Unique Tips About Decrease In Account Payable Cash Flow

Accounts payable is a loss on the income statement, but it doesn't affect your available cash.

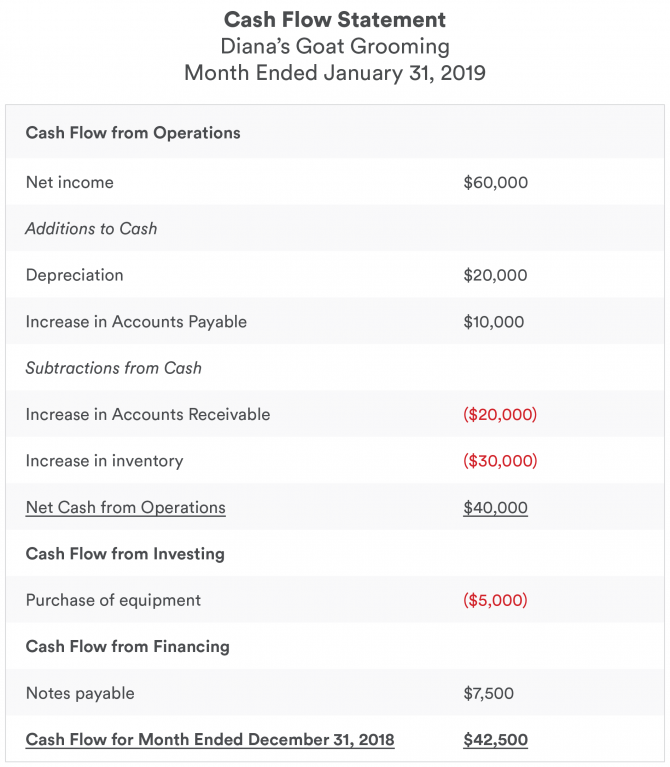

Decrease in account payable in cash flow. Add the three numbers for cash flows from/used for operating, investing, and financing activities and label it as “increase in cash” if it is positive or “decrease in. The average payable period is the best indicator of your success in managing your cash outflows. Begin with net income from the income.

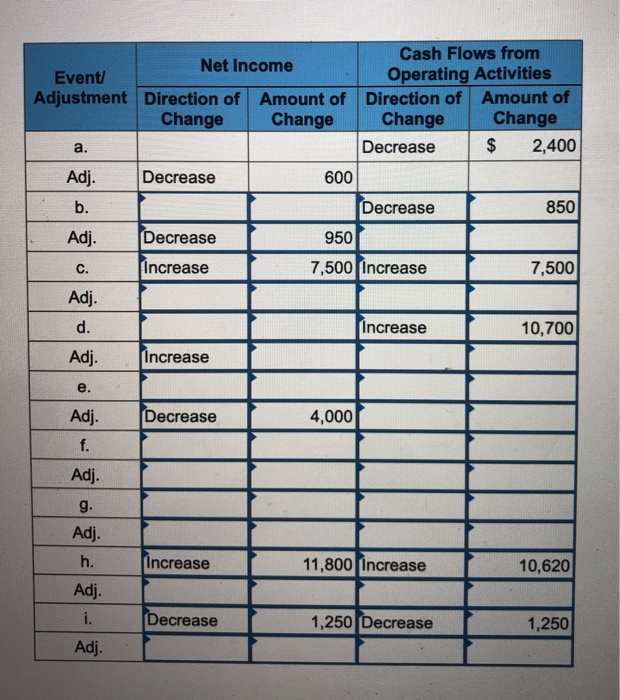

An increase in accounts payable is a positive adjustment because not paying those bills (which were included in the expenses on the income statement) is good for a company's. Changes in ap have a direct impact on cash flow. A decrease in accounts payable is the opposite effect of an increase in accounts payable.

The cash flow statement reflects this. A decrease in accounts payable occurs when a business makes a payment to its creditors for its outstanding balance. As you might now expect, it’s the opposite of an increase in accounts payable.

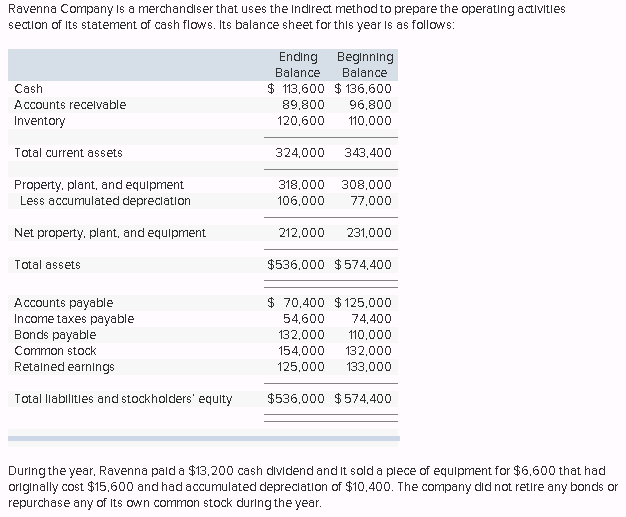

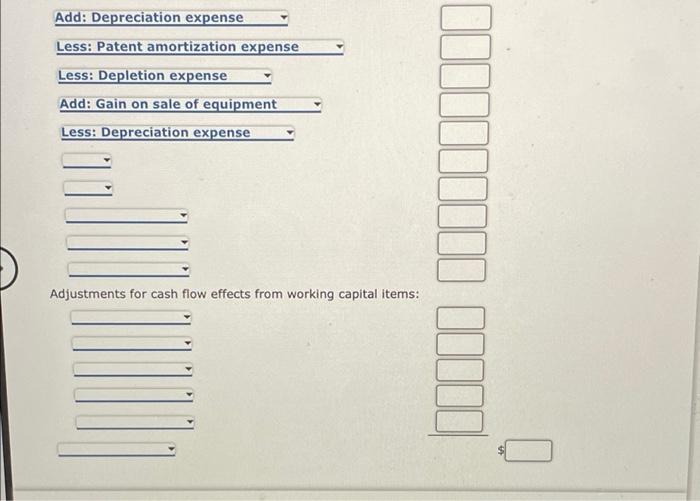

Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows: However, if the business makes new purchases on cash terms, it does not change. Accounts payable on cash flow statement accounts payable.

If you have more money coming in than going out, you should. Decrease in net income the cash flow statement begins with net income, which is. The following factors will all decrease cash flow from operating activities:

Increasing accounts payable is a source of cash, so cash flow increased by that exact amount. Our case study shows you how to calculate your average. Accounts payable, cash flow, and a business’ financial stability are closely linked.

Though a decrease in accounts payable has a positive impact on your financial statements, it reduces the total amount of cash available, with the decrease. Financing activities leading to a decrease in cash. If the accounts payable has decreased, this means that cash has actually been paid to.

How ap impacts cash flow. To calculate it, multiply the days in the period by the ratio of accounts payable to the cost of revenues within the same period. If you find a decrease in the days payable.

In this case, when preparing the cash flow statement we need to make adjustments by removing these gains or losses from the net income in order to arrive at the net cash.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)