Fabulous Tips About Income & Expenditure Statement

Important information relating to taxes, duties and levies for.

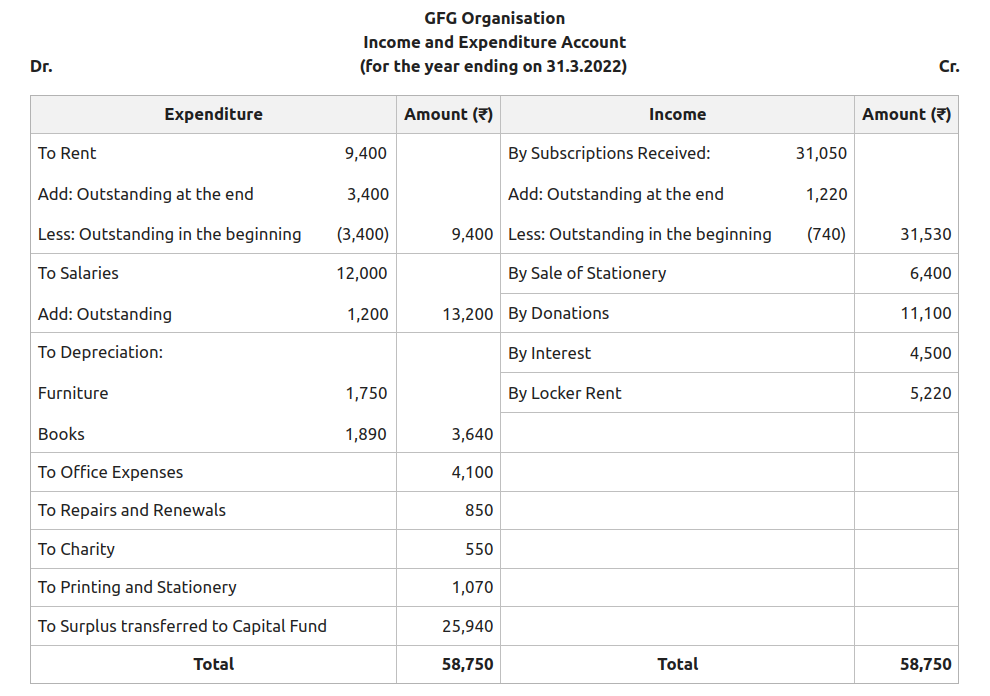

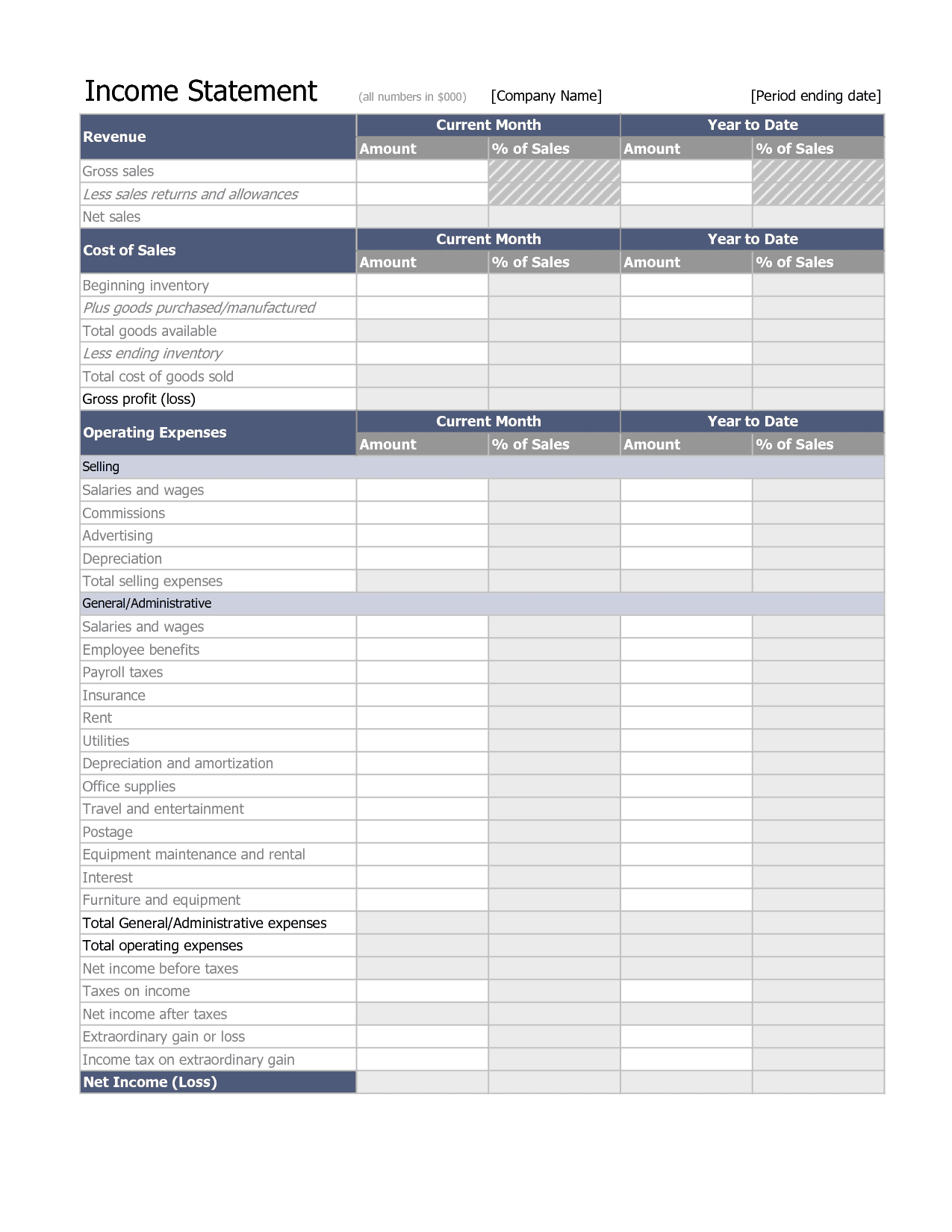

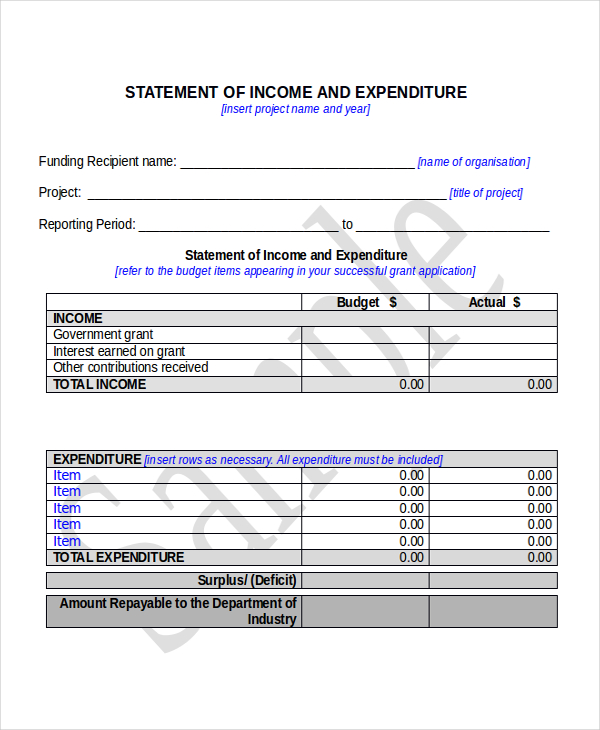

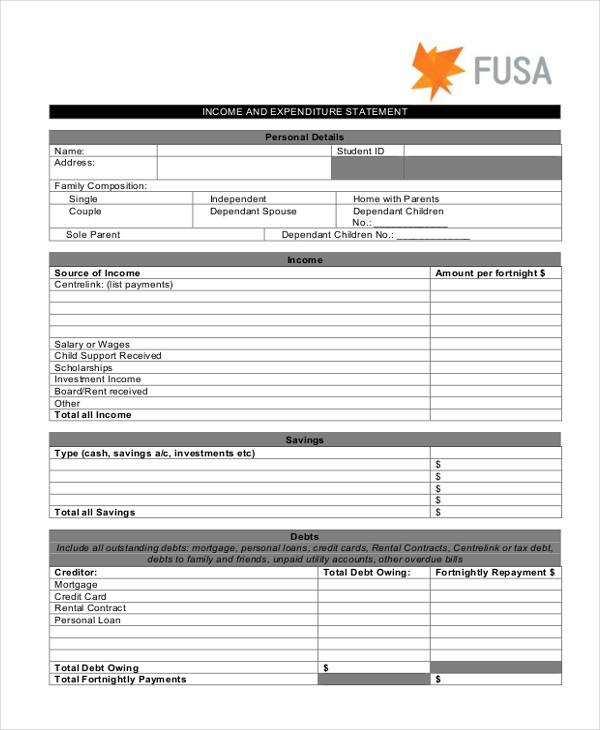

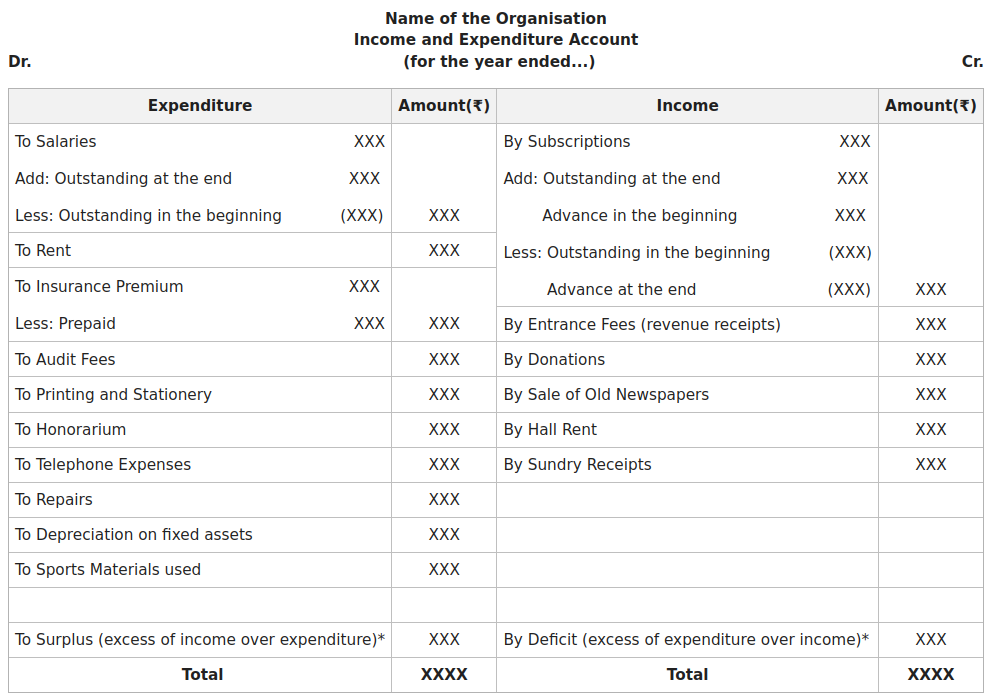

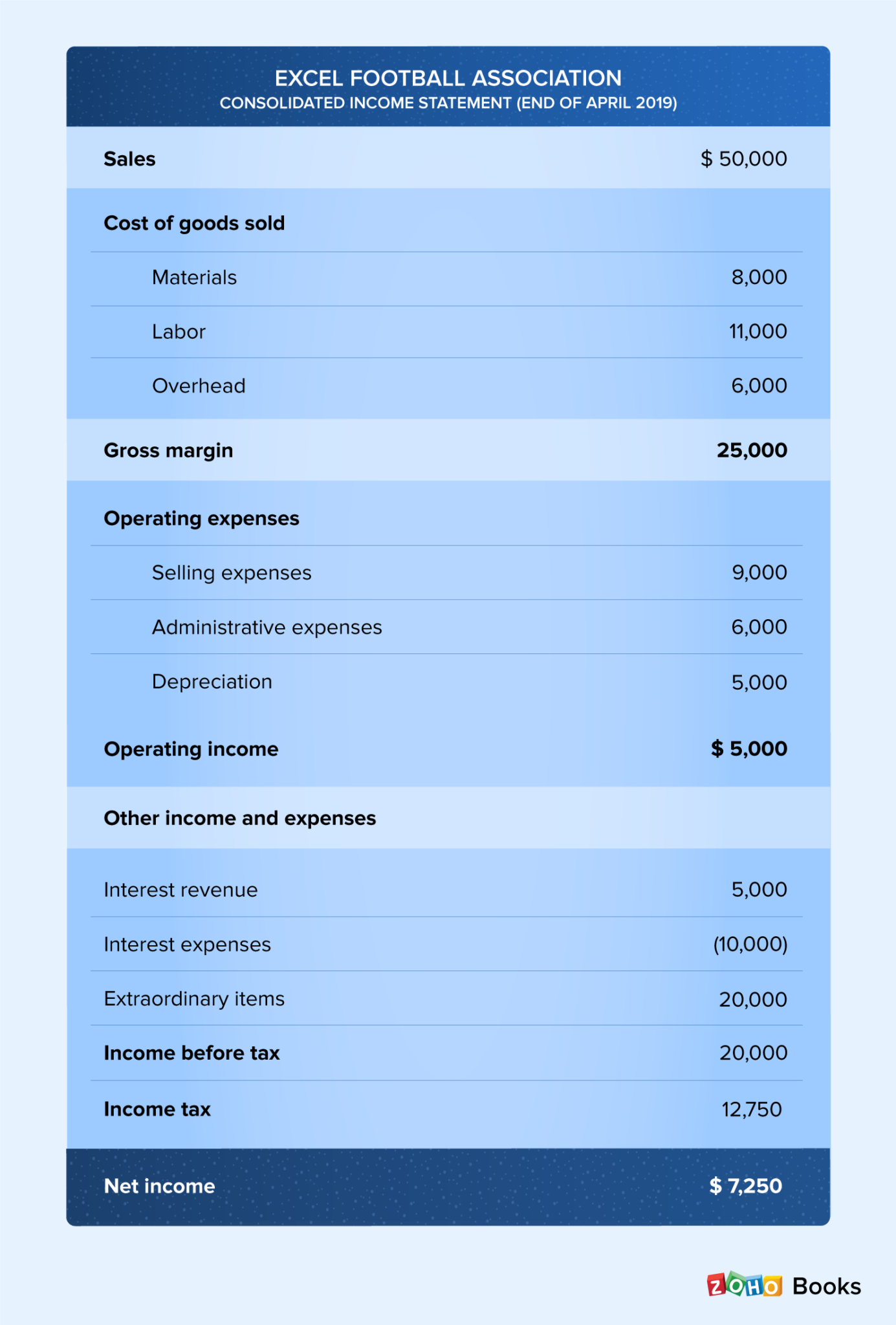

Income & expenditure statement. The statement quantifies the amount of revenue generated and expenses incurred by an organization during a reporting period, as well as any resulting net profit or net loss. The income statement (also called a profit and loss statement) summarizes a business’ revenues and operating expenses over a time period to calculate the net income for the period. It also shows whether a company is making profit or loss for a given period.

The single step income statement formula is: What is an income and expenditure statement? This is the latest release.

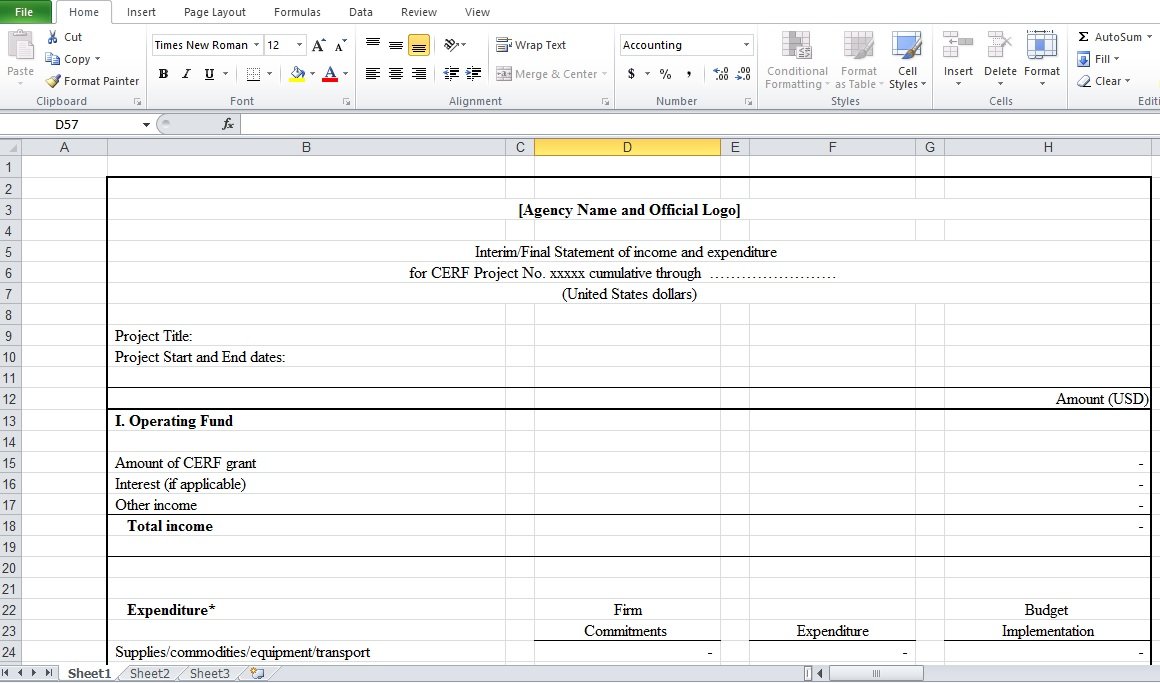

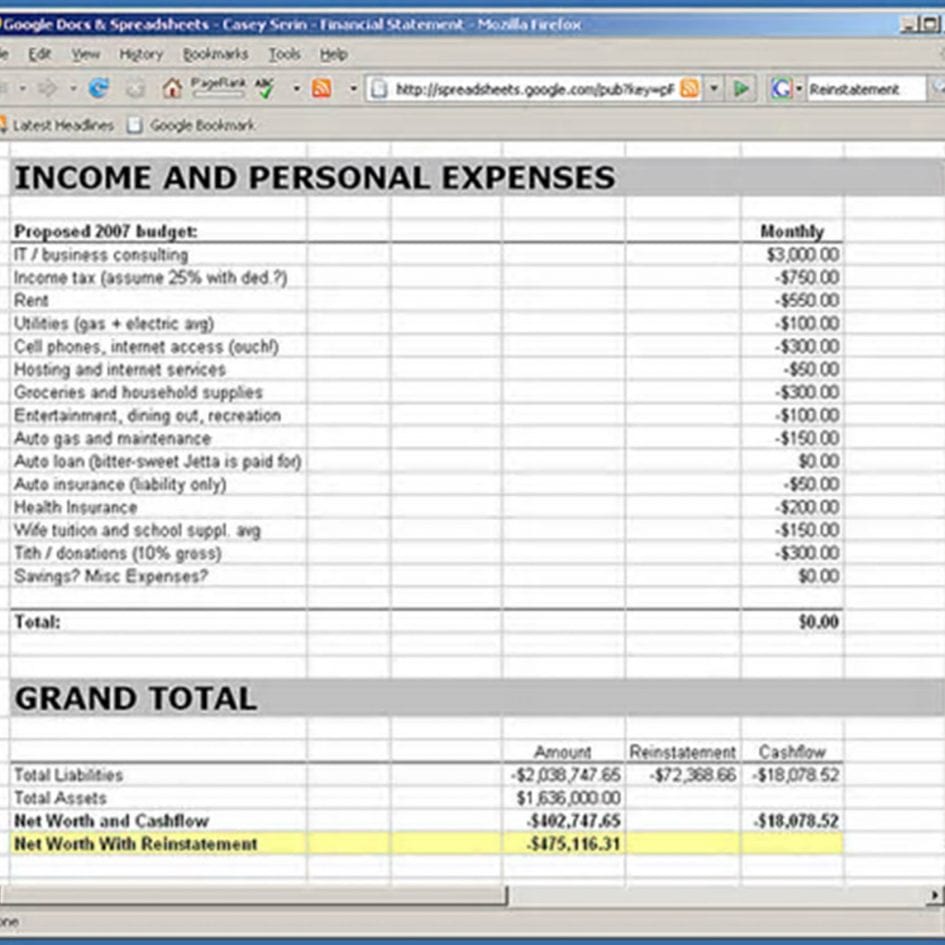

Use this monthly small business income statement template to track and manage your small business finances. It is ready with the target of sorting out the excess or deficit arising out of current incomes over current expenses. It's crucial for budgeting and financial planning, revealing trends and opportunities for improvement.

Income & expenditure statement is suitable for organizations which do not engage in trading of goods or services. The cash flow statement or statement of cash flows measures the sources of a company's cash and. The income statement formula consists of the three different formulas in which the first formula states that the gross profit of the company is derived by subtracting the cost of goods sold from the total revenues, and the second formula states that the operating income of the company is derived by subtracting the operating expenses from the total.

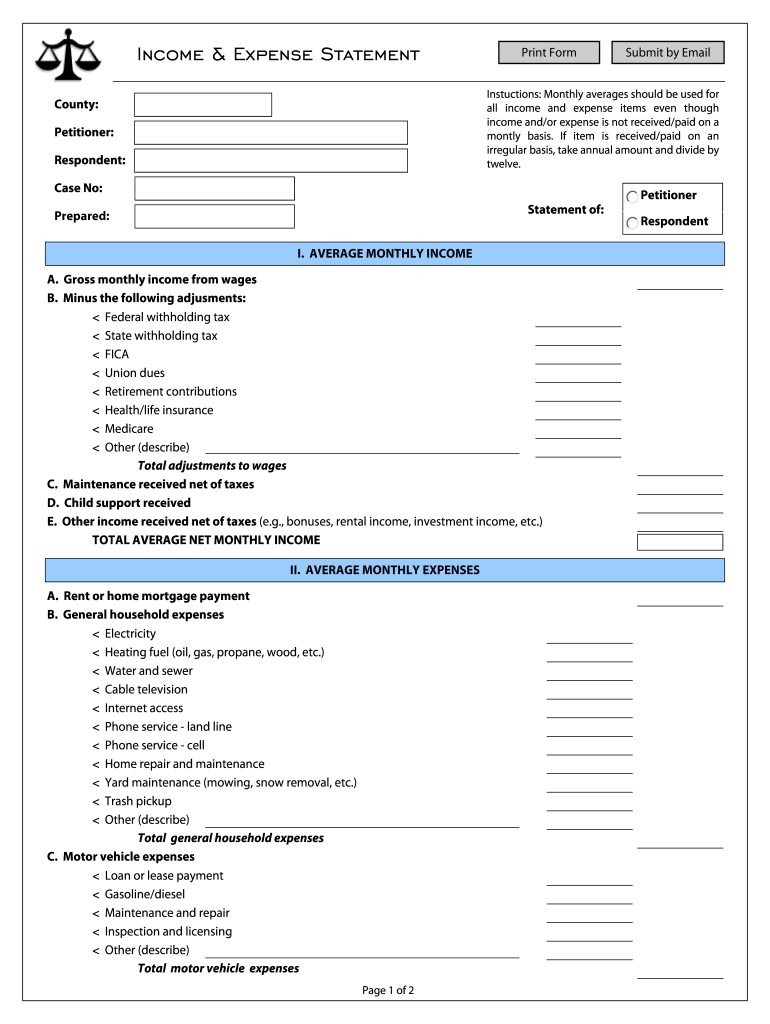

Released 23 january 2024 resents the balance sheet, statement of operations and statement of other economic flows for the public sector, compliant with the government finance statistics. Essentially, it summarises all your business income and expenses. Income and expenditure form and financial statement.

This sars tax pocket guide provides a summary of the most. Below are two types of income statement. The cash flow statement and the income statement are integral parts of a corporate balance sheet.

Calculate the cost of goods sold (direct labor, materials, and overhead). The 2024 budget speech by finance minister enoch godongwana put this speculation to rest when he announced that there would be no major changes to income tax, and no inflation adjustment to. Vat relief in respect of basic food items based on 2010/11 income and expenditure survey data, and two food items and sanitary towels (pads) added from 1 april 2019 5.

The income and expenditure statement is a summary of all items of income and expenses which relate to the ongoing accounting year. It tells the financial story of a business’s operating activities. You’ll have a complete sheet to save for your records and a simple way to stay on top of your numbers.

Tax rates from 1 march 2024 to 28 february 2025: The purpose of an income statement is to show a company’s financial performance over a given time period. An income statement presents the financial results of a business for a stated period of time.

It is categorised into different line items such as revenue by type, or costs. The income statement calculates the net income of a company by subtracting total expenses from total income. An income statement is a financial report detailing a company’s income and expenses over a reporting period.