Lessons I Learned From Info About Increase In Inventory Cash Flow Statement

We come up with the following rule:

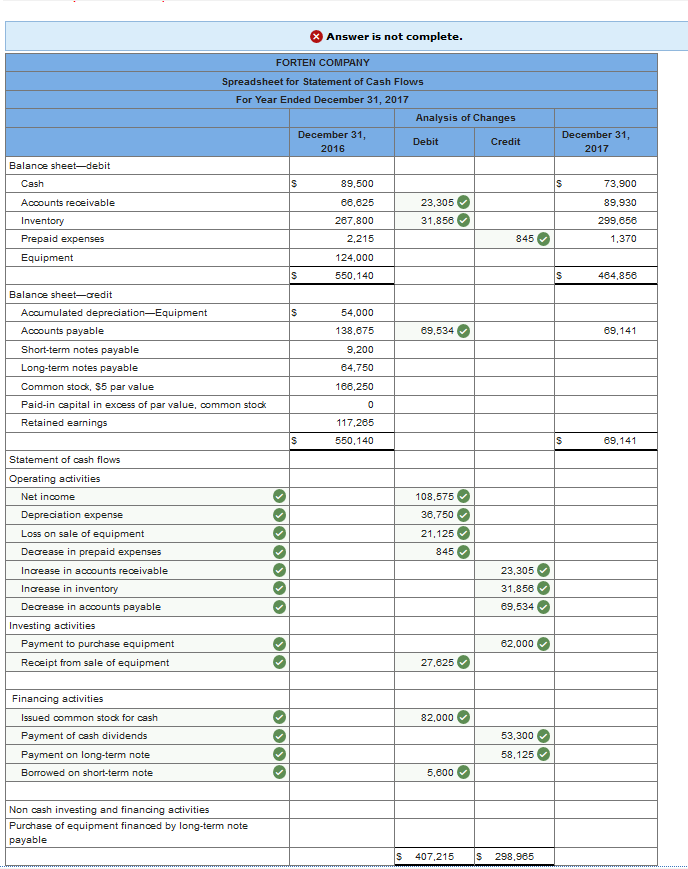

Increase in inventory in cash flow statement. An outflow of cash has a negative or unfavorable effect on the company's cash balance. And yet a negative cash flow statement is not in itself cause for alarm. Prioritise their availability and keep safety stock, as they have the highest impact on profitability.

A items are top 20% by value. As the year comes to a close, it’s tim. Increase in accounts receivable => deduct the increased amount from net income decrease in accounts receivable => add the decreased amount to net income accounts receivable on cash flow statement example for example, we have a $57,800 net income on the income statement for the period.

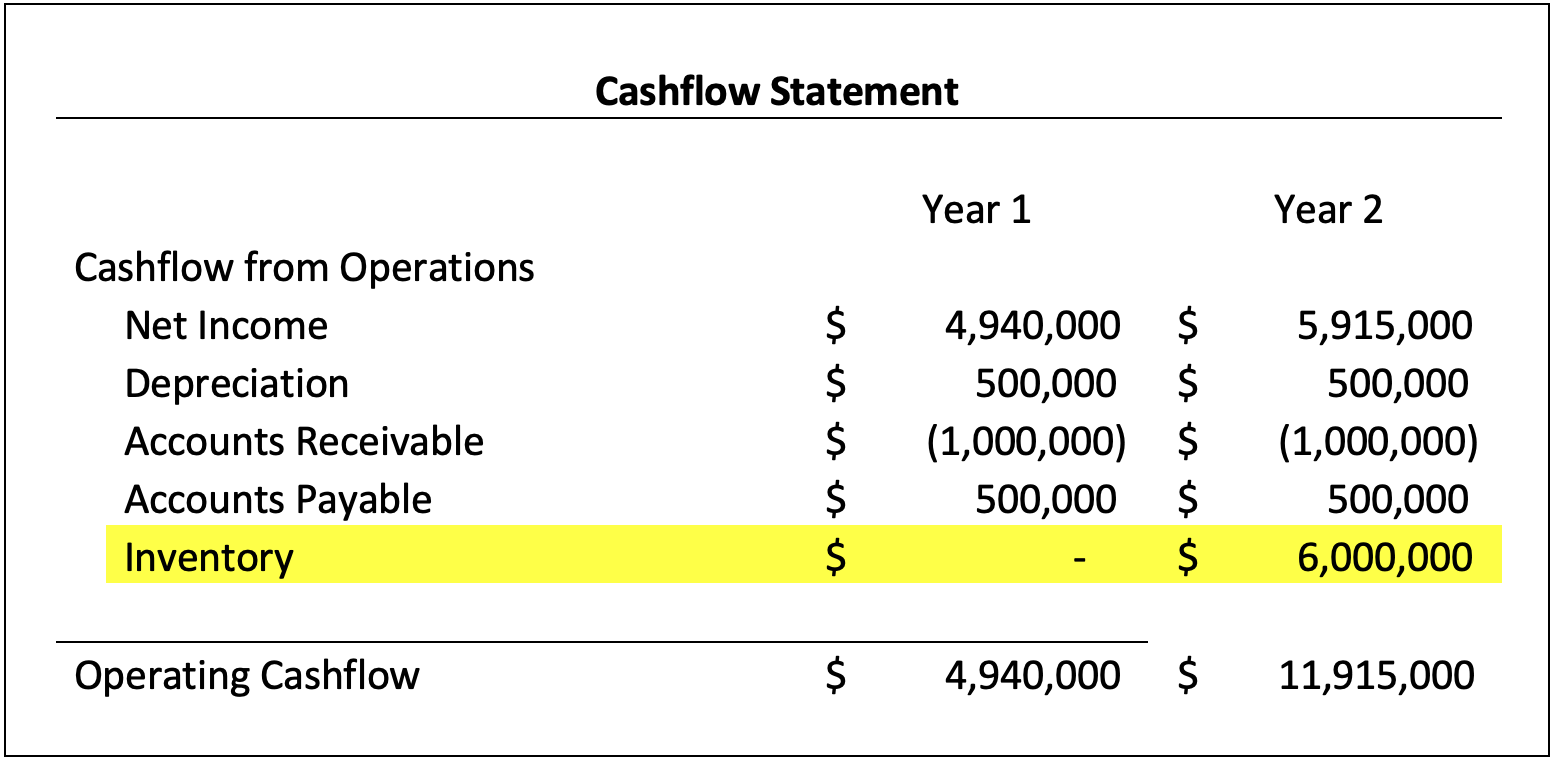

An increase in a company's inventory indicates that the company has purchased more goods than it has sold. Based on the rules mentioned above, the impact of inventory movement on the cash flow can be summarized as follows: These 4 quick wins can boost your customer count and revenue dynamic management of cash flow and credit card debt.

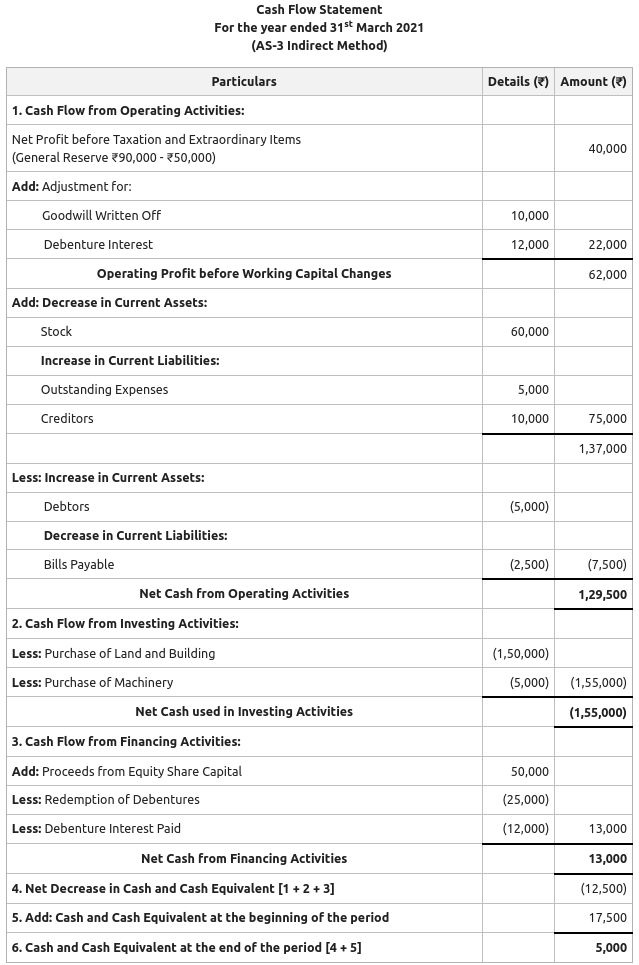

Cash flows from operating activities, cash flows from investing activities, cash flows from financing activities, reconciling the increase in cash from the scf with the change in cash reported on the balance sheet, supplemental information When the company purchases inventory related items, that increases the inventory balance and represents a cash outflow. Or, it could mean the business is in growth mode.

The cash flow statement also shows $2,000 of financing by the owner. This information will give you insight into the optimal inventory to buy to avoid running out or keeping too much in stock, giving you an ideal inventory level. My typical client — depending on their industry — has anywhere from 20 to 40 percent of their working capital tied up in inventory.

The inventory balance decrease when items are sold, and the company recognizes the sale and costs of good. We may sell the inventory on credit, so cash not yet receive too. The balancing figure is the cash spent to buy new ppe.

What is the statement of cash flows? Internal users can assess sources of and uses of cash in order to aid in adapting, as necessary, to ensure adequate future cash flows. Inventory is the biggest drain on a company’s cash flow.

Inventory increase => cash outflow (negative) inventory decrease => cash inflow (positive) what if we purchase inventory on credit, so there is no cash flow. In example corporation the net increase in cash during the year is $92,000 which is the sum of $262,000 + $ (260,000) + $90,000. Use abc analysis in inventory management.

Since the purchase of additional inventory requires the use of cash, it means there was an additional outflow of cash. In fact, a company with consistent net profits could potentially even go bankrupt. On the other hand, the decrease of inventory will make cash inflow as we have sold them.

The cfs measures how well a. The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. A cash flow statement tells you how much cash is entering and leaving your business in a given period.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)