Stunning Tips About Small Company Balance Sheet Example

You’re in good company if you aren’t comfortable reading a balance sheet.

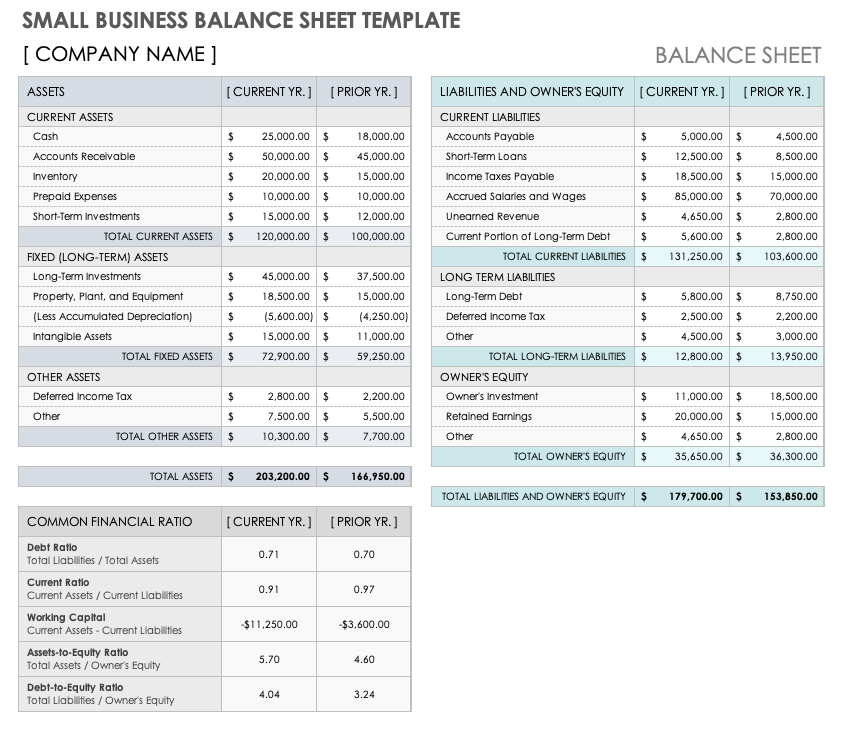

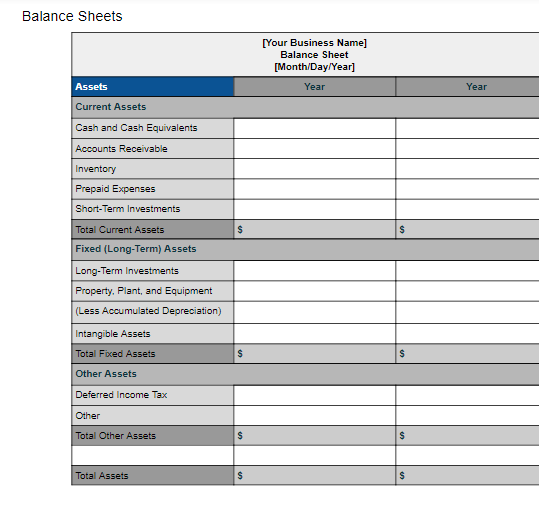

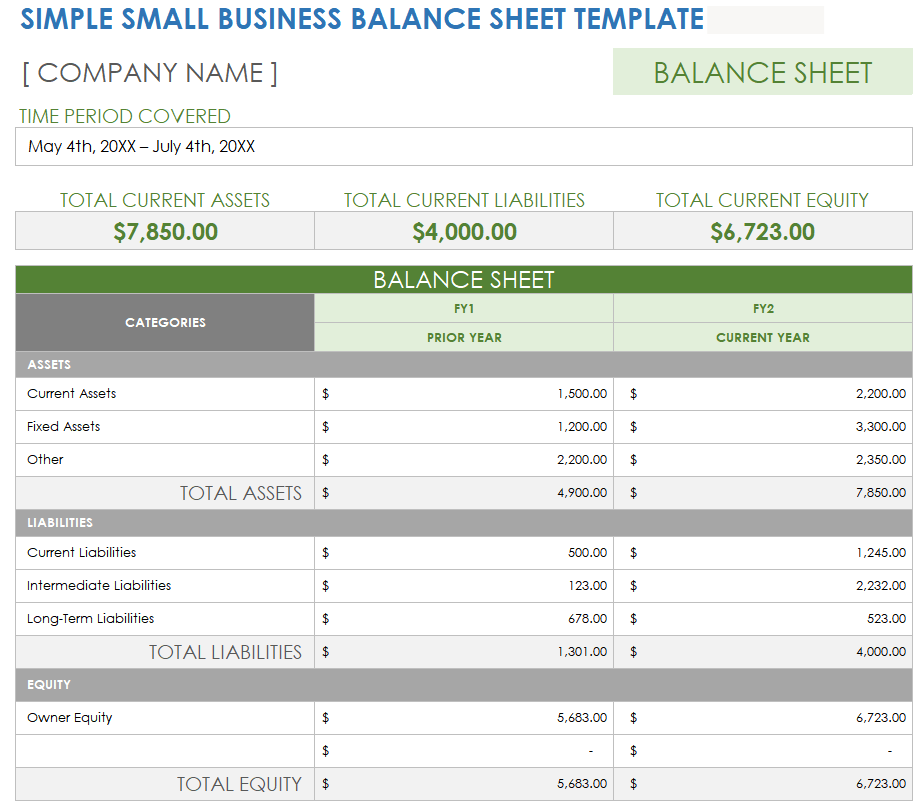

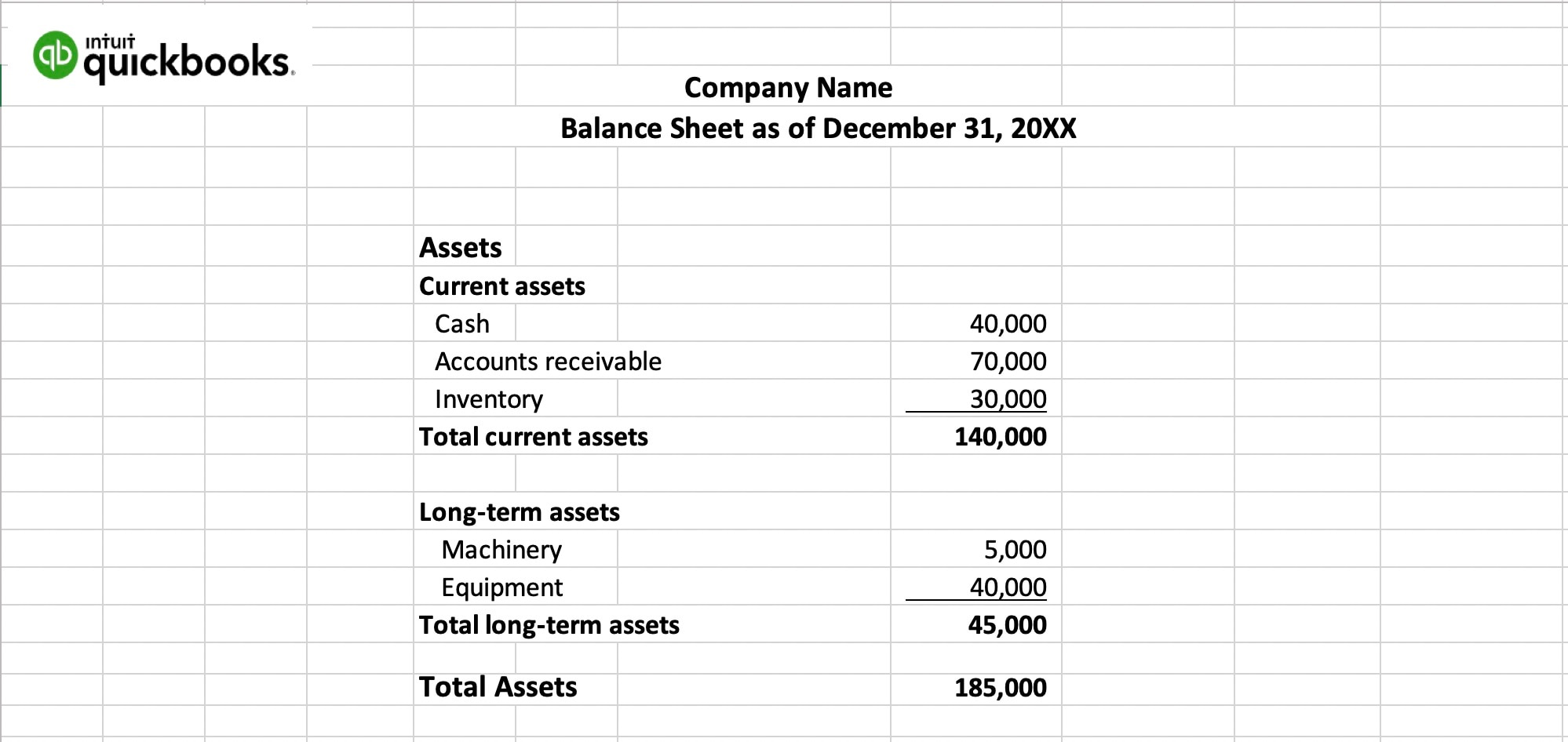

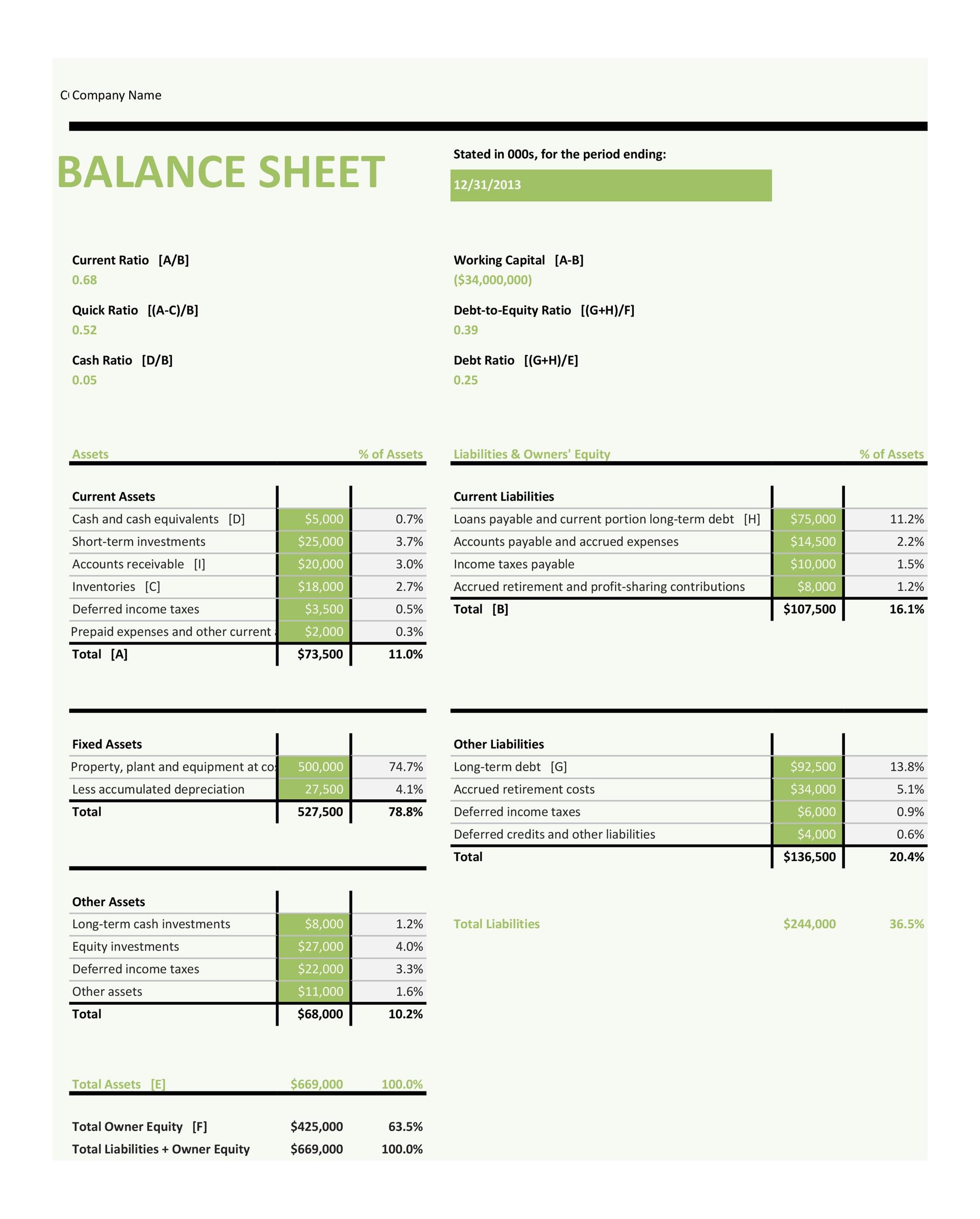

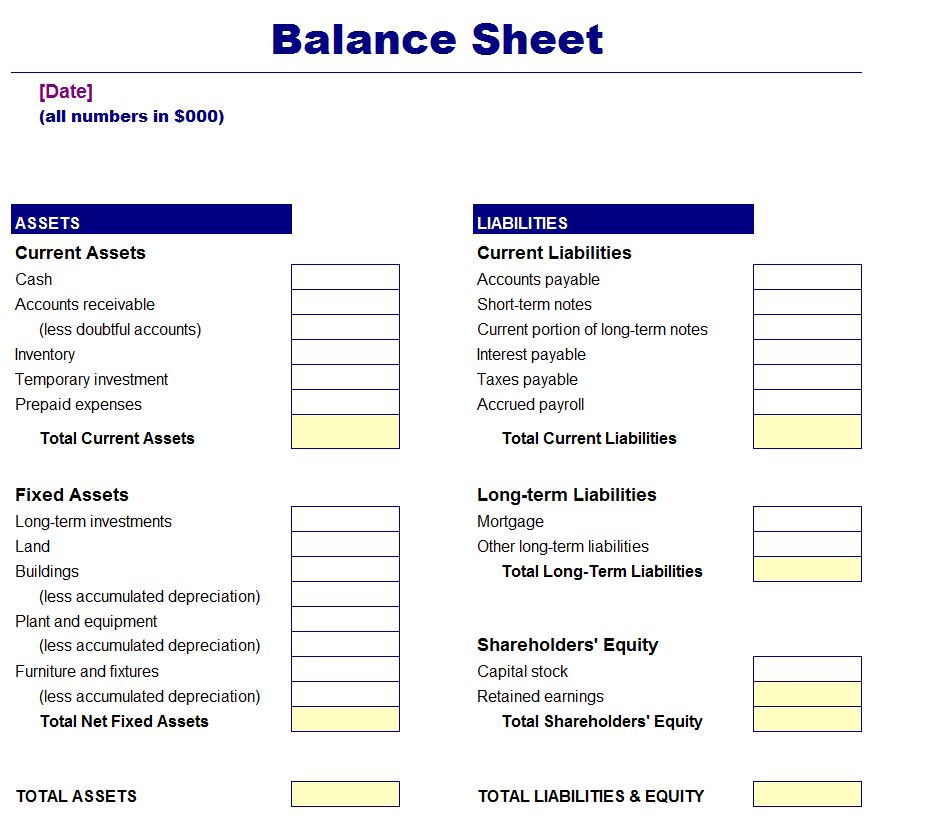

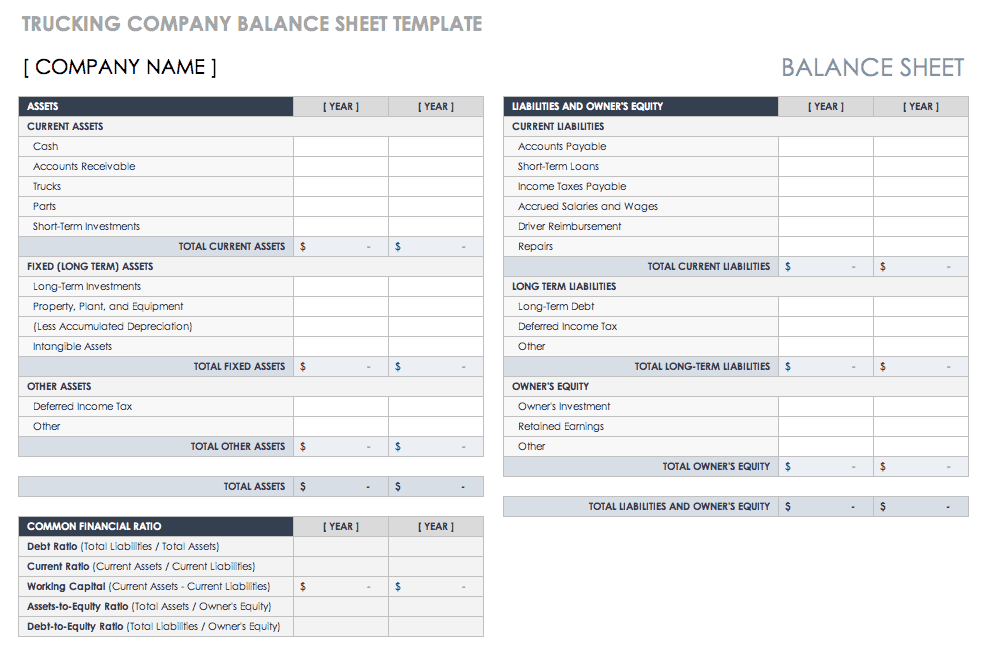

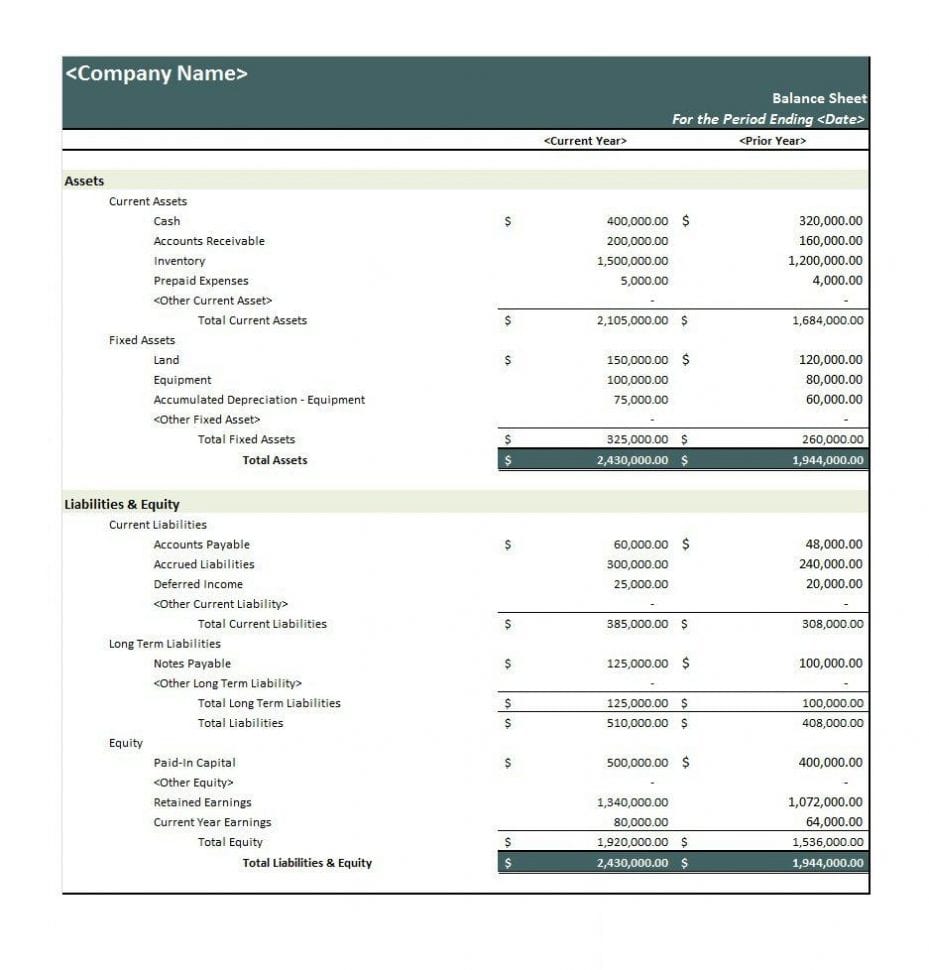

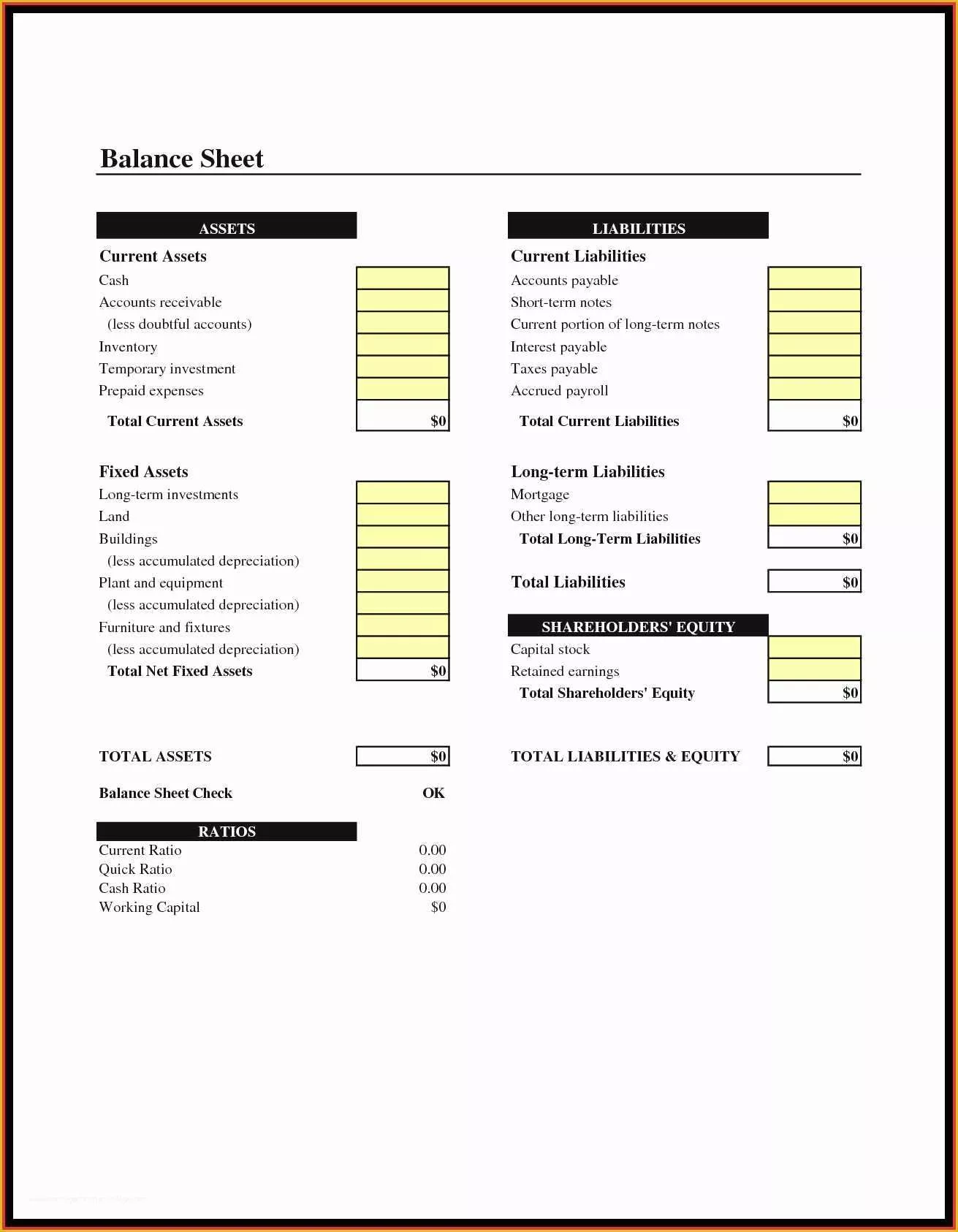

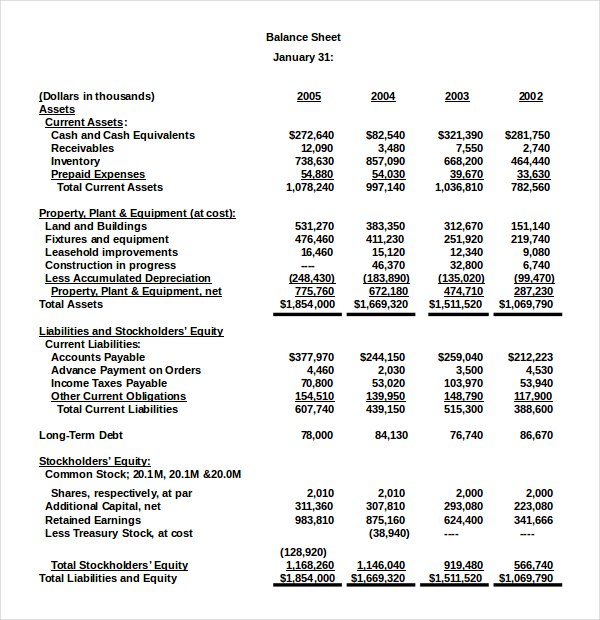

Small company balance sheet example. Key takeaways a balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity. Included on this page, you'll find many helpful balance sheet templates, such as a basic balance sheet template, a pro forma balance sheet template, a monthly balance sheet template, an investment property balance sheet template, and a daily balance sheet template, among others. Get started, speak w/ a founder, or schedule a callback.

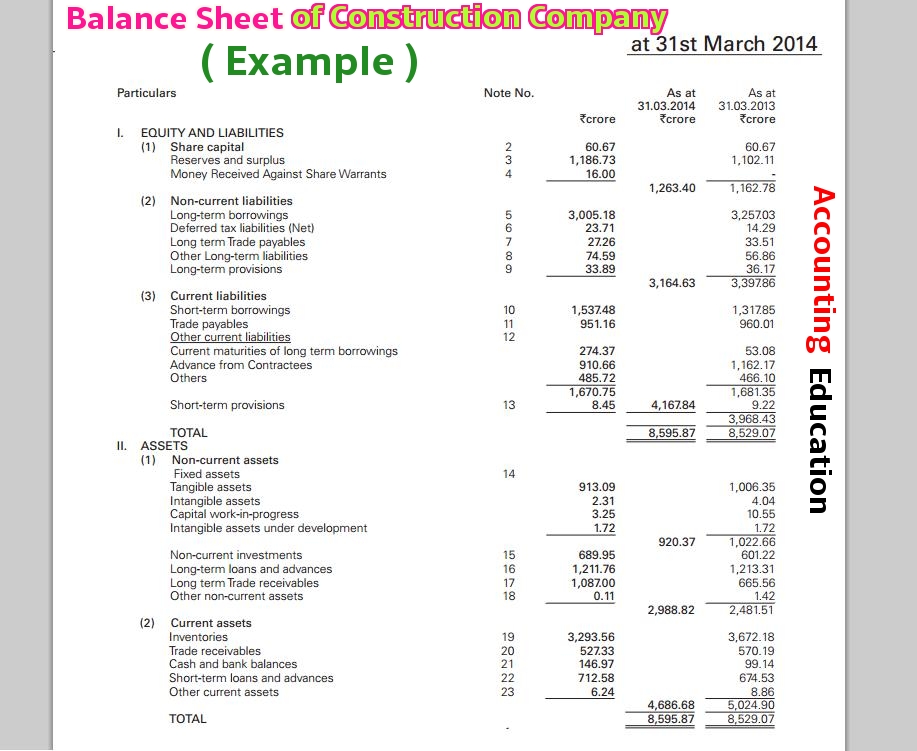

How to create a balance sheet for your business. This can be especially beneficial for startups, entrepreneurs, and other small business owners looking to expand. Most small companies will submit abbreviated accounts.

The document that allows an entrepreneur to record and track these health metrics is called a balance sheet. The balance sheet is one of the three core financial documents for running your business, along with your cash flow forecast and the profit and loss. In the realm of small businesses, understanding financial health is paramount.

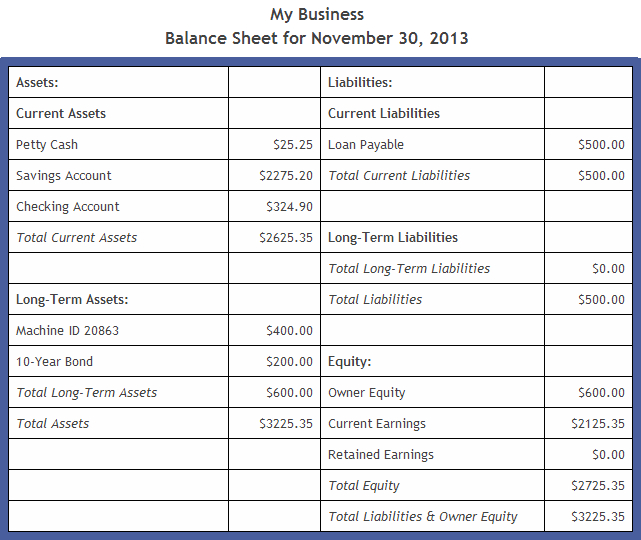

How do you prepare a balance sheet from an income statement? A balance sheet is a summary of your startup’s assets, liabilities, and equity to convey your company’s financial position. You need to know how much money you have and how much you have available to spend.

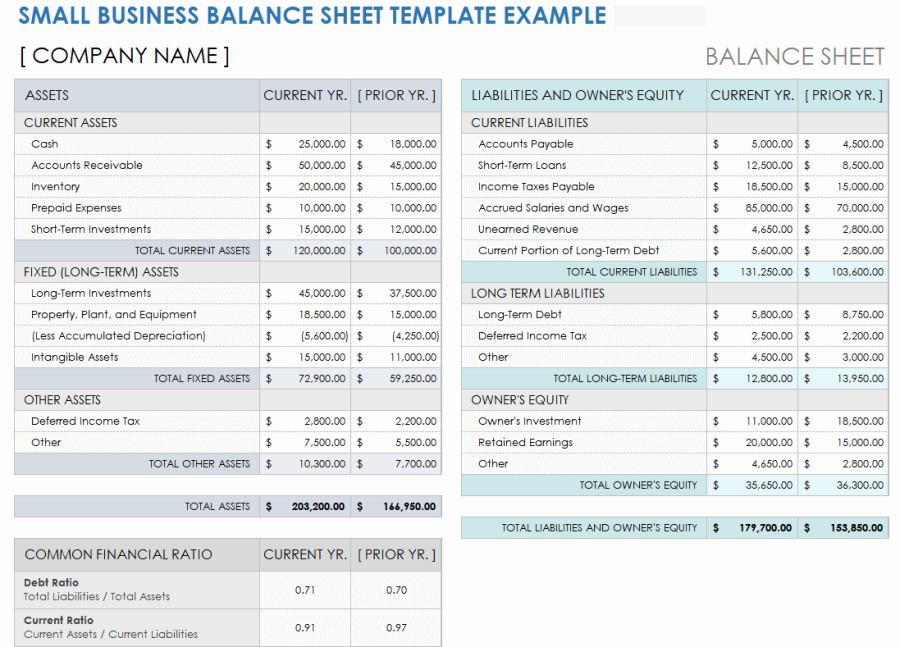

5 balance sheet examples of small businesses facebook twitter want help with your bookkeeping? Income statement vs balance sheet; You can download two versions of this template:

Enter your assets, liabilities, and owner’s equity to determine common financial ratios. Difference between an income statement and balance sheet; A blank balance sheet, or a sample balance sheet template with example text to guide you through the process.

Investors and analysts will read the balance sheet alongside the income statement and cash flow statement, to evaluate the company’s overall financial position. Template details license: A crucial tool for achieving this is the balance sheet.

These topics will show you the connection between financial statements and offer a sample balance sheet and income statement for small businesses: Example balance sheet open a business account what is a balance sheet? The balance sheet, profit and loss (p&l) statement, and a cash flow statement.the balanced sheet, alongside a profit and loss (p&l).

Most of the time, this is the last day of the accounting period (such as a month, quarter, or year). How can a balance sheet template benefit my small business? For the business itself, a balance sheet can, for example, help an owner figure out how much cash may be needed to pay off liabilities or how much capital is tied up in investments.

Companies are required to create three financial reports quarterly and annually: Office equipment (computers, machinery, etc.) inventory real estate commercial vehicles cash accounts receivable investments note that if you lease equipment, you won’t be able to list it as either an asset or a liability. All limited companies must submit a balance sheet each year, which is available to view.