Amazing Tips About Net Income And Comprehensive

Note that the statement for toulon ltd.

Net income and comprehensive income. Using the previous example, $525 per week over 52 weeks would result in a gross annual income of $27,300 ($525 x 52). Record adjusted ebitda margin fourth. If you work the whole year, this would be 52 weeks.

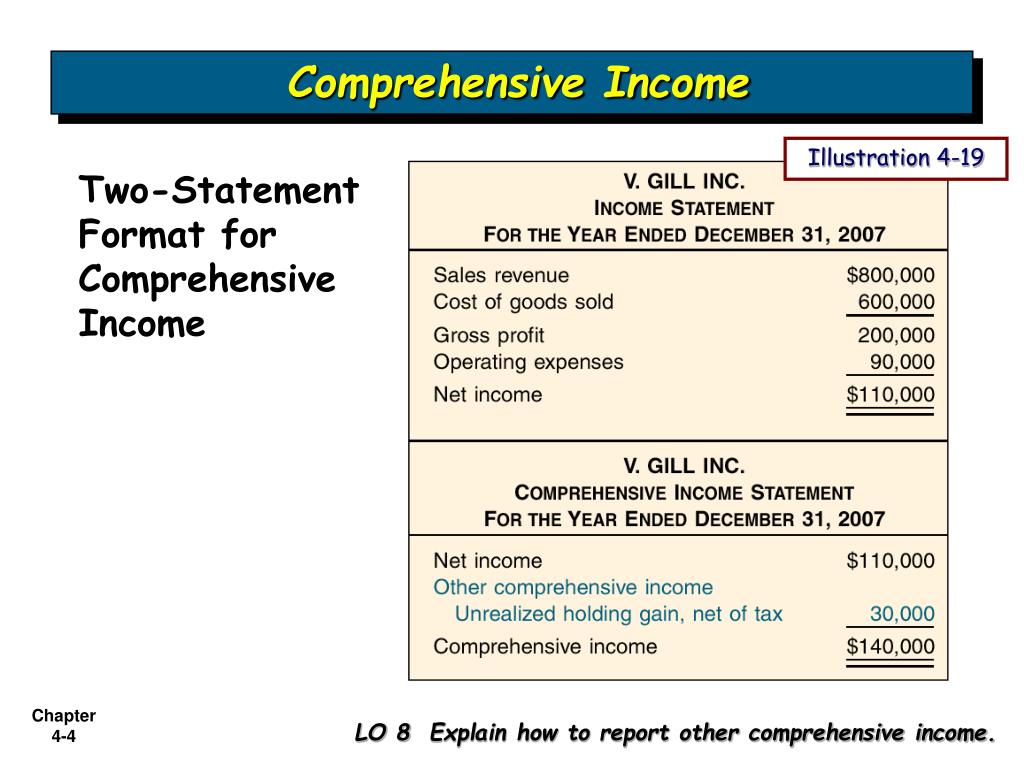

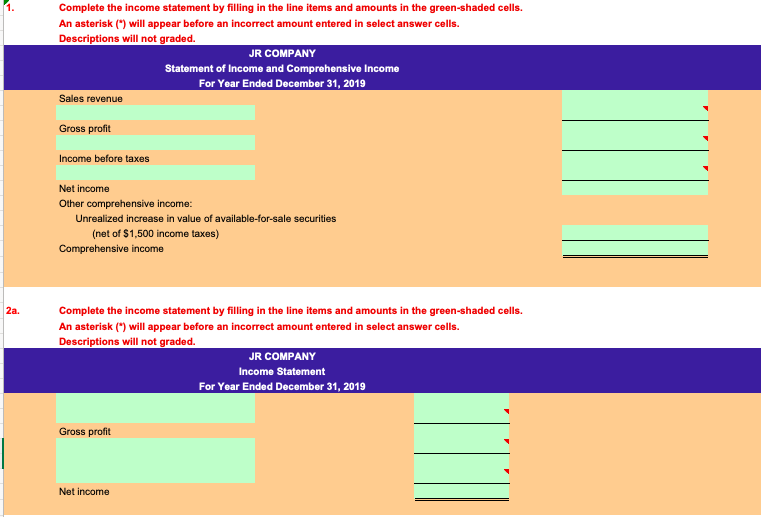

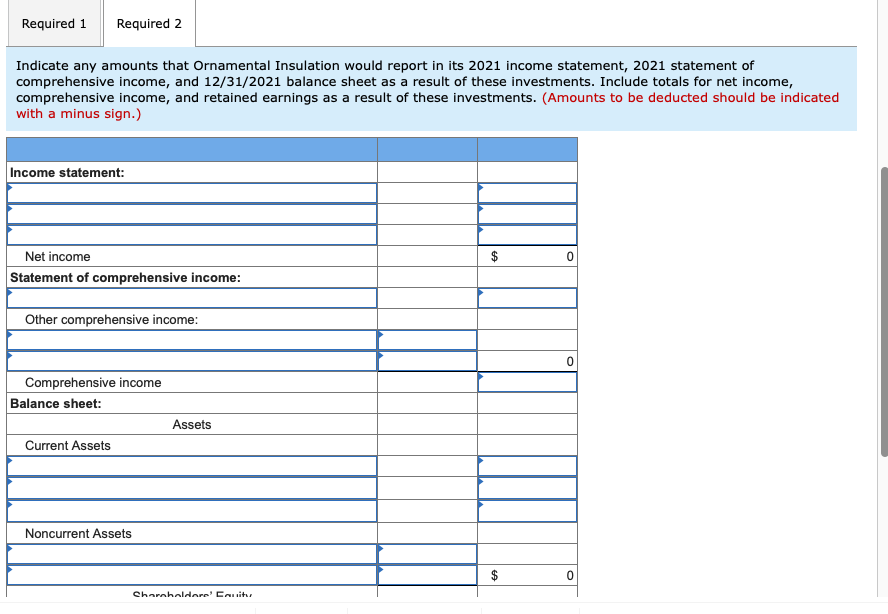

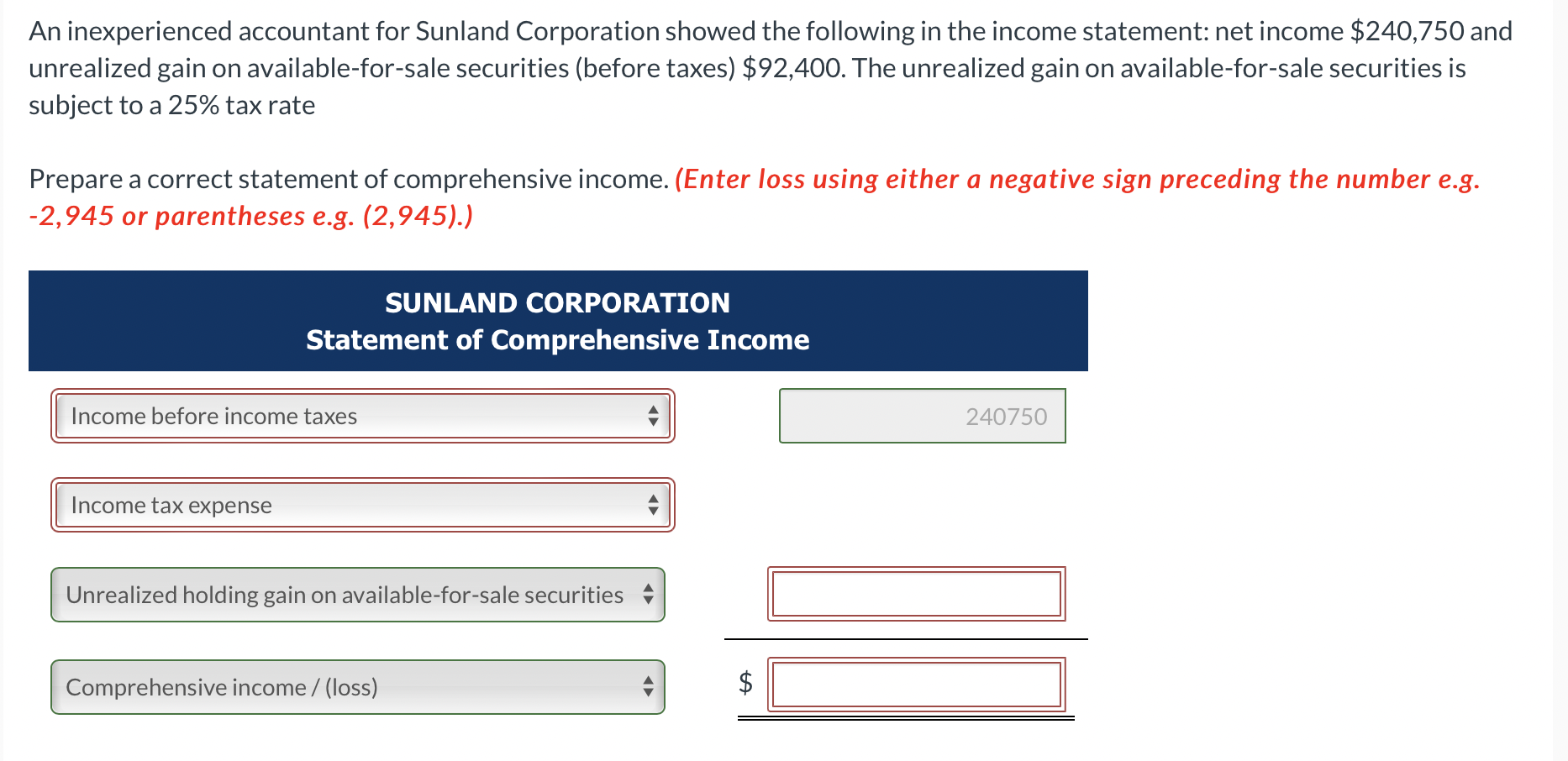

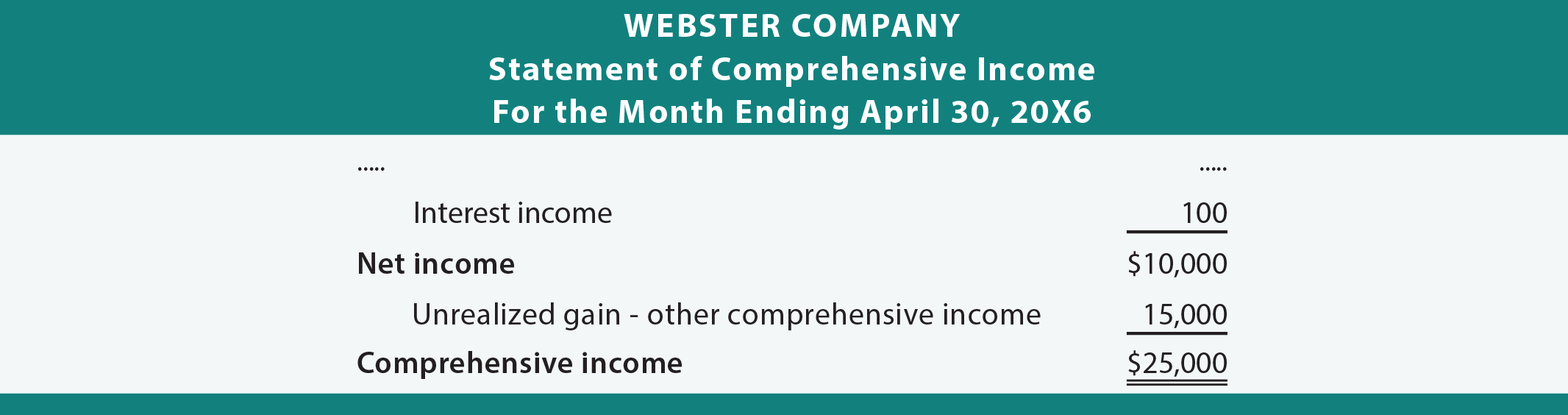

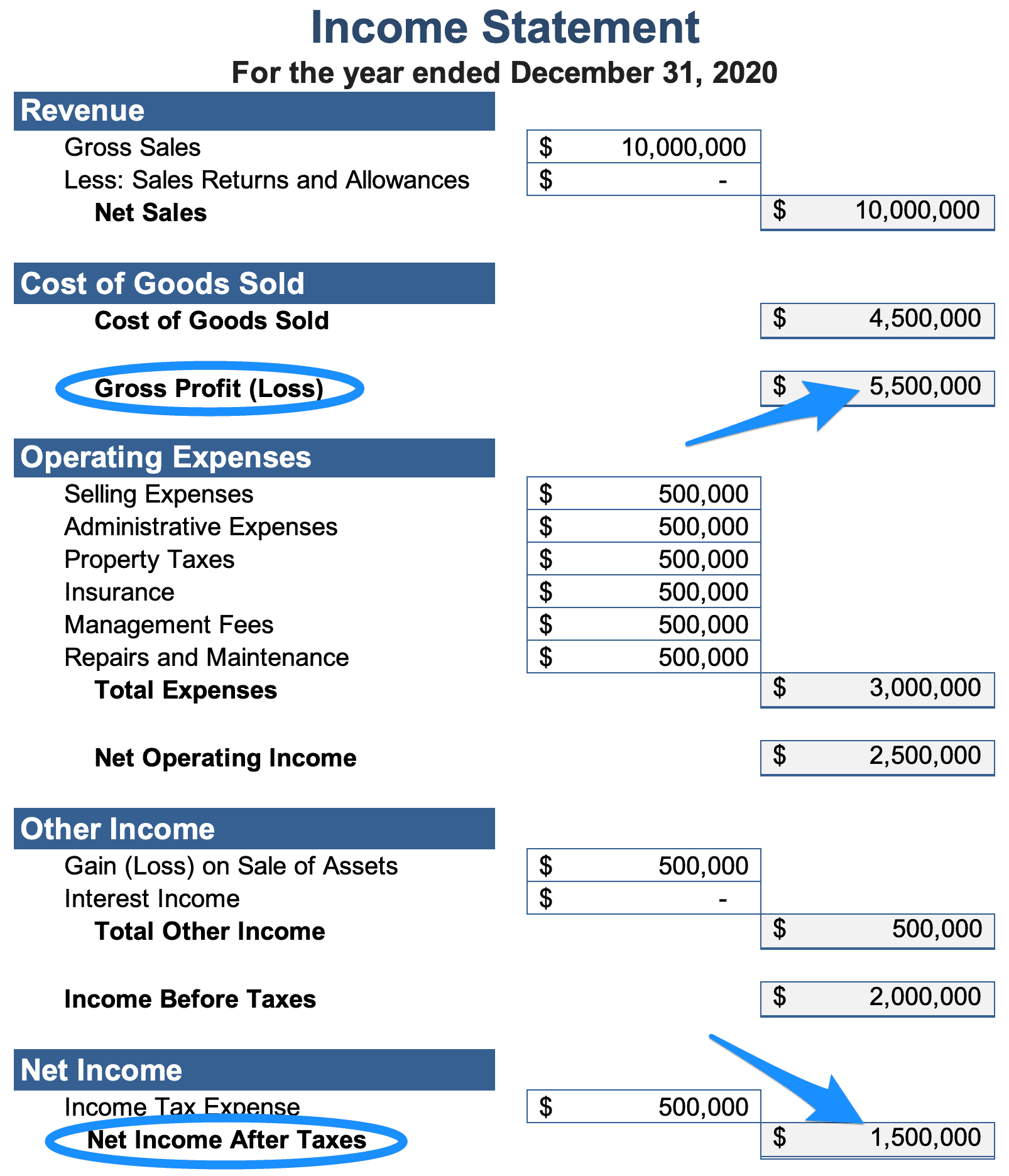

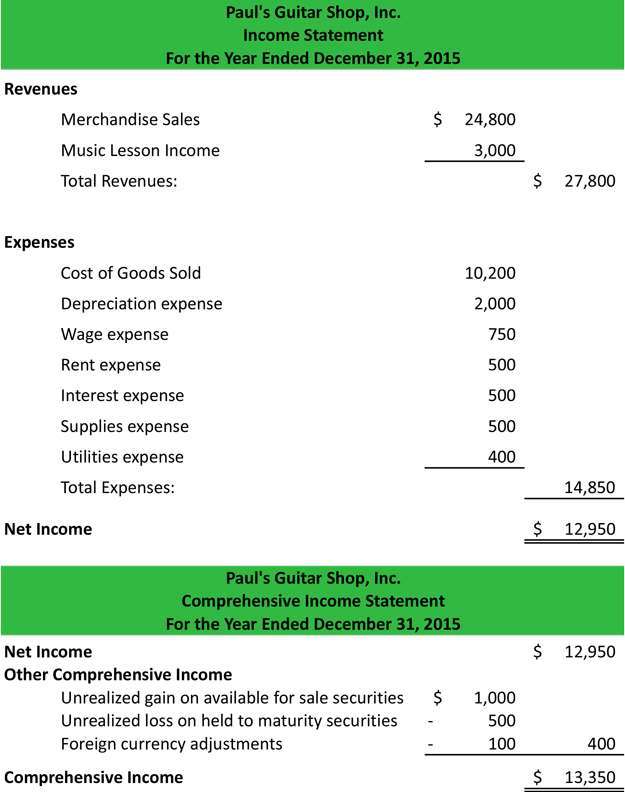

Comprehensive income is the sum of net income and other items that must bypass the income statement because they have not been realized, including items like an unrealized holding gain or loss from available for sale securities and foreign currency translation gains or. The statement of comprehensive income is a financial statement that highlights your business's net income and other comprehensive income (oci). This subtopic uses the term comprehensive income to describe the total of all components of comprehensive income, including net income.

States and the district of columbia is 42.32 percent as of january 2024, with rates ranging from 37 percent in states without a state income tax to 50.3 percent in california. The rising costs overshadowed a decent holiday quarter. Net income should represent the irreversible outcomes of an entity.

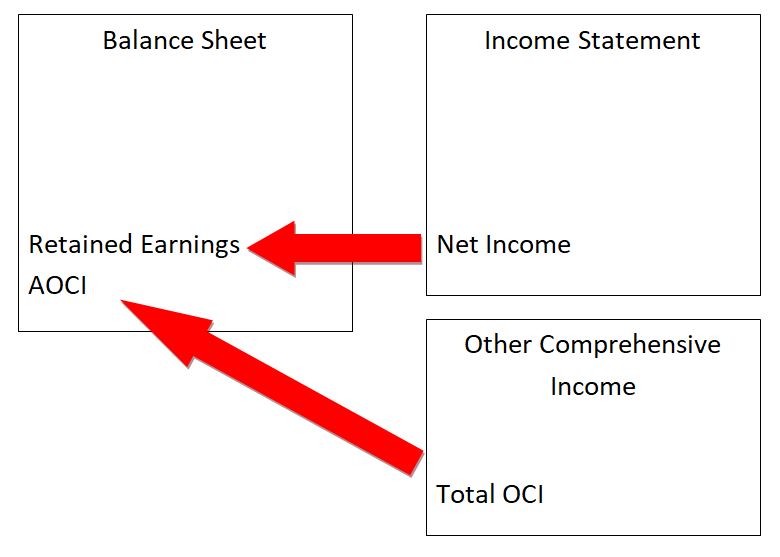

Accumulated other comprehensive income (aoci) is part of a company’s equity that records gains and losses not yet realized in net income. Oci consists of revenues, expenses, gains, and losses to be included in comprehensive income but excluded from net income. Present total net income, other comprehensive income, and comprehensive income.

The net income is obtained from your business income statement for your accounting period. Comprehensive income and income statement. Wyatt’s net income for the quarter is $20,000.

Andrew juma updated february 3, 2023 a statement of comprehensive income is a broad financial metric that includes all incomes and expenses that affect a company's financial standing over a period. To find your annual gross income, multiply your average weekly income by the number of weeks you work in a year. What is a net income?

The main part of this series (over 90 per cent) is. The statement of retained earnings includes two key parts: For companies, comprehensive income sheds light on changes in equity.

Earnings per share is typically shown below net income and before comprehensive income. Comprehensive income comprehensive income is equal to net income plus other comprehensive income. Total comprehensive income is therefore equal to net income + other comprehensive income = $50 million + $25 million = $75.

Earnings per share increased by 650% to. Net income (ni) is a company's total earnings (or profit ); Annualize your income:

Net income is calculated by taking revenues and subtracting the costs of doing business such as depreciation , interest. What is the statement of comprehensive income? Income from operations of $652 million;