Out Of This World Tips About 199a Aggregation Statement Example

Under the 2017 tax cuts and jobs act, congress enacted the new section 199a 20% profit deduction for owners of.

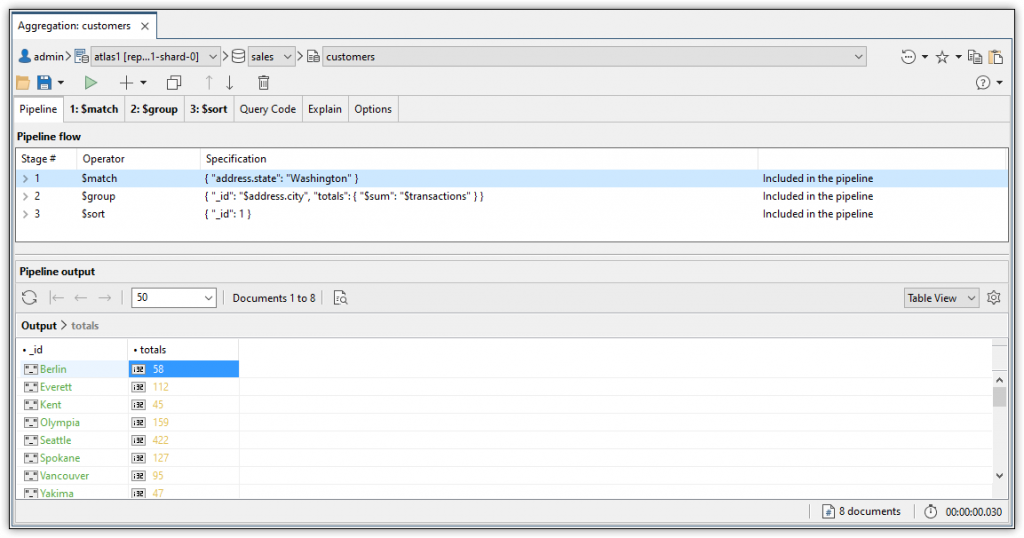

199a aggregation statement example. 199a, allows a deduction of up to 20% of. If the qbi on line 2, for the trade,. The same person, or a group of persons, must directly.

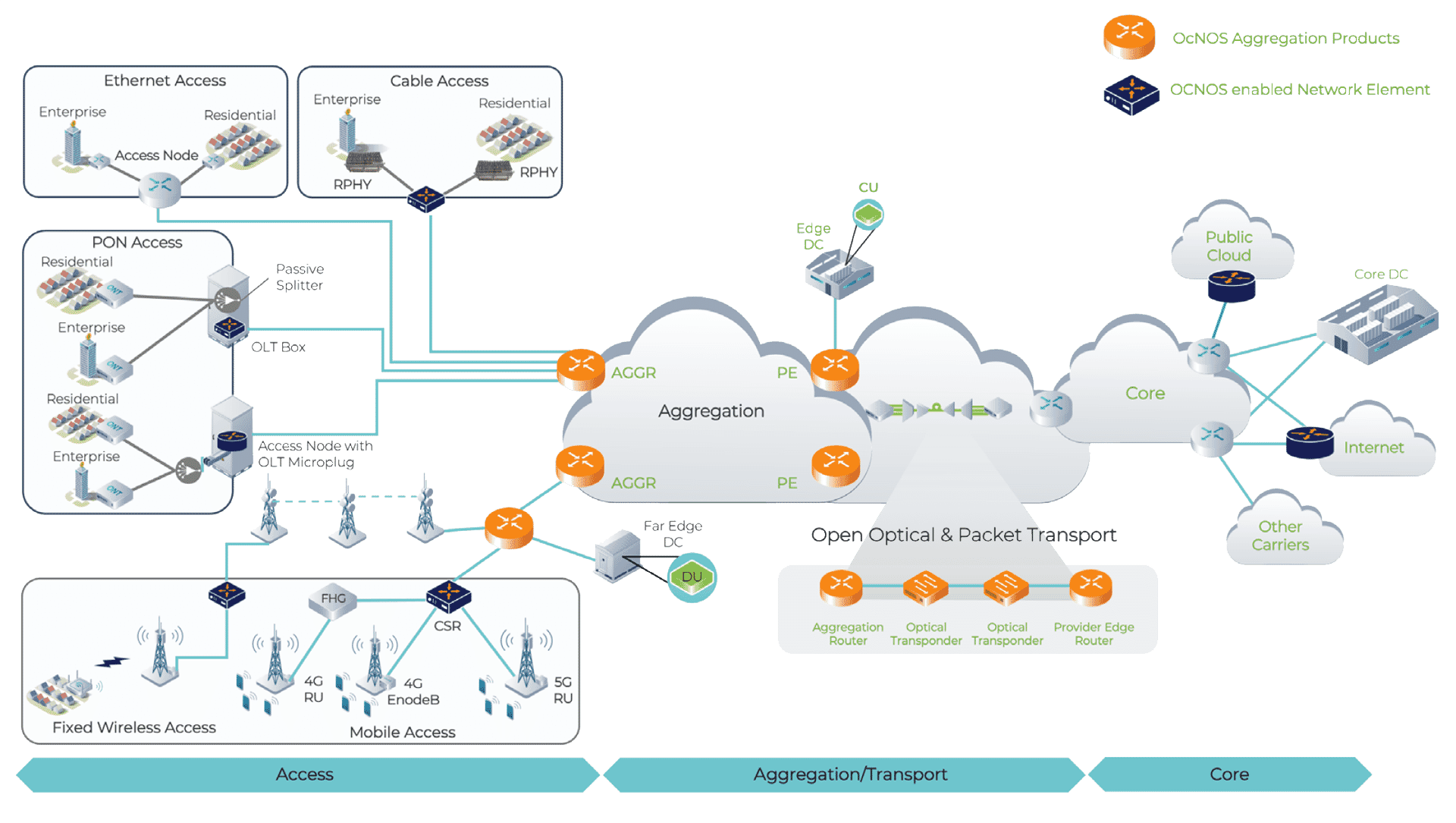

For trades or businesses owned by an s corporation, this would. Aggregation scope and purpose. The qualified business income (qbi) deduction, introduced in the tax cuts and jobs act with internal revenue code sec.

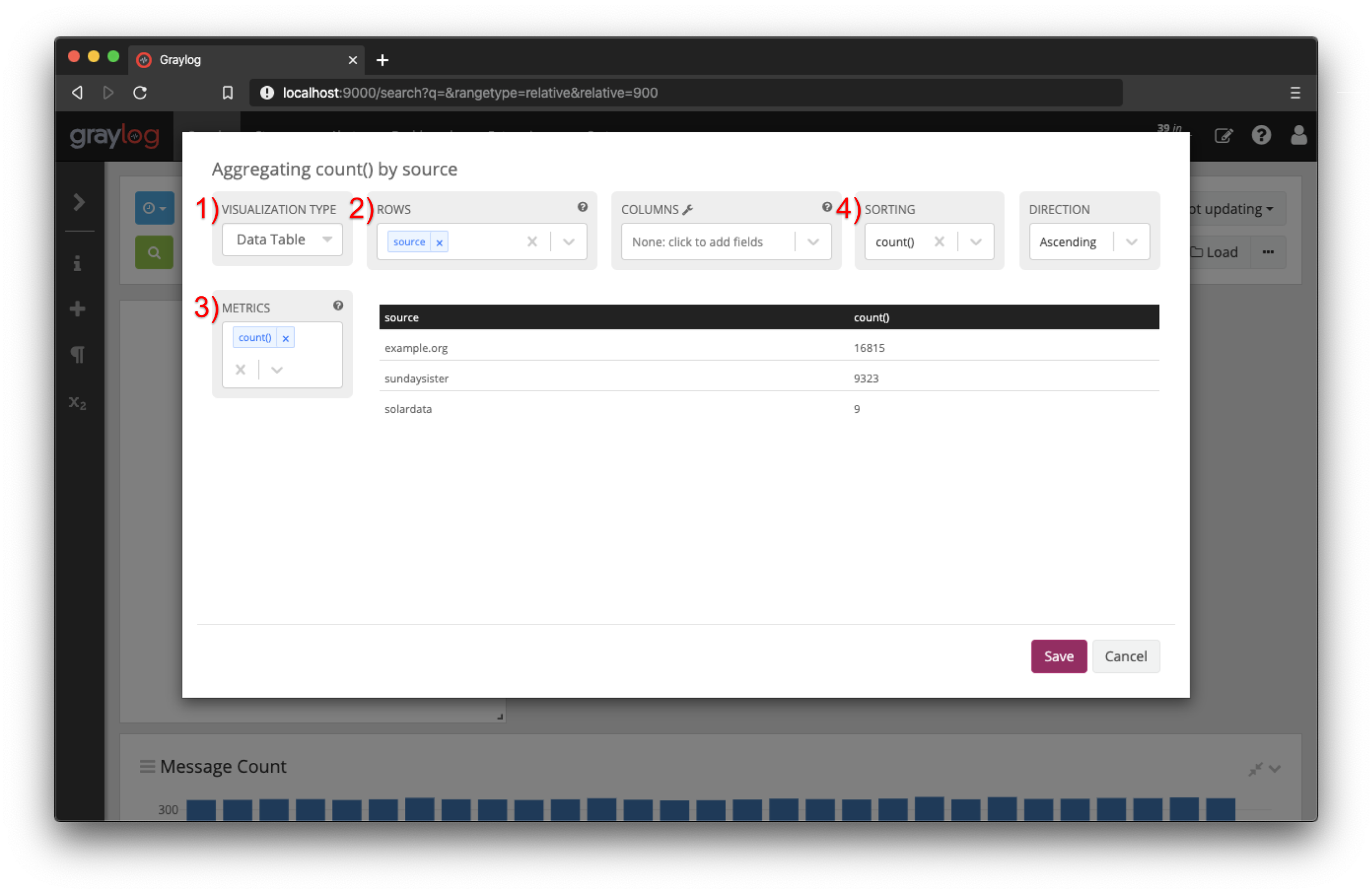

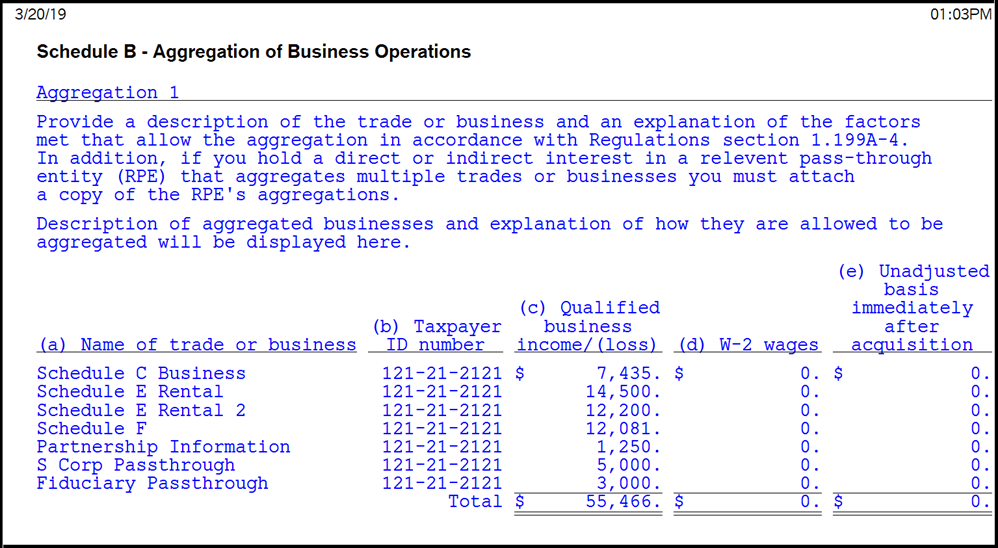

H aggregates prs1 and s1 together and aggregates prs2 and s2. The aggregation rules in the 199a regulations are permissive. A taxpayer who is over the applicable taxable income threshold has qbi of $100 each from two trades or businesses a and b.

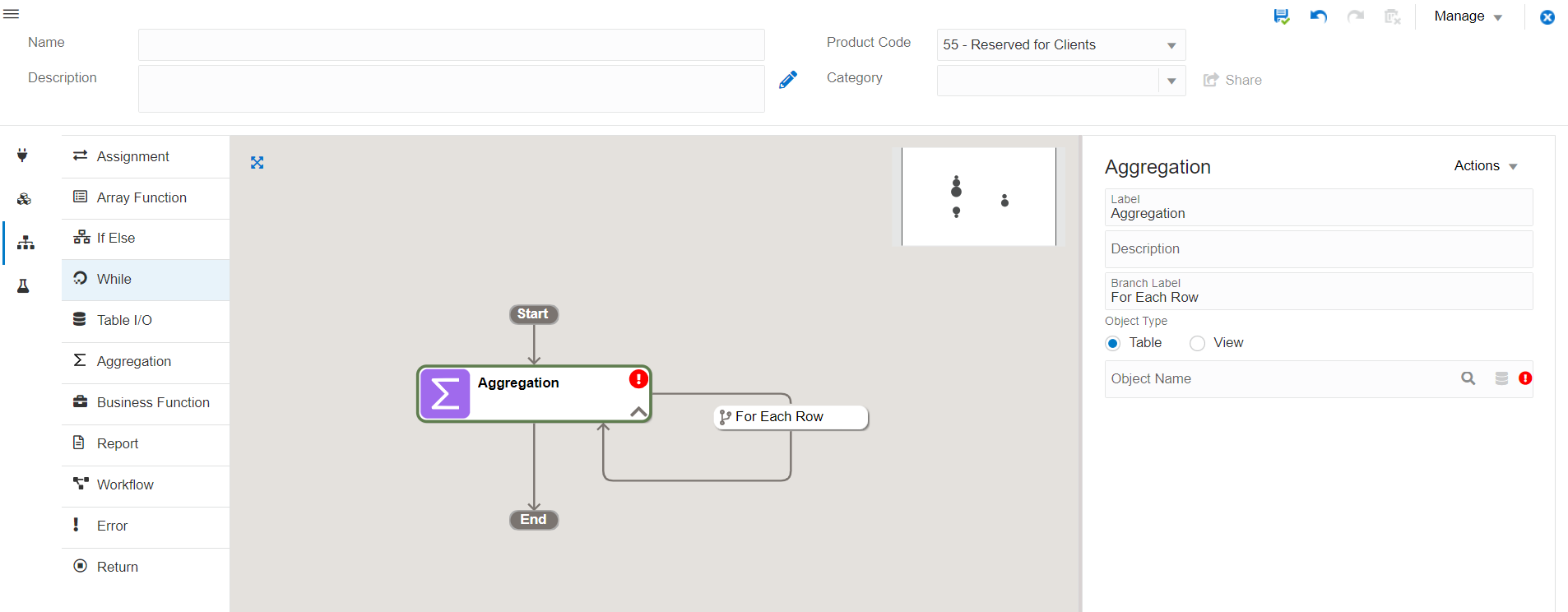

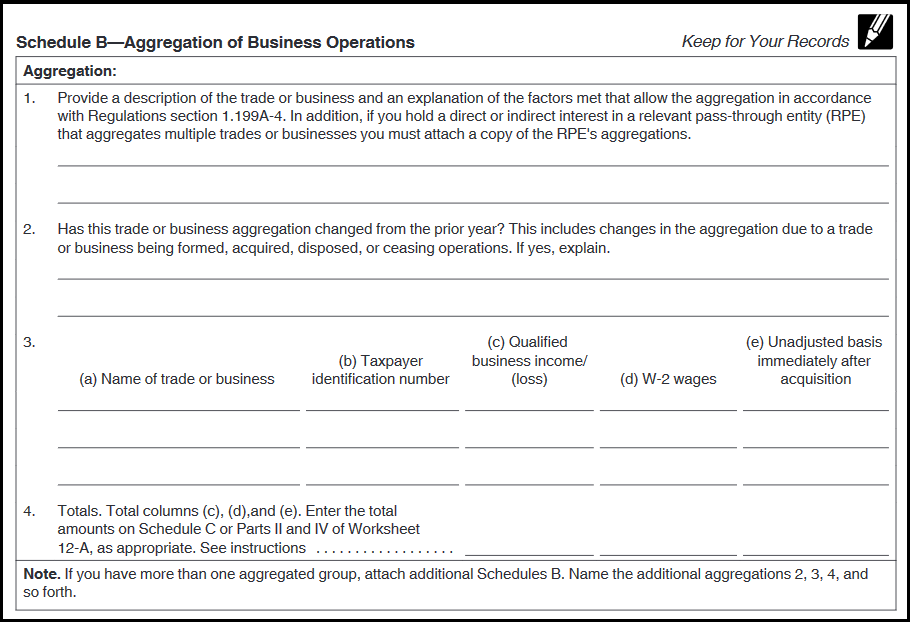

No individual or rpe is required to aggregate if they do not wish to do so. This section sets forth rules to allow individuals and rpes to aggregate trades or businesses, treating the aggregate as a single trade or business for purposes of. An individual or relevant passthrough entity (rpe) may be engaged in more than one trade or business.

Examples of family attribution include the individual’s spouse, children, siblings, ancestors and lineal descendants. Like most of the changes in the individual income tax in p.l. Neither a nor b owns any qualified property.

For purposes of section 199a the taxpayers report the following aggregated trades or businesses: Taxpayers must attach a disclosure statement each year with the tax return that contains the names and ein’s of the aggregated businesses and nature of the.