Neat Tips About Audited Balance Sheet Requirement

Balance sheet requirements for state registered advisers.

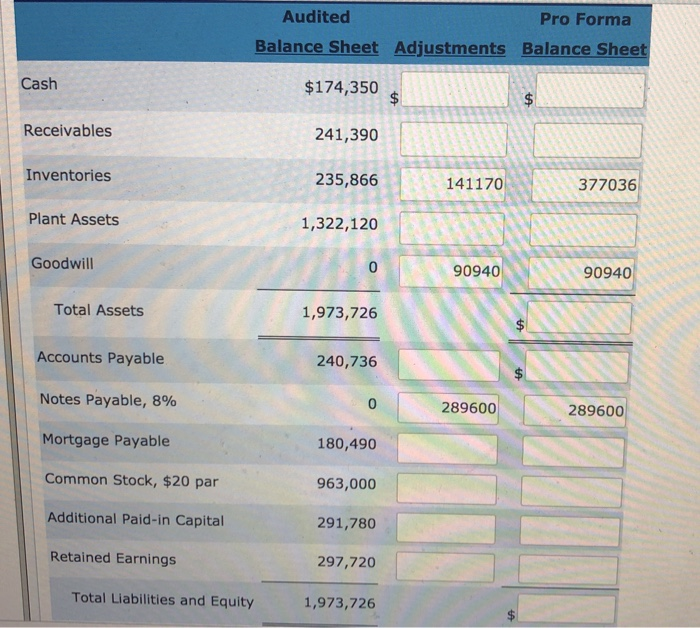

Audited balance sheet requirement. This information is used by a wide range of stakeholders (e.g., investors) in making economic decisions. 1365.3 maximum audited reporting period. 1365.4 securities act registration statement

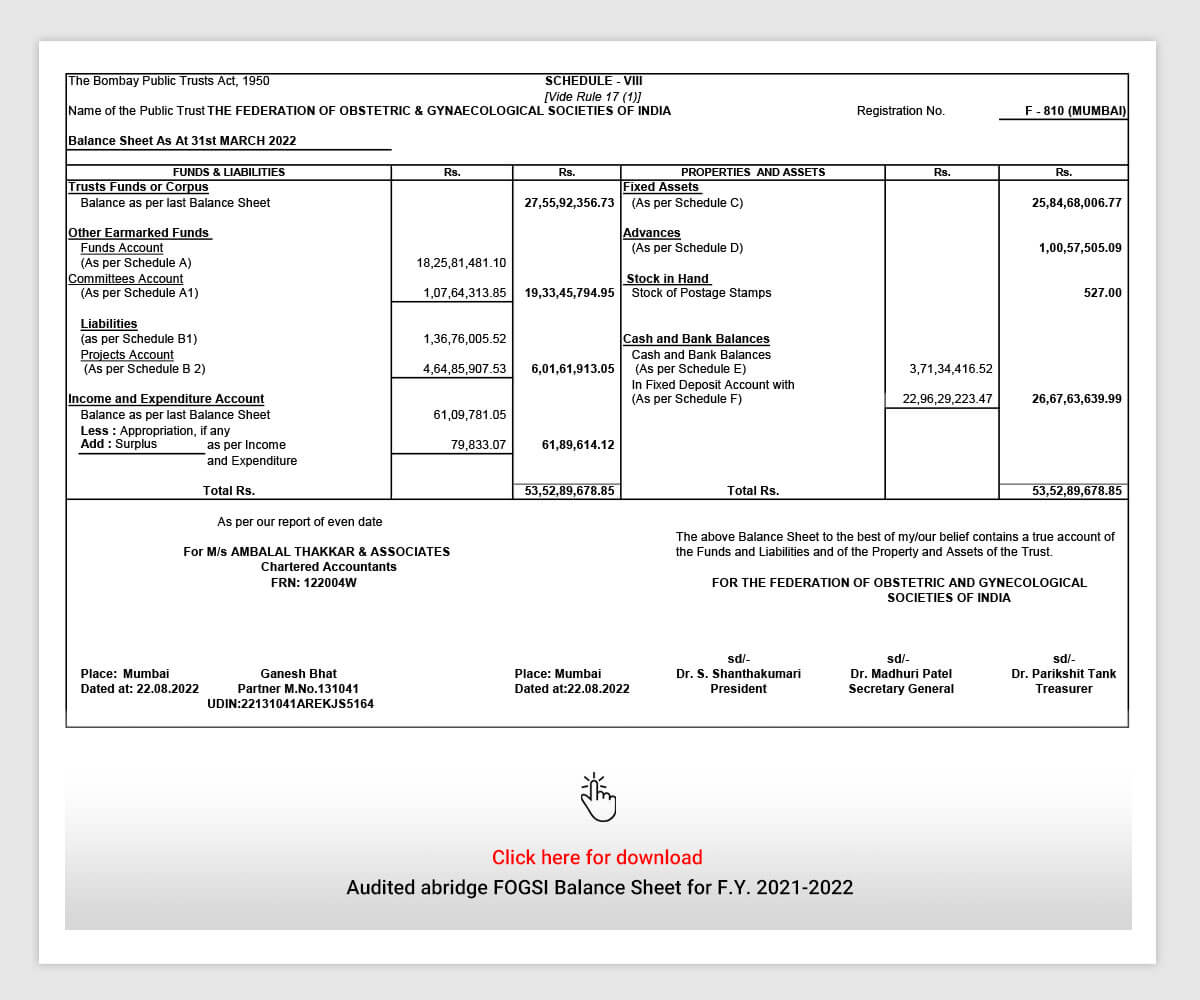

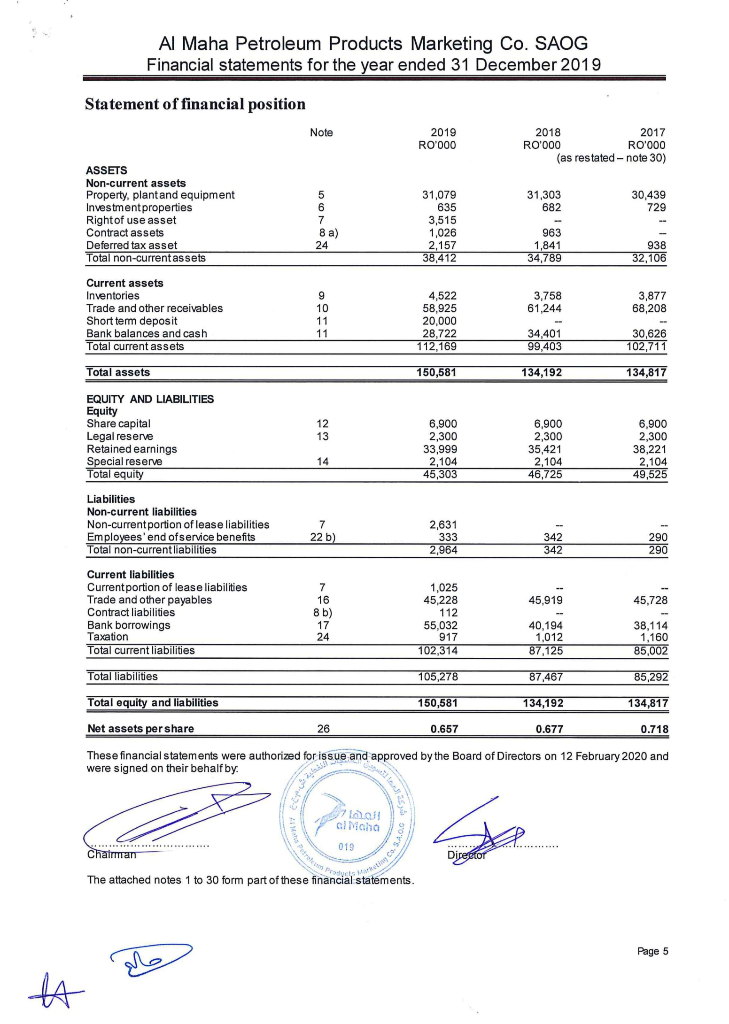

In the case of a company registered in malta, the balance sheet and profit and loss account, which shall comply with the provisions of the companies act and notwithstanding any exemption made by that act, such balance sheet and profit and loss account shall be accompanied by a report made out by a. The european central bank’s (ecb’s) audited financial statements for 2023 show a loss of €1,266. If the issuer has been in existence less than one year, an audited balance sheet as of a date within 135 days of the date of filing the registration statement.

The balance sheet audit includes the following: To learn more about this, check out this guide on how to read a balance sheet (with examples). Zero) after release of €6.6 billion from provision for financial risks.

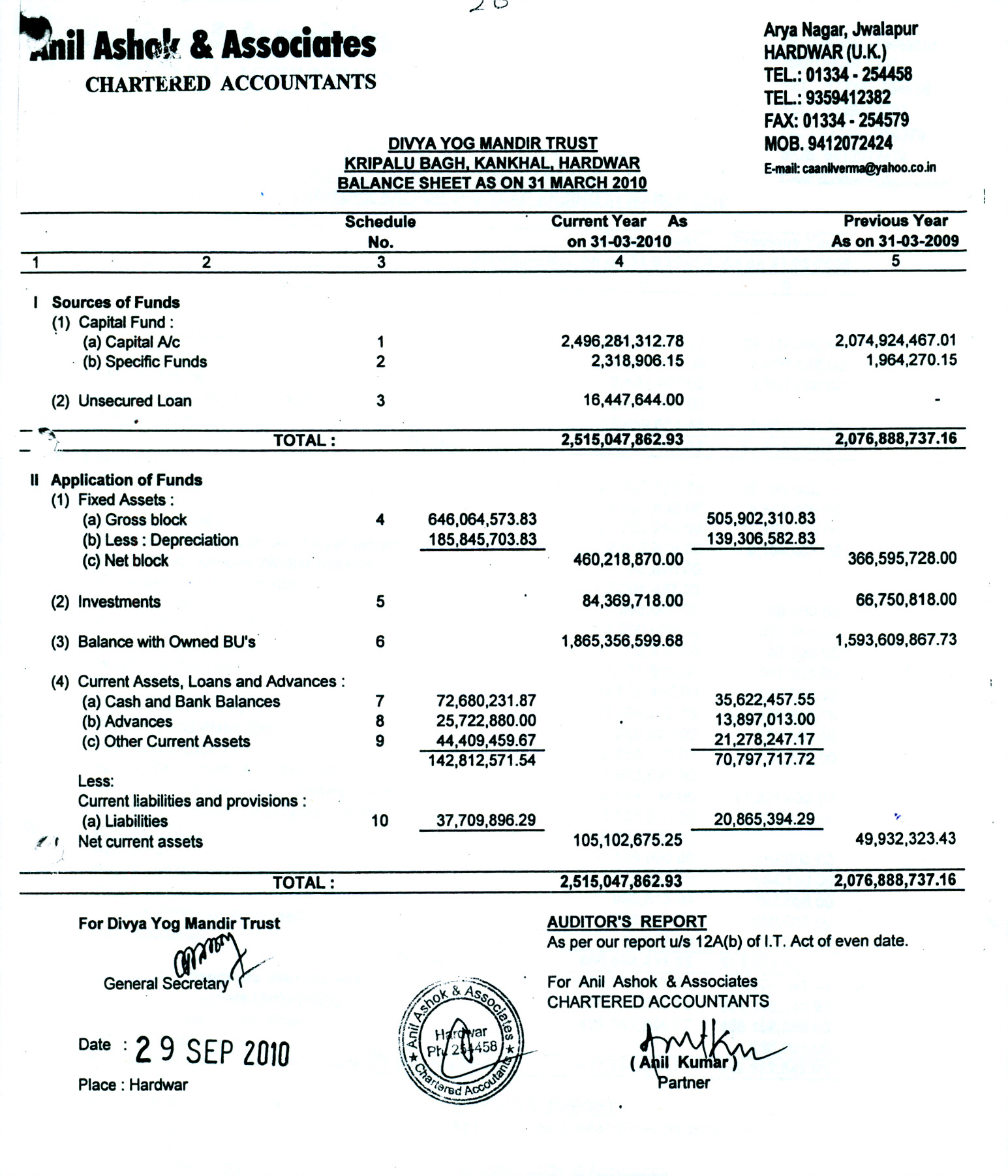

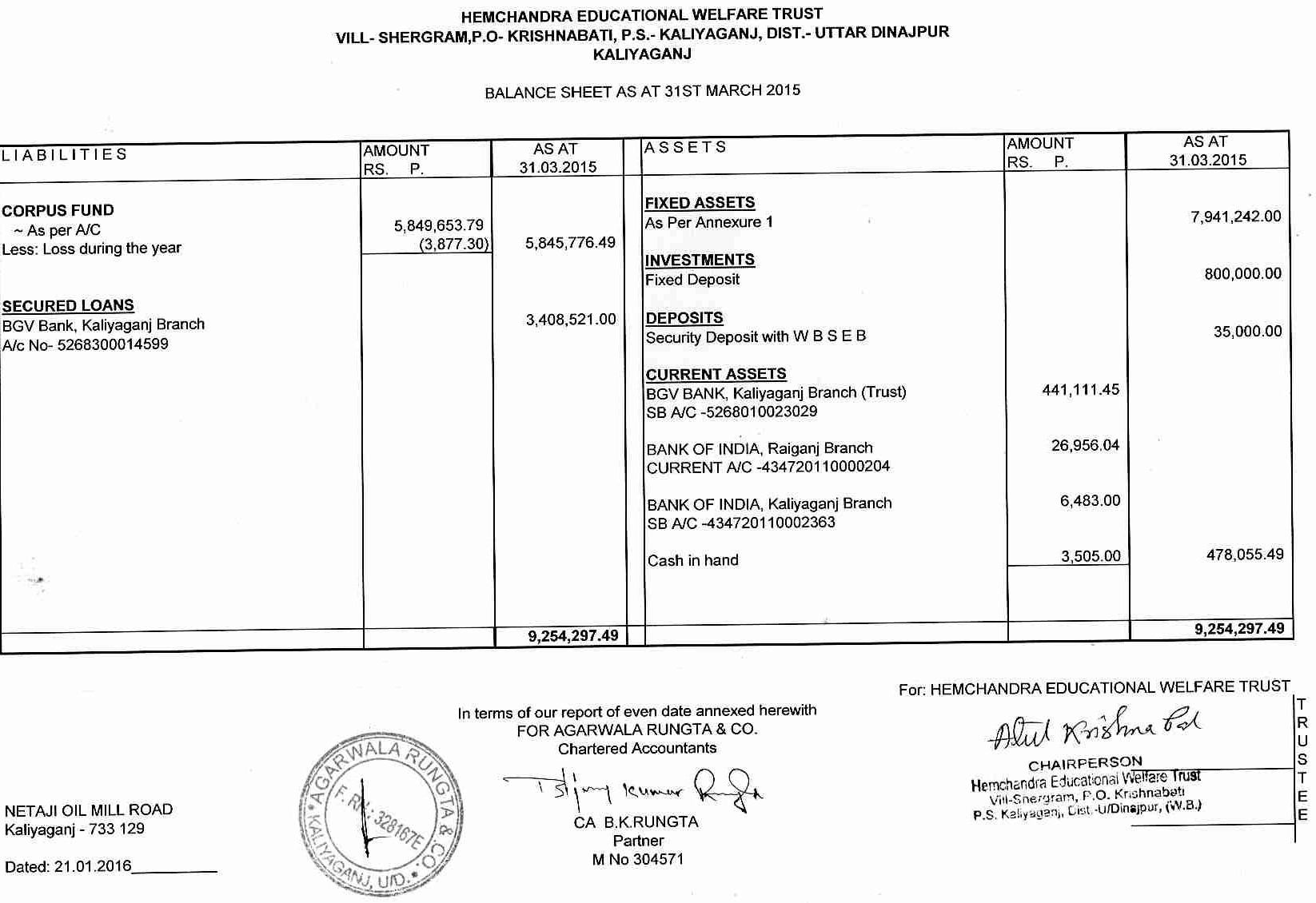

Types of audited financial statements. The chartered accountant conducting the tax audit is required to give his findings, observation, etc., in the form of audit report. You must include the following statement on the balance sheet of your accounts if you’re using an audit exemption.

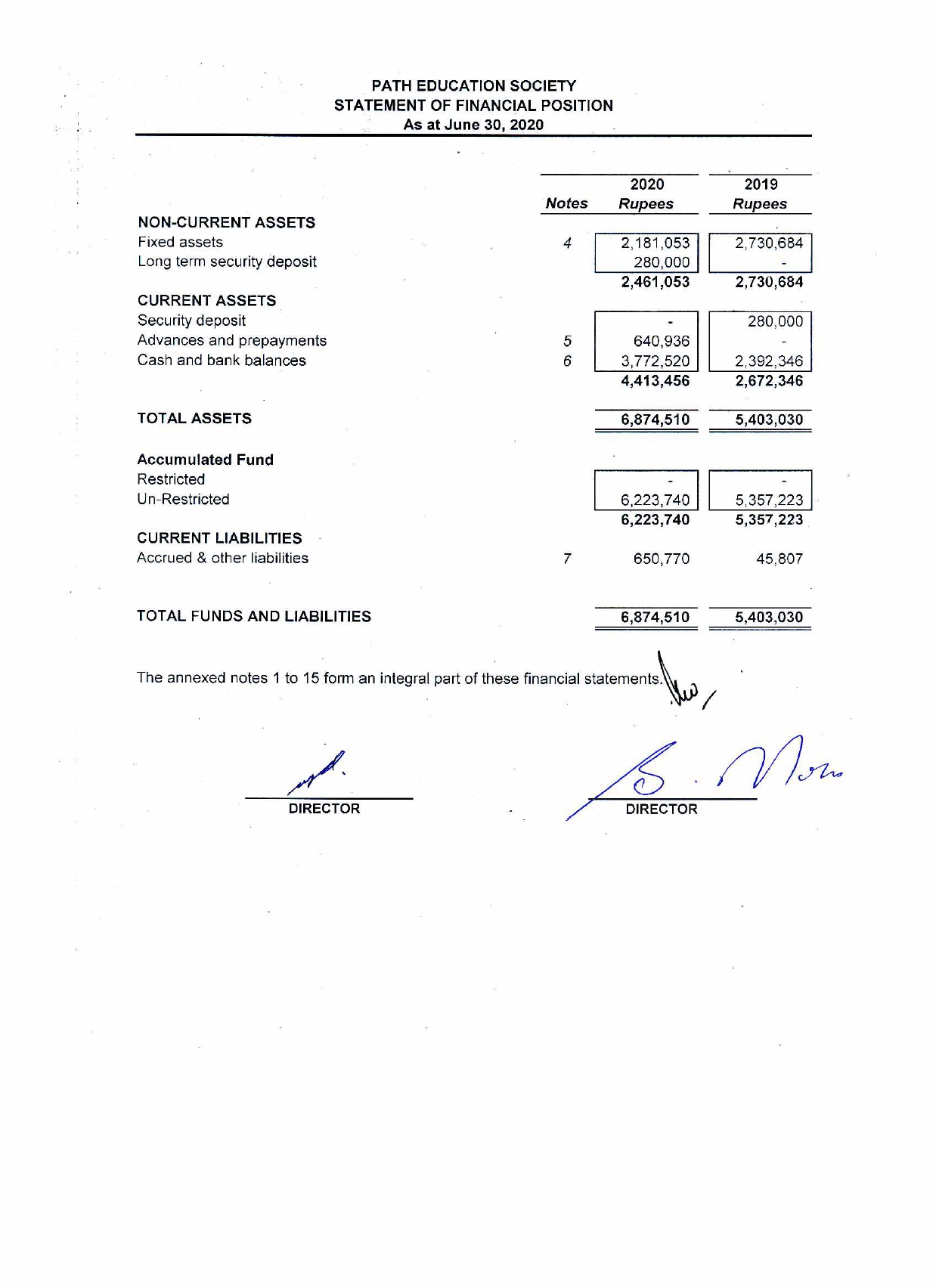

Overview purpose of a financial statement audit companies produce financial statements that provide information about their financial position and performance. Once approved by rbi, you can revise the previously filed return with audited. Finance act 2020:

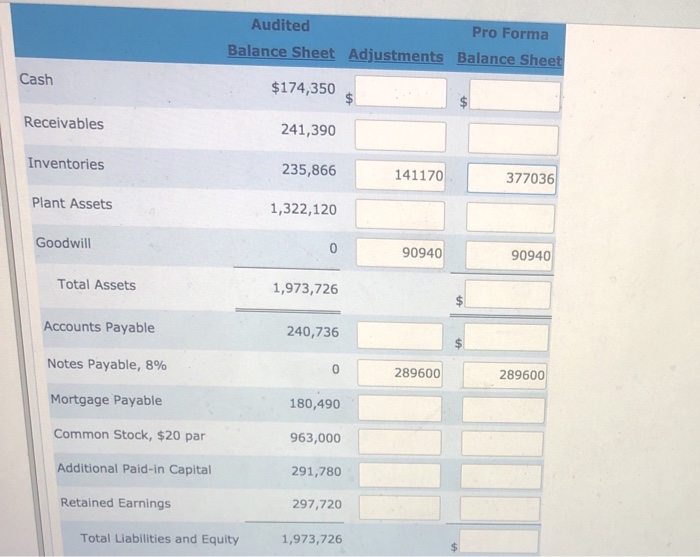

Typically, those that own a company, the shareholders, are not those that manage it. The balance sheet provides a balanced view of a company’s assets, liabilities, and equity. An audited balance sheet must be included in the brochure for any state registered investment adviser who requires or solicits clients for substantial prepayment of fees.

As per section 44ab, following persons are compulsorily required to get their accounts audited : Financial statements of the ecb for 2023. Ecb reports loss of €1.3 billion (2022:

Central government net cash requirement (excluding uk asset resolution ltd and network rail) was in surplus by £19.5 billion in january 2024, a £1.4 billion lower surplus than in january 2023. It reveals the value of assets, liabilities, and equity of a company. A person carrying on business, if his total sales, turnover or gross receipts (as the case may be) in business for the year exceed or exceeds rs.

Auditors and audit requirement. The most widely used balance sheet measure used to describe the uk public sector's financial position at a point in time is public sector net. A balance sheet details your business’s total assets, shareholder equity and debts at a given point in time.

Audited balance sheets as of the end of the two most recent fiscal years. The guidance for sec registrants is more explicit regarding the required reporting periods for balance sheets. Who is required to maintain books of account?