Real Info About Royalty Expense In P&l

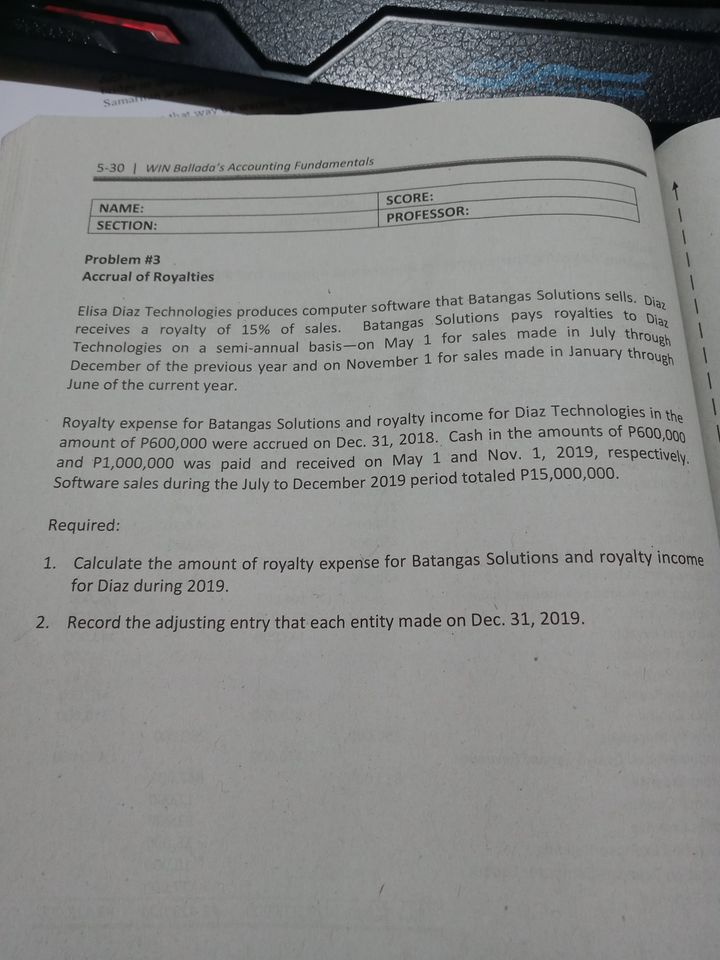

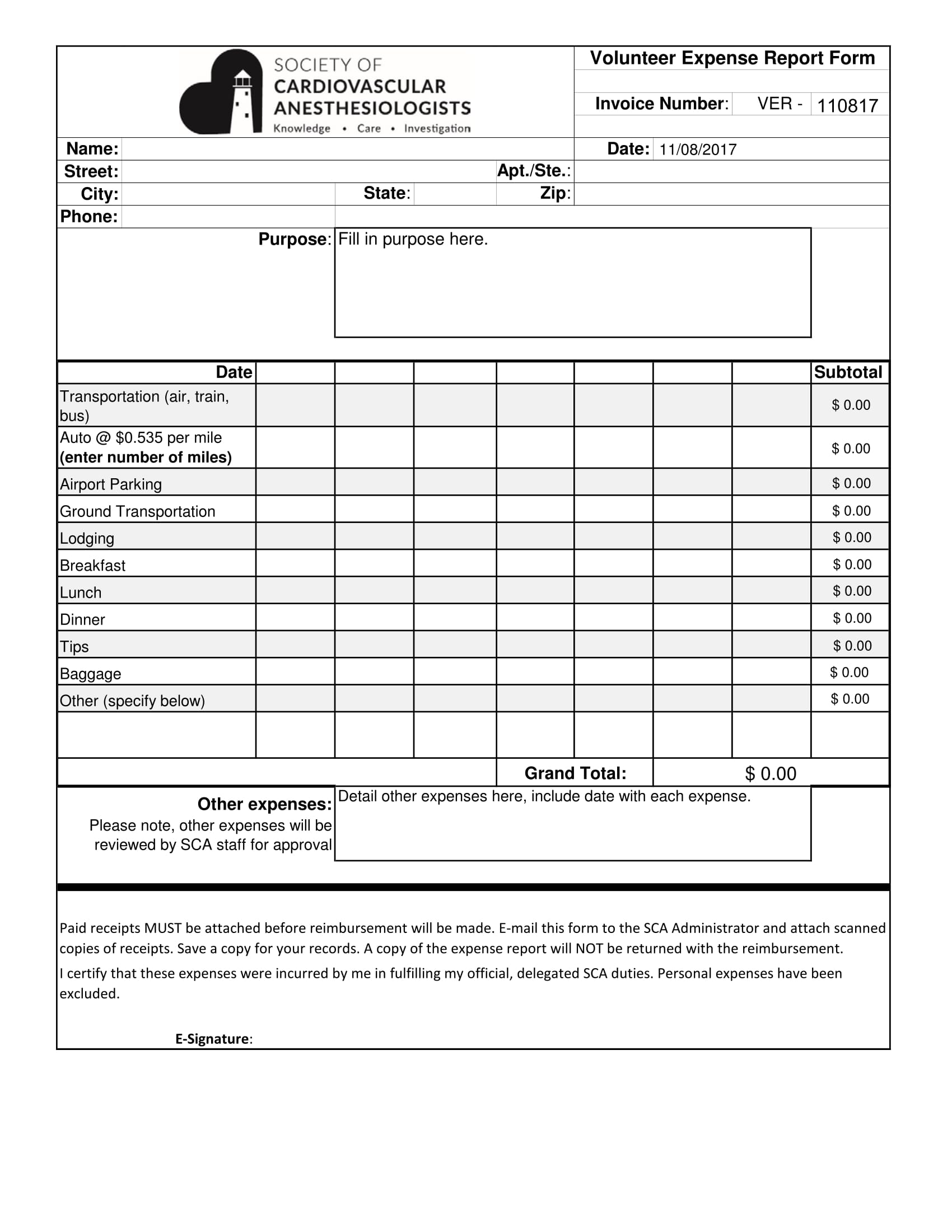

If possible, negotiate royalties so that they can be paid monthly, quarterly or semi.

Royalty expense in p&l. The royalty income earned by the company from luitpold’s sales of gem 21s is classified as revenue on the company’s consolidated statements of operations in accordance with. Traditionally this advance is your projected first two years of. Royalty meaning in accounting.

1 negotiate contracts so that royalties are payable at regular intervals. Royalty revenue is the return received from allowing the other to use the original asset such as copyright, franchise, and natural resource. Get the details of how.

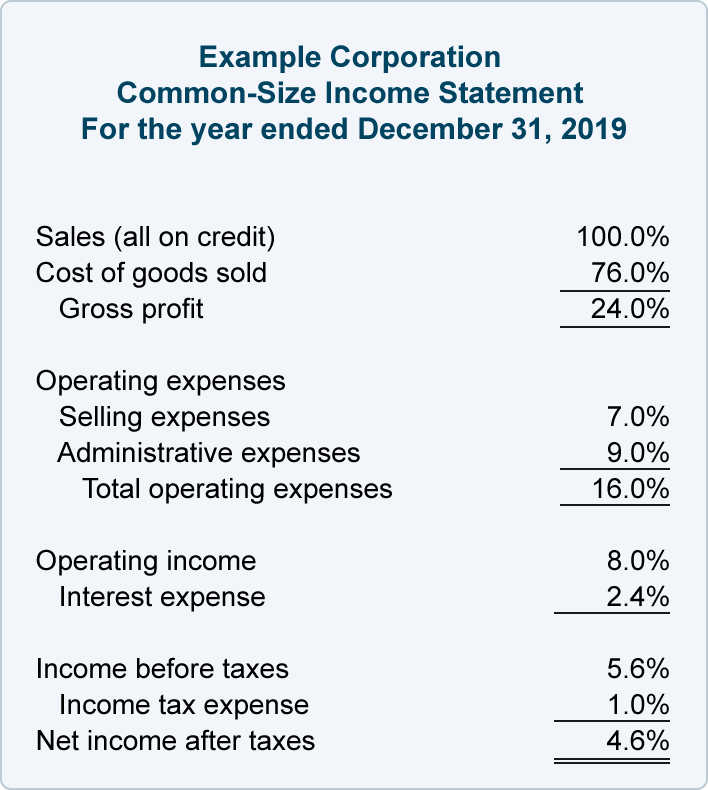

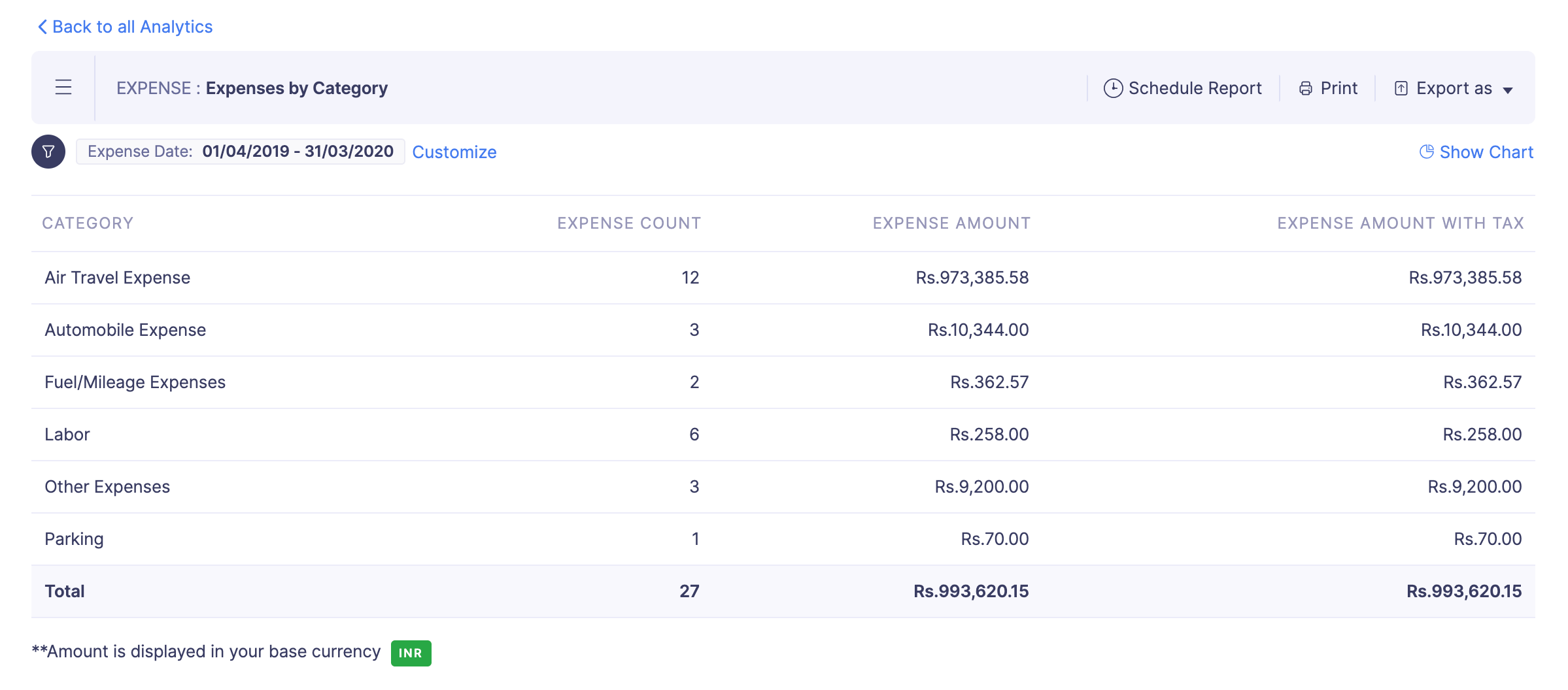

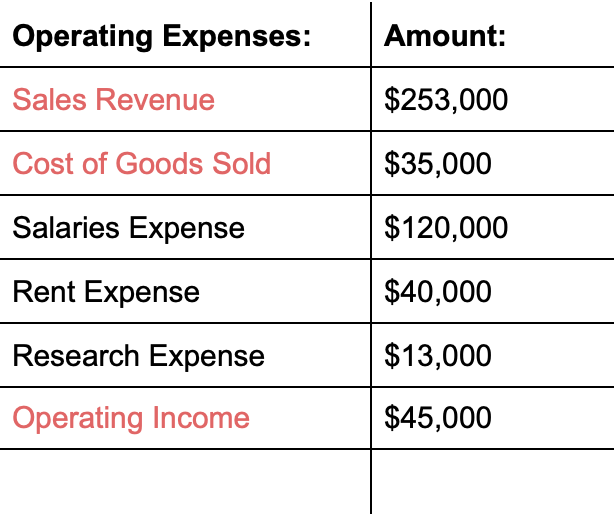

For example, your advance royalty was $50,000 and your royalty payment is 5 percent of. The minimum rent is ₹20000. Total expenses takes into account all of the expense items in the p&l.

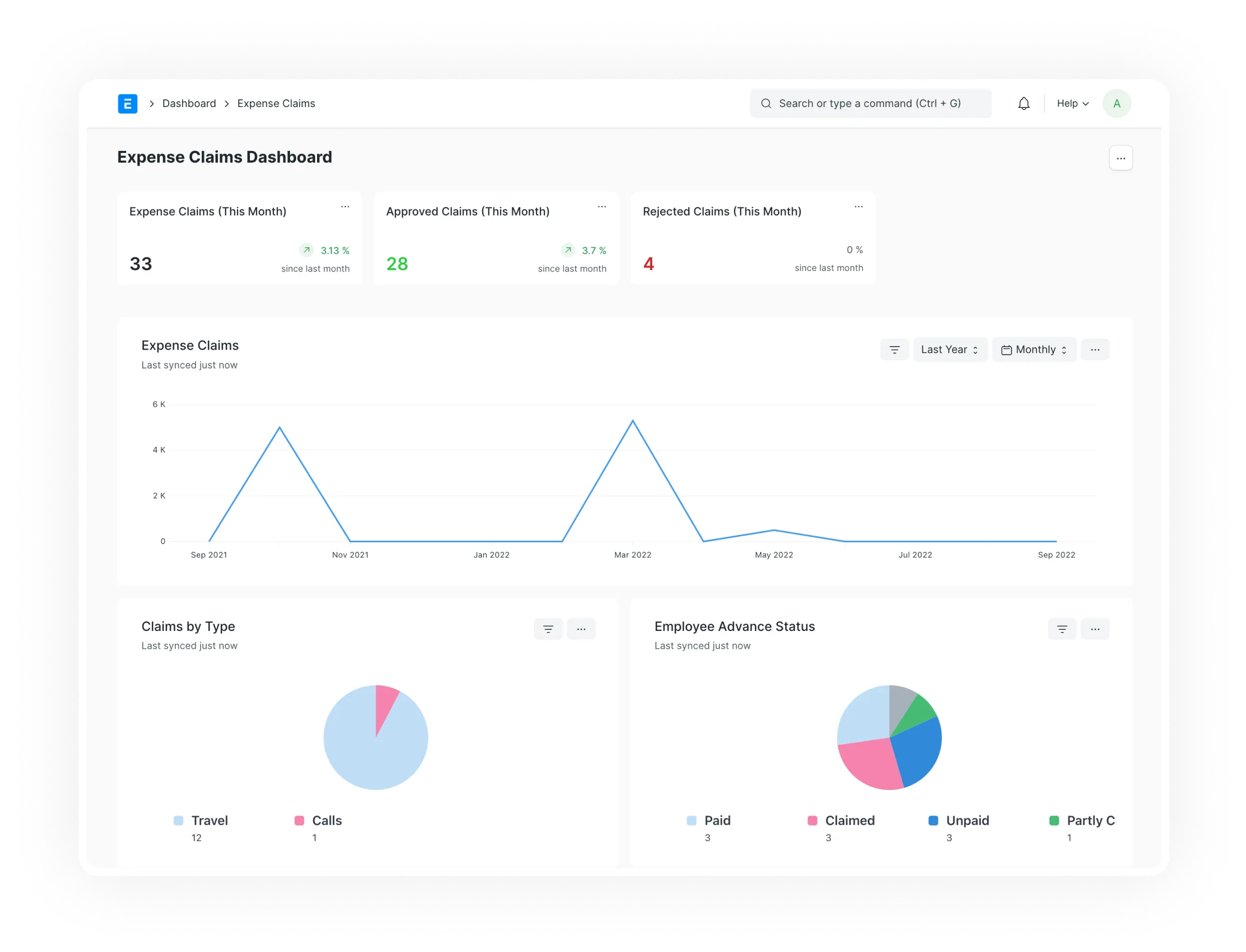

Any commissions expense is recognized under the accrual basis of accounting as soon as the business has incurred the. The p&l tells you if a company is profitable. This is because the sum of income and expenses from financing activities and cash and cash equivalents is likely to be a net expense.

A revisit of the data in goldscheider et al (2002) further demonstrates that a “forced” linear fitting seems to make the average royalty rate equal to 23 percent of the average. The sales in the 5 years are:. The whole royalties process can be overwhelming.

It the revenue from leasing such kind. Royalty is ₹5 per book. A profit and loss statement (p&l) is an effective tool for managing your business.

In the midst of the chaos, all these events are impacting your. Royalty is nothing but a periodical payment made by the user of the asset to the owner or the creator of such an asset for its use. This total includes your direct costs, operating expenses, interest.

Accounting for sales commissions. Royalty is a type of monetary reward for the use of copyrights, patents, trademarks and brands, franchises, natural resources, and other types of property. It starts with revenue, subtracts expenses, and shows the “bottom line”— a.k.a.

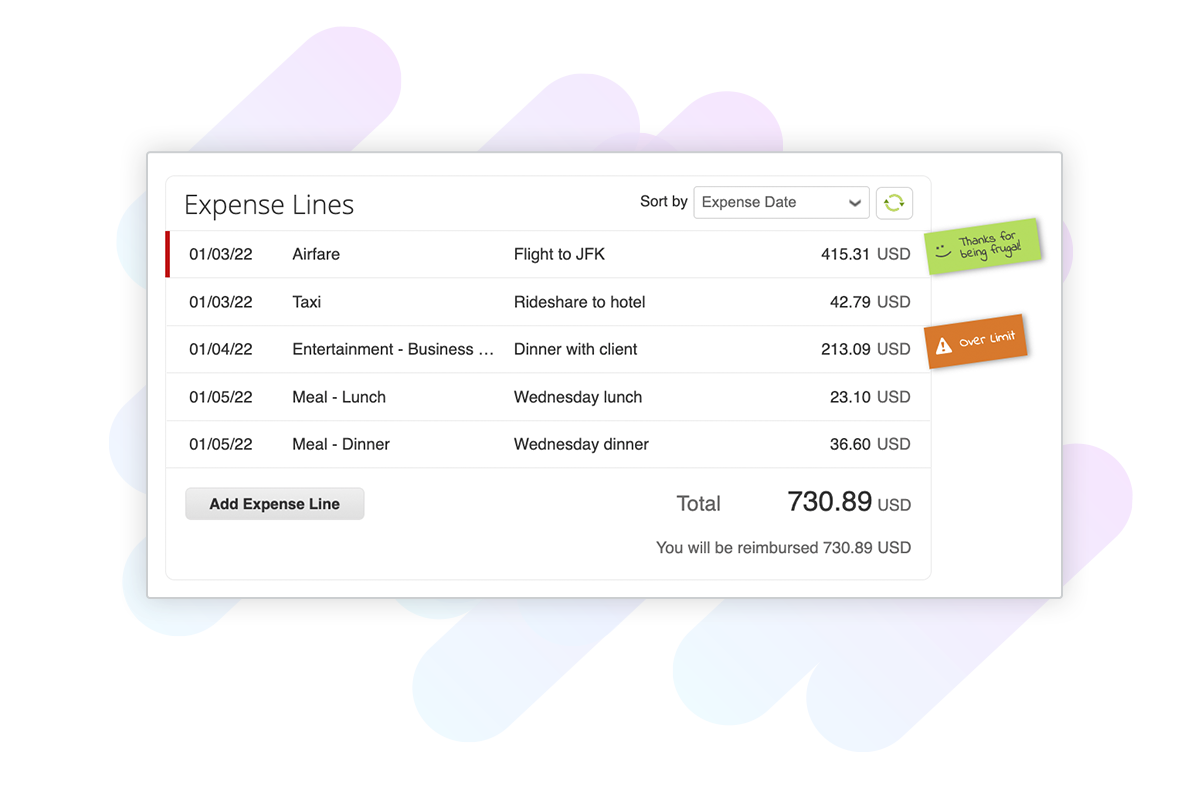

Royalty payments are classified as current expenses on the income statement. Recording royalties whenever an individual is paid, the accounting department makes a journal entry to the general ledger under each affected account. 4 introduction to miag with more than 3,575 industry.

A royalty is a legally binding payment made to an individual or company for the ongoing use of their assets, including copyrighted works, franchises, and natural. Therefore, entities will have an incentive. 28 feb 2022 us revenue guide licenses of intellectual property frequently include fees that are based on the customer’s subsequent usage of the ip or sale of.