Supreme Tips About Preparing Cash Flow Statement Direct Method

As mentioned earlier, the only difference when applying the direct method, as opposed to the indirect method, is in the operating activities section;

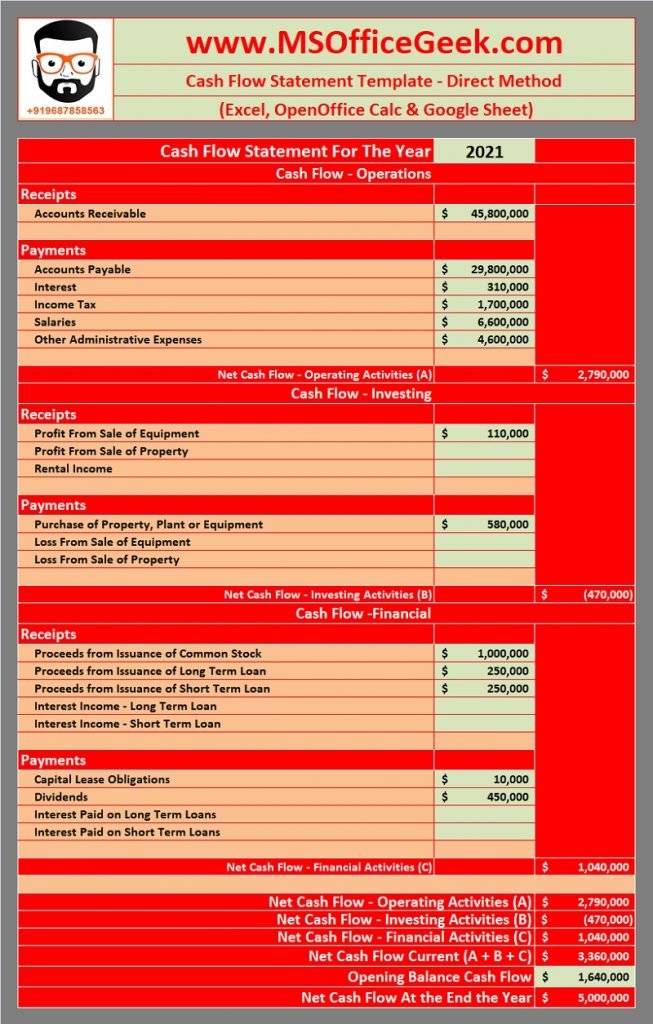

Preparing cash flow statement direct method. Not many businesses adopt this approach as it can be quite time consuming. A cash flow direct method formula is used to calculate cash inflows and cash outflows when preparing a cash flow statement using the direct method. Calculate cash flow from operating activities one you have your starting balance, you need to calculate cash flow.

In the direct method, the cash records of the business are analysed for the period, picking out all payments and receipts relating to operating activities. For instance, assume that sales are stated at $100,000 on an accrual basis. In other words, it lists where the cash inflows came from, usually customers, and where the cash outflows went, typically employees, vendors, etc.

The direct method of presenting the statement of cash flows presents the specific cash flows associated with items that affect cash flow. Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. Preparing the statement of cash flows using the direct method would be a simple task if all companies maintained extremely detailed cash account records that could be easily summarized like this cash account:

This includes specifics like cash received from customers and cash paid to. Do not include any sales made on credit. Methods of cash flow statement.

The direct method and the indirect method. The direct method is one of two accounting treatments used to generate a cash flow statement. However, this is the preferred method.

The second and third steps in preparing the cash flow statement. It is one of two methods a company can apply when presenting its cash flow statement, which reports on three types of activities that generate and use cash in a business — operations, investments and financing. Prepare a statement of cash flows using the direct method the direct method.

For instance, assume that sales are stated at $100,000 on an accrual basis. How to create a cash flow statement 1. Fasb also asserts that a direct method statement is more useful to a broad range of users and enhances their ability to predict cash flows, and to assess the relationship between amounts reported on the income statement and.

In many cases, some companies may have a salaries payable balance. The direct method converts each item on the income statement to a cash basis. The actual inflows received and the outflows paid for, and not accrued, are added and subtracted in the cash flow statement using the direct method.

Issues with the direct method. The first step in preparing the cash flow statement involves the determination of the total cash flows from operating activities. The direct method of developing the cash flow statement lists operating cash receipts (e.g., receipt.

Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance. It requires the use of the actual cash inflows and outflows of the organization. List cash collected from customers.

/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)