Matchless Info About Absorption Costing Profit Statement

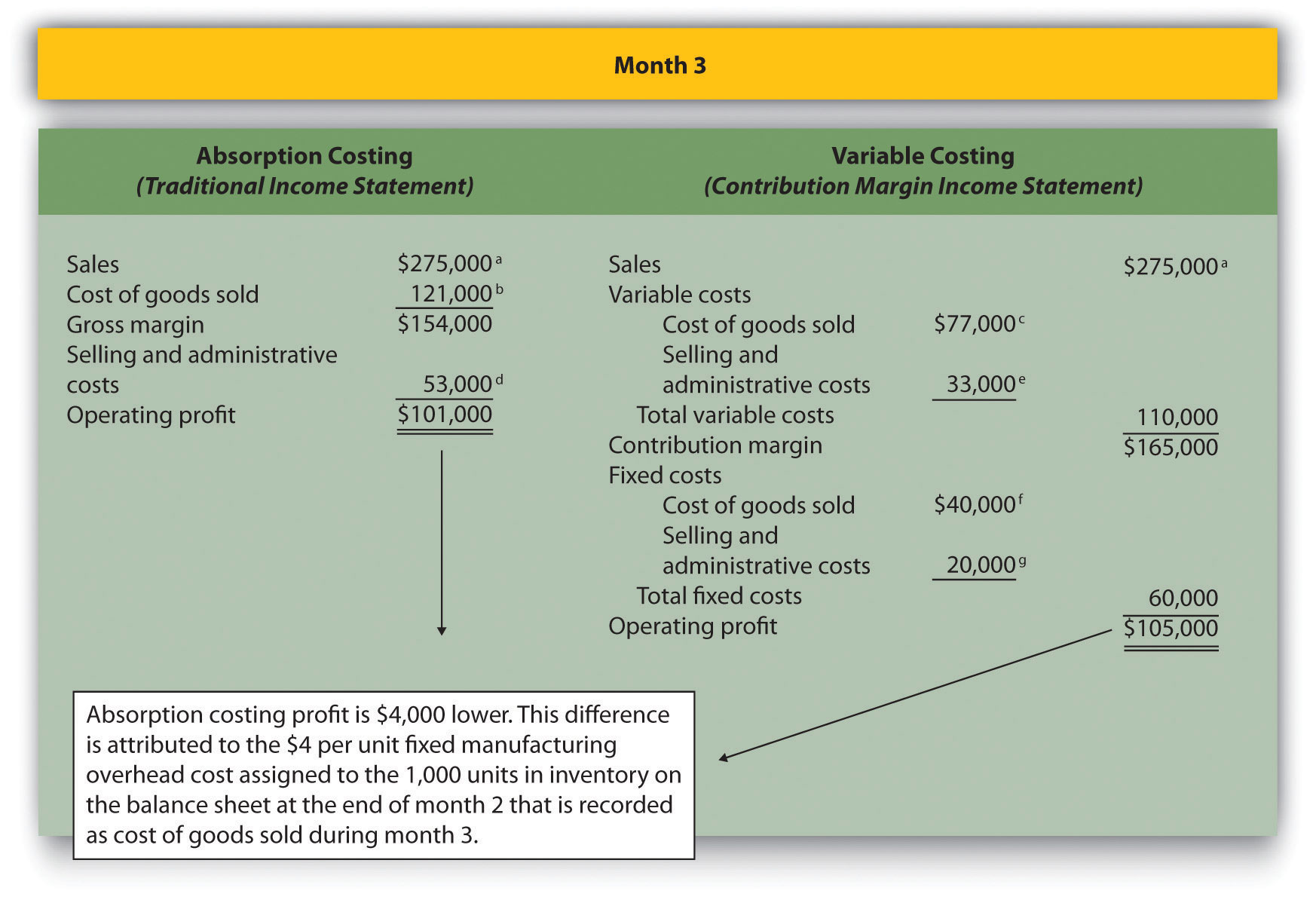

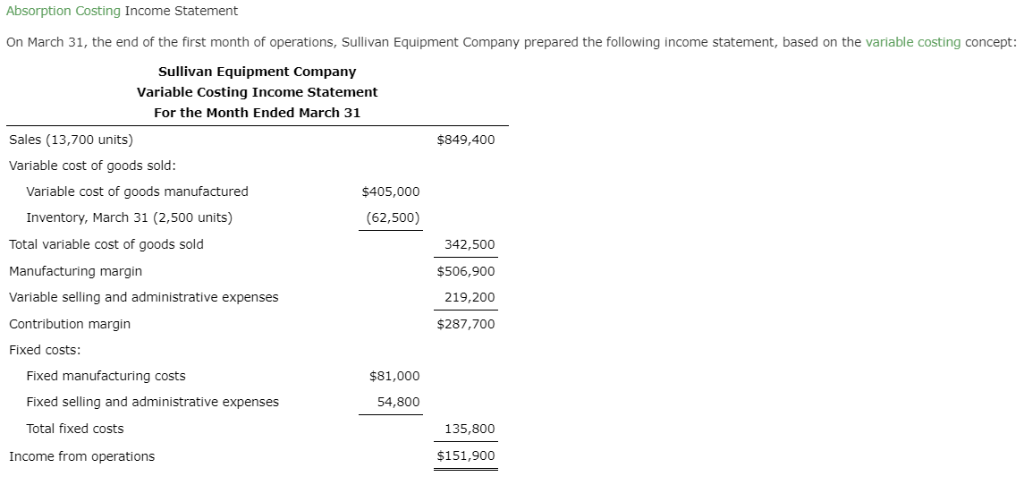

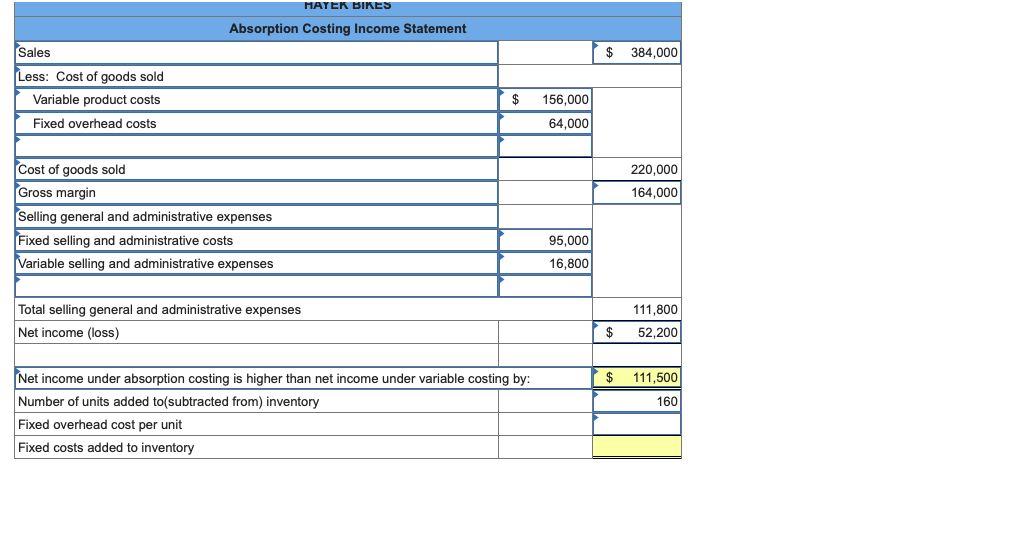

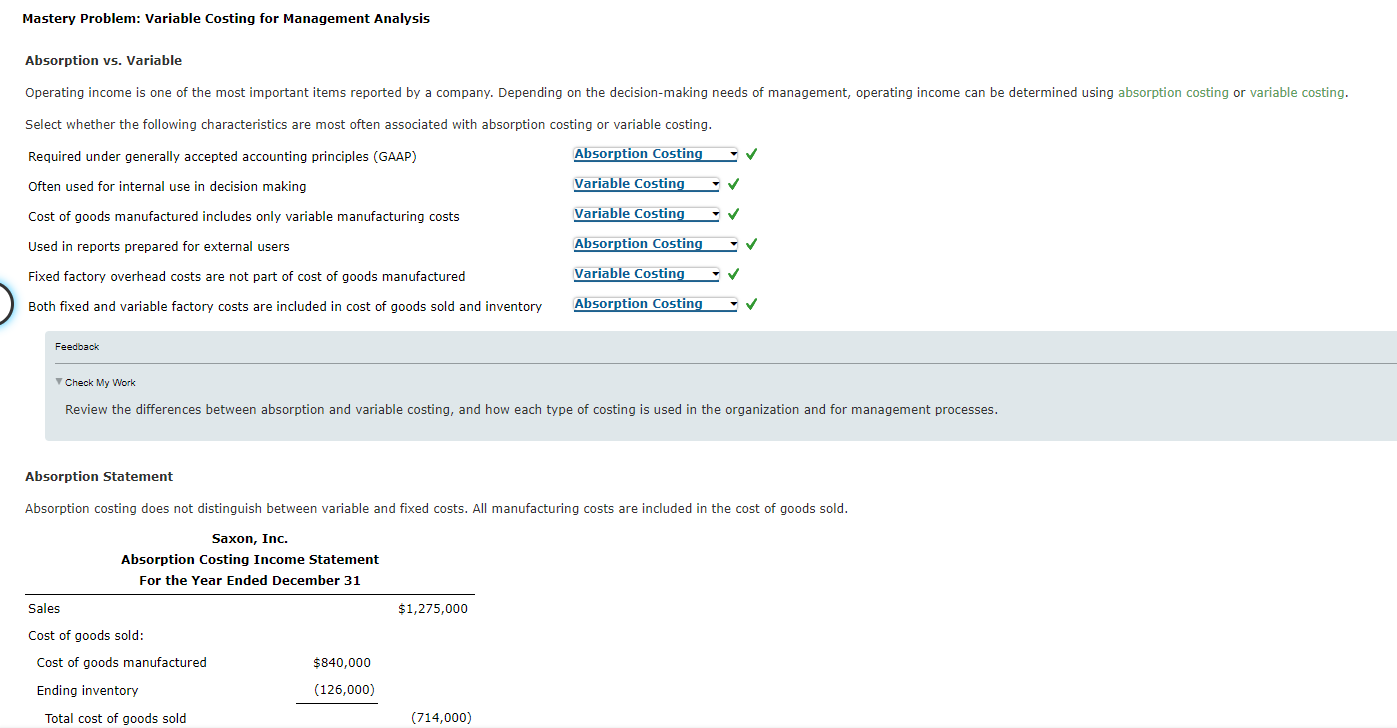

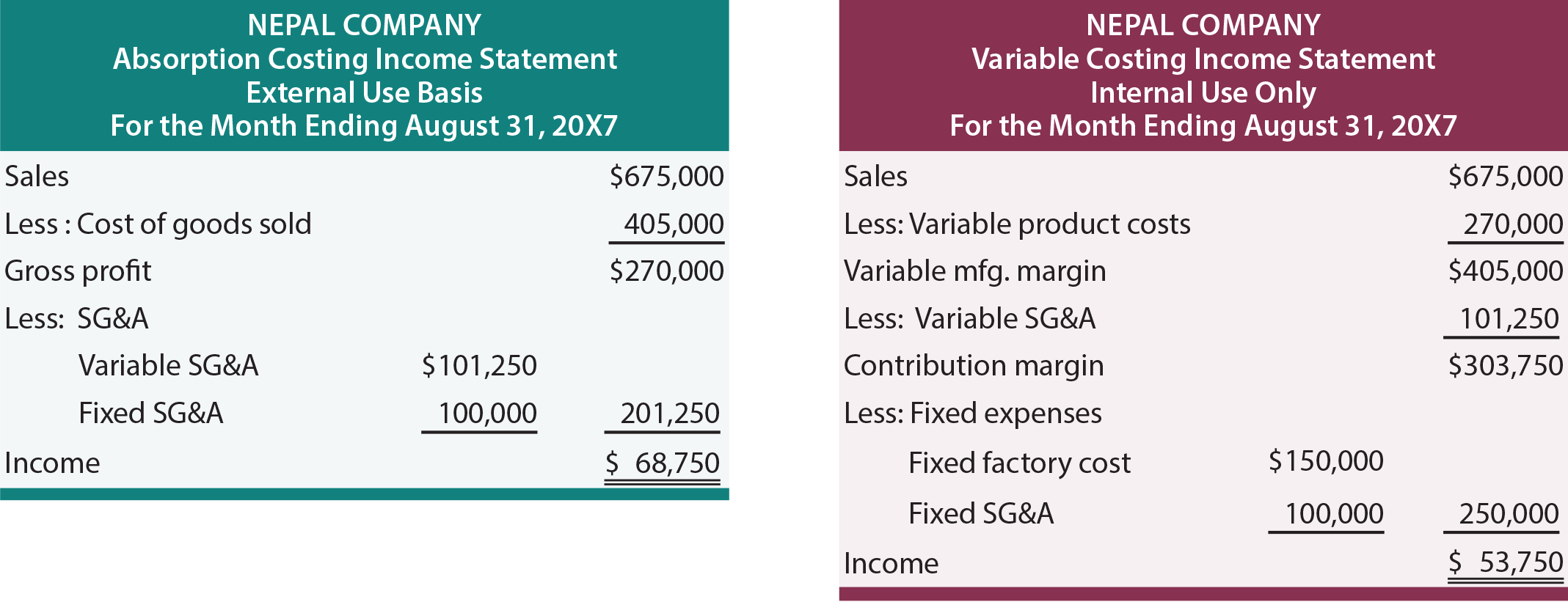

Absorption costing is the costing method used for financial accounting and tax purposes because it reflects a more comprehensive net income on income.

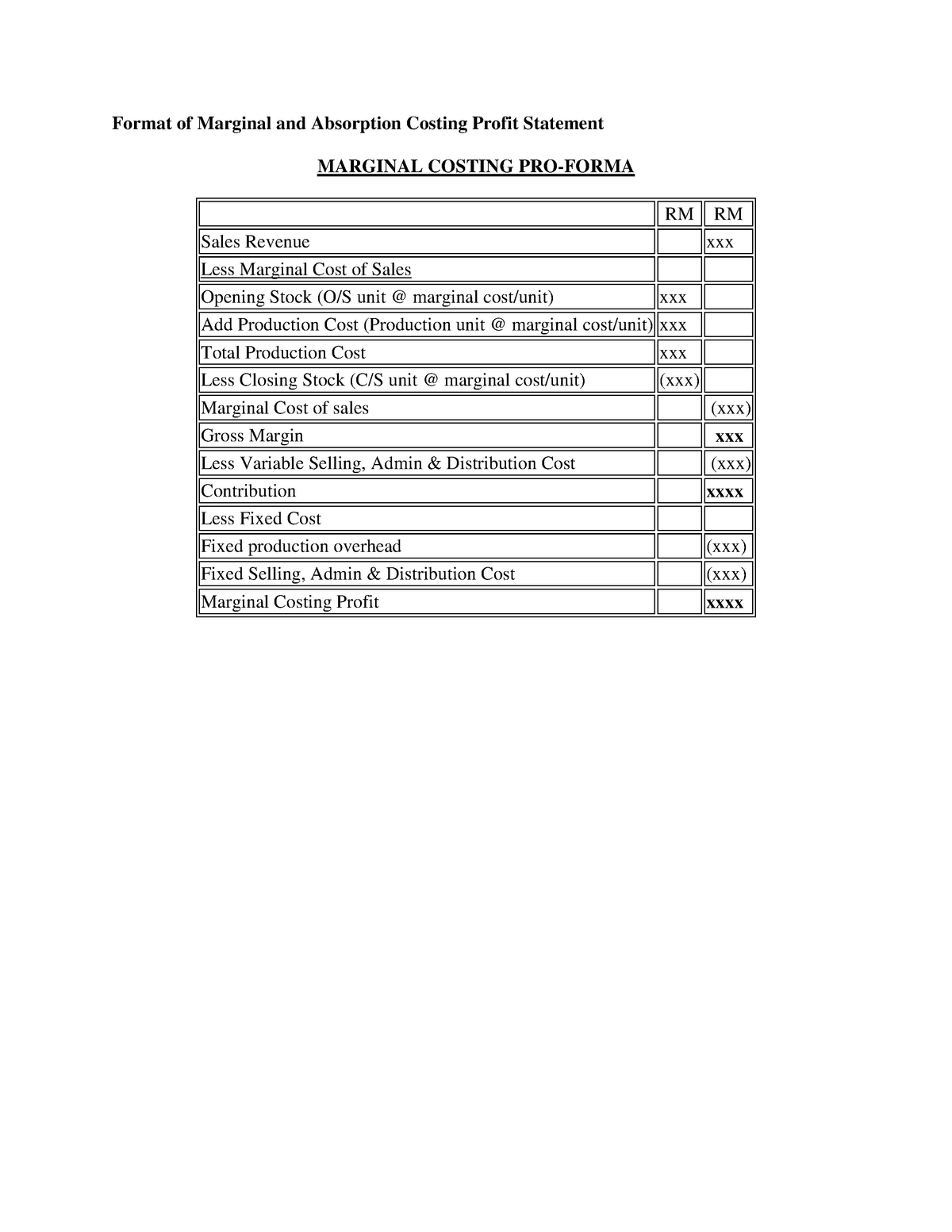

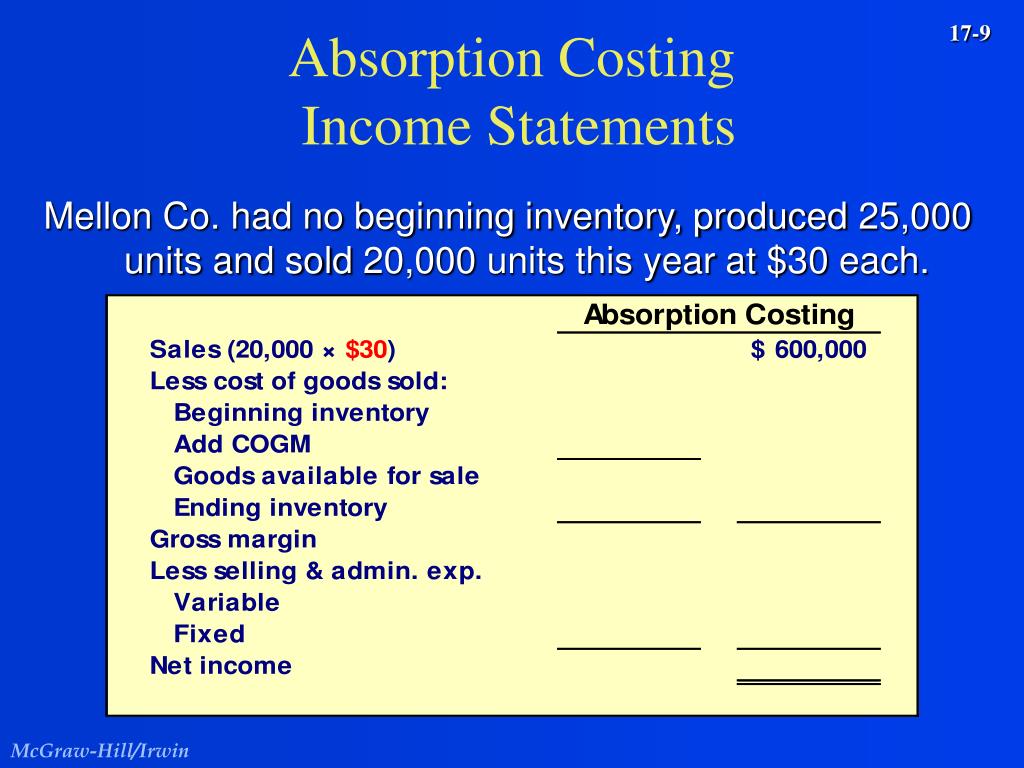

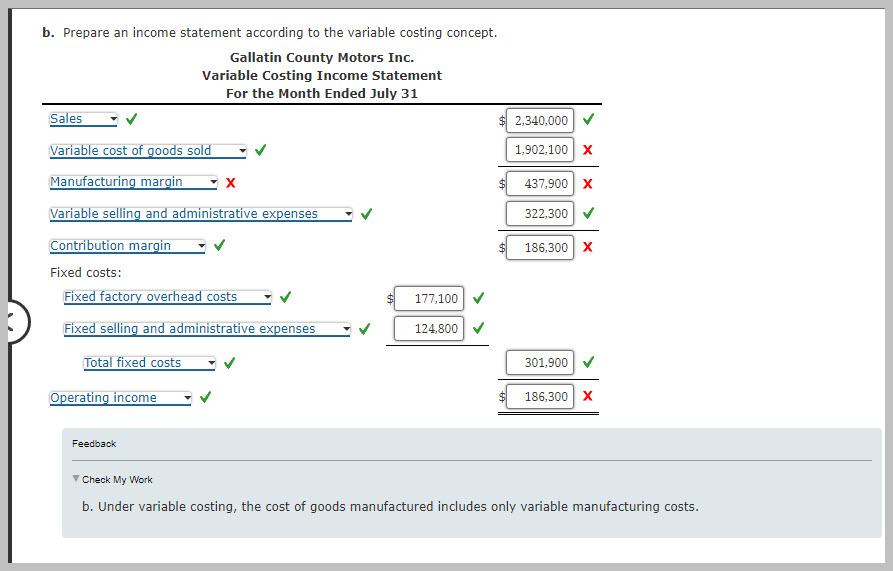

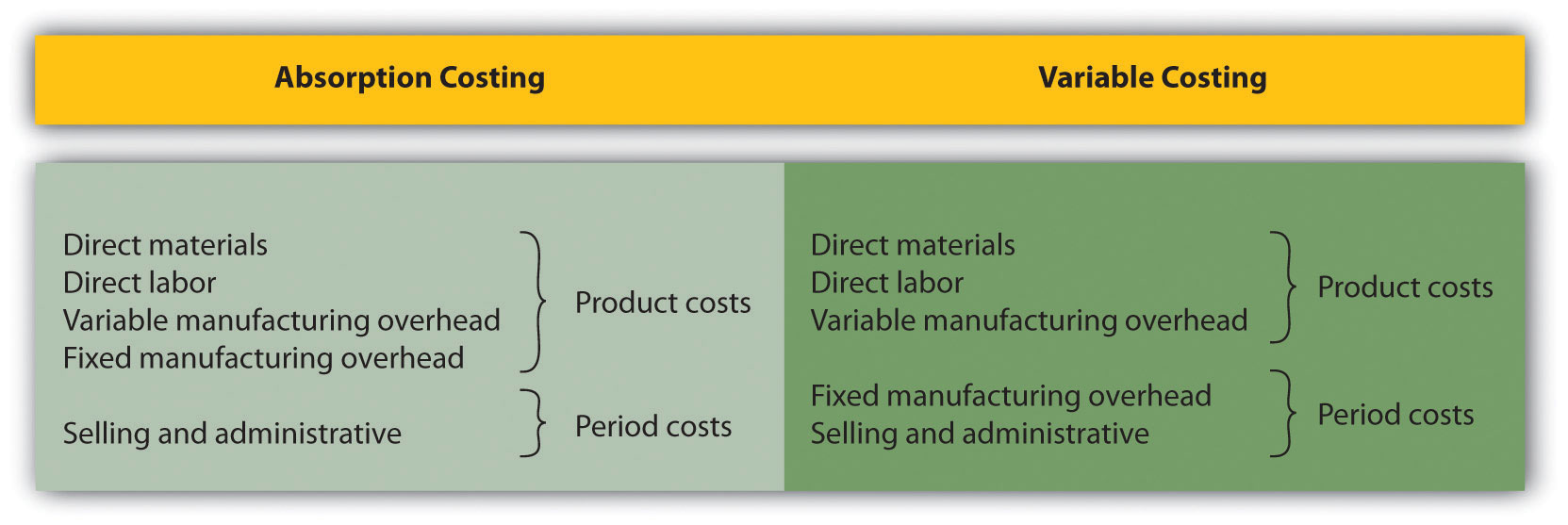

Absorption costing profit statement. Absorption costing profit formula: One of the key principles of absorption costing is that inventory and units produced must include a share of all production costs, both fixed and variable, incurred in getting them. In contrast, absorption costing, also called full costing, is a method that applies all direct costs, fixed overhead, and variable manufacturing overhead to the cost.

More precisely, it is a technique to determine the cost or profit of. Standard gross profit (9000x8) 92 000: Absorption costing, also called full costing, is what you are used to under generally accepted accounting principles.

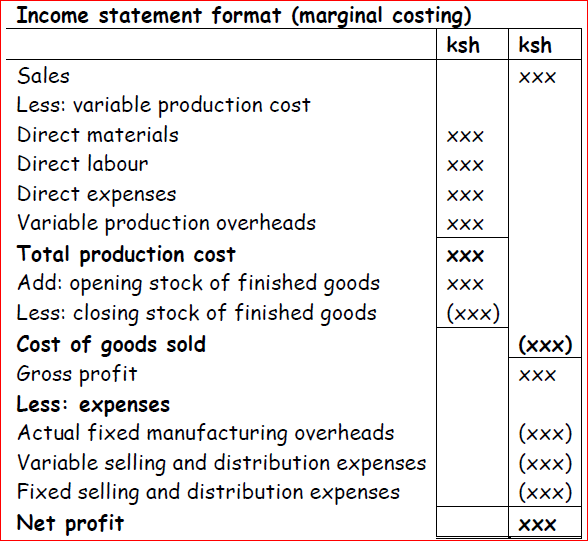

And the cost can be determined in many ways such as: Absorption costing is the oldest technique for estimating profit/cost per unit for goods and services. The income statement divides the period and product cost to have an overview of the costs.

What is the gross profit for product a, using absorption costing? Cost + profit = selling price. It shows that the gross profit is less than the selling and that the administrative.

Absorption cost formula = (direct labor cost + direct material cost + variable manufacturing overhead cost + fixed manufacturing overhead) / no. Administrative, selling and manufacturing costs are all separated into three categories by absorption costing. It includes all costs of manufacturing the product, whether variable or.

Absorption costing entails allocating fixed overhead costs to all units produced for an accounting period. Absorption costing considers both fixed and variable manufacturing costs in valuing inventory. Variable costing includes all of the variable direct.

Under absorption costing, companies treat all. Category 1:in order to calculate gross margin/gross profit on sales in the income statement, all production expenses, both fixed and variable, are deducted from the sales revenue. Absorption costing, also called full costing, is what you are used to under generally accepted accounting principles.

Production cost + non production cost = total cost; Under absorption costing, companies treat.

:max_bytes(150000):strip_icc()/dotdash-INV-final-Absorption-Costing-May-2021-01-bcb4092dc6044f51b926837f0a9086a6.jpg)