First Class Tips About Cash Flow Forecast For Small Business

The first step to managing your cash flow is forecasting.

Cash flow forecast for small business. Cash flow is the heartbeat of your. Improving cash flow is a top priority for small business owners. Your net cash flow shows if your business is earning more cash than it’s burning, or vice versa.

It will also show you when more cash is going out of the business than in. New survey analyzes small business sentiment and cash flow data for holistic overview of small business health. Plan for future cash shortcomings.

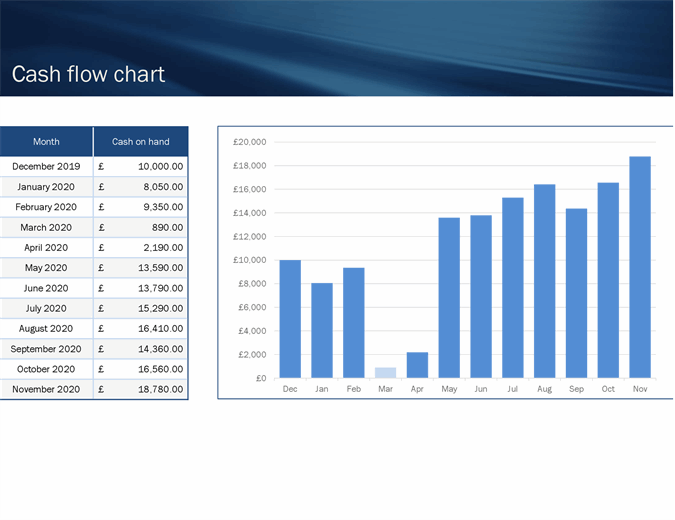

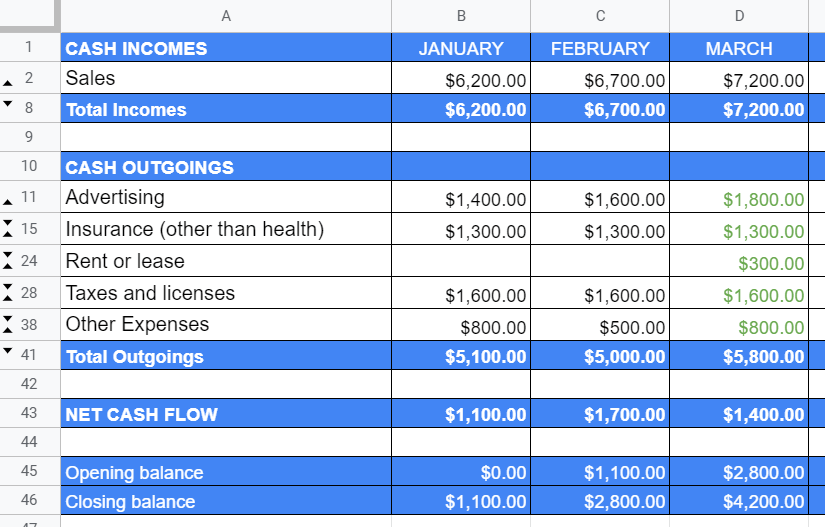

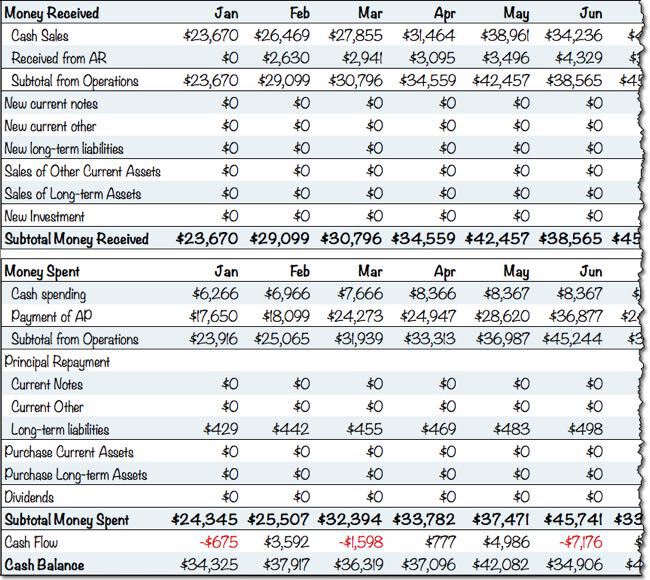

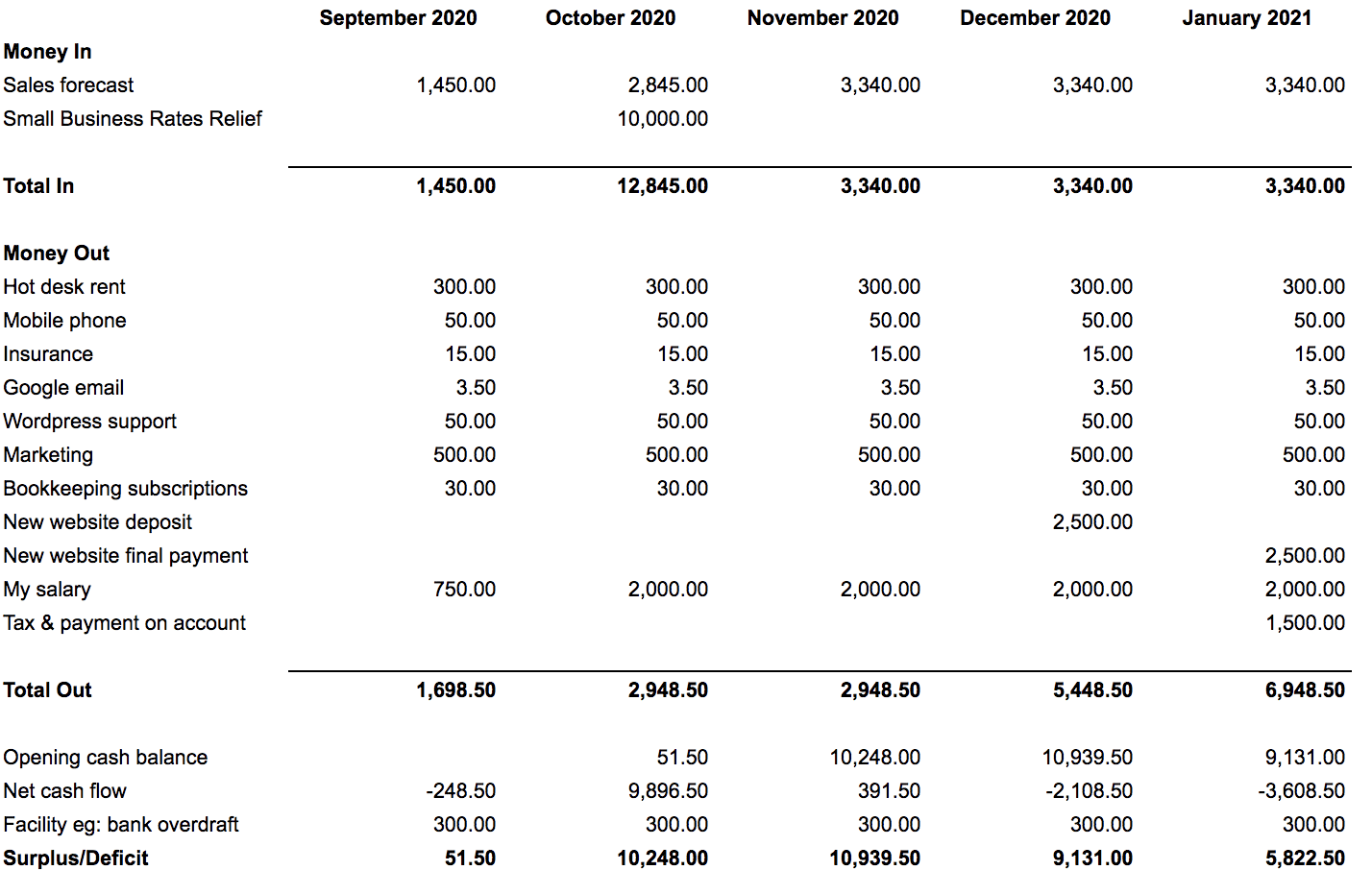

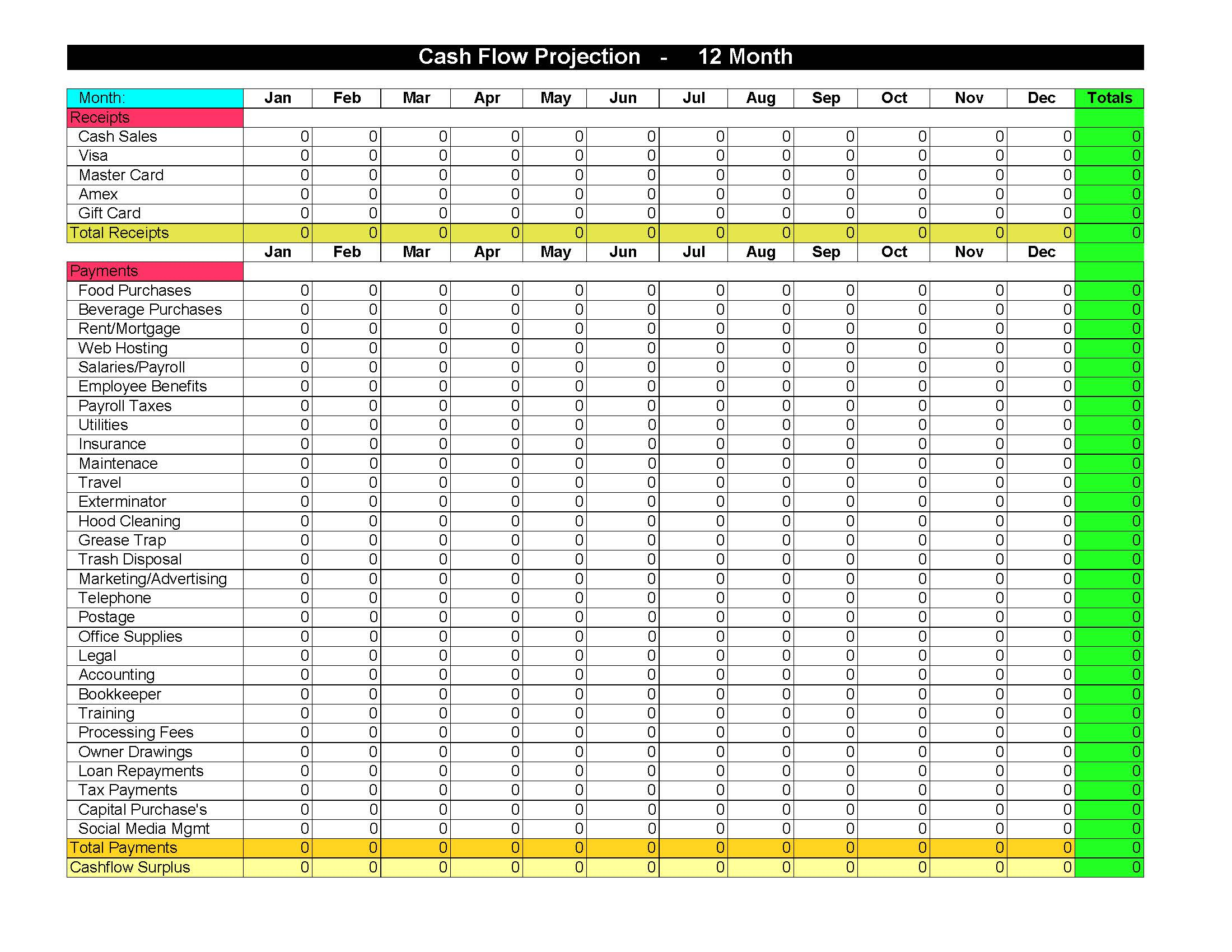

This involves predicting the amount of cash that will come in and out of your business in the next. Cash flow forecasting always specifies a period of time, and the first step is choosing your forecasting period. Complete your bookkeeping when you want to create a cash flow forecast the starting point is vital.

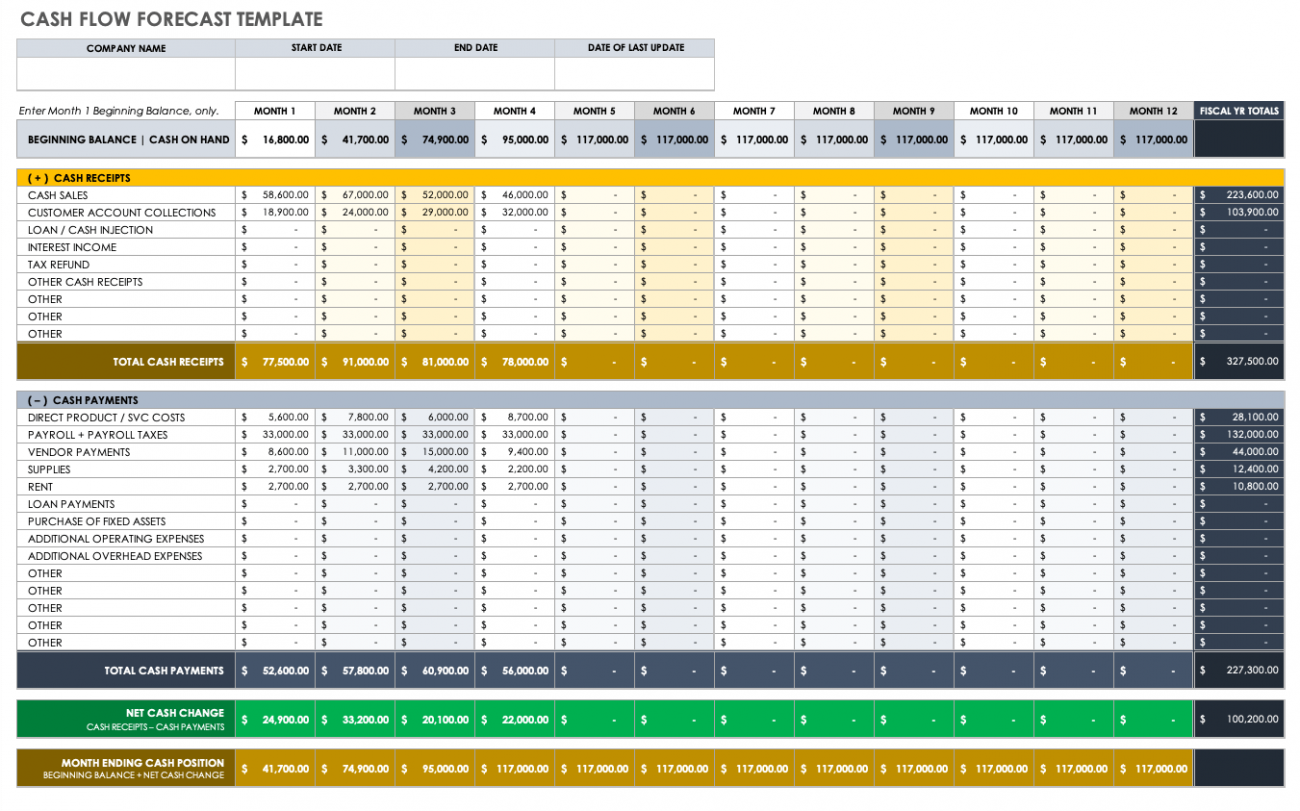

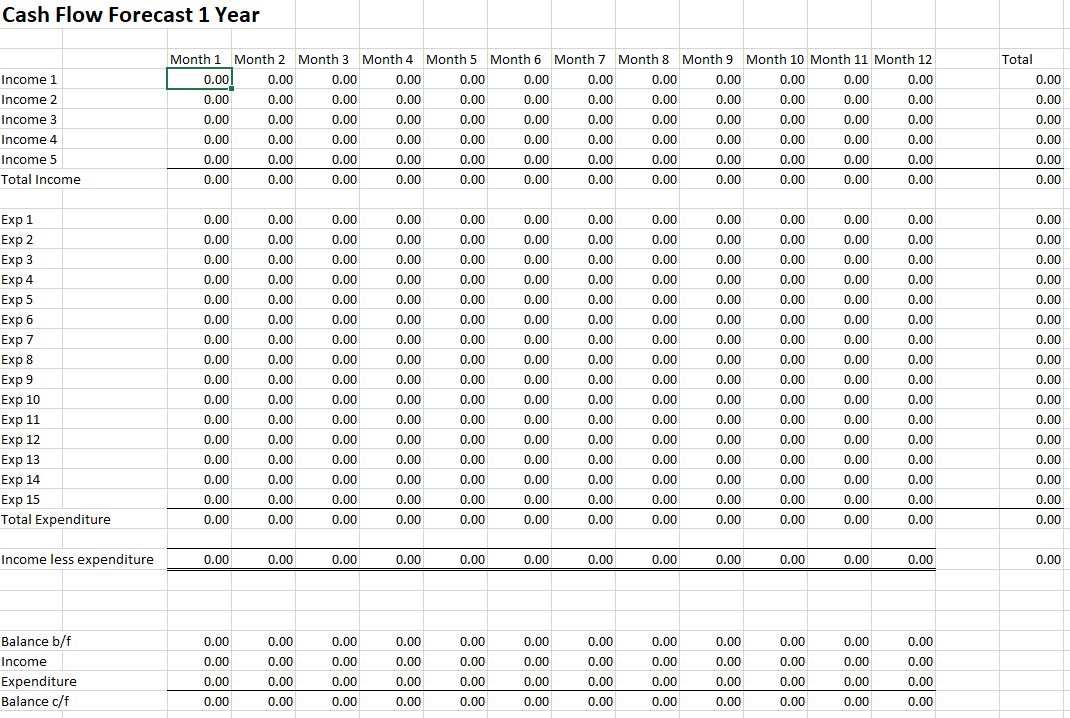

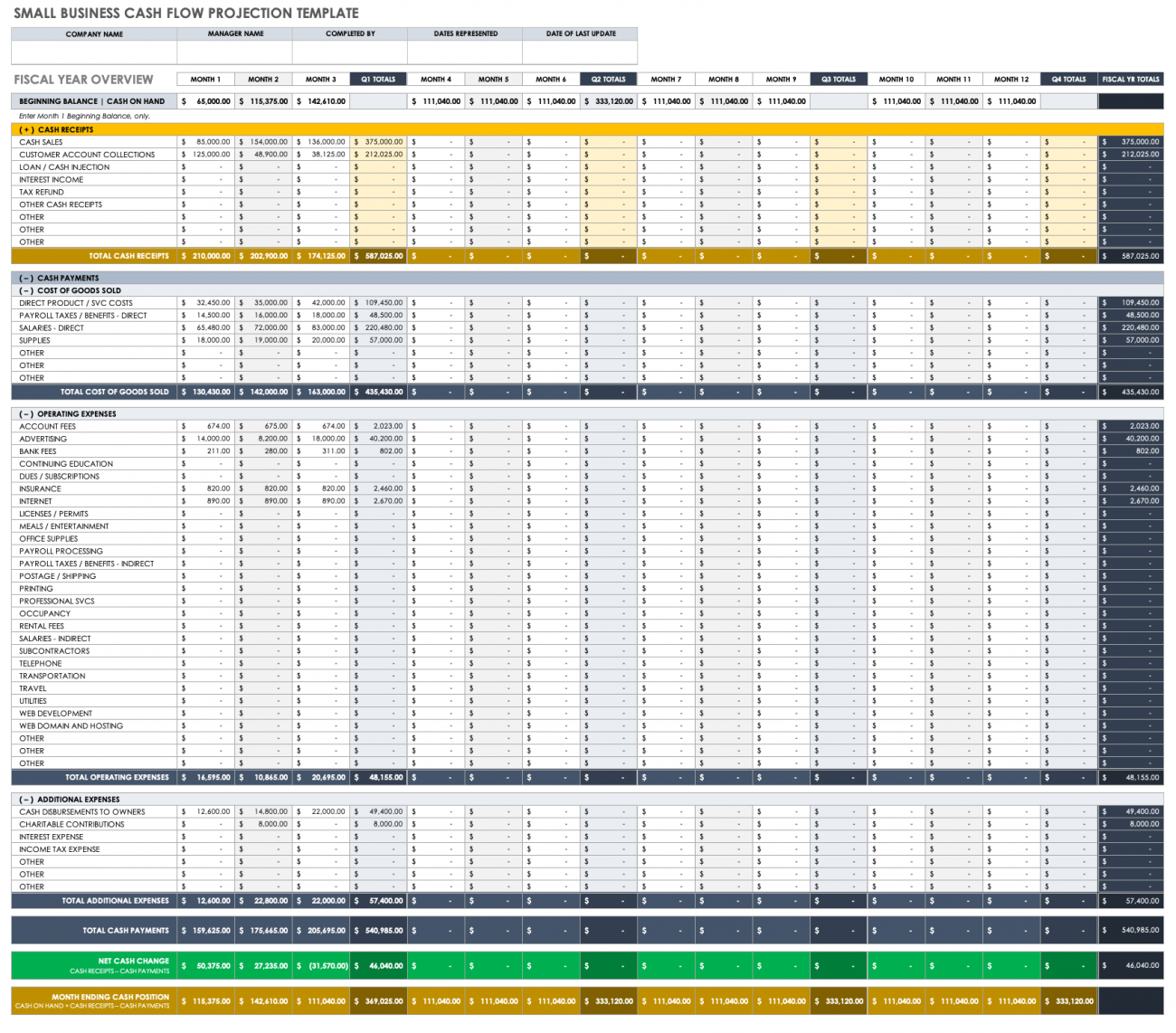

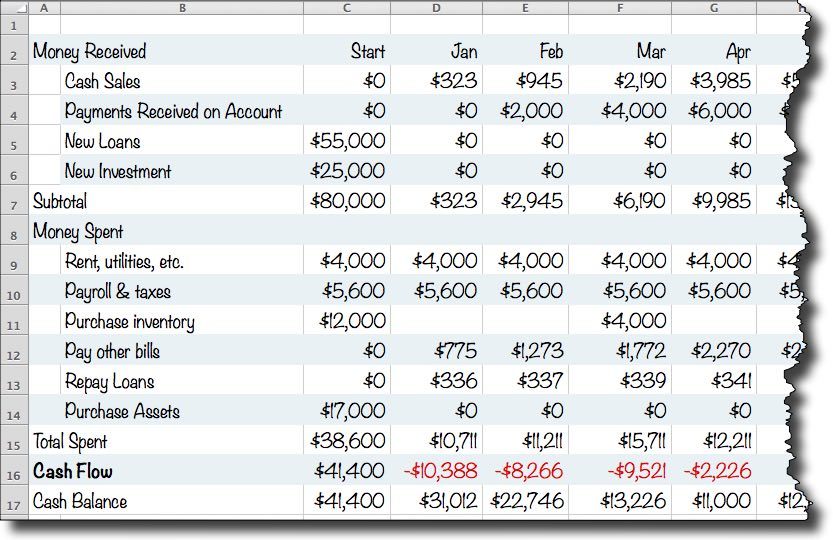

With forecasting software, which can connect to sage, you can get something. Our cash flow forecasting template is an excel spreadsheet that you can use to forecast and record. Direct cash flow forecasting.

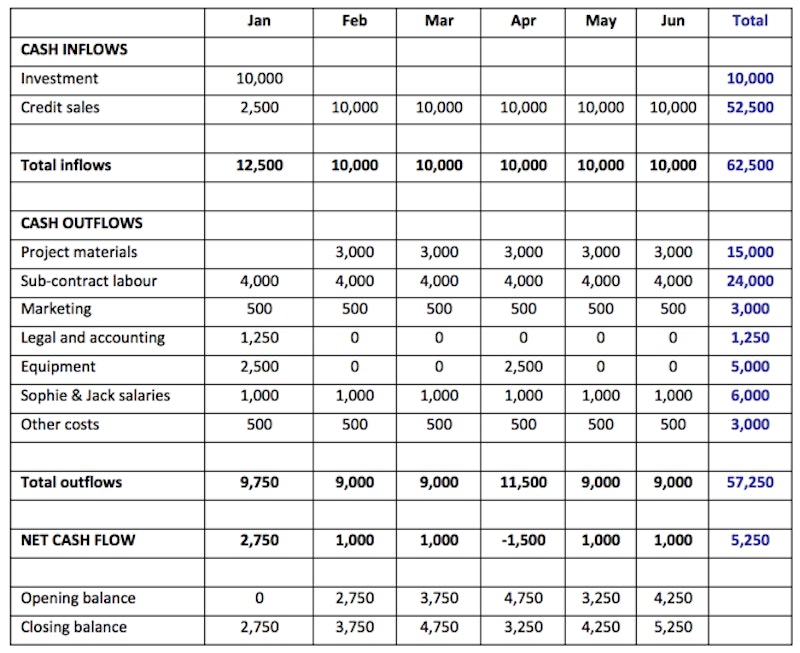

This type of cash flow forecast looks at the expected cash inflows and outflows for a short period of time, such as a month, quarter,. You can use forecasts to: Not one forecasting method is better than the other.

Use the one based on your chosen cash flow forecasting period and the available data needed to create your. So you might prefer to use this method if your business is new, or has irregular or. Cash flow forecasts are an important tool for all stages of contracting, being a sole trader or in business.

In the dynamic world of business, mastering the art of financial management is crucial for small enterprises. Cash flow forecasting always specifies a period of time, and the first step is choosing your forecasting period. The books are your best place to start calculating cash flow.

Remember, adaptability is a must in budget management, as business conditions are rarely static. Here are some effective strategies to boost cash flow: Aim attempts to better match provisional tax payments with actual cash flow.