Great Tips About A Statement Of Changes In Equity Personal Finance Balance Sheet Template

/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)

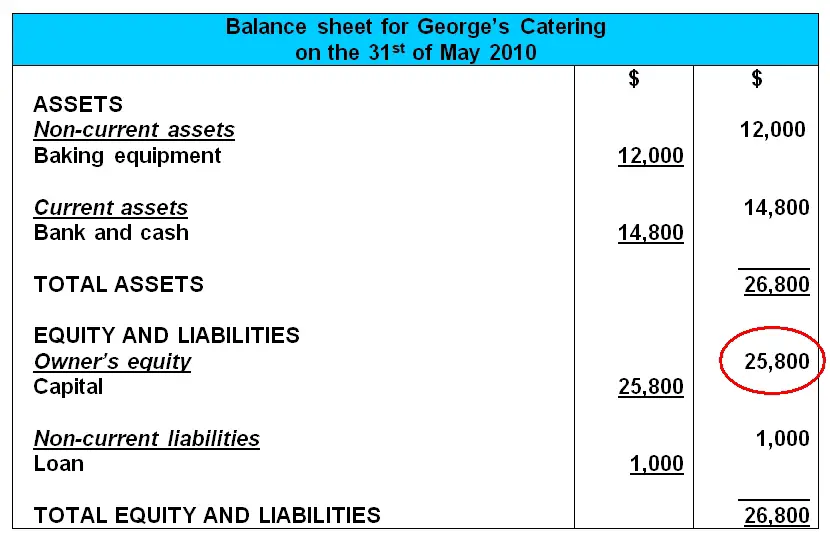

This financial statement is used both internally and externally to determine the so.

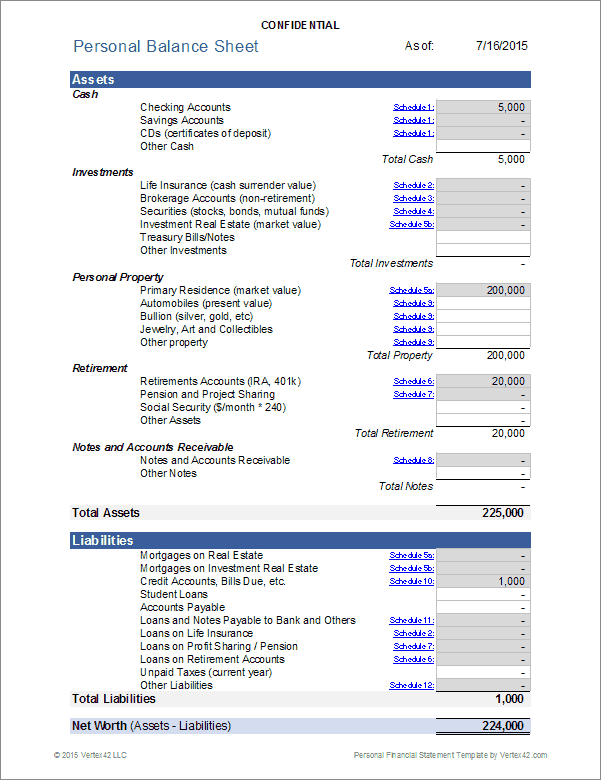

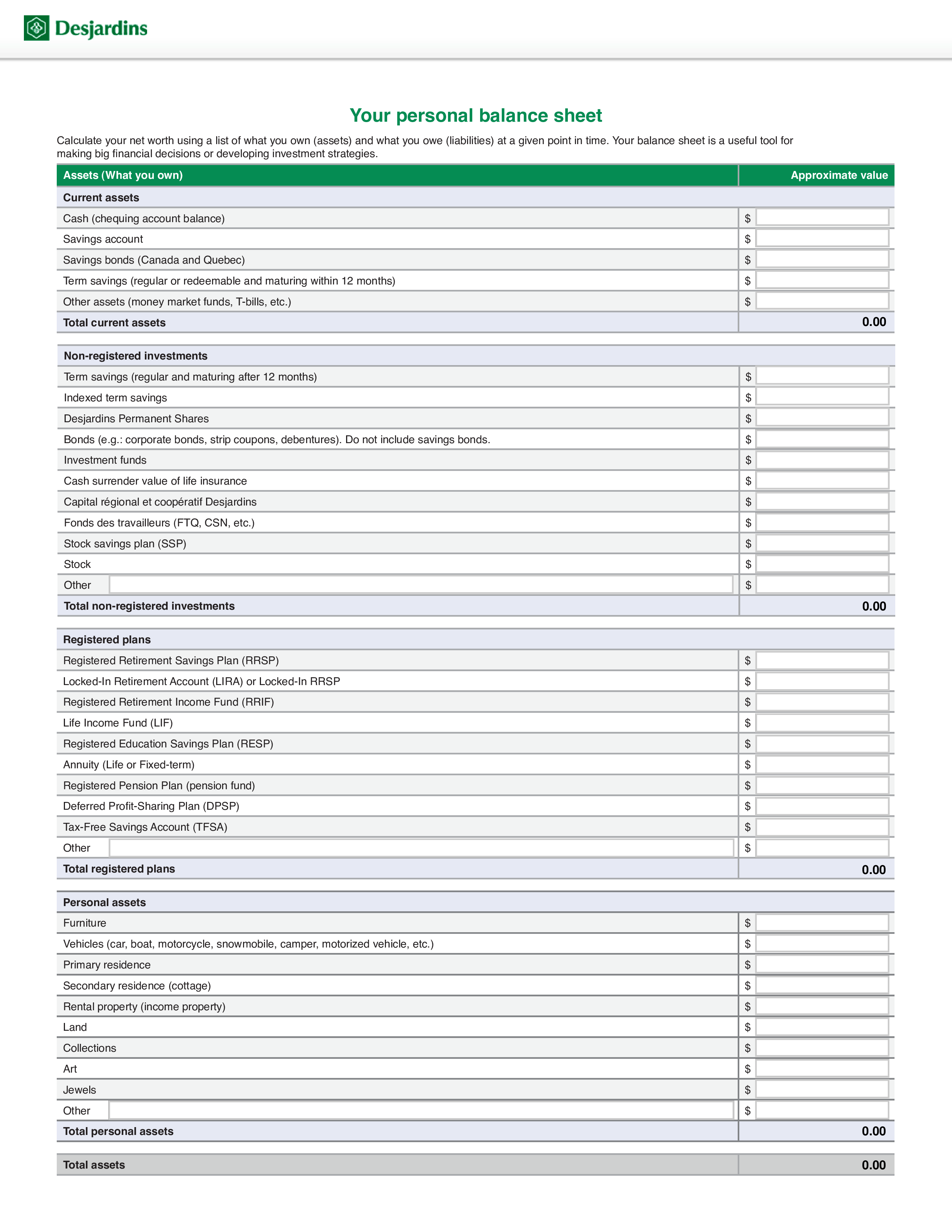

A statement of changes in equity personal finance balance sheet template. 2.1 describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate; The balance sheet is one of the three core financial statements that are. 2.2 define, explain, and provide examples of current and noncurrent assets, current and noncurrent liabilities, equity, revenues, and expenses;

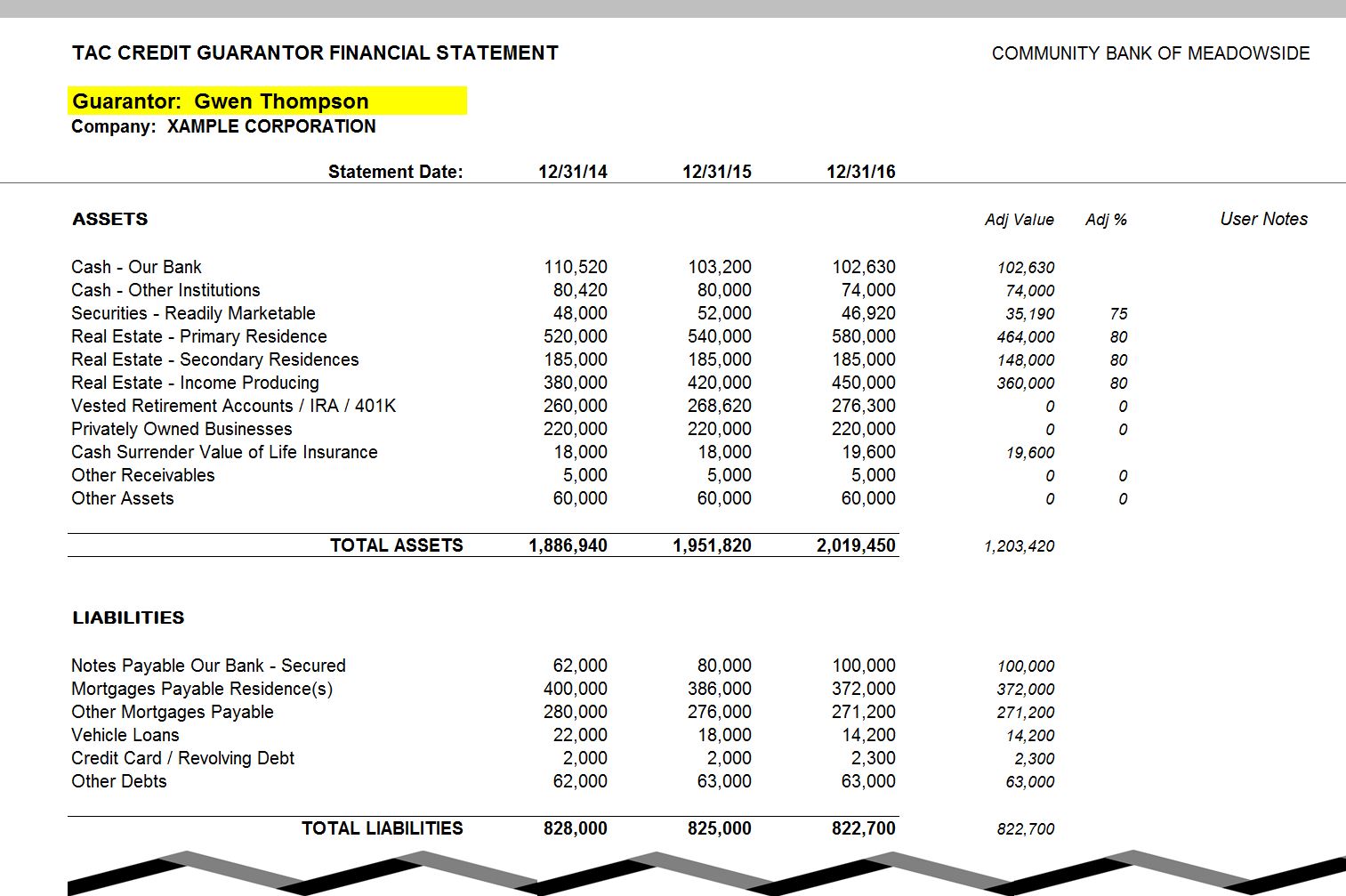

Cash, investments, real estate, etc. Statement of changes in equity shows a linkage between the balance sheet and income statement of the company. As fixed assets age, they begin to lose their value.

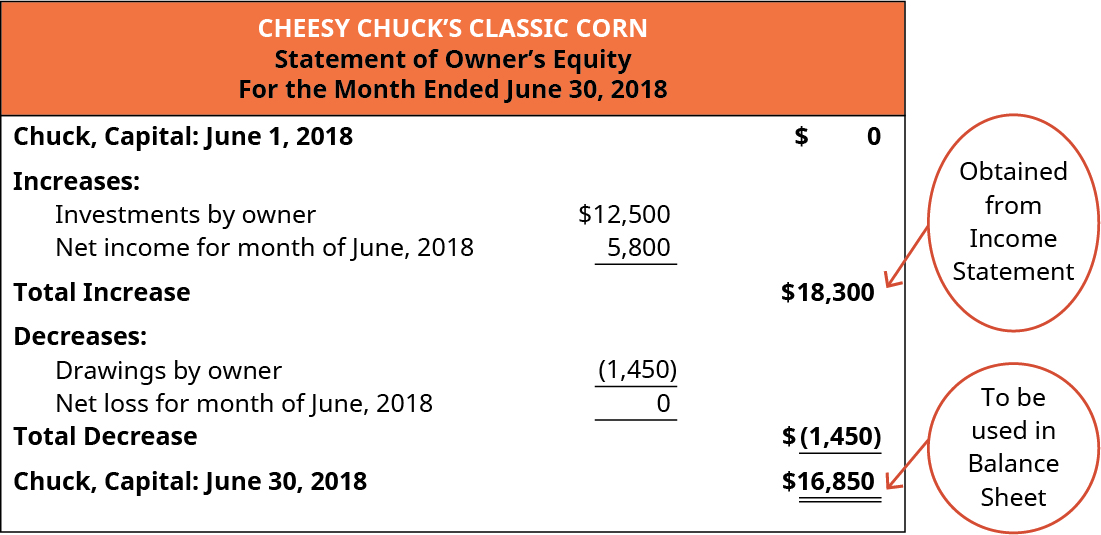

It explains the connection between a company’s income statement and balance sheet. Movement in shareholders’ equity over an accounting period comprises the following elements: What is a balance sheet?

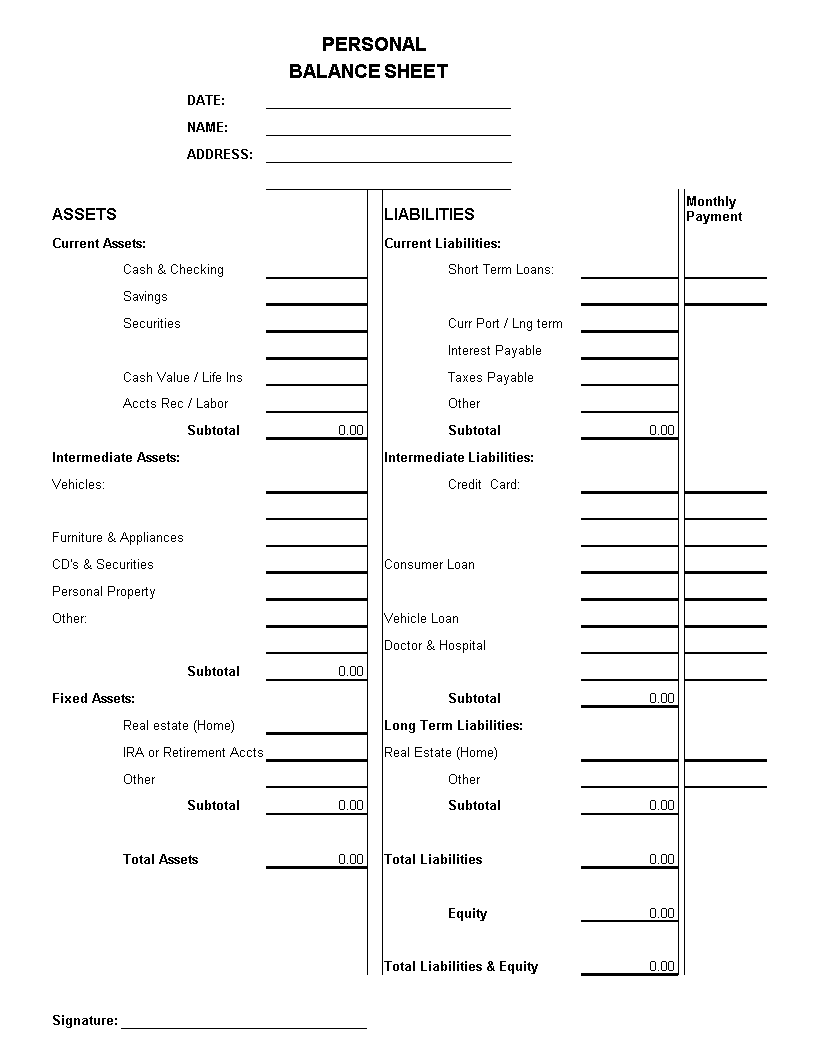

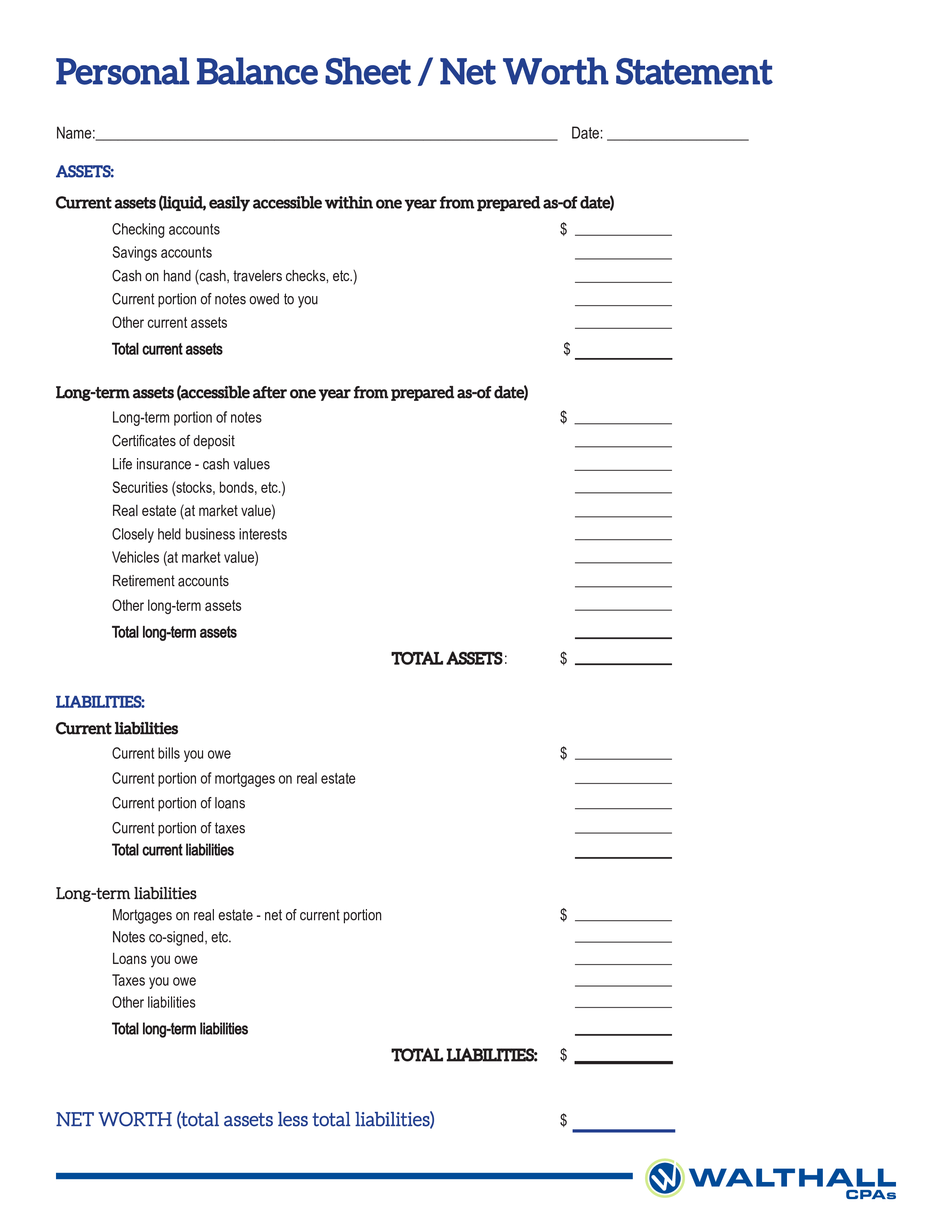

This determines if you have a positive or negative net cash flow. The statement of owner’s equity reports the changes in company equity, from an opening balance to and end of period balance. This document provides details on your liabilities and assets.

The statement of changes in equity is a financial statement of equal importance to the balance sheet, to the profit and loss account, to the cash flow statement and to the explanatory notes. Statement of changes in equity, often referred to as statement of retained earnings in u.s. Assess the current value of each asset.

For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it. It provides t ransparency for investors to see changes in the cash flow specifically equity accounts and the activities that lead to such shift in the. 2.3 prepare an income statement,.

You can create a personal balance sheet by completing the following steps, including getting all relevant documents, listing your assets and liabilities, and calculating your net worth. A balance sheet provides a snapshot of a company’s financial performance at a given point in time. Profit or loss for the period

The statement of changes in equity is one of the four main financial statements prepared by the entity for the end of the specific accounting period along with other statements such as balance sheet, income statement, and statement of cash flow. A personal balance sheet is a summary of your overall financial situation at. The statement is also referred to as.

Getting all your financial documents ensures you have accurate. It also shows the transactions that are not presented on the balance sheet and the income statement, such as dividend paid and the owner’s withdrawal. The changes include the earned profits, dividends, inflow of equity, withdrawal of equity, net loss, and so on.

This represents the beginning balance of shareholders’ equity at the start of the reporting period. Statement of changes in equity is the reconciliation between the opening balance and closing balance of shareholder’s equity. The structure of the statement of changes in equity.