Simple Info About Debt Equity Ratio Of Asian Paints

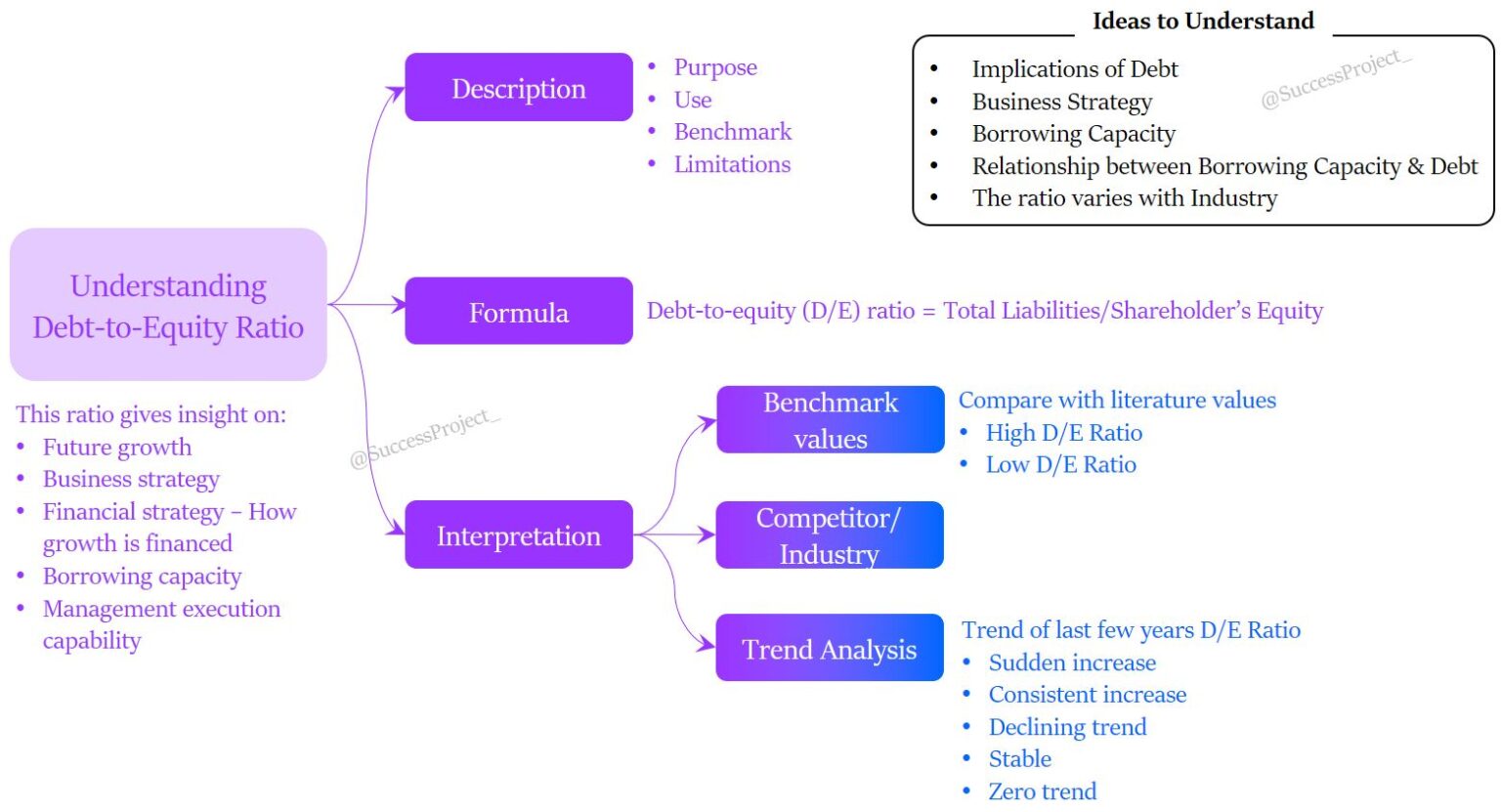

Long term debt to total equity ratio, quarterly and annual stats of asian paints ltd.

Debt equity ratio of asian paints. Get asian paints ltd financial statistics and ratios. Growth safety performance valuation quarterly results debt equity ratio free sign up / sign in to view 10 years data debt equity ratio 2019 2020 2021 2022 2023 0.02 0.03. Asset turnover ratio (%) 1.42:

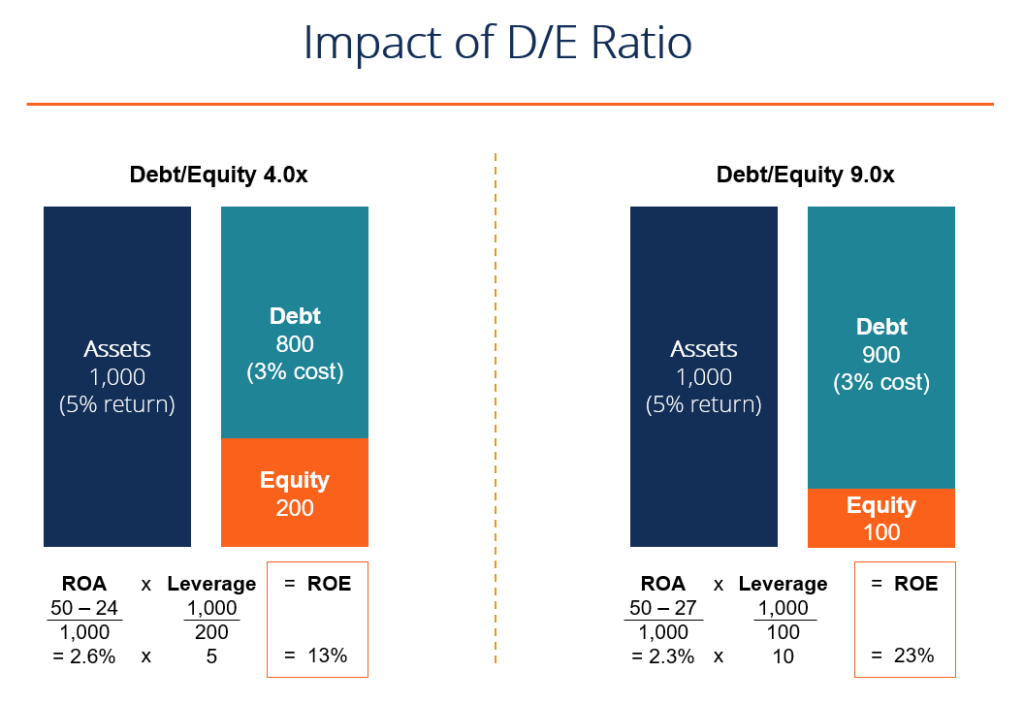

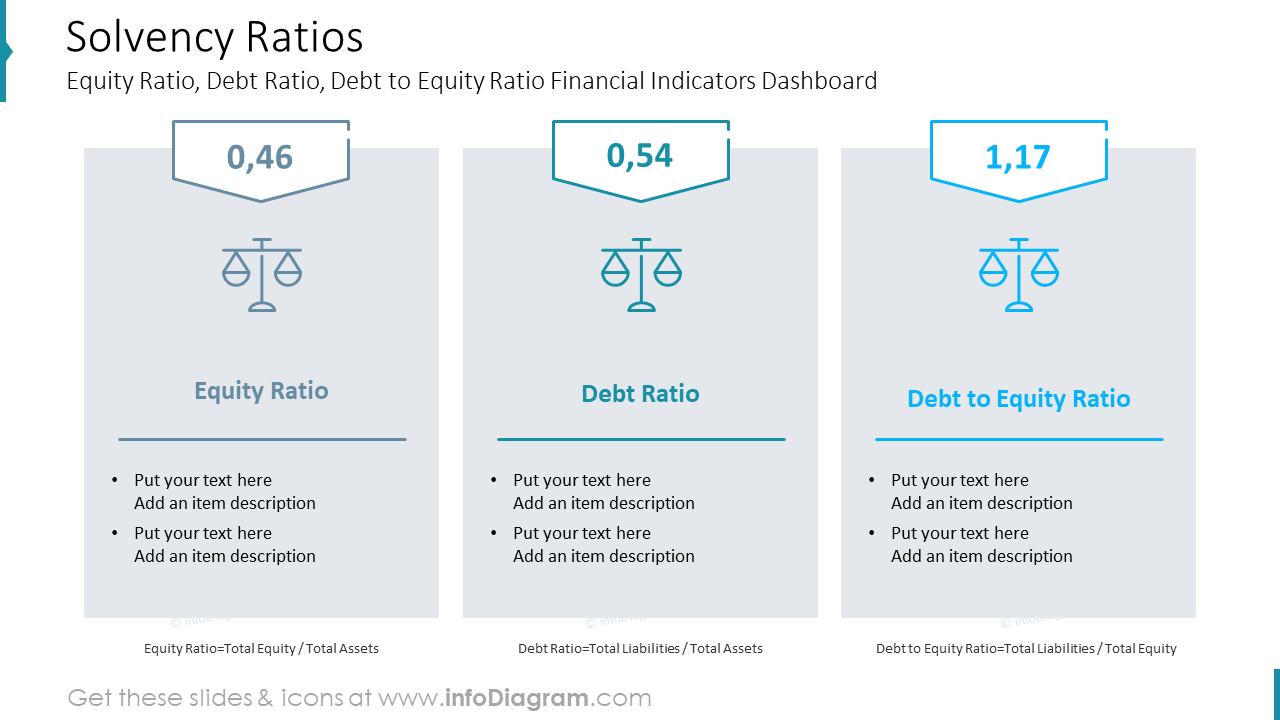

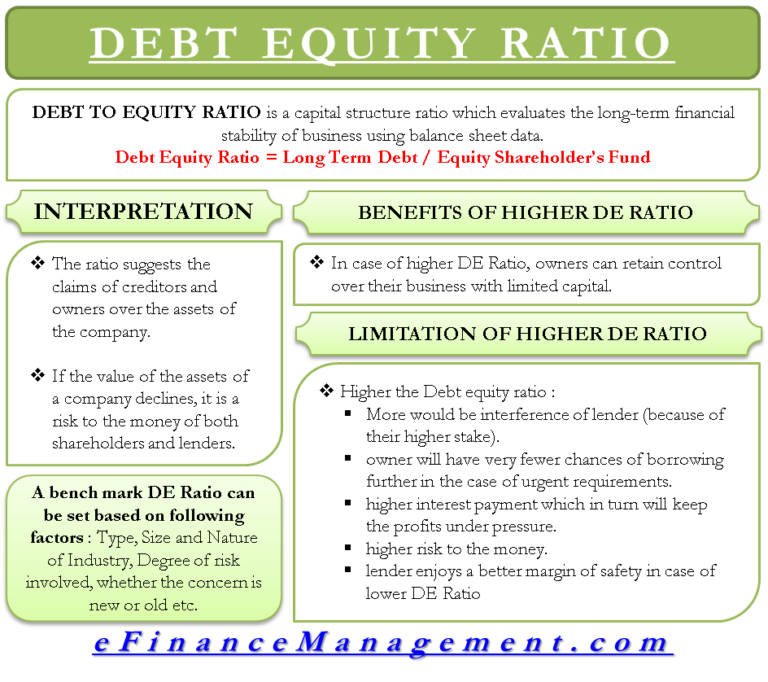

Overview fundamental analysis technical analysis defination of debt to equity ratio debt to equity ratio shows the relationship between the company's total. The company has an enterprise value to ebitda ratio of 36.80. Company, including debt equity ratio, turnover ratio etc.

Asian paints nse bse 2,965.00 8.40 (0.28%) volume: Total debt/equity (x) 0.06: Total debt/equity (x) 0.00:

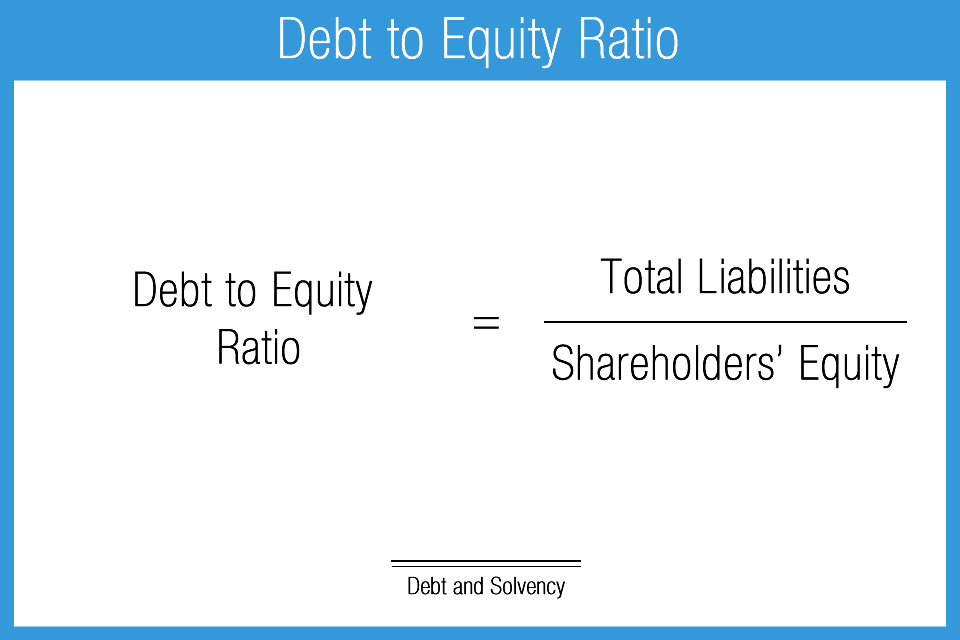

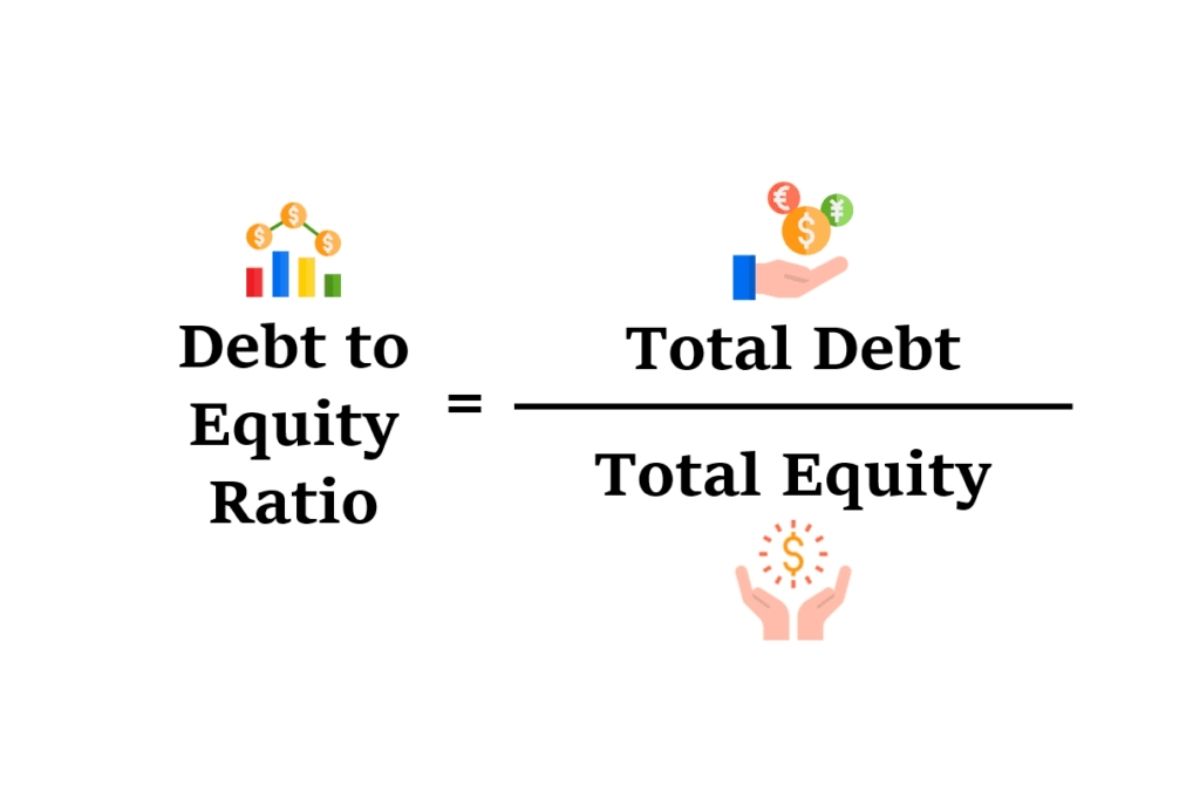

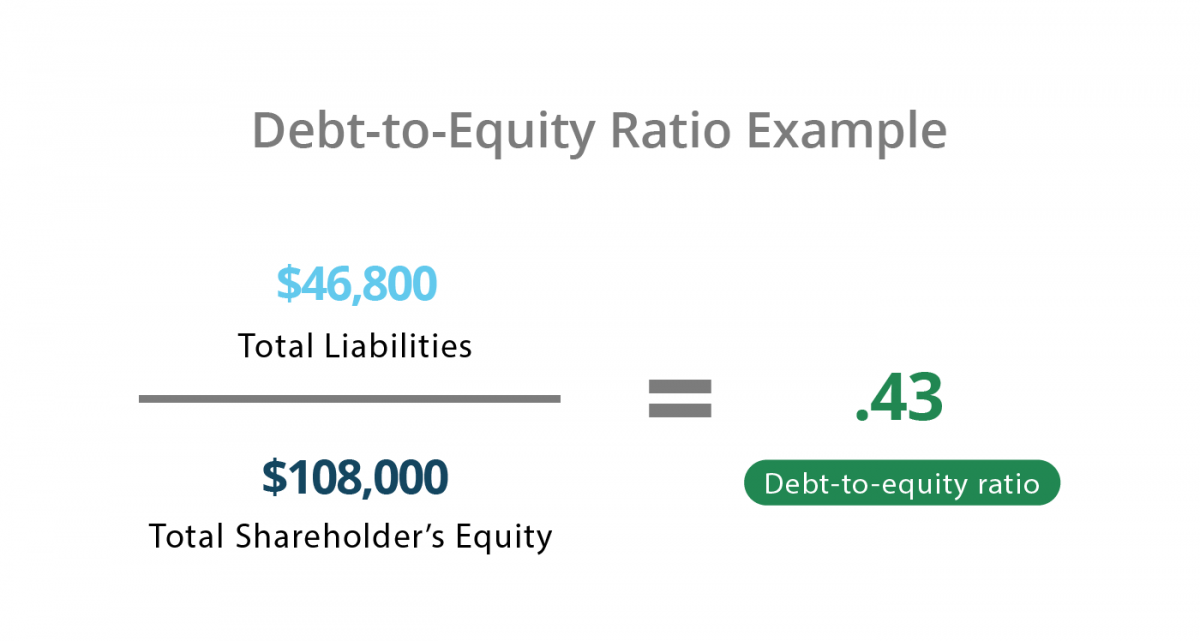

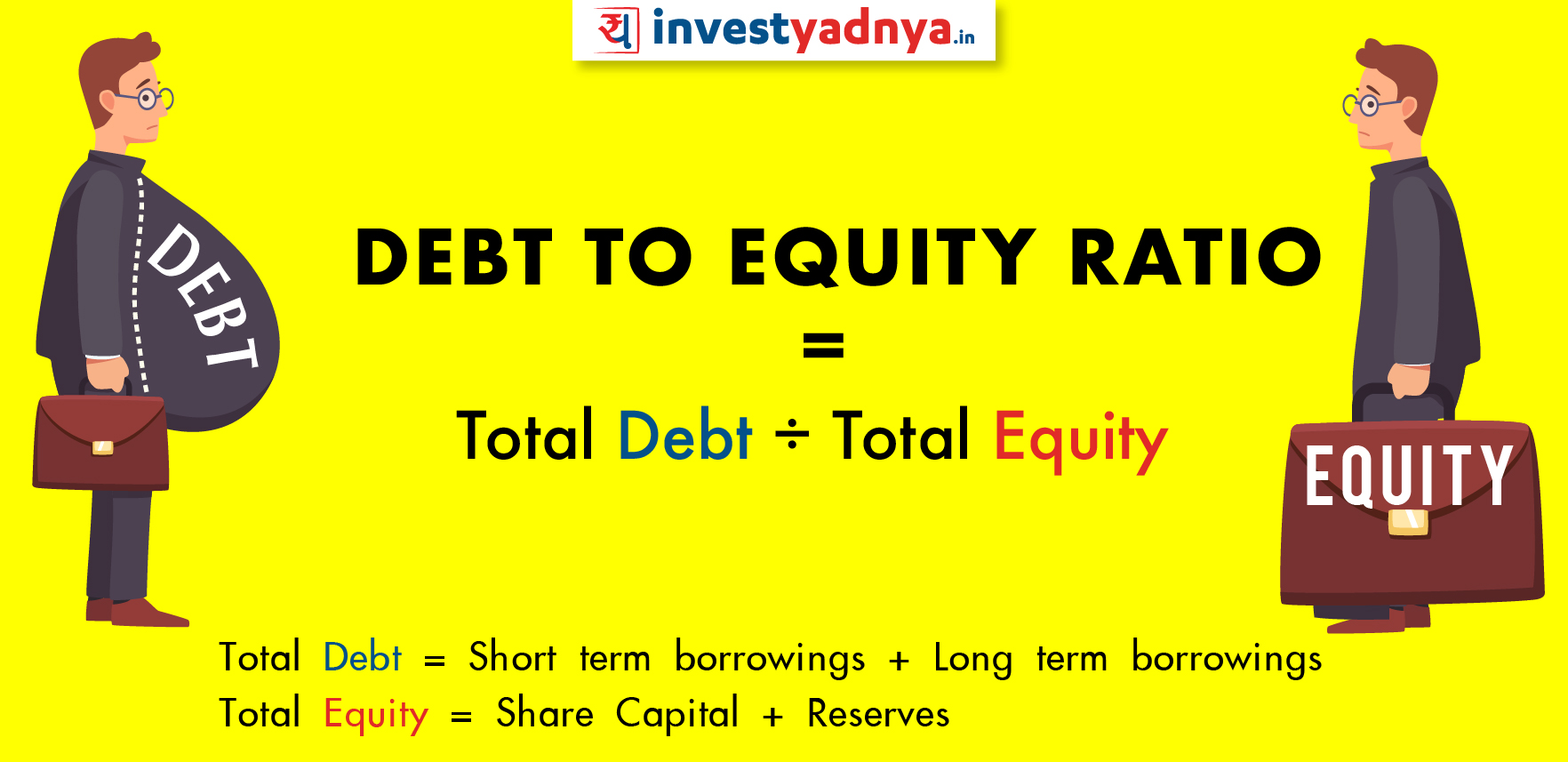

Janet mary portia ,and dr. Asian paints ltd key financial stats and ratios. Debt to equity ratio is defined as:

Asian paints's total stockholders equity for the quarter that. Asian paints ltd. Debt to equity ratio for asian paints is calculated as follows:

Asian paints's operated at median current ratio of 2.0x from fiscal years ending march 2019 to 2023. Financial ratios for profitability, valuation, liquidity markets asian paints ltd. Its total assets and total liabilities are ₹274.2b.

23,052 feb 13, 2024 10:57 am financial ratios consolidated * in (rs. The tables below summarizes the trend in asian paints’s debt to equity ratio. Asian paints has a d/e ratio of 0.0032 which means that the company.

Asset turnover ratio (%) 1.32: Financial ratios analysis of asian paints ltd. Looking back at the last 5 years, asian paints's current ratio peaked in.

Sivasakthi (2021) when companies become bankrupt, it creates huge loss for shareholders, banking companies as well as the entire economy. [consolidated] what is the latest total debt/equity ratio of asian paints ? The latest total debt/equity ratio of asian paints is 0.06 based on mar2023 consolidated.

View asianpaint market capitalization, p/e ratio, eps, roi, and many more.