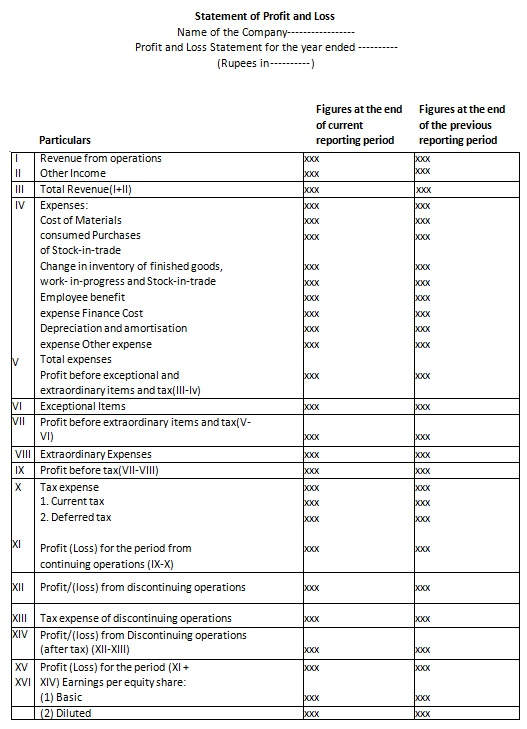

Peerless Tips About Extraordinary Items In Profit And Loss Account

An income statement or profit and loss account [1] (also referred to as a profit and loss statement (p&l), statement of profit or loss, revenue statement, statement of financial.

Extraordinary items in profit and loss account. Profit or loss from extraordinary activities is such which do not arise under the normal course of business. 04 may 2020 the number and size of exceptional items that will need to be recognised and presented in the profit and loss account due to coronavirus are likely to be substantial. A) loss on account of a hail storm ($ 25,000) b) gain on account of sale of the business segment :

An extraordinary loss is reported as a separate line item in the income statement, net of taxes, and after the results of operations. In the early form of ias 1, the extraordinary items were presented separately in the profit and loss account. Profit and loss account.

The nature and the amount of each extraordinary item. Extraordinary items consisted of gains or losses from events that were unusual and infrequent in nature that were separately classified, presented and disclosed on companies' financial statements. Business entities must separately declare.

What is the profit and loss statement (p&l)? Extraordinary items in accounting are income statement events that are both unusual and infrequent. Profit and loss account show separately in the order of:

At the revision from 2003, the ias 1 standard interdicted the. These activities do not occur regularly. Loss from extraordinary items ($ 10,000).

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a. An extraordinary item on a balance sheet indicates a substantial gain or loss that is unlikely to be repeated. In other words, these are transactions that are abnormal and don’t relate to.

An extraordinary item in accounting is an event or transaction that is considered abnormal, not related to ordinary company activities, and unlikely to recur in. Costs or income affecting a company's profit and loss account that do not derive from the ordinary activities of the company, are not expected to recur, and, if undisclosed, would. These statements recommended an income statement that showed extraordinary gains and losses on its face after determination of net income for the.

For the financial year ending 31 december 2018 (in €‘000) notes. An extraordinary item is an accounting term that refers to an abnormal gain or loss that is not generated from the. The nature of an extraordinary event or transaction and the principal items entering into the determination of an extraordinary gain or loss shall be described.

Definitions net profit or loss for the period extraordinary items profit or loss from ordinary activities prior period items changes in accounting estimates. Extraordinary items must be declared in the statement of profit or loss as a part of net profit or loss for the given period.