Nice Tips About Bad Debt Expense Income Statement

Example of bad debt expense

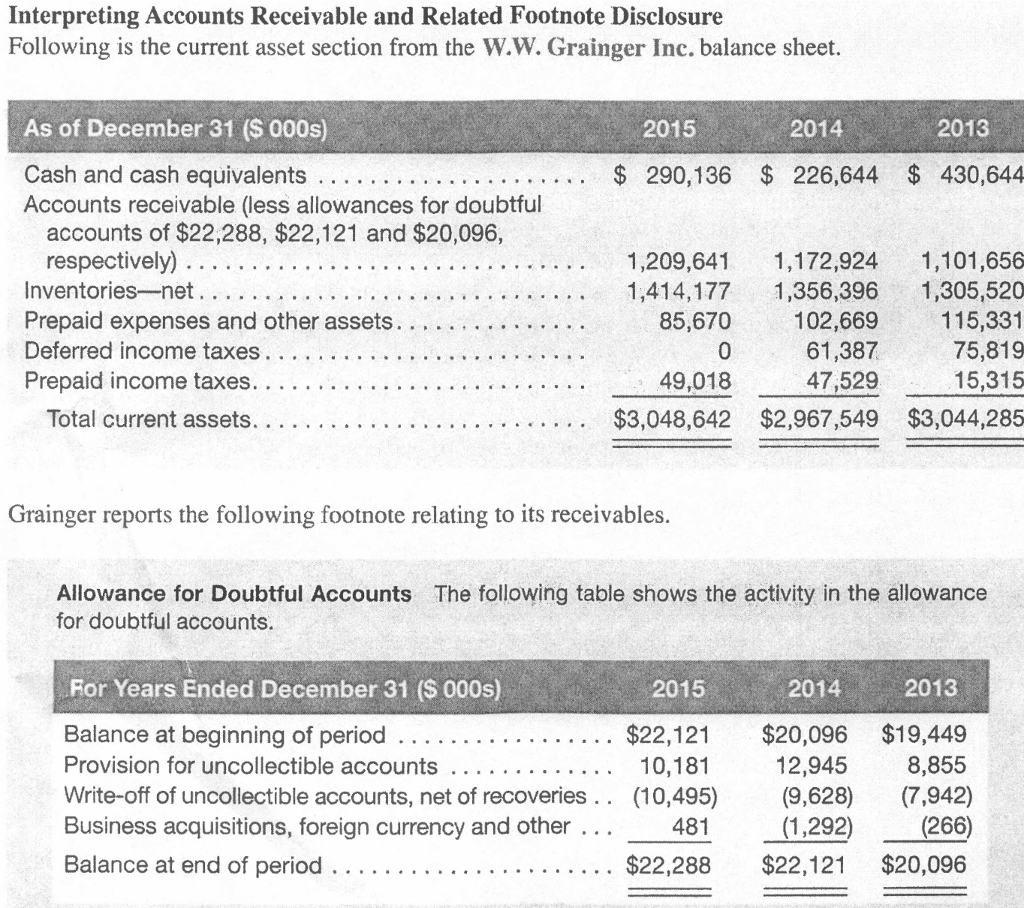

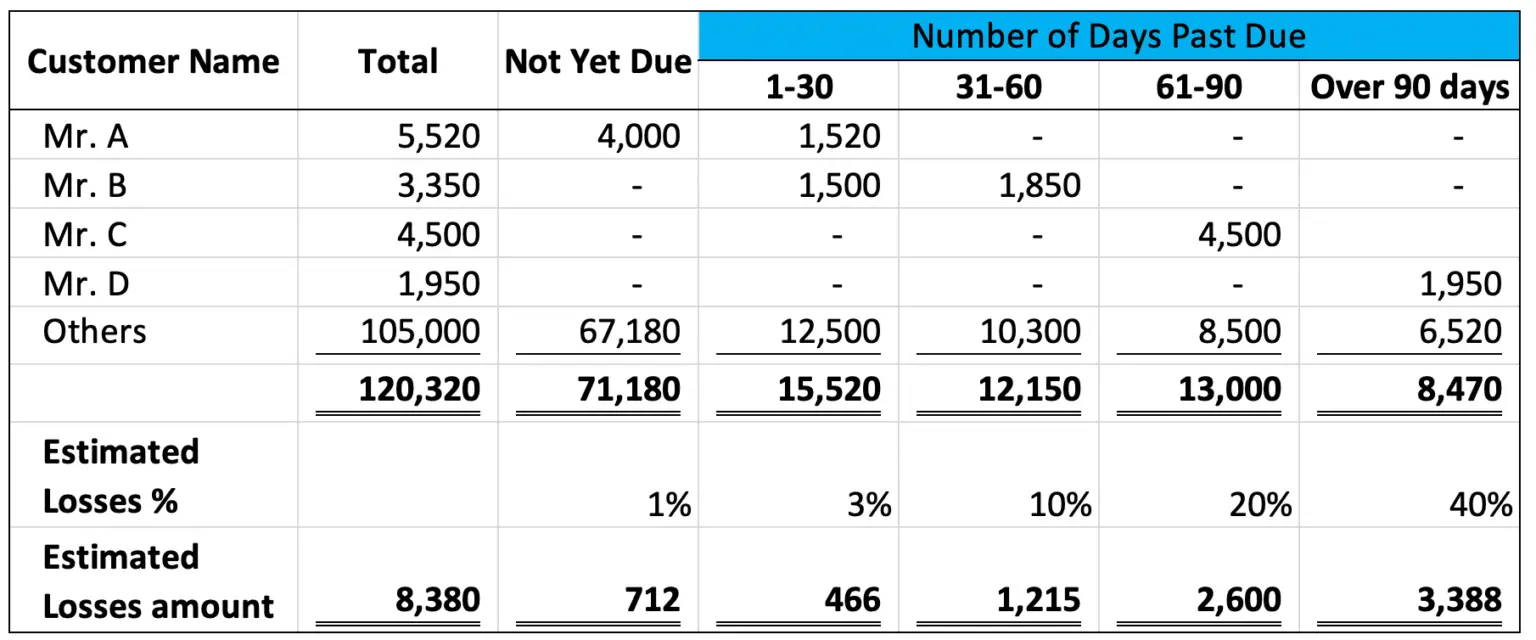

Bad debt expense income statement. Though part of an entry for bad debt expense resides on the balance sheet, bad debt expense is posted to the income statement. The estimation is typically based on credit sales only, not total sales (which include cash sales. Using the same information as before, rankin makes an estimate of uncollectible accounts at the end of the year.

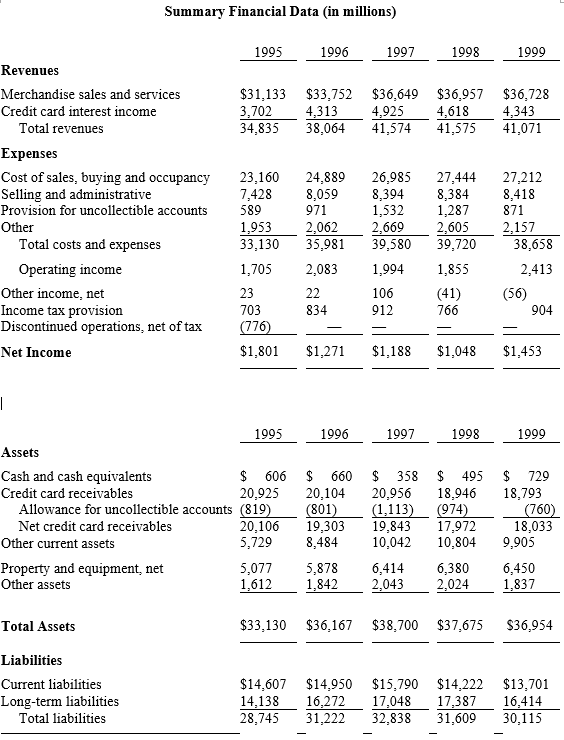

However, inflation may be to blame rather than a lack of ability to collect. The percentage of sales method is an income statement approach, in which bad debt expense shows a direct relationship in percentage to the sales revenue that the company made. The percentage of credit sales approach (also known as the income statement approach) estimates bad debt expenses based on the assumption that at the end of the period, a certain percentage of sales during the period will not be collected.

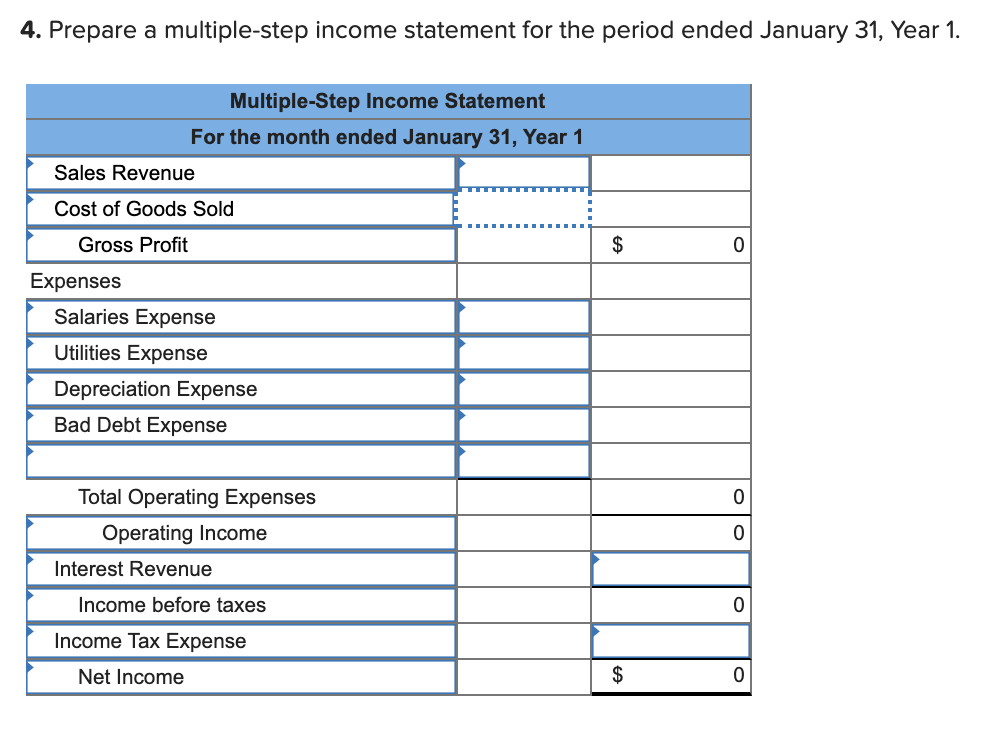

The bad debt expense account is an income statement account that increases expenses and reduces net income. Bad debts expense is an income statement account while the latter is a balance sheet account. Bad debt expense is used to reflect receivables that a company will be unable to collect.

Accounting for a credit or loan agreement can be distilled into four key steps: How to find bad debt expense. You can also use doubtful accounts expense and.

Bad debt expense = $20 million × 1.0% = $200k; Likewise, the calculation of bad debt expense this way gives a better result of matching expenses with sales revenue. Bad debts expense represents the uncollectible amount for credit sales made during the period.allowance for bad debts, on the other hand, is the uncollectible portion of the entire accounts receivable.

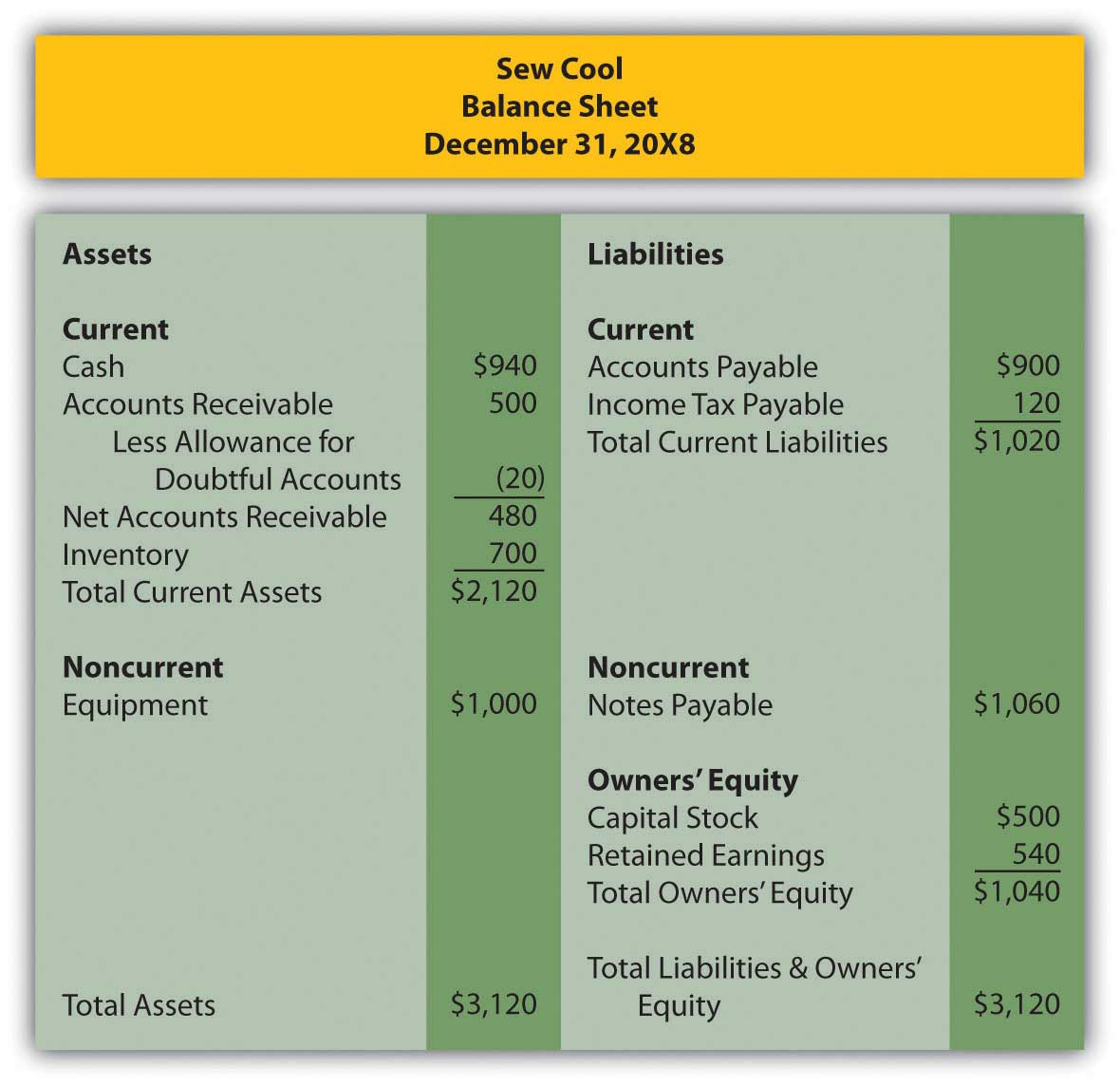

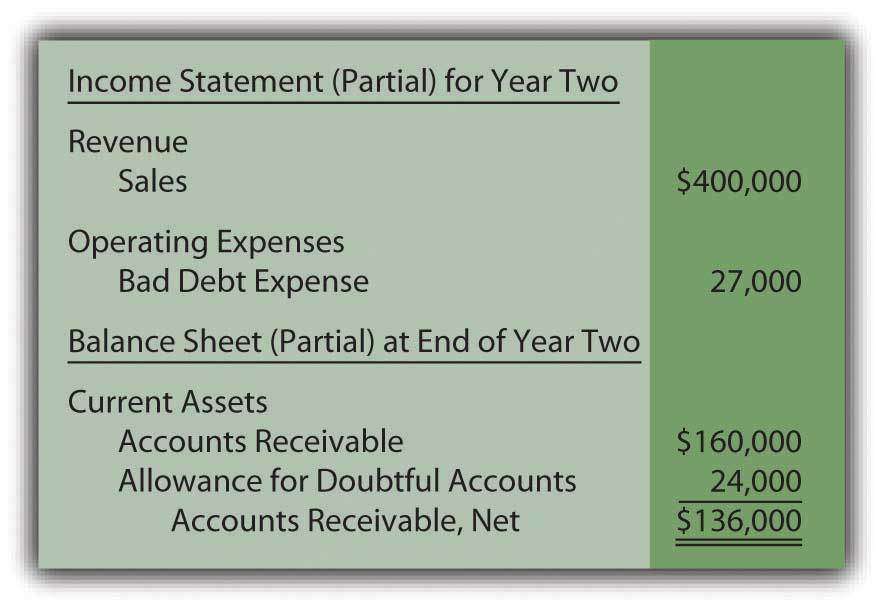

On the income statement, the bad debt expense is recorded in the current period to abide by the matching principle, while the accounts receivable line item on the balance sheet is reduced by the allowance for doubtful accounts. Recording uncollectible debts will help keep your books balanced and give you a more accurate view of your accounts receivable balance, net income, and cash flow. Table of contents what is bad debt expense formula?

Income statement method for calculating bad debt expenses the income statement method (also known as the percentage of sales method ) estimates bad debt expenses based on the assumption that at the end of the period, a certain percentage of sales during the period will not be collected. For example, in one accounting period, a company can experience large increases in their receivables account. Reporting bad debt expense on income statement allows companies to accurately and completely report their financial position.

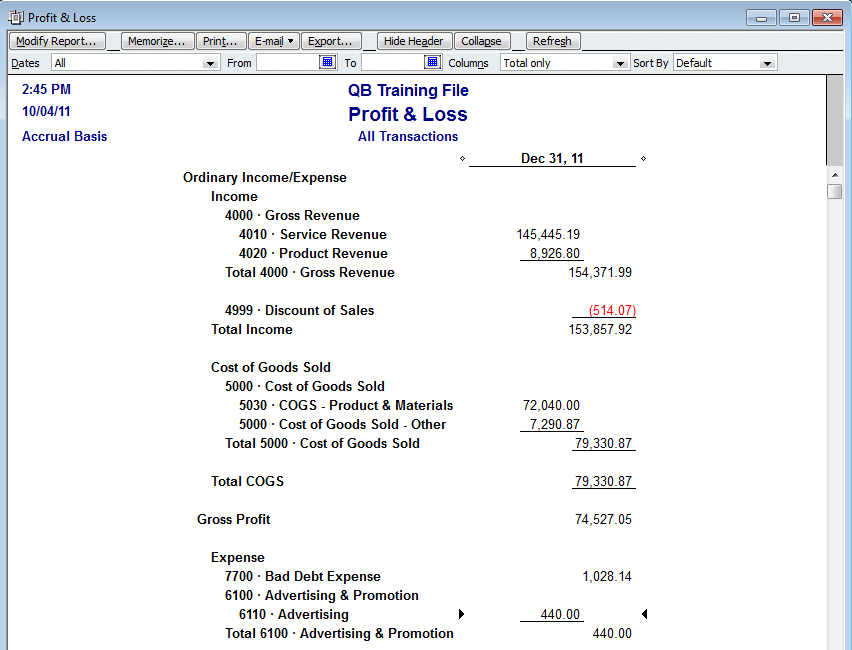

The income statement shows the aggregate financial position of a business during a specified period by displaying the amount of revenue generated and expenses incurred by a business. Yes, bad debts are recorded in the income statement. This practice ensures the income statement reflects the company’s profitability with.

However, there are cases where the bad debt expense can be negative, where it actually increases the amount of reported profit. Presentation of bad debt expense. The bad debt expense appears in a line item in the income statement, within the operating expenses section in the lower half of the statement.

Bad debt expense is an expense recorded in financial statements when amount receivable from debtors are not recoverable due to inability of debtors to meet their financial obligation and can be calculated using direct allowance/estimation method. With respect to financial statements, the seller should report its estimated credit losses as soon as possible using the allowance method. Recognizing and accurately recording bad debt expense when they occur is crucial.

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)