Casual Tips About Skeletal Profit And Loss Statement

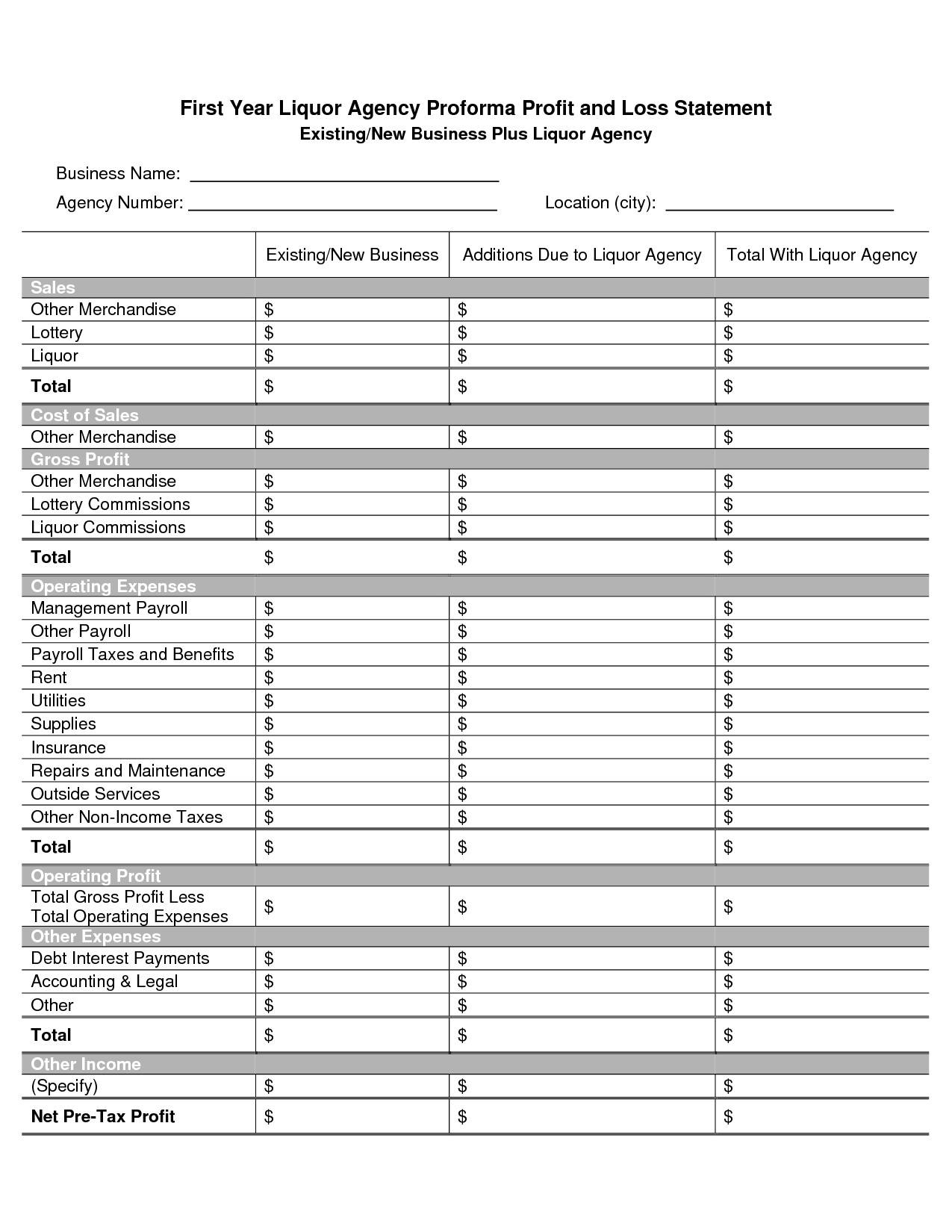

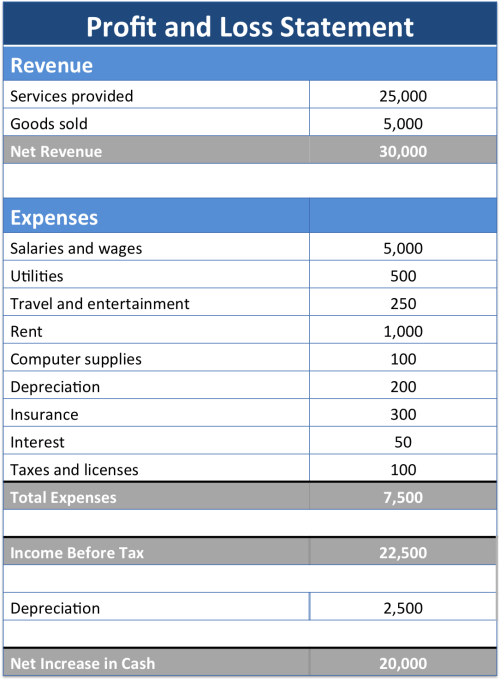

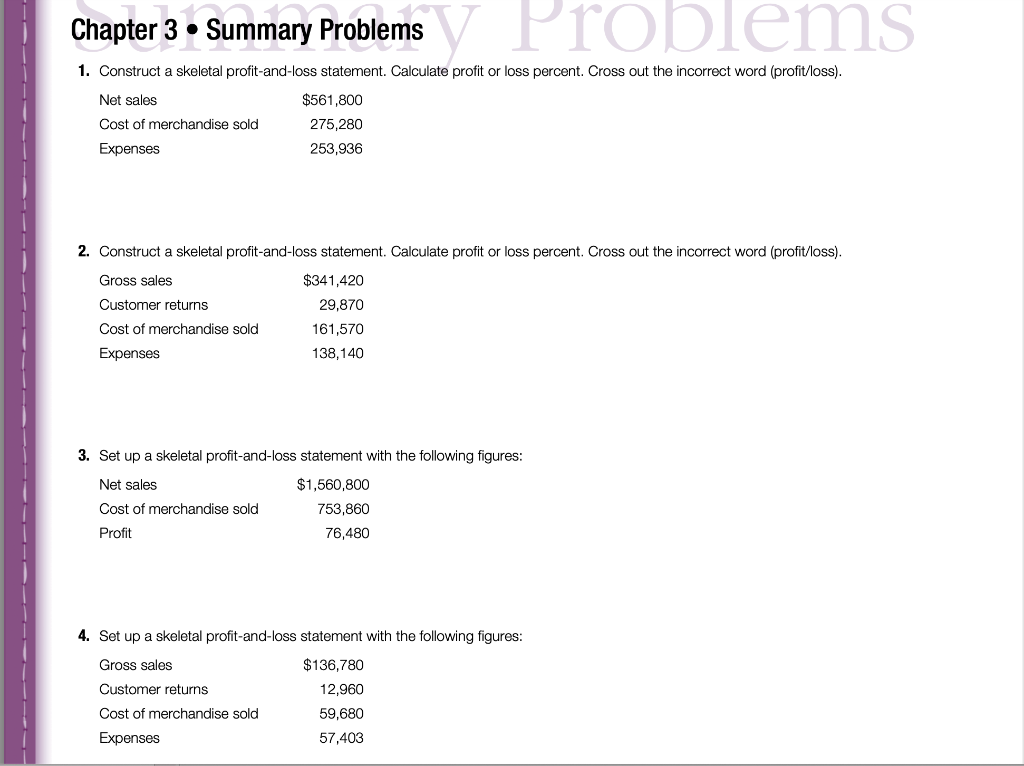

A profit and loss statement—also called an income statement or p&l statement—is a financial statement that shows a business’s revenue, expenses, and net income over a specific period of time.

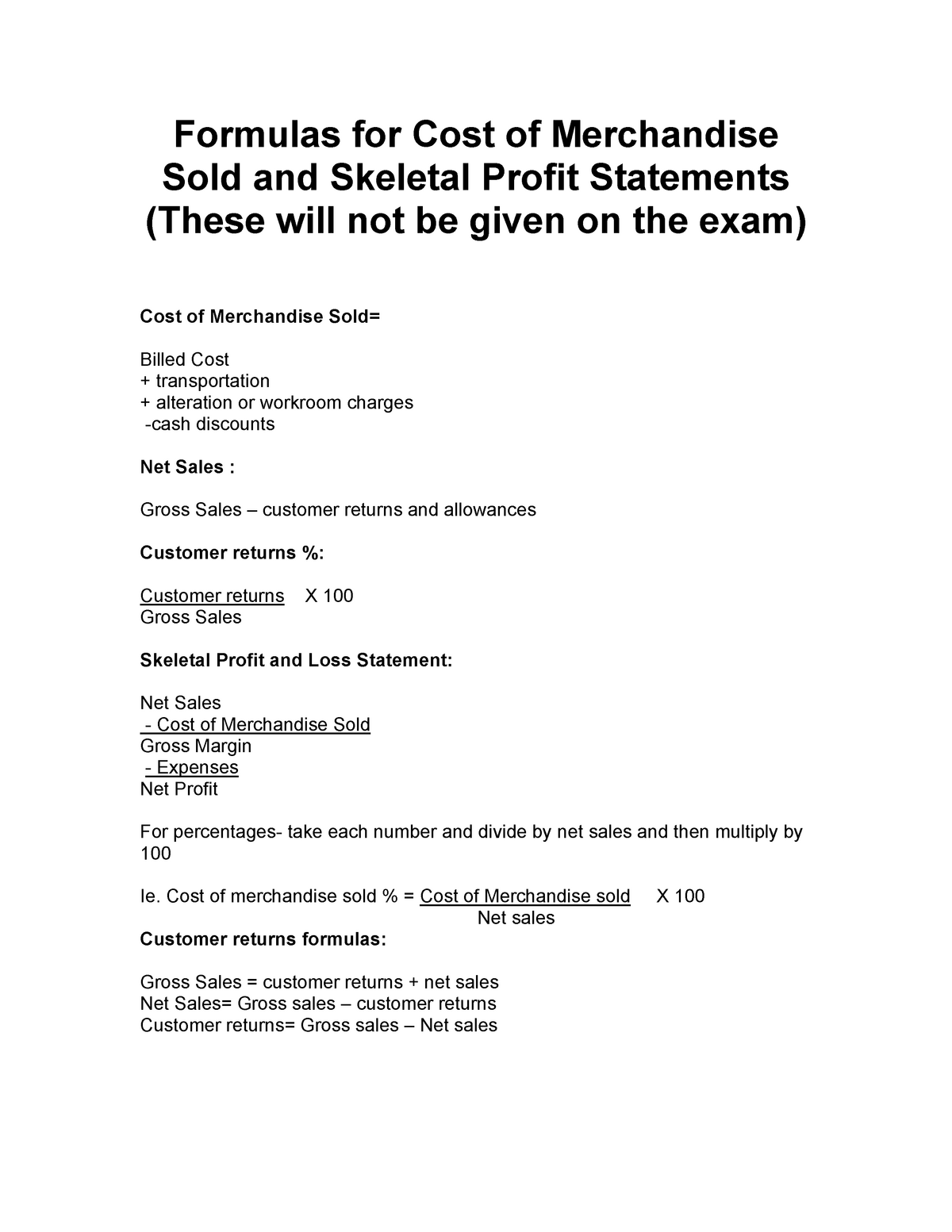

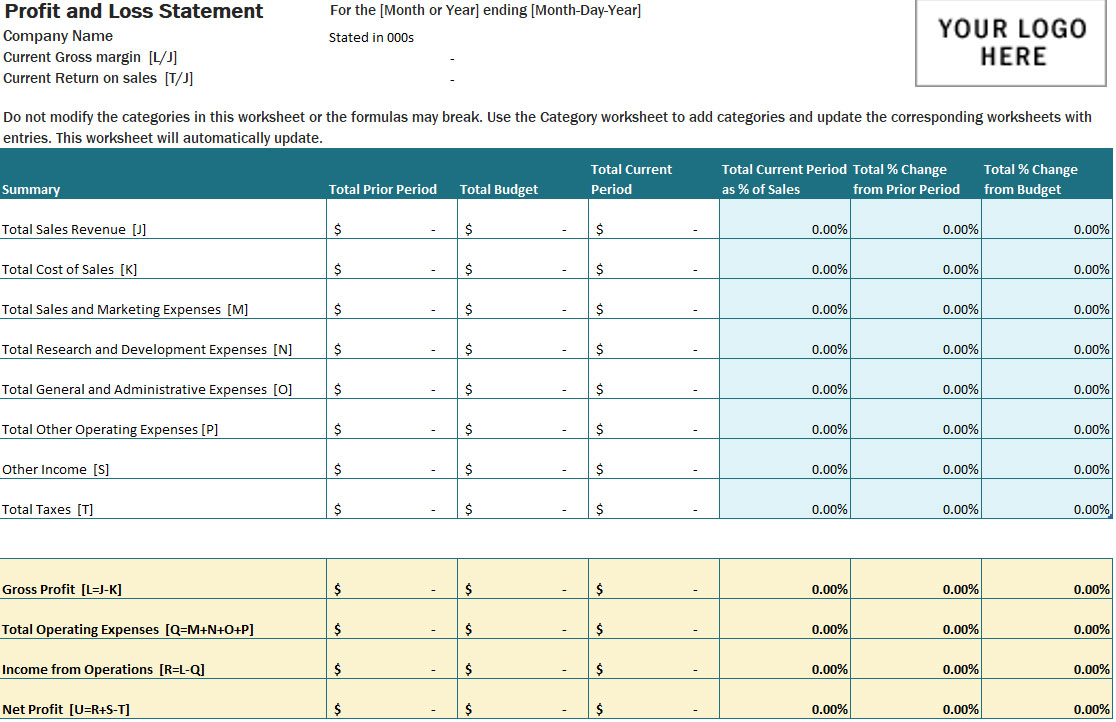

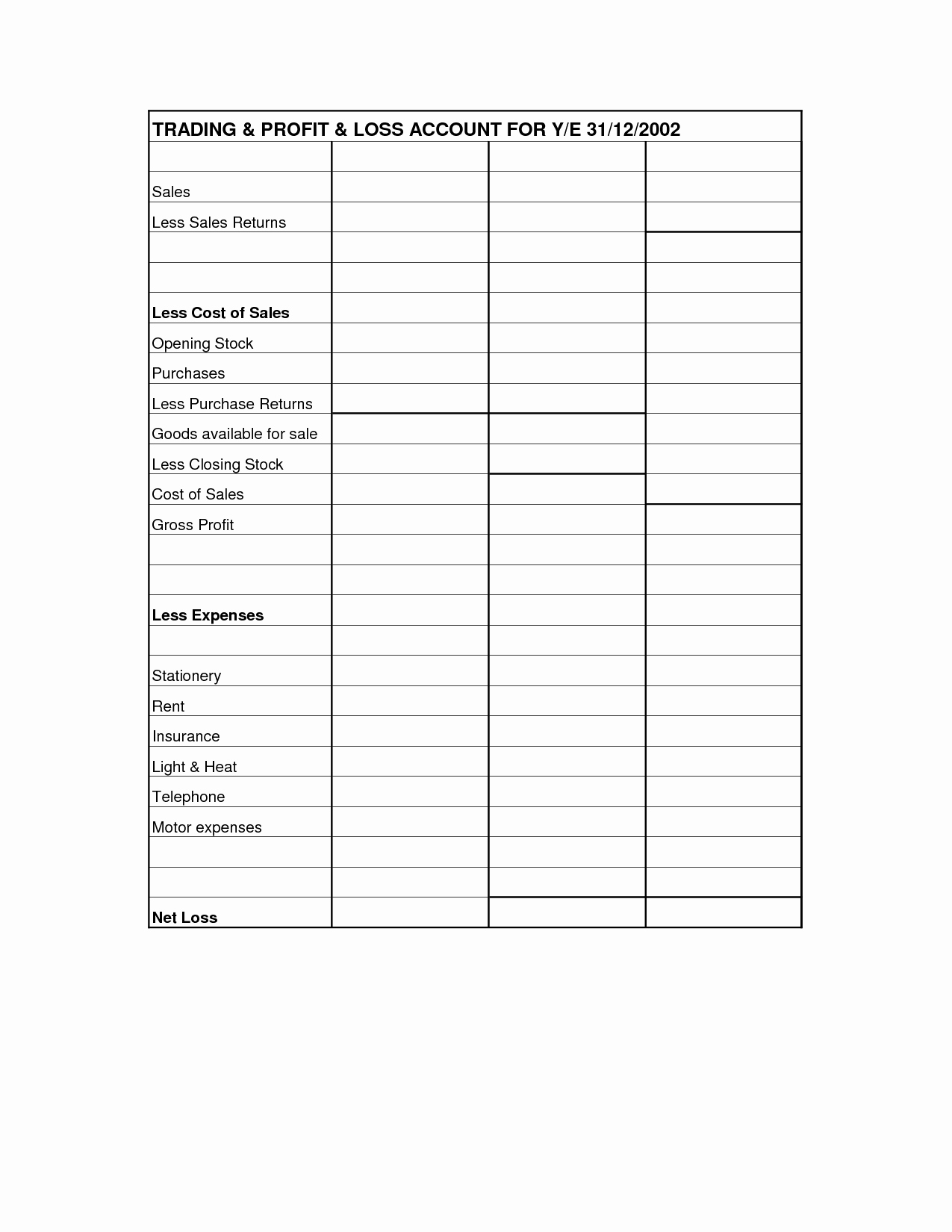

Skeletal profit and loss statement. Calculating the p & l components part 2: The p&l reporting period can be any length of time, but the most common are monthly, quarterly, and annually. It is suitable for both individuals and limited companies.

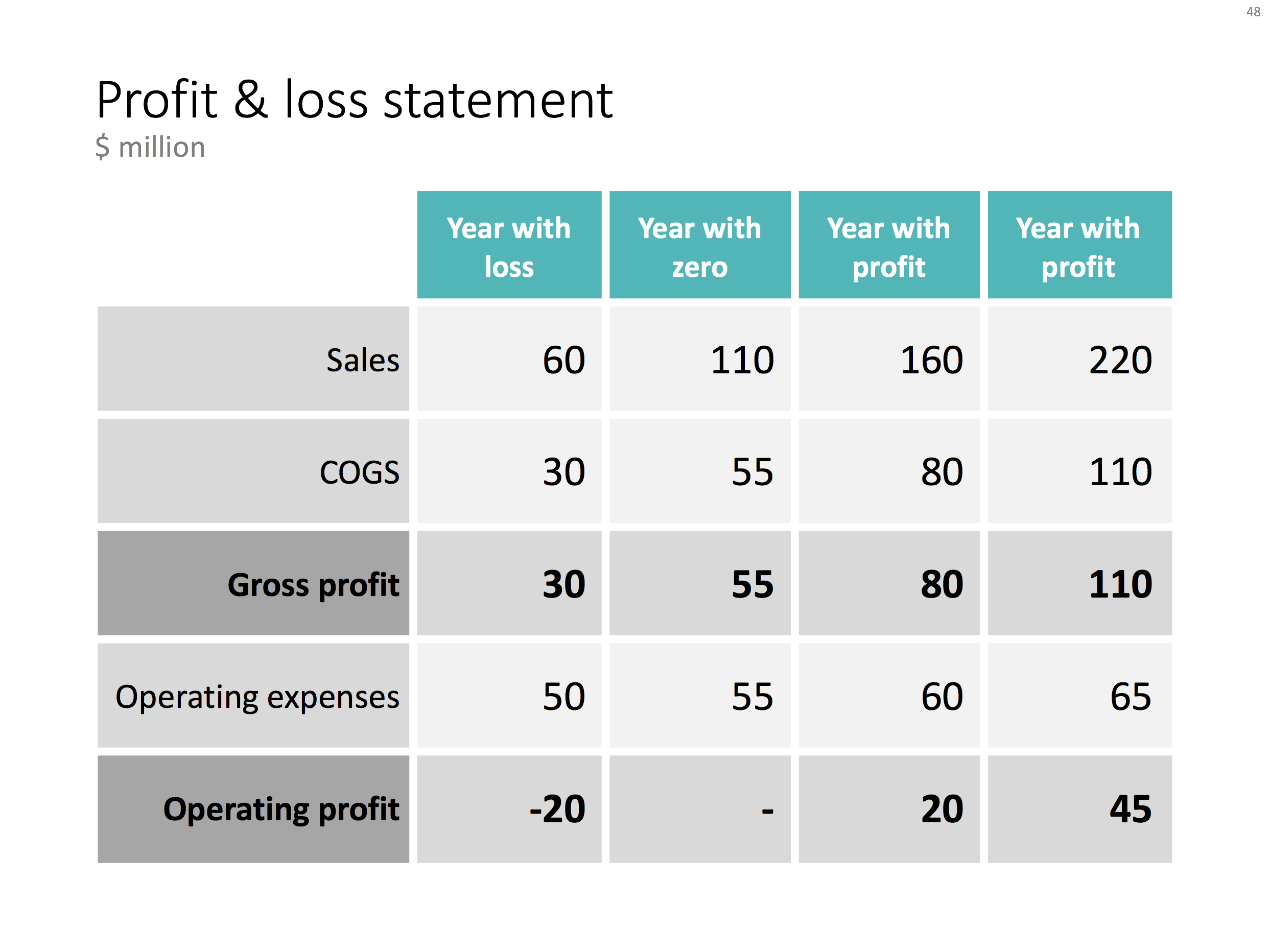

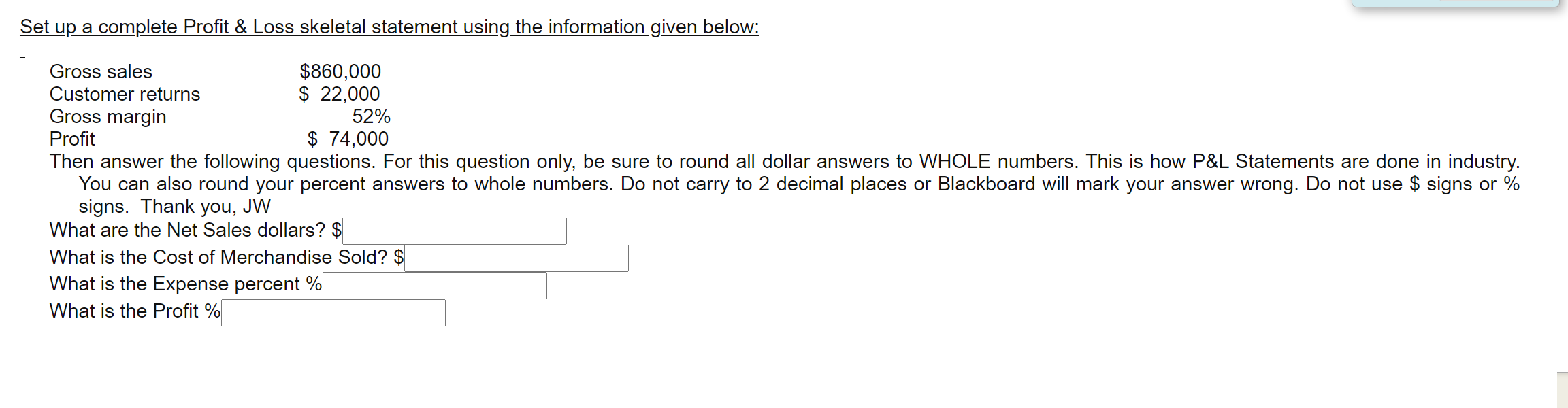

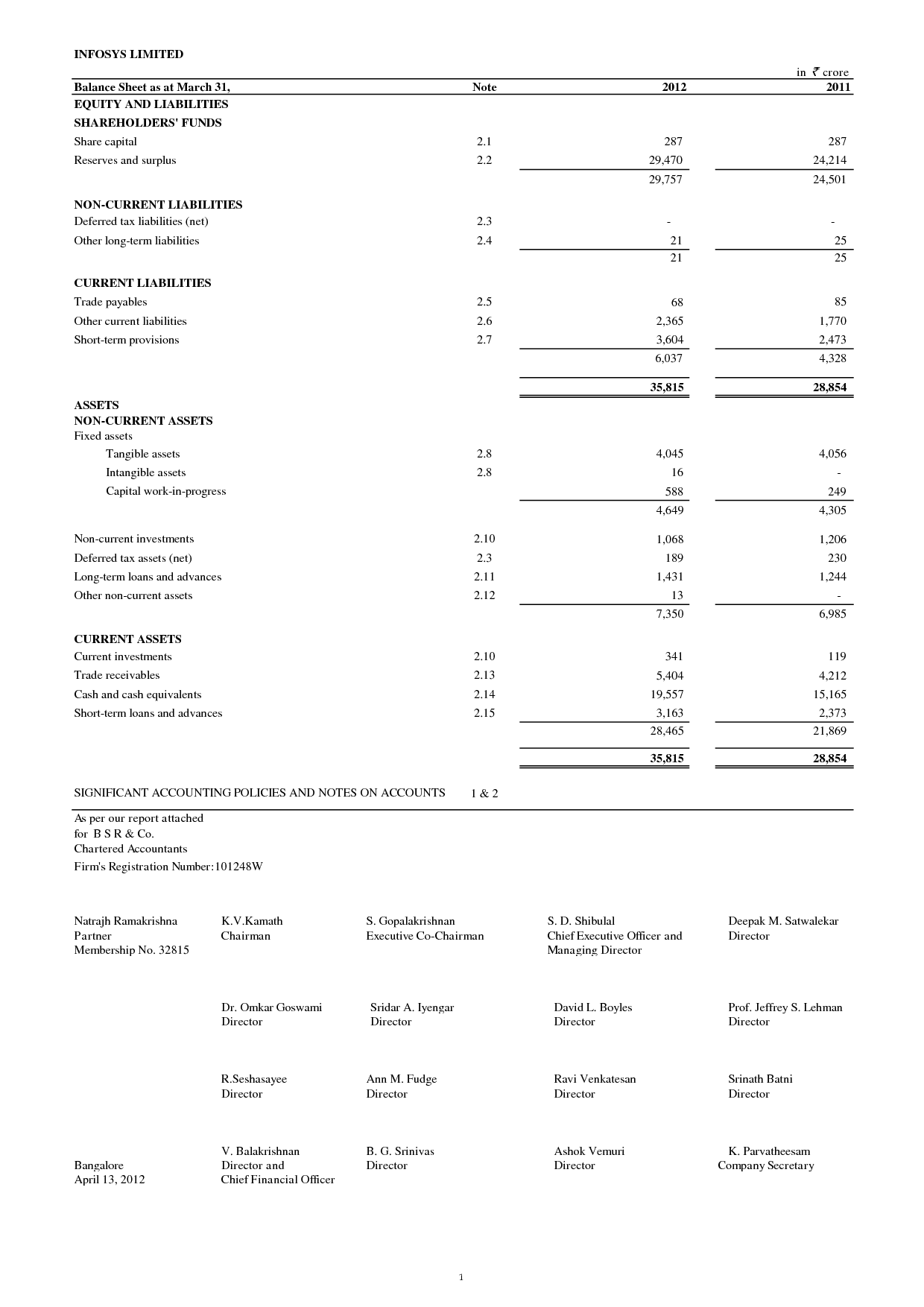

Net sales cost of goods sold expenses $240,000 $100,800 $125,000 35. $119,760 gross margin expenses 41.20% profit 2.60% this problem has been solved! A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time.

You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Total expenses, as the term indicates, are inclusive of all of the above types of expenses that a retail store incurs while doing business. Net sales $ = cost of goods sold $ + gross margin $ problem:

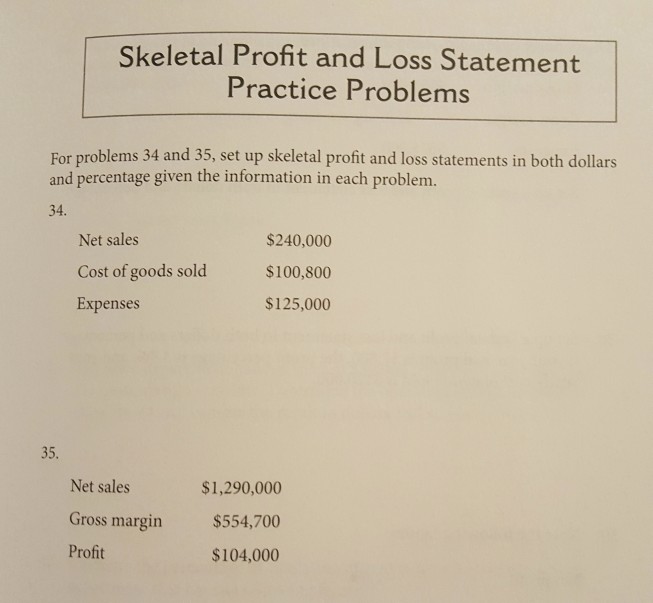

The skeletal p&l statement invisibly begins with gross sales minus customer returns and allowances. It’s usually assessed quarterly and at the end of a business’s accounting year. Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a quarter or fiscal year.

The profit and loss statement summarizes all revenues and expenses a company has generated in a given timeframe. This summary provides a net income (or bottom line) for a reporting period. 51 determine net sales if gross sales were $98,656 and customer returns were 4.8%

The oil and gas company's earnings statement showed that adjusted net income totalled 513 million euros ($556 million) in. Operating expenses are a one line entry on the skeletal p & l statement. Example figures for calculating the skeletal p & l statement gross margin $ = ?

For the skeletal p & l statement, total operating expenses will be used. Set up a skeletal profit and loss statement: Published nov 4, 2023 + follow in this edition, we delve deep into the skeletal framework of the profit & loss (p&l) statement—a critical financial document that, when structured properly,.

(net) operating profit is the difference between gross margin and total operating expenses and is profit before taxes. Skeletal profit and loss statement practice problems for problems 34 and 35, set up skeletal profit and loss statements in both dollars and percentage given the information in each problem. While business accounting software makes it simple to.

429 views 2 years ago. How to set up a skeleta profit and loss statement in excel.more. Creating one is a standard way to compile historical data for your business to tell its financial story over time.

How to set up a skeleta profit and loss statement in excel. Operating expenses $ = $72,000.00 (net) operating profit = $12,000.00 gross margin $ = operating expenses $ + (net) operating profit $ gross margin $ = $72,000.00 + $12,000.00 gross margin $ = $84,000.00 It shows your revenue, minus expenses and losses.