Nice Info About Fedex Financial Ratios

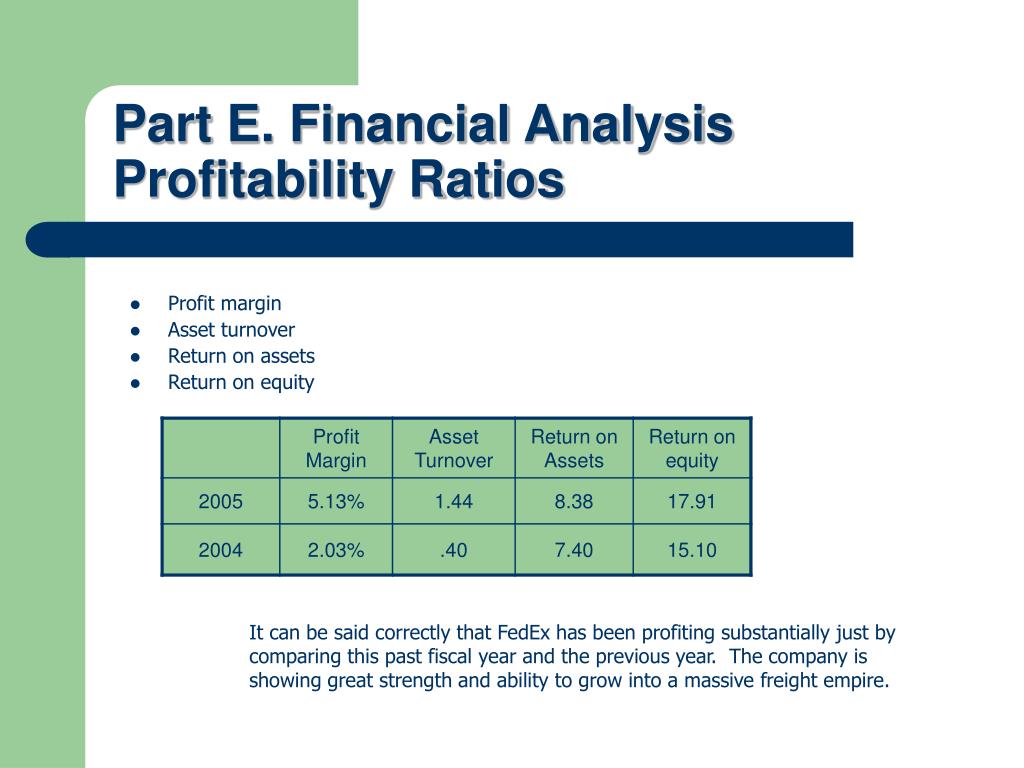

Financial ratio analysis can also be defined as the process of presenting financial ratios, which are mathematical indicators calculated by comparing key financial information.

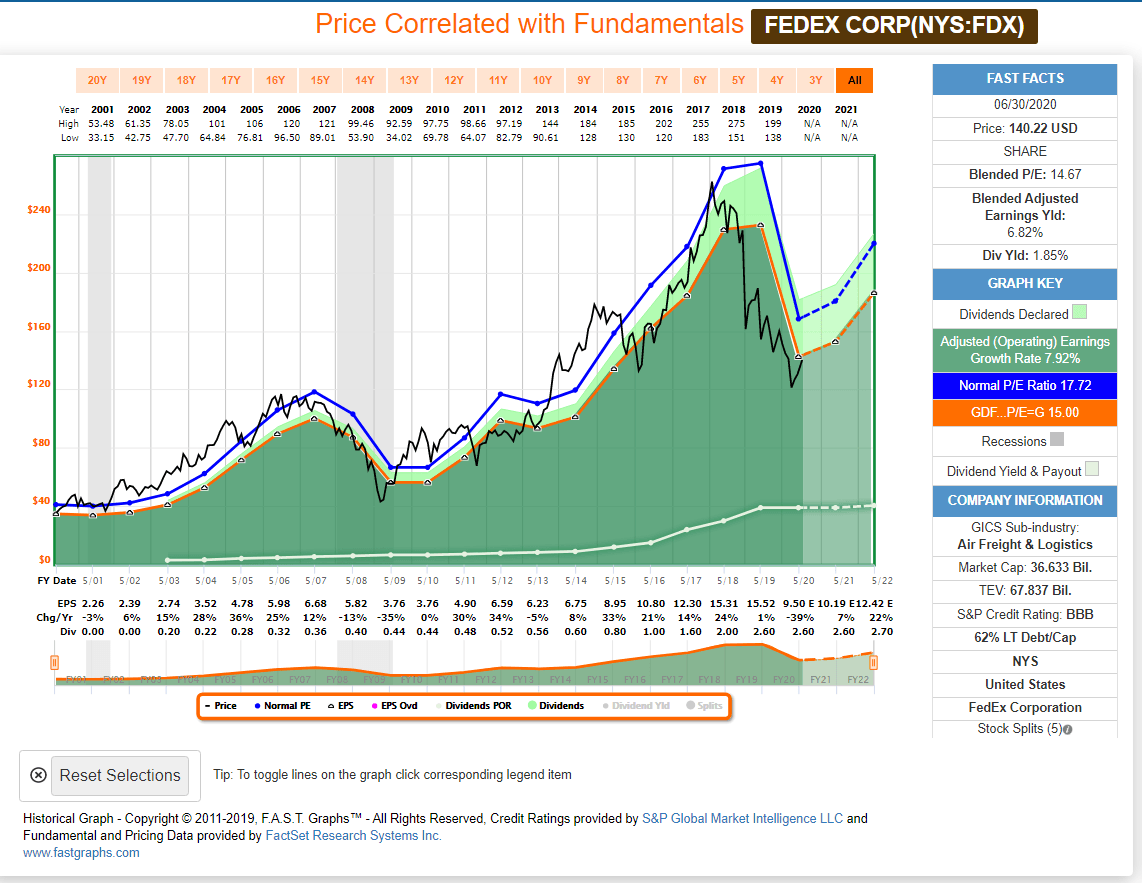

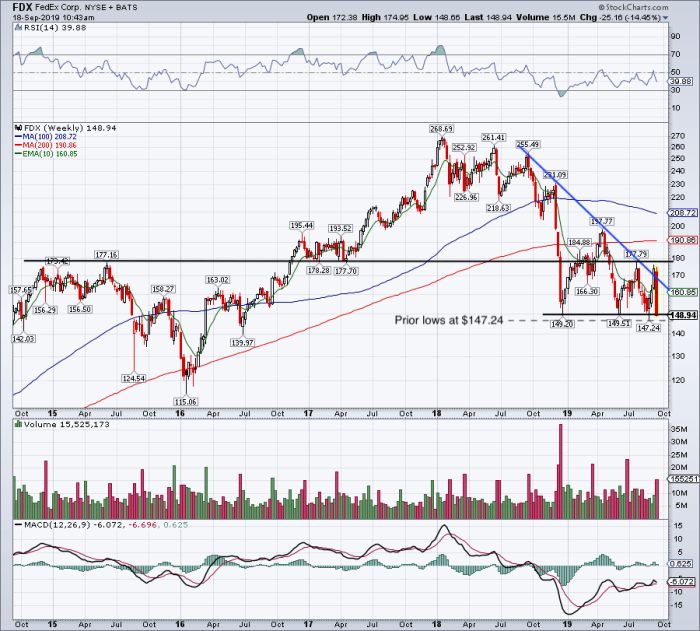

Fedex financial ratios. Price to book ratio 2.10: Ten years of annual and quarterly financial ratios and margins for analysis of fedex (fdx). Price to sales ratio 0.62:

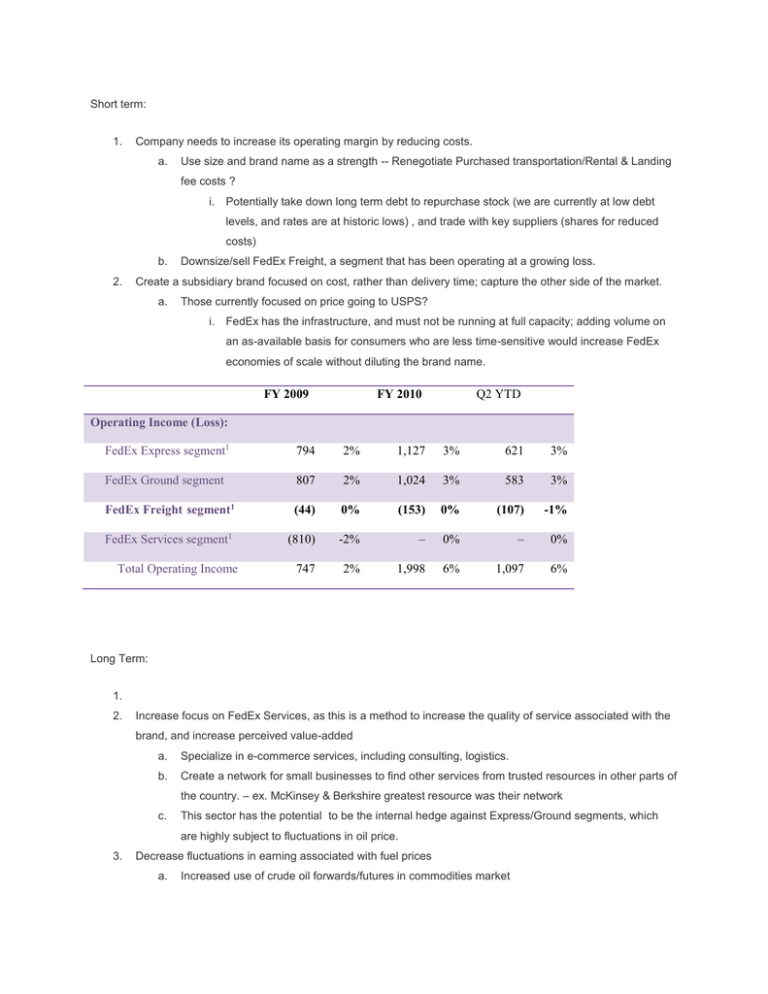

P/e ratio (including extraordinary items) 13.97: $24.99 analysis of profitability ratios annual data quarterly data profitability ratios measure the company ability to generate profitable sales from its resources (assets). Short % of shares outstanding (jan 31, 2024) 4:

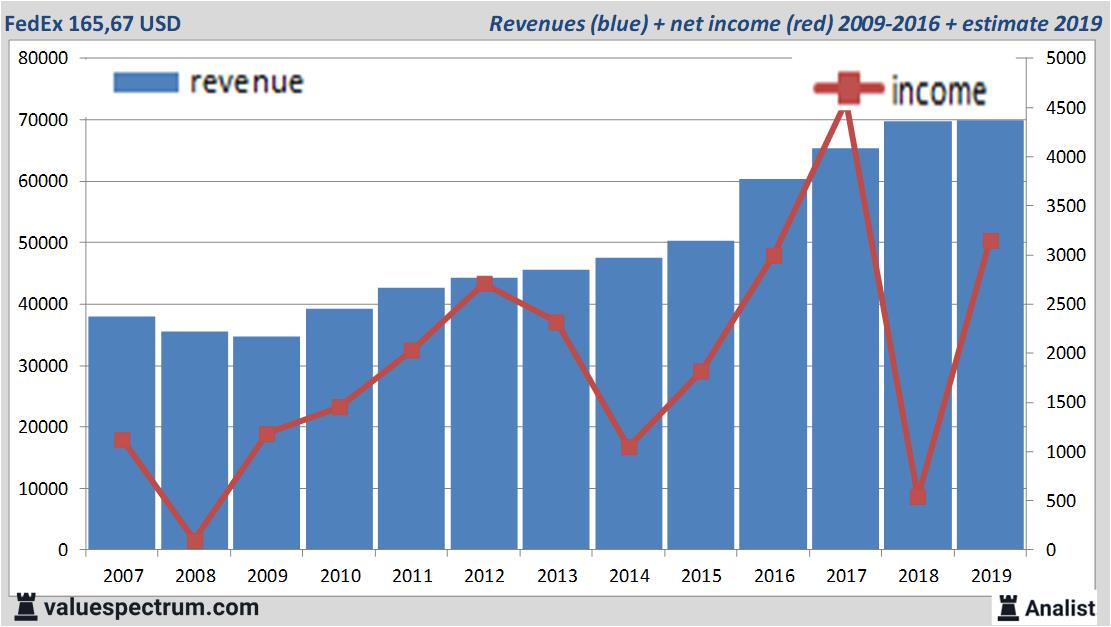

According to these financial ratios fedex corporation's valuation is way above the market valuation of its peer group. In this section of the financial report, i walk you through definitions of various popular financial ratios, how to calculate the ratios, formulas. 29 rows financial ratios and metrics for fedex corporation (fdx).

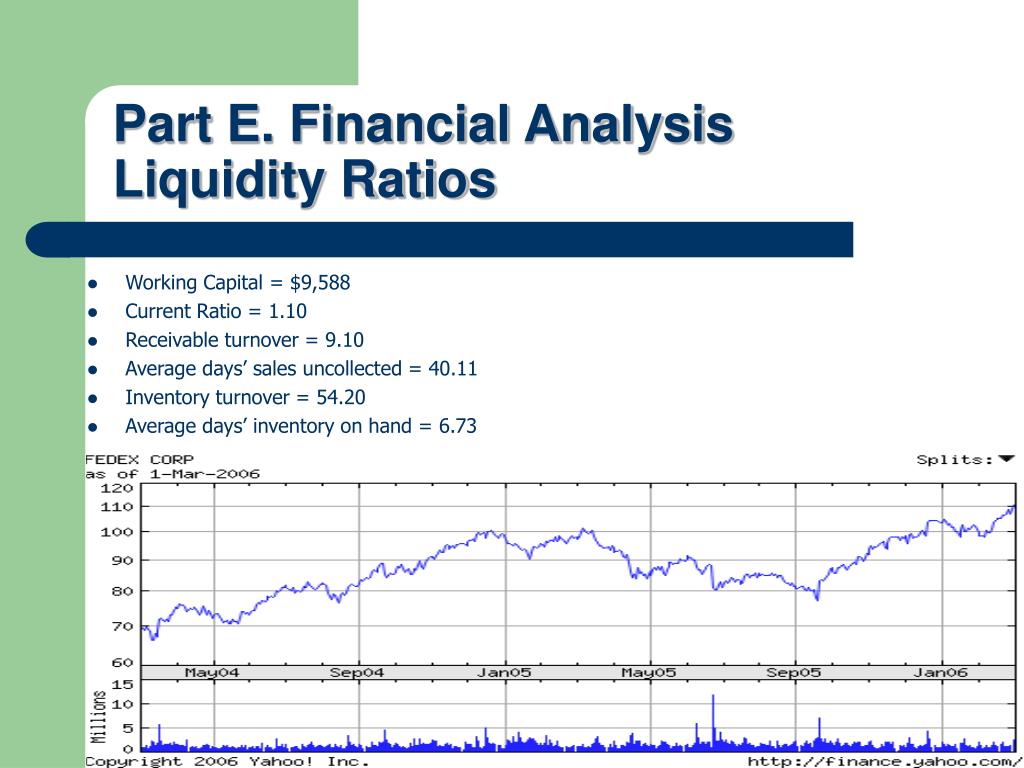

62 rows return on tangible equity. Current and historical current ratio for fedex (fdx) from 2010 to 2023. Short % of float (jan 31, 2024) 4:

The ev/ebitda ntm ratio of fedex corporation is. Overview financials statistics forecast dividends profile statistics market cap total valuation fedex has a market cap or net worth of $59.37 billion. The company has an enterprise value to ebitda ratio of 8.95.

P/e ratio (ttm) 15.60: Current ratio can be defined as a liquidity ratio that measures a. Fedex financial ratios sample.

Price to cash flow ratio 6.31: As of 2022 they employed. Key financial ratios view annual reports ten years of annual and quarterly financial statements and annual report data for fedex (fdx).

Factsheet company data company peers comparable analysis gprv ® charts my view ratios valuation of fedex corporation ( fdx | usa) the ev/ebitda ntm ratio (also. Annual stock financials by marketwatch. Solvency ratios (summary) debt to equity debt to equity.

Fedex corp., adjusted financial ratios based on: Shares short (prior month dec 29, 2023).