Top Notch Tips About Trading Operating Profit

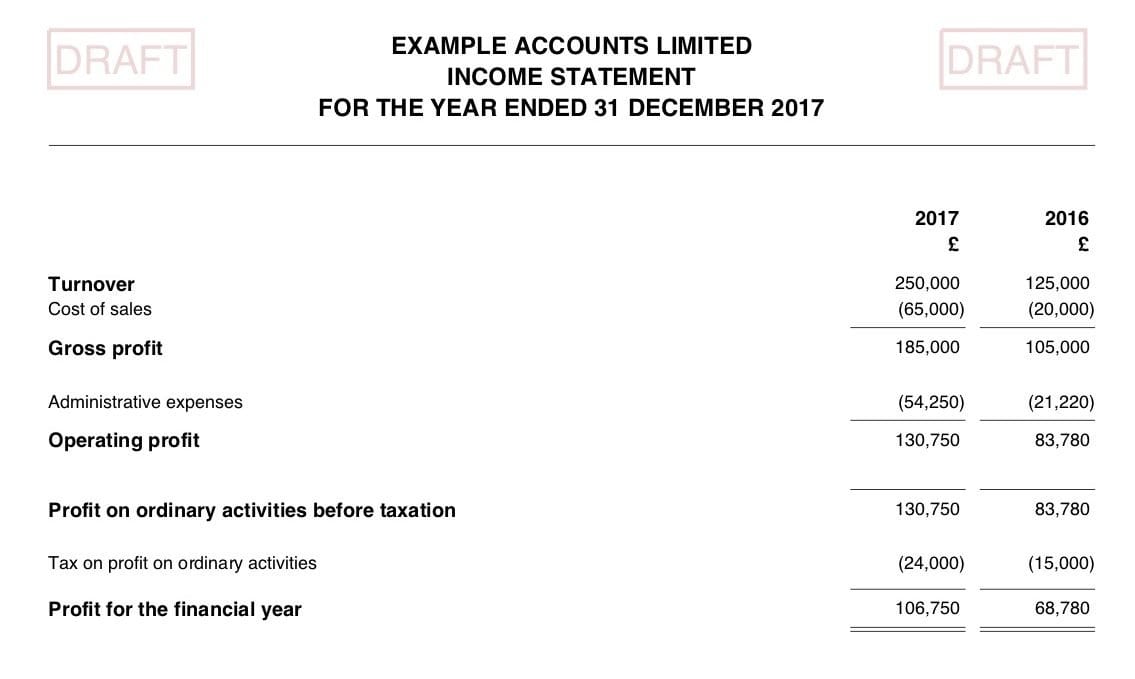

The operating profit is a measure of a company’s profitability from its core business activities, excluding the effects of discretionary items such as interest expense.

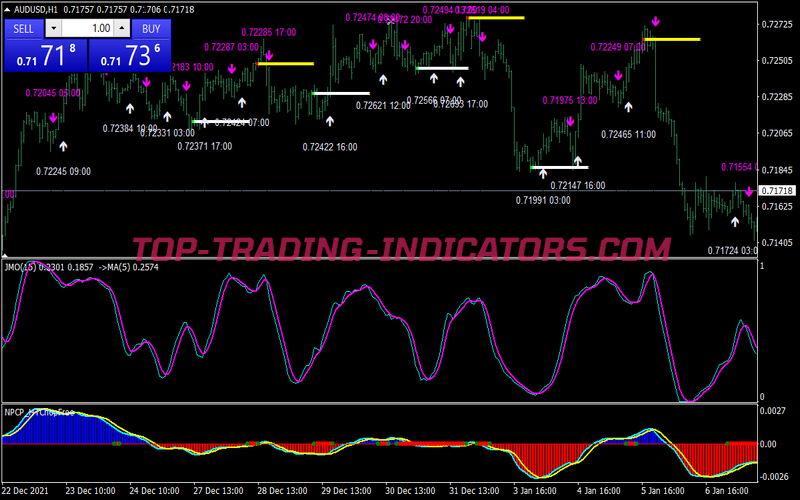

Trading operating profit. Operating profit margin is a profitability or performance ratio that reflects the percentage of profit a company produces from its operations before subtracting taxes and interest. Operating profit, also known as operating income, is an important indicator of a company’s financial health because it reflects the profitability of its primary business activities. There is a lot more to the.

Nvda) today reported revenue for the fourth quarter ended january 28,. Trading profit is equivalent to earnings from operations. Santa clara, calif., feb.

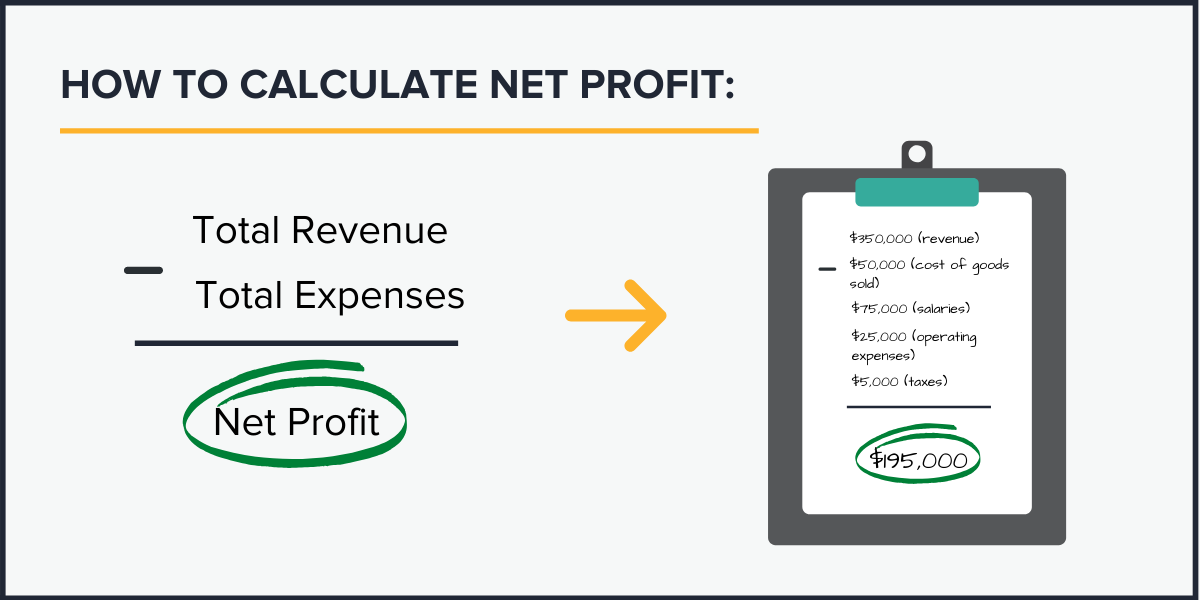

What is operating profit? Underlying trading operating profit is trading operating profit before the impact of other trading expenses and other trading income (mainly restructuring costs,. The op formula is as follows:

Operating profit is derived from gross profit. To calculate operating profit margin, the formula is: When it comes to the financials of a business, the operating profit is regarded to be a very pivotal element in analysing the revenue earned for a period.

Operating profit tells you how. A company's operating profit is its total earnings from its core business functions for a given period, excluding the deduction of. The underlying trading operating profit margin of other businesses increased by 90 basis points, based on operating leverage and structural cost.

The trading operating profit (top) margin decreased by 290 basis points to 14.0% on a reported basis, largely reflecting impairments related to the wyeth.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Operating_Income_Aug_2020-01-e3ccd90db6224fc8b0bea6dac86e478f.jpg)