Recommendation Tips About Sba Form 413 Printable

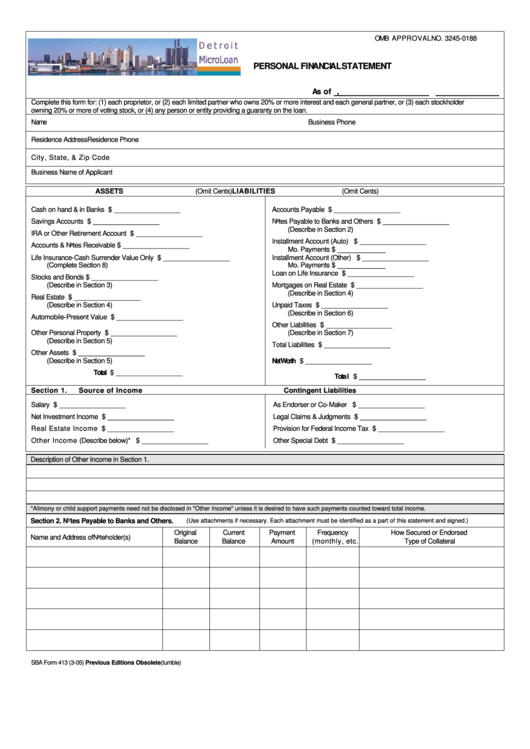

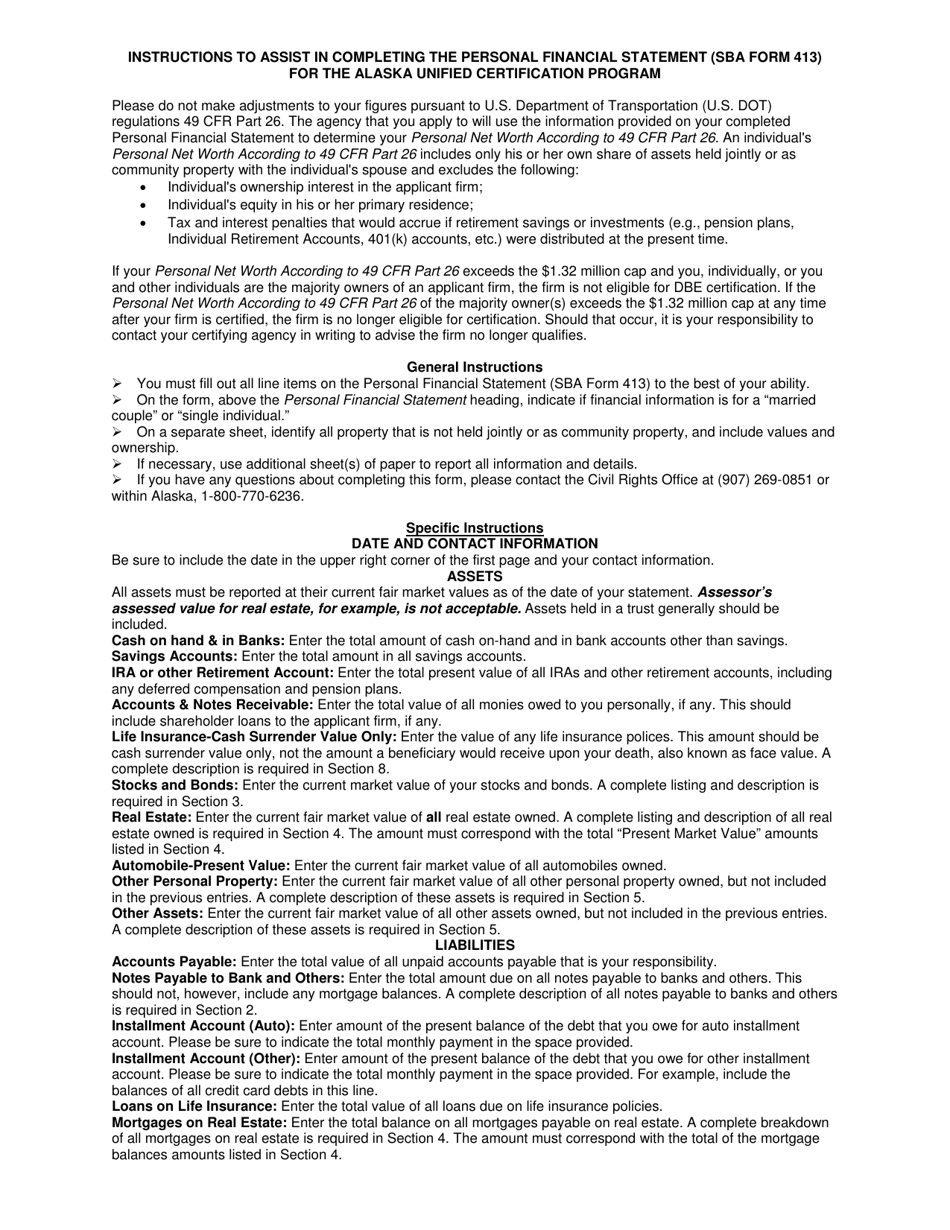

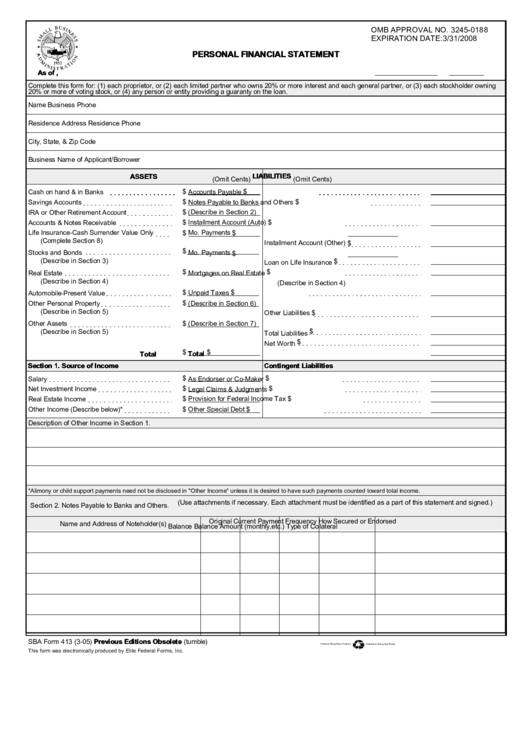

Sba form 413 includes 11 sections for business loan applicants to complete.

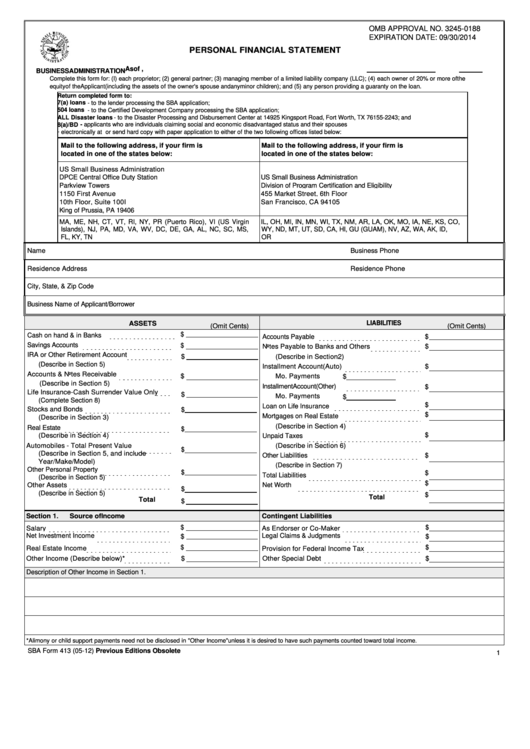

Sba form 413 printable. Criminal penalities and administrative remedies for false statements: Form 413 is one of the most important factors when it comes to approval of an sba loan. _____ notice toloan and surety bond applicants:

Download the sba form 413 pdf. The role of sba form 413 in sba loans. Sba the small business administration (sba) requires form 413, the personal financial statement, for most sba loans, such as the eidl loan, 7 (a) loan, and 504 loan.

What is sba form 413? Sba form 413, also known as the personal financial statement, is an essential document for those seeking an sba loan. This form provides a snapshot of your personal assets and liabilities, which allows the lending partner to evaluate your ability to.

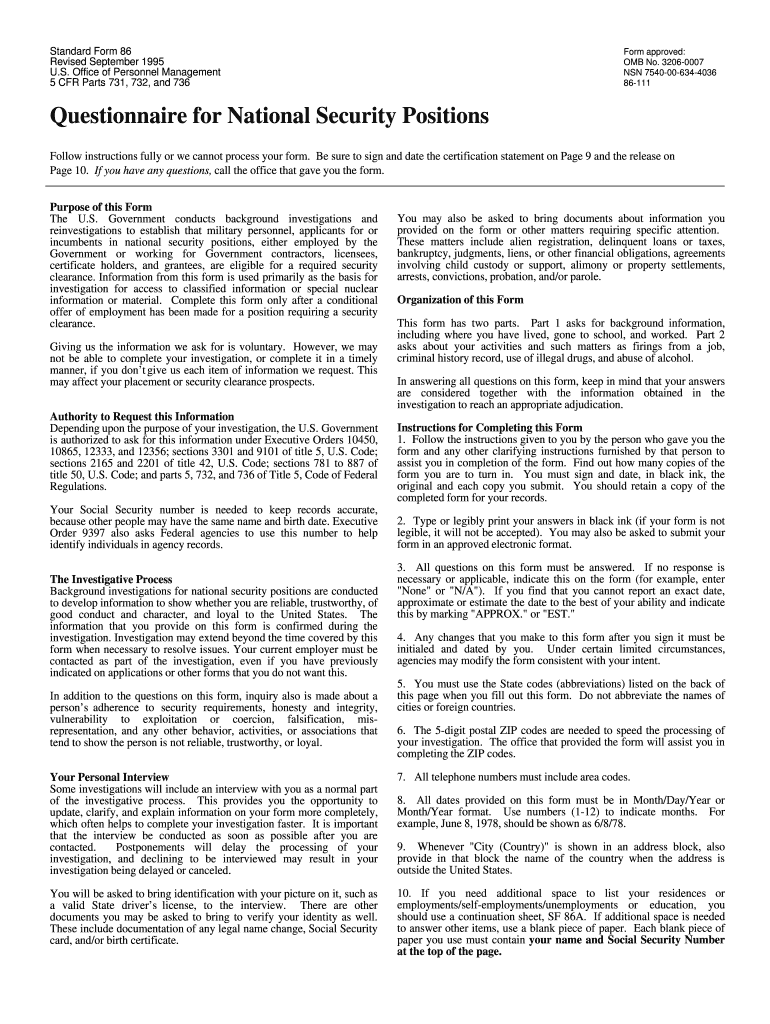

Download as pdf who needs to fill out form 413? Businesses applying for an sba 7 (a) loan, sba 504 loan, or an sba disaster loan must include a personal financial statement in their loan application package. Each of the following people must complete and provide their own personal financial statement:

All borrowers and guarantors applying for certain sba loans must fill out sba form 413, which is intended to collect details about applicants’ personal finances. Small business administration, united states federal legal forms, legal and. The small business administration and approved lenders use this form to help determine borrowers’ creditworthiness and ability to repay the loan.

Fill out the personal financial statement online and print it out for free. The sba uses this form to evaluate your finances. Small business administration in pdf format online.

Wait until sba form 413 printable is appeared. Sba form 413 personal financial statement sba uses this form to assess the financial situation of applicants for multiple sba programs and certifications. 13 sba form 413 templates are collected for any of your needs.

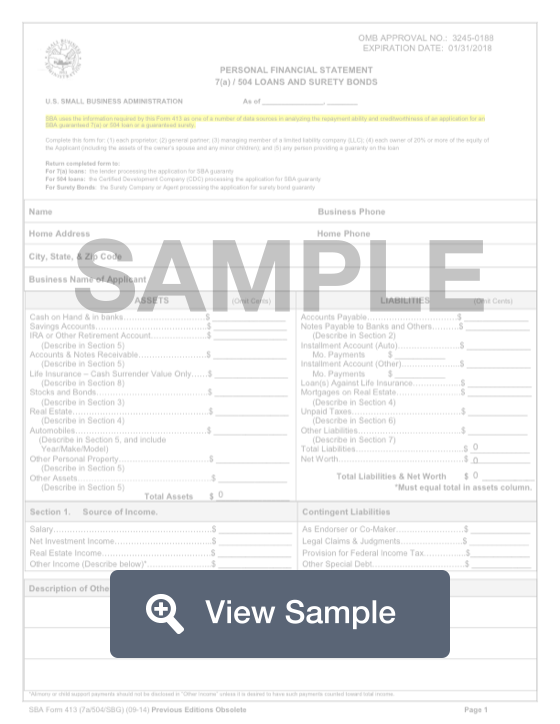

Sba lenders and surety companies/surety agents must begin to utilize the renewed version of sba form 413 (7a/504/sbg/oda/wosb/8a) immediately. Sba form 413 is typically required as part of an sba loan application. Sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an applicant for an sba loan or, with respect to a surety bond, to assist in recovery in the event that the contractor defaults on the contract.

It is also known as a personal financial statement. The purpose of this document is to provide you with supplemental pages if you need more space when completing sba form 413, which is the sba personal financial statement form required for sba 7(a) loans, sba 504 loans, and sba surety bonds. Customize your document by using the toolbar on the top.

Sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an application for an sba guaranteed 7(a) or 504 loan or, with respect to a surety bond, to assist in recovery in the event that the contractor defaults on the contract. Read the following instructions to use cocodoc to start editing and writing your sba form 413 printable: The sba reviews your personal financial information to determine your.