Outstanding Tips About Debit Balance Of Profit And Loss Account Sheet Sample Problem

The feature of p&l account:

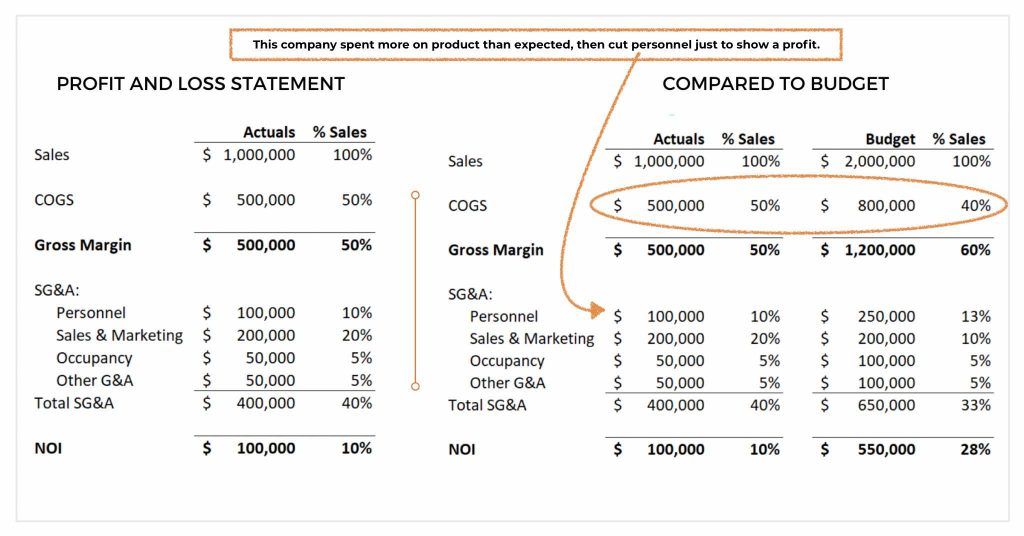

Debit balance of profit and loss account balance sheet sample problem. A p&l account with a debit balance can be subtracted from capital or be shown on the asset side of. Make a provision for bad debts @ 5% on sundry. This indicates that the company has not made enough money to cover its costs.

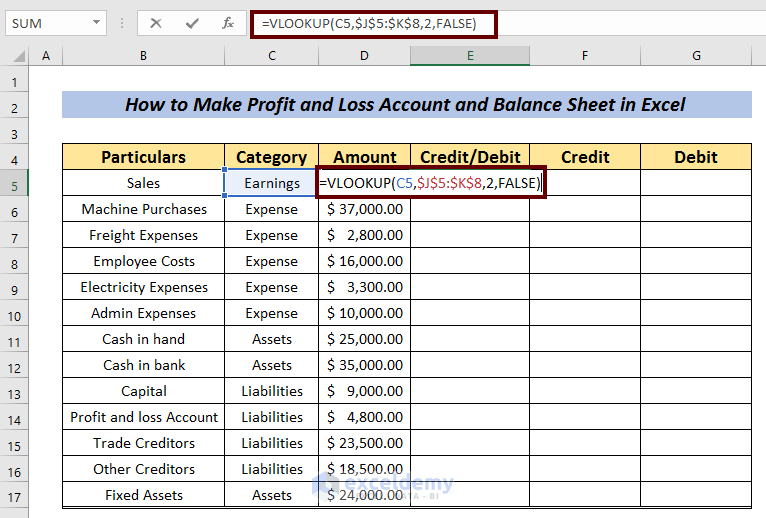

A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. Example 1 say you use your debit card to pay for some stationery. Prepare a statement of owner’s equity.

Try it in the numerade app? The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement,. Pass the journal entries (which should have at least 30 transactions (without gst), post them into the ledger, closing the books of accounts prepare a.

This loss is what we call the debit balance of a profit and loss account. When the debit side of the profit and loss account is greater than the credit side, it is a debit balance. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time.

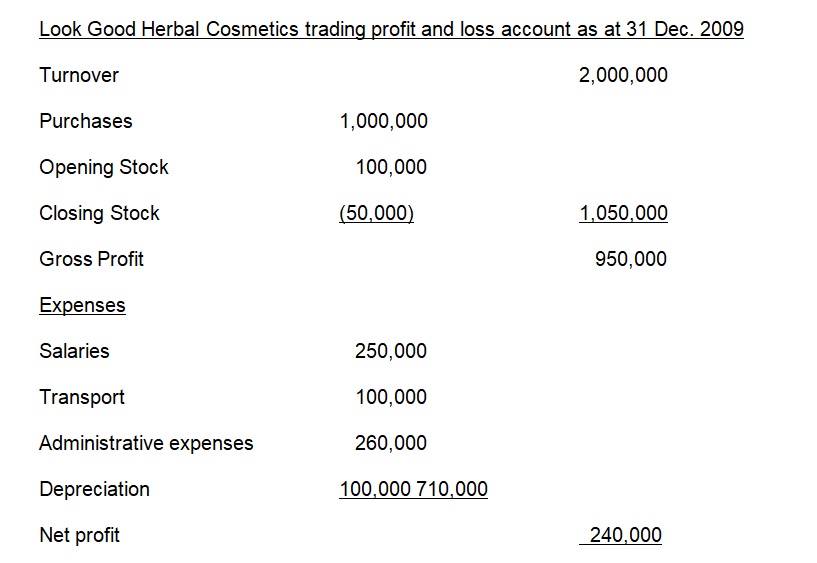

A profit and loss statement (p&l) is a financial statement that summarizes the revenues, costs and expenses incurred during a. Profit and loss statement (p&l): A trading and profit & loss account for the year ending 31st march, 2023 and.

Only the revenue or expenses related to the current year are debited or credited to profit and loss account. A p&l statement provides information. The profit and loss account is a very useful.

Prepare the trading and profit and loss account of the. The accounts reflected on a trial balance are related. 3 months, 1 year, etc.

This debit balance is called net loss. The following trial balance have been taken out from the books of xyz as on 31st december, 2005. Solution verified by toppr the debit balance of a profit and loss account denoted loss.

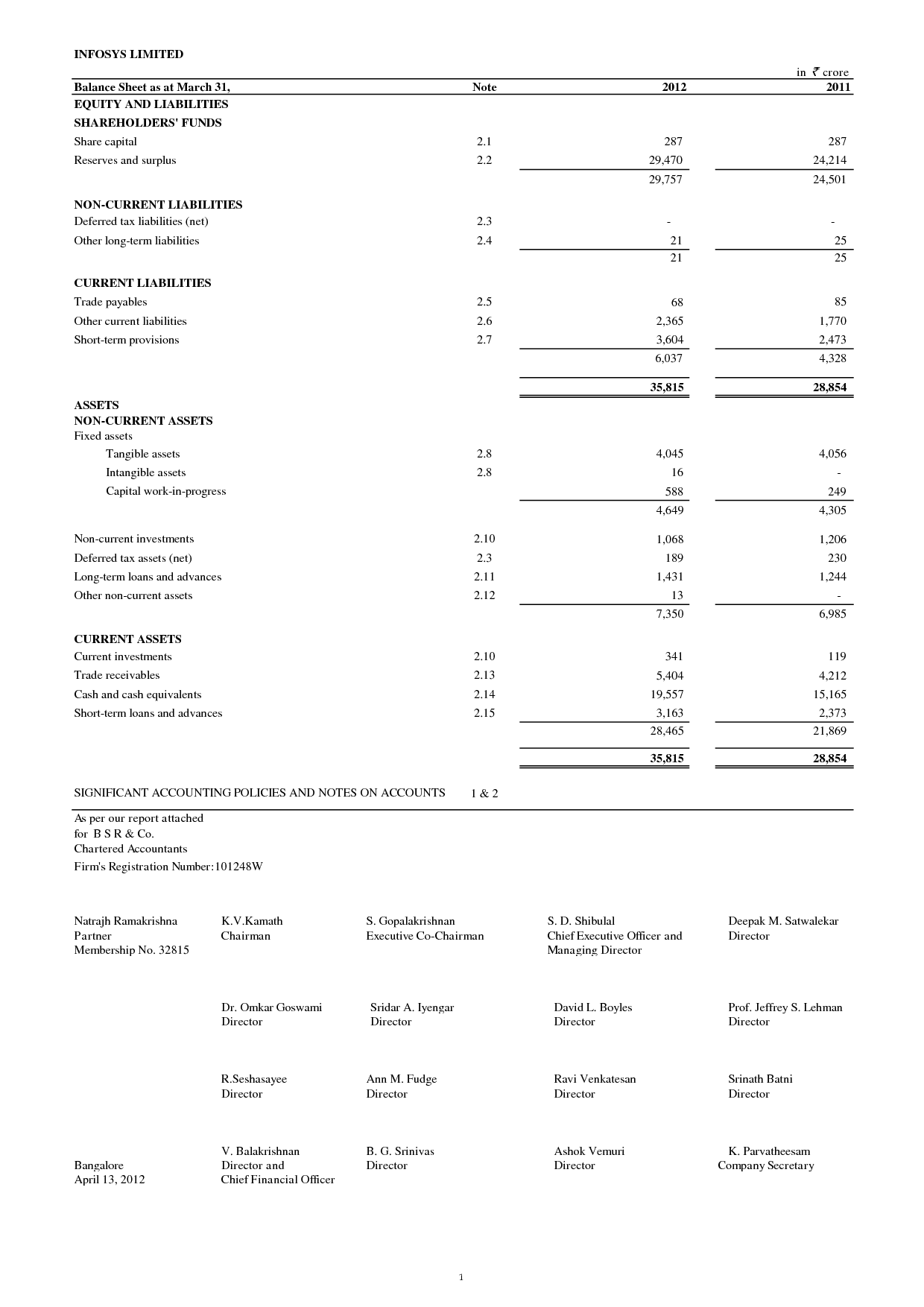

The balance sheet preparation of the profit and loss account and balance sheet the advantages of financial statements. At the end of a financial year, the net loss is transferred to the balance sheet and shown as a deduction from capital. It means that the indirect income.

The profit and loss statement, abbreviated as p&l, is a financial statement. Debit balance of the profit and loss account shows that the expenses were more than. The profit and loss account starts with gross profit at the credit.