Unbelievable Tips About Authorised Capital In Balance Sheet

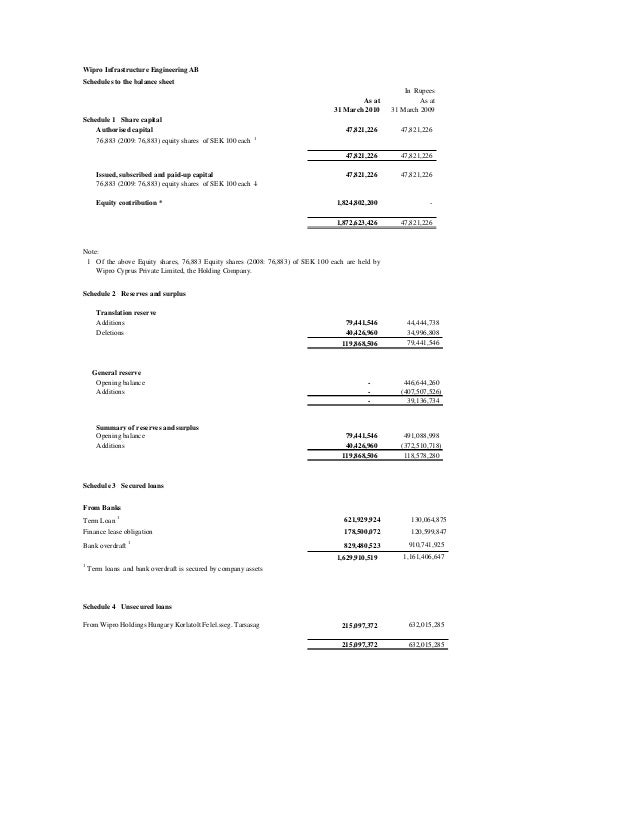

From accounting point of view the share capital of the company can be classified as follows:

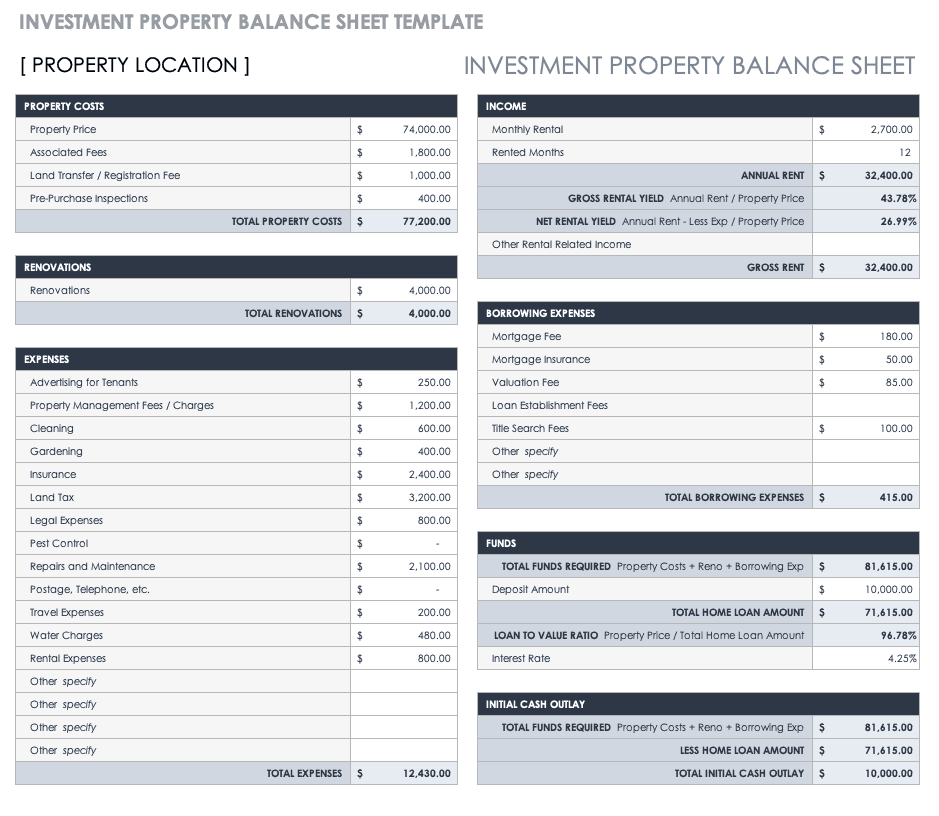

Authorised capital in balance sheet. The authorised capital can be increased at any time in future by following necessary steps as required by law. It further issued to public 25,000 equity shares at a premium of 20% for subscription payable as under: Ril’s capital schedule report is showing an issued capital of rs.6,338.69 crore.

Ril’s authorised capital is rs.14,000 crore. Authorized share capital can be reported in the balance sheet as follows: 1) 3,000 equity shares of ₹100 each were allotted as fully paid up as a contract without payments being received in cash.

Each share of stock is issued with a base. The company cannot raise more than the amount of capital as specified in the memorandum of association. For example, a company might have 1,800,000 authorized shares.

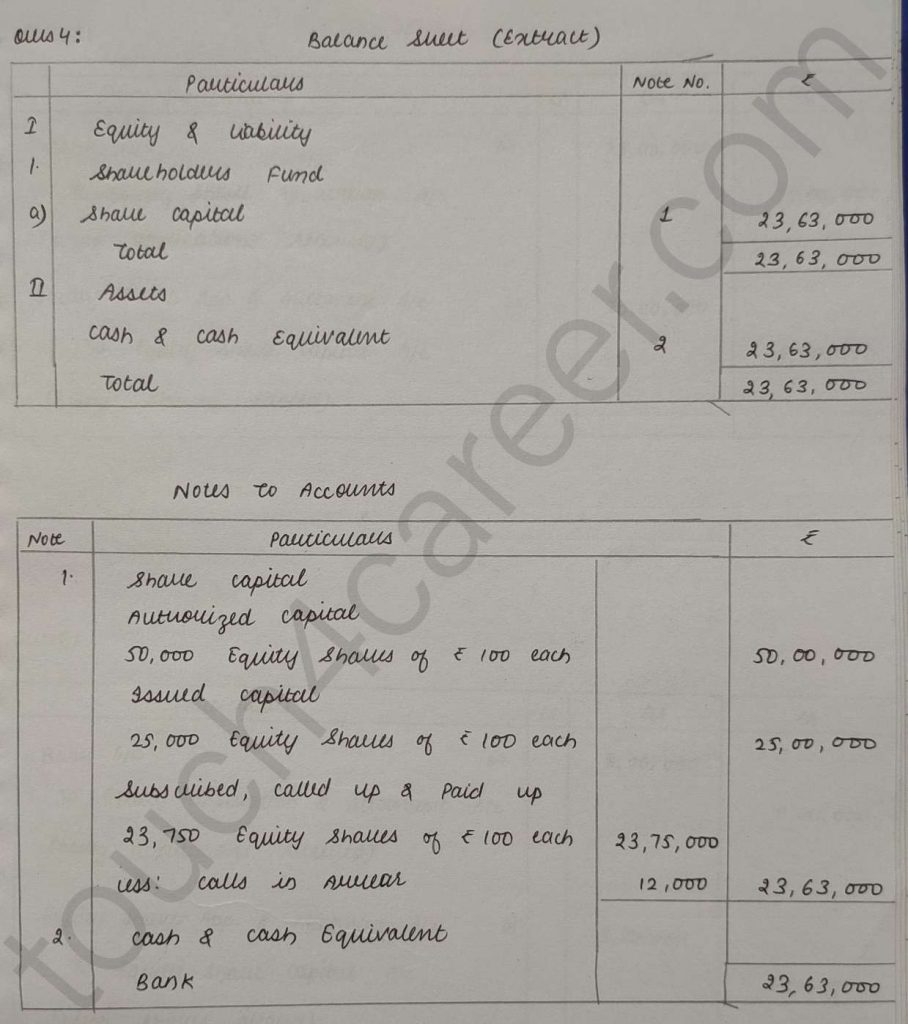

How presented in ind.as balance sheet? On 1st april, 2019, chetan ltd. The company invited applications for 18,750 equity shares.

There are four main types of capital: Was registered with an authorised capital of ₹10,00,000 divided into 1,00,000 equity shares of ₹10 each. It isn’t considered in the totalling of the balance sheet.

This is not limited to cash—rather, it includes cash equivalents as well, such as stocks and investments. The issue was fully subscribed and the company allotted shares to all applicants. 2) calls unpaid on shares by others (600 x 20) ₹12,000 illustration 2:

The authorised capital of a company (sometimes referred to as the authorised share capital, registered capital or nominal capital, particularly in the united states) is the maximum amount of share capital that the company is authorised by its constitutional documents to issue (allocate) to shareholders. You are required to prepare the balance sheet of the company as per schedule iii of companies act, 2013, showing share capital balance and also prepare notes to. Was formed with an authorised capital of ₹22,50,000 divided into 22,500 equity shares of ₹100 each.

It is important to note that authorized share capital is disclosed in a company’s balance sheet only for information purpose and does not form part of the value of liabilities side in the balance sheet. The authorised share capital of a company is only reported on the balance sheet for information purposes. Has an authorised capital of ₹80,00,000 divided into 8,00,000 shares of ₹10 each.

Capital can also include a company's facilities and equipment. Authorized share capital is the number of stock units (shares) that a company can issue as stated in its memorandum of association or its articles of incorporation. This limit is outlined in its constitutional documents and can only be changed with the.

This amount is present in the memorandum of association of that company. It is also known as normal or registered capital. All the dues on allotment received except on 15,000 shares held by sanju.