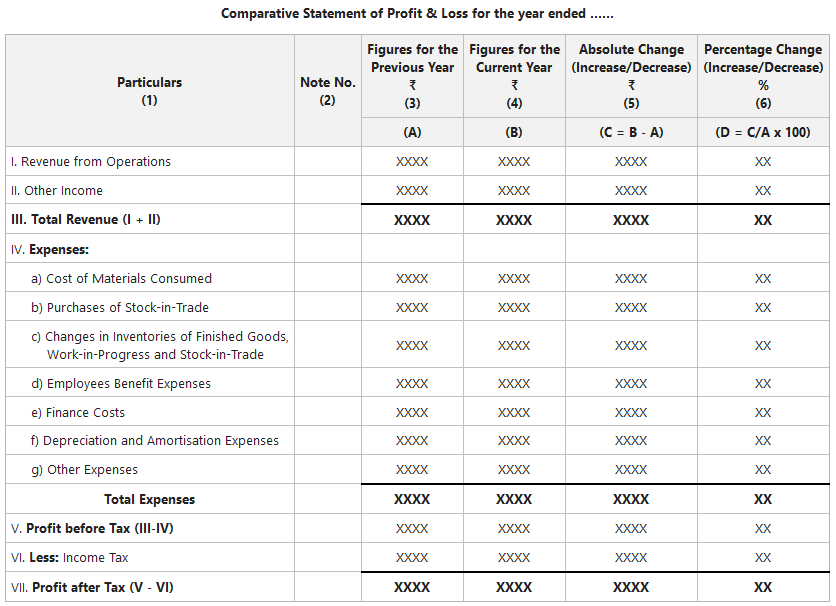

These statements help in determining the profitability of the business by comparing financial data from two or. Preparation of comparative income statement (statement of profit & loss) a comparative income statement has the following six columns: Calculate the absolute change in the items mentioned in the income statement.

This is accomplished by subtracting. In the first column, every item of the statement of profit & loss (revenue and expenses) is written. It presents previous figures with the latest financials, enabling one to compare a company’s performance against its competitors.

How to make a comparative income statement step #1. Preparation of comparative statements a comparative statement has five columns. Enter the items of income and expenditure in first column.

Vertical analysis can be used to compare and identify trends within a company from year to year (intracompany) or between different companies (intercompany). A comparative income statement will consist of two or three columns of amounts appearing to the right of the account titles or descriptions. Revenue from operations and other income are written separately.

Following are the steps to be followed in preparation of the comparative statement: Enter the previous year's figures in second column. A vertical analysis of financial statements often reports the percentage of each line item to a total amount.

Or, you can compare your income statement to other companies. Let’s look at an example to better comprehend the comparative profit and loss statement. It helps you identify financial trends and measure performance over time.

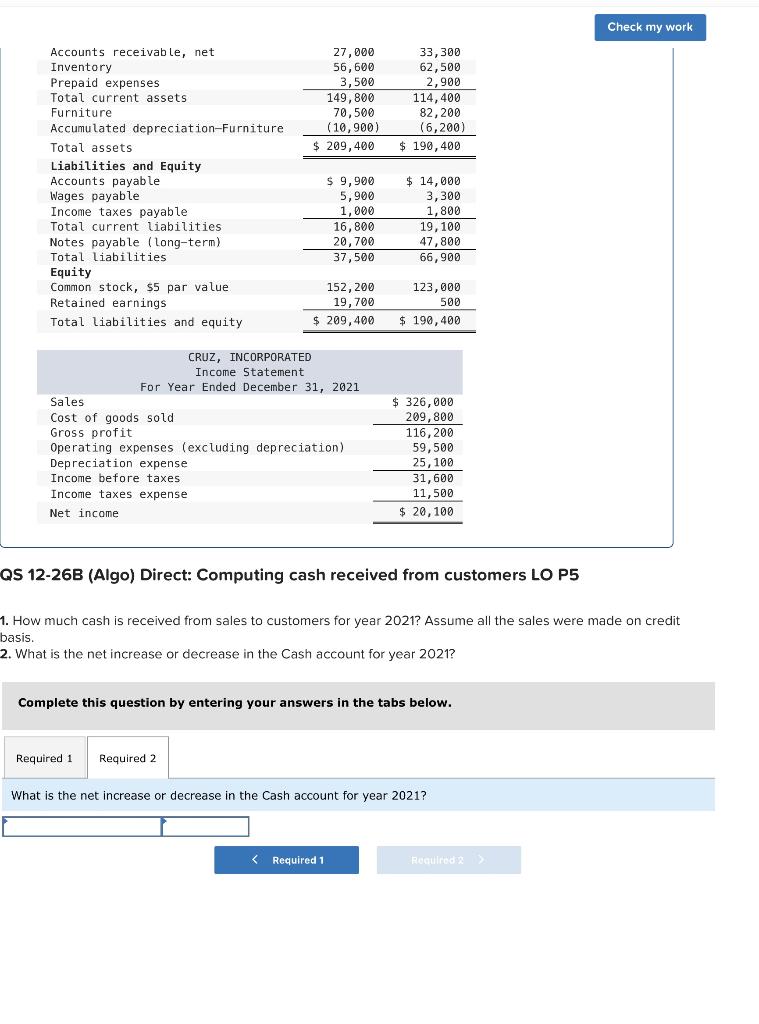

Enter the current year's figures in third column. If you have more than one year of financial data, you can compare income statements to see your financial progress. To begin, provide absolute figures for items such as cost of goods sold, net sales, selling expenses, office.

Our solutions resources our company professional partnerships login let's get started a comparative income statement is a very useful tool for business owners. A comparative income statement is an income statement in which different periods of the income statement are dealt with and compared side by side to allow the reader to compare prior year’s incomes and determine whether or not to invest in the firm. Then, establish support on either payroll period, with the most newest at the top.

Solved comparative income statements and credit sheets for. Perform a vertical analysis of a company’s financial statements. Add up all your revenue from sales during the reporting period and deduct your returns and concessions.