Perfect Info About Current Financial Year For Income Tax

Some components of your salary are exempt from tax, such as telephone bills reimbursement, leave travel allowance.

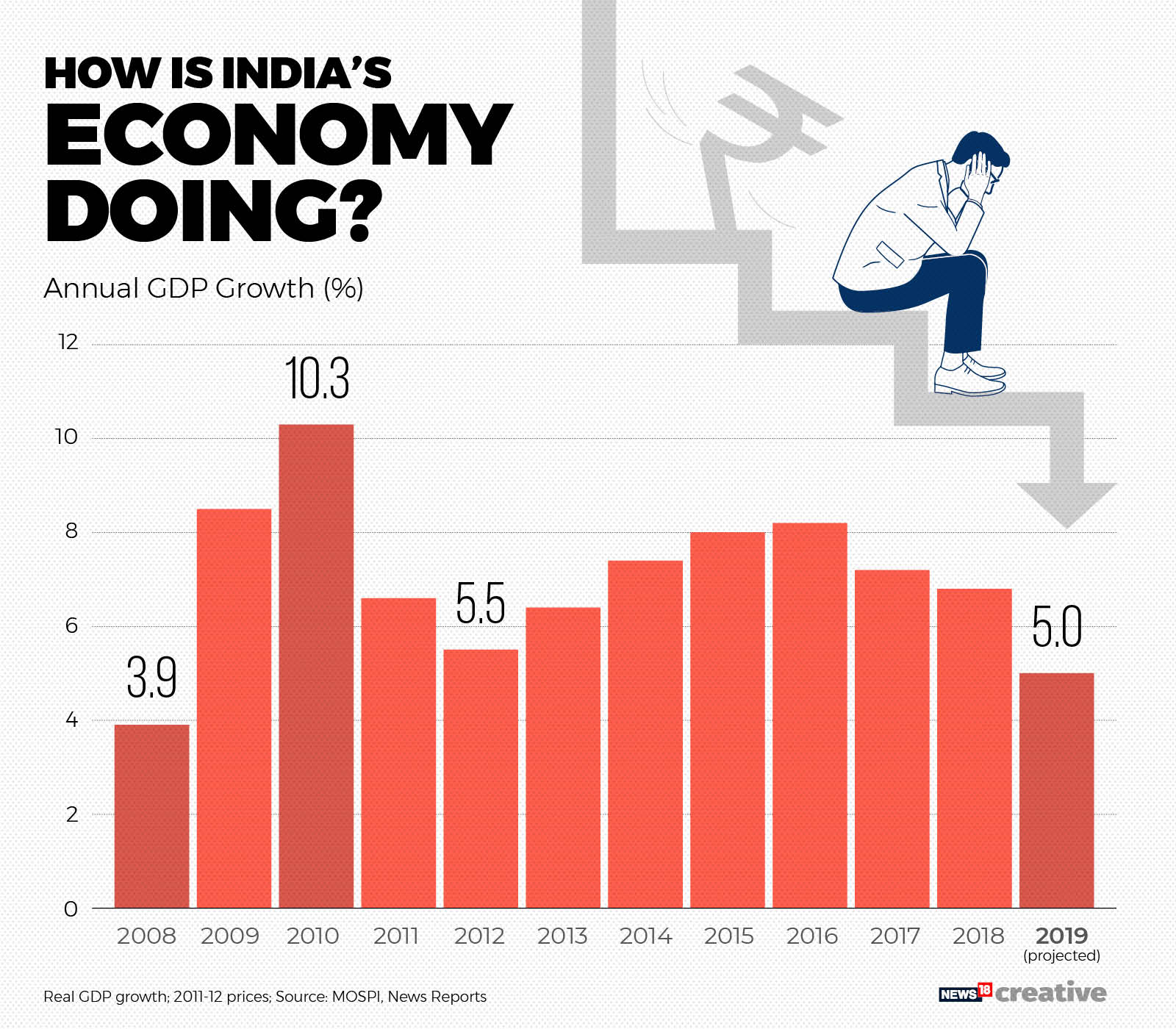

Current financial year for income tax. Shannon stapleton/getty images. This period starts on 1 st april and ends on 31 st march next year. Check your tax code and personal allowance see.

An assessment year is a period when the previous year's earnings are assessed, taxes are due, and the filing of income tax returns (itrs) is done. This page is also available in welsh (cymraeg). Under current law, for tax year 2023, the following currently apply:

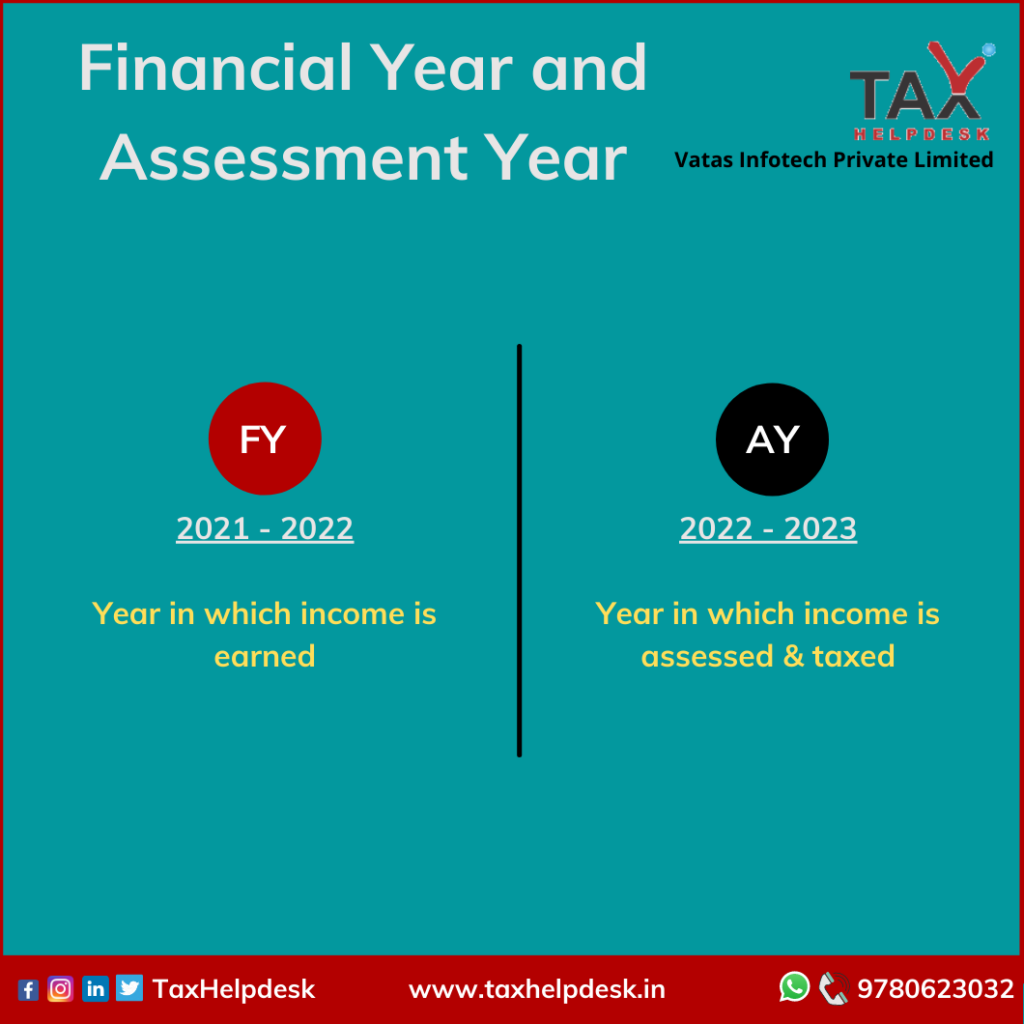

Fact checked by rinju abraham what is tax year? In other words, it’s the year in which the taxpayer’s income tax liability is calculated and the tax return is processed. What is income tax?

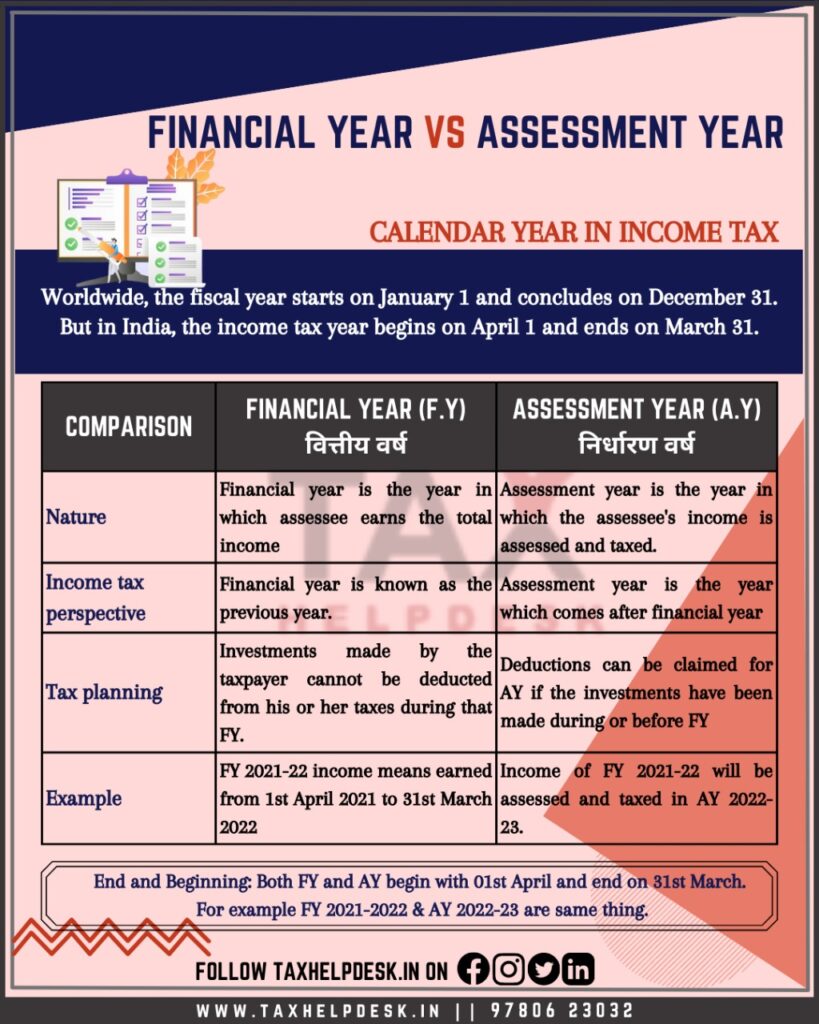

On the other hand, the assessment year is the year followed by the financial year in which the previous year’s income is evaluated, tax is paid on the same, and an income tax return (itr) is filed. This service covers the current tax year (6 april 2023 to 5 april 2024). From an income tax perspective, fy is the year in which you earn an income.

Taxpayers always get confused between the financial year (fy) and assessment year (ay) for which they are filing itr. 5 rows learn what is a financial year and an assessment year, and how they relate to income tax returns in india. These terms are widely used in the context of itr filing, tds return filing, and payment of income tax.

Both the assessment year and the financial year beginning on april 1 of a year and end on. Current income tax, along with deferred income tax, constitutes the total tax expense shown in the income statement. As per india’s income tax laws, the income which taxpayers earn in the current year will be taxable in the next financial year.

If you receive hra and live on rent, you can claim exemption on hra. What is previous year in income tax? Thus, the previous year in income tax is the current financial year.

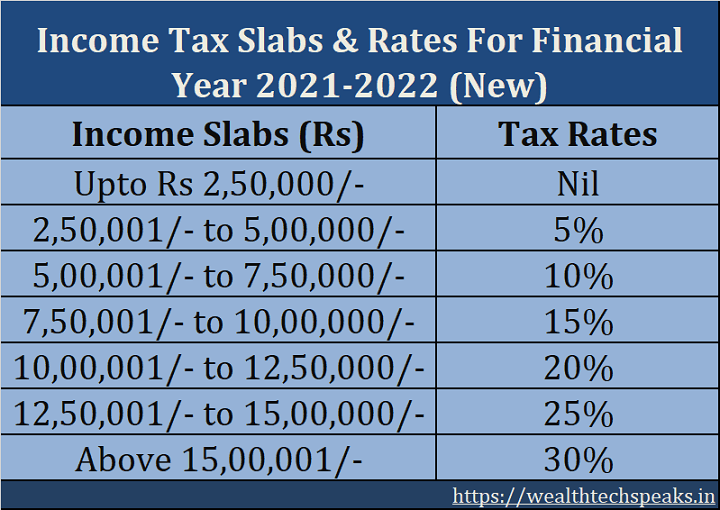

It is governed by the income tax act of 1961, which outlines the norms for. Income from operations of $652 million; Finance minister enoch godongwana has outlined the new tax brackets for personal income taxpayers in his budget speech 2024 on wednesday (21 february).

For example, if the financial year 2022. Record adjusted ebitda margin fourth. Income tax is a tax on the annual income earned by the individual or company during the fiscal year.

To claim the eitc without a qualifying child in 2023, taxpayers must be at. This income is subject to tax in the assessment year. The current financial year (which is effectively the same as the current fiscal year) in india started on 1st april 2023 and will end on 31st march 2024.