Nice Tips About Financial Condition Ratio

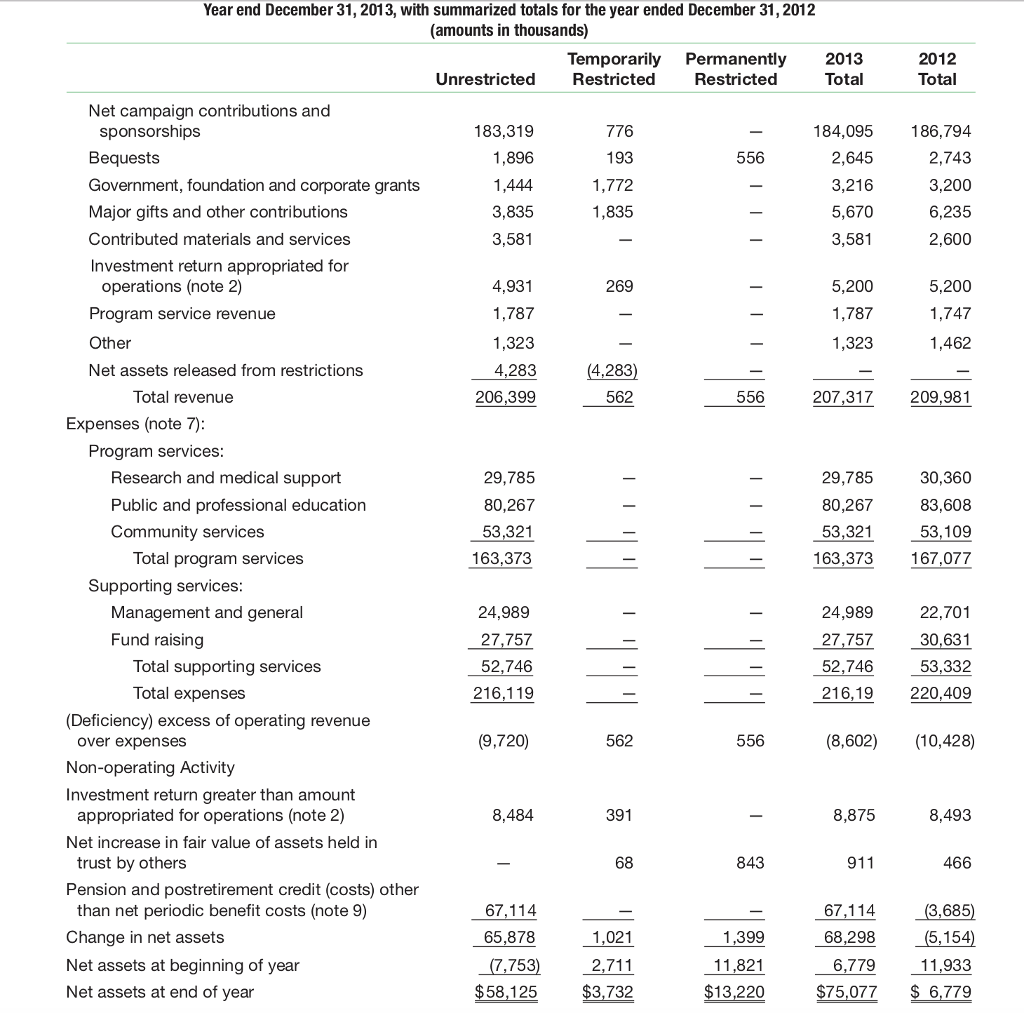

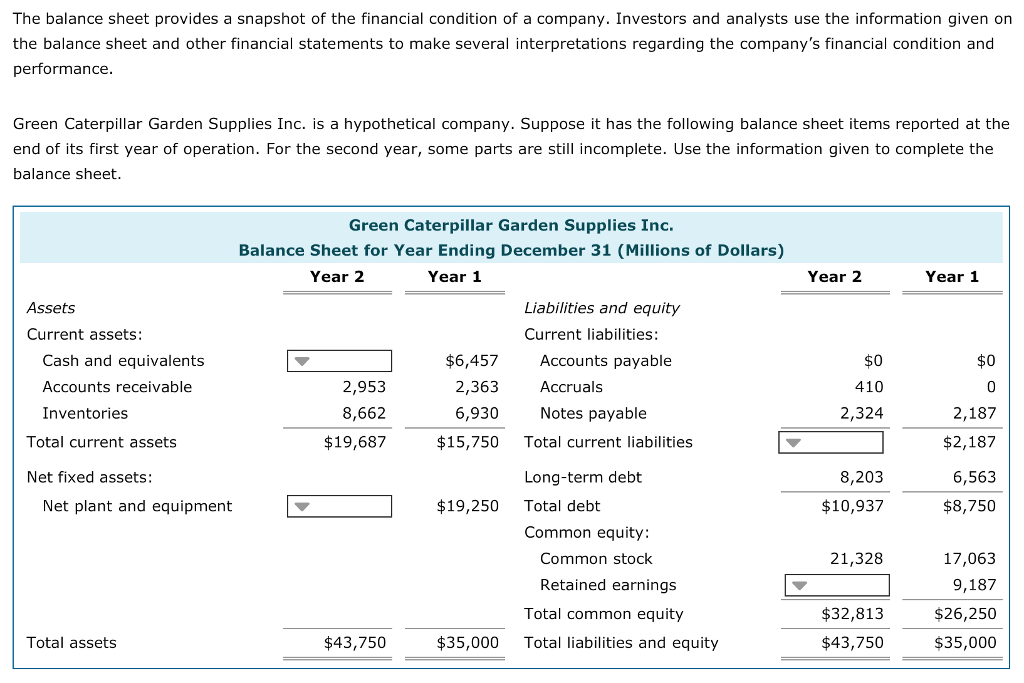

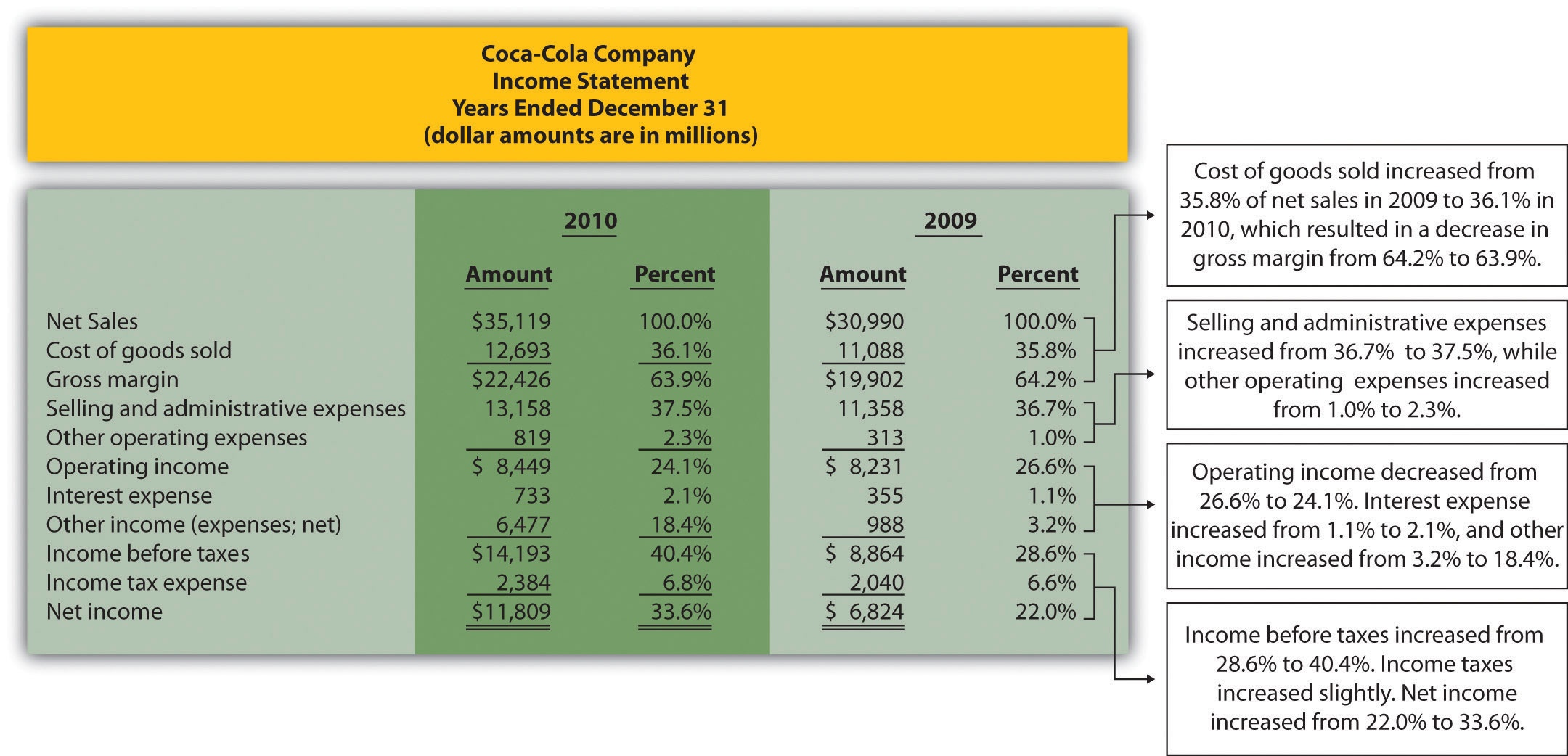

Financial ratio analysis involves studying these ratios to learn about the company's financial health.

Financial condition ratio. A company's worth is based on its market value. Analysis of financial ratios serves two. They are mainly used by external analysts to determine various aspects of a business, such as its profitability, liquidity, and solvency.

Formula, decomposition, interpretation, pros, cons. Fears condition’s range of symptoms and link to chronic diseases will have lasting impact on health systems Financial ratios are quantitative metrics used to assess the financial health and performance of a company or organization.

Analyzing historical growth rates and projecting future ones are a big part of any financial analyst’s job. Financial ratios are grouped into the following categories: Investors value a company by examining its financial position based on its financial statements and calculating certain ratios.

Save 40% on year 1 s$708 s$419. This is the most conservative ratio among the three, considering cash and cash equivalents and invested funds relative to current liabilities. Ratio analysis is a quantitative method used in finance to evaluate a company’s financial performance and situation, where various numbers collected from a company’s financial statements are compared and analyzed.

Private savings equal to the sum of household and business savings. It involves calculating ratios from the provided financial data to assess profitability,. Ratio to gross domestic product [xdc_r_b1gq] currency denominator not applicable [_z]

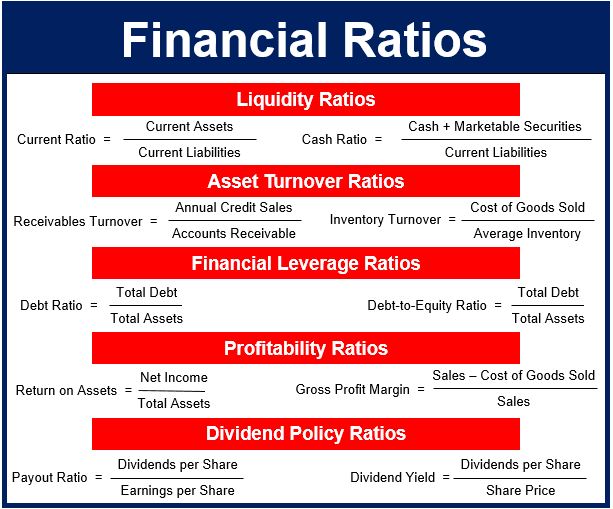

Types of ratio analysis the various kinds of financial ratios. Analysis of the business activity (turnover ratios) 3. Common examples of ratios include:

Different financial ratios indicate the company’s results, financial risks, and working efficiency, like the liquidity ratio, asset turnover ratio, operating profitability ratios, business risk ratios, financial risk ratios, stability ratios, etc. It measures a company’s ability to meet. Financial ratio analysis is a powerful analytical tool that can give the business firm a complete picture of its financial performance on both a trend and an industry basis.

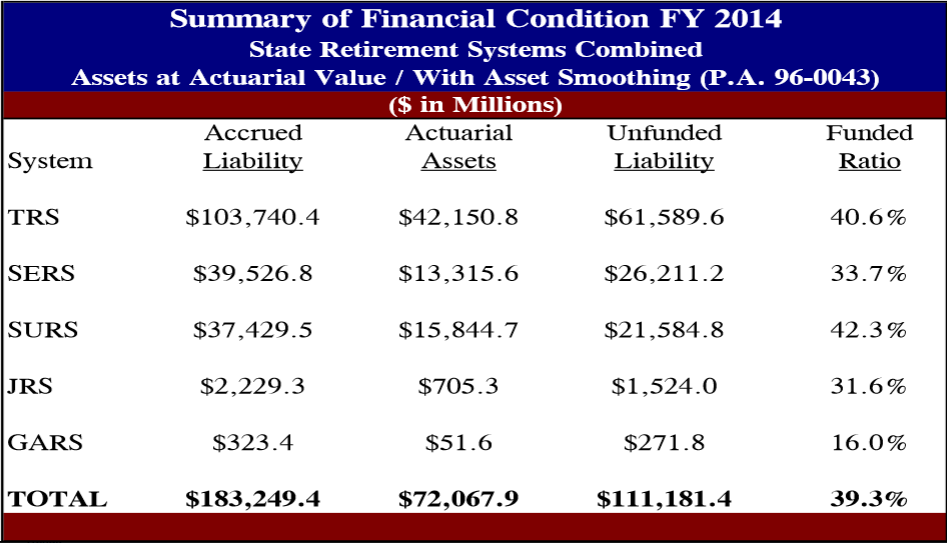

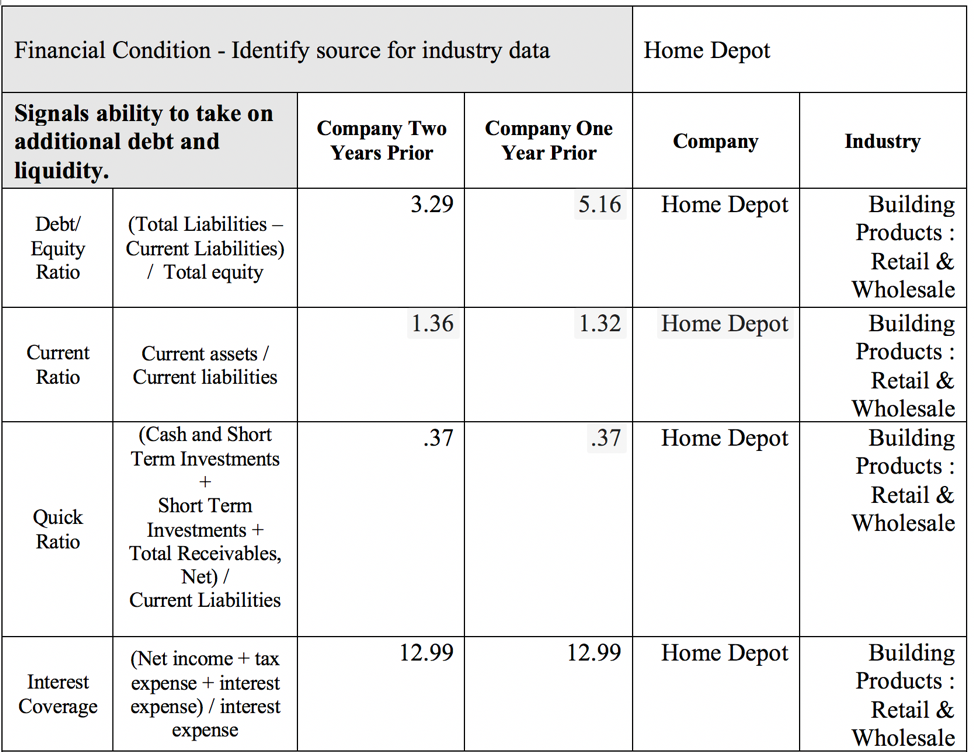

Now that you know how financial statements are prepared, let’s see how they’re used to help owners, managers, investors, and creditors assess a firm’s performance and financial strength. Ratio analysis definition. Ratios of financial condition indicate the overall financial health of a business.

Key ratios of the company's financial sustainability 1.3.2. Ratio analysis refers to the analysis of various pieces of financial information in the financial statements of a business. Financial ratios are often divided up into seven main categories:

A ratio is the relation between two amounts showing the number of times one value contains or is contained within the other. Essential digital access to quality ft journalism on any device. A financial ratio is a metric usually given by two values taken from a company’s financial statements that compared give five main types of insights for an organization.