Lessons I Learned From Info About Interpreting Financial Statements

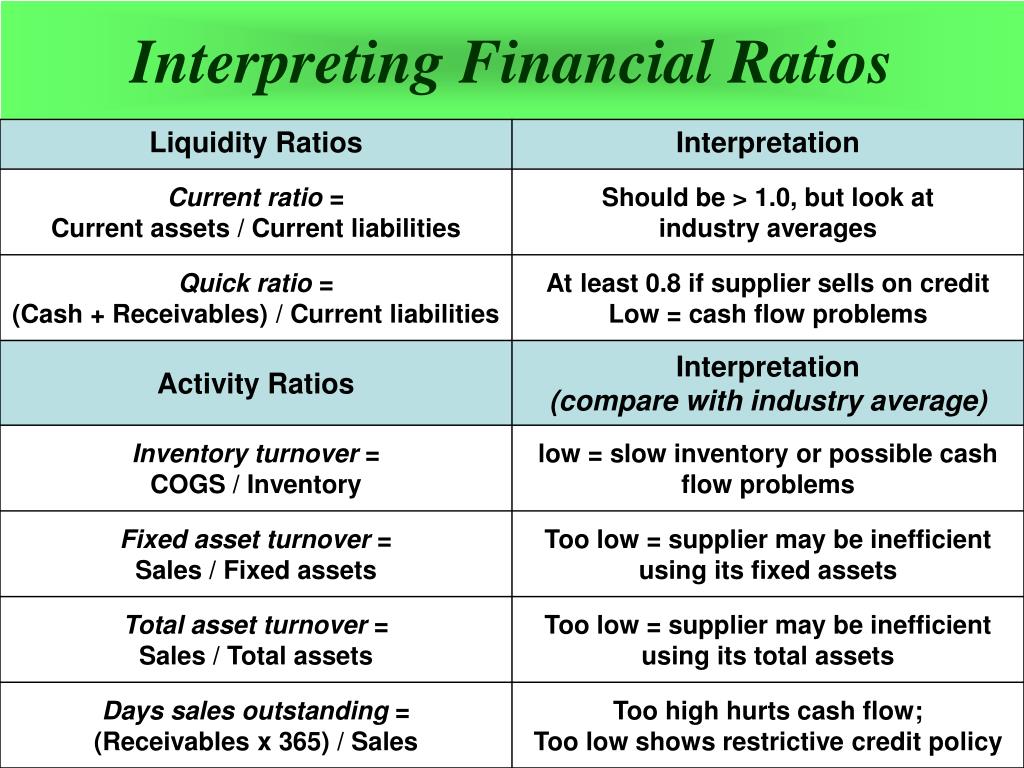

Interpreting financial statements. These three financial ratios let you do a basic analysis of your balance sheet. Balance sheets, income statements, cash. Candidates require good interpretation skills and a good understanding of what the information means in the context of a question.

Balance sheets, income statements (also called profit and loss or p&l statements), and cash flow statements. Learn how to read financial statements. Balance sheets show what a company owns and what it owes at a fixed point in time.

Evaluating a company’s financial health: The three main types of financial statements are the balance sheet, income statement and cash flow statements. In this article, you will learn about three types of financial statements:

Understanding financial statements to understand a company’s financial position—both on its own and within its industry—you need to review and analyze several financial statements: Financial statements are written records that convey the financial activities of a company. By analyzing a company’s income statement, balance sheet, and cash flow statement, you can get a sense of its financial performance and position.

There are four main financial statements. Interpreting financial statements requires analysis and appraisal of the performance and position of an entity. In thischapter we will consider how to interpret them and gain additionaluseful information from them.

Financial statements are often audited by government agencies and accountants to ensure. And (4) statements of shareholders’ equity. 1 interpreting financial information introduction financial statements on their own are of limited use.

Analyzing a balance sheet with financial ratios. Income statements show how much money a company made and spent over a period of.