Out Of This World Info About Cash Flow Preparation Methods

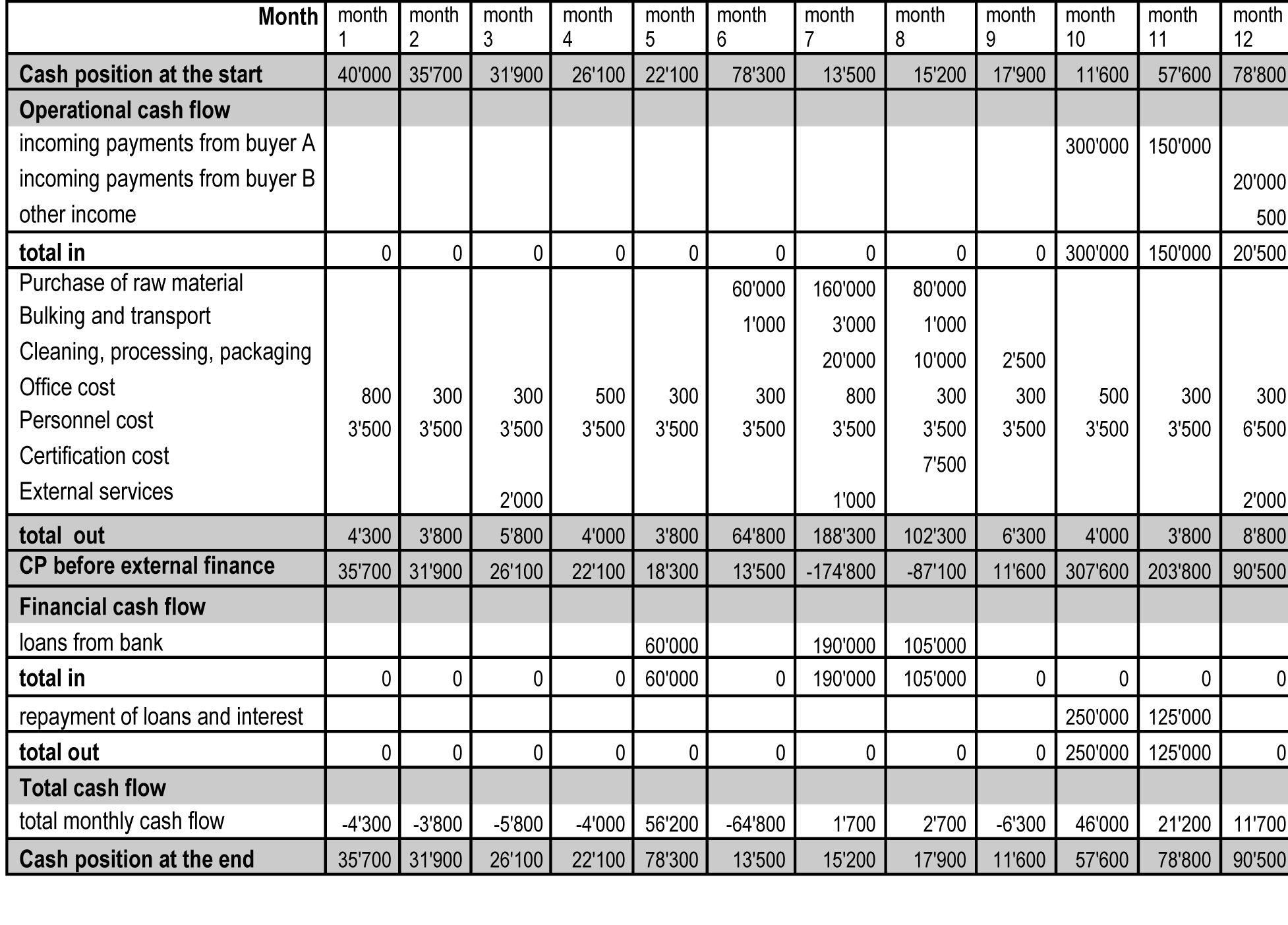

Both of them help calculate the cash flow from operating activities.

Cash flow preparation methods. The direct method of cash flow and the indirect method of cash flow. What is the cash flow statement direct method? Two methods are available to prepare a statement of cash flows:

The two methods of calculating cash flow are the direct method and the indirect method. Before you start working on your statement, determine whether the indirect method or the direct method to prepare a cash flow statement makes the most sense, given your needs. The company’s chief financial officer (cfo) chooses between the direct and indirect presentation of operating cash flow:

There are two methods for cash flow statement preparation: The financial accounting standards board (fasb) prefers the direct method, while many businesses prefer the indirect method. There are two ways to prepare your cash flow statement:

In other words, it lists where the cash inflows came from, usually customers, and where the cash outflows went, typically. How the cash flow statement is used the cash flow statement paints a picture as to how a. There are two ways to prepare a cash flow statement:

In accounting and finance, the cash flow statement (cfs), or “statement of cash flows,” matters because the financial statement reconciles the shortcomings of the reporting standards established under. You may prepare your statement of cash flows quarterly, semiannually or annually, depending on a business' plans and needs. Cash flow from operations typically includes the cash flows associated with sales, purchases, and other expenses.

The direct method of presenting the statement of cash flows presents the specific cash flows associated with items that affect cash flow. Essentially, the direct method subtracts the money you spend from the money you receive. The cash flow statement presented using the direct method is easy to read because it lists all of the major operating cash receipts and payments during the period by source.

The direct method of calculating cash flow. The cash flow from the operations section of the cash flow statement can be prepared using either the direct or indirect method. The cash flow statement is divided into three categories—cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities.

Preparation of the investing and financing sections of the statement of cash flows is an identical process for both the direct and indirect methods, since only the technique used to arrive at net cash flow from operating activities is affected by the choice of the direct or indirect approach. How to perform a cash flow analysis (template + examples) 1 june, 2023 5min brett johnson, avp, global enablement listen to the blog: Direct cash flow method.

The cash flow from financing and investing activities’ sections will be identical under both the. The cash flow statement can be prepared using either the direct or indirect method. (a) using the direct method prepare the operating activities section of the statement of cash flows.

Items that typically do so include: Keep in mind that the method you select will only affect the operating activities section of your statement—as the investing and financing activities sections will. Indirect method of cash flow both methods of cash flow analysis yield the same total cash flow amount, but the way the information is presented is different.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

![Complete Guide to Cash Flow and Cash Flow Statements [++templates]](https://www.deskera.com/blog/content/images/2020/06/10-Ways-to-Improve-Cash-Flow.png)