Underrated Ideas Of Info About Net Operating Loss Balance Sheet

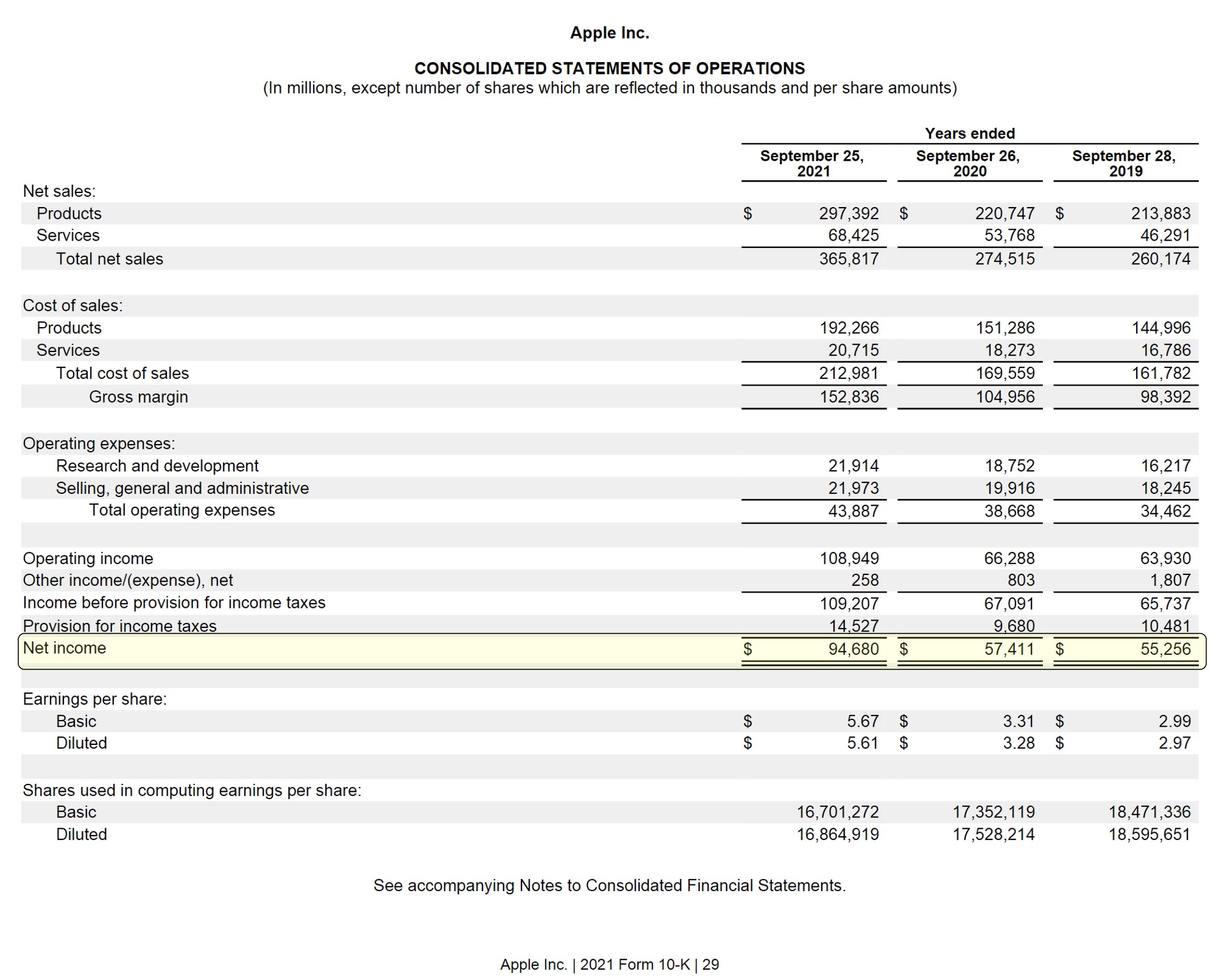

Both involve a company’s finances, but their differences are significant by sean ross updated april.

Net operating loss balance sheet. Treatment of nols that existed prior to the transaction depends on whether the deal is structured as an asset or a stock. Net loss is an accounting term, and it refers to a negative value for income. Start free written by cfi team what is net loss?

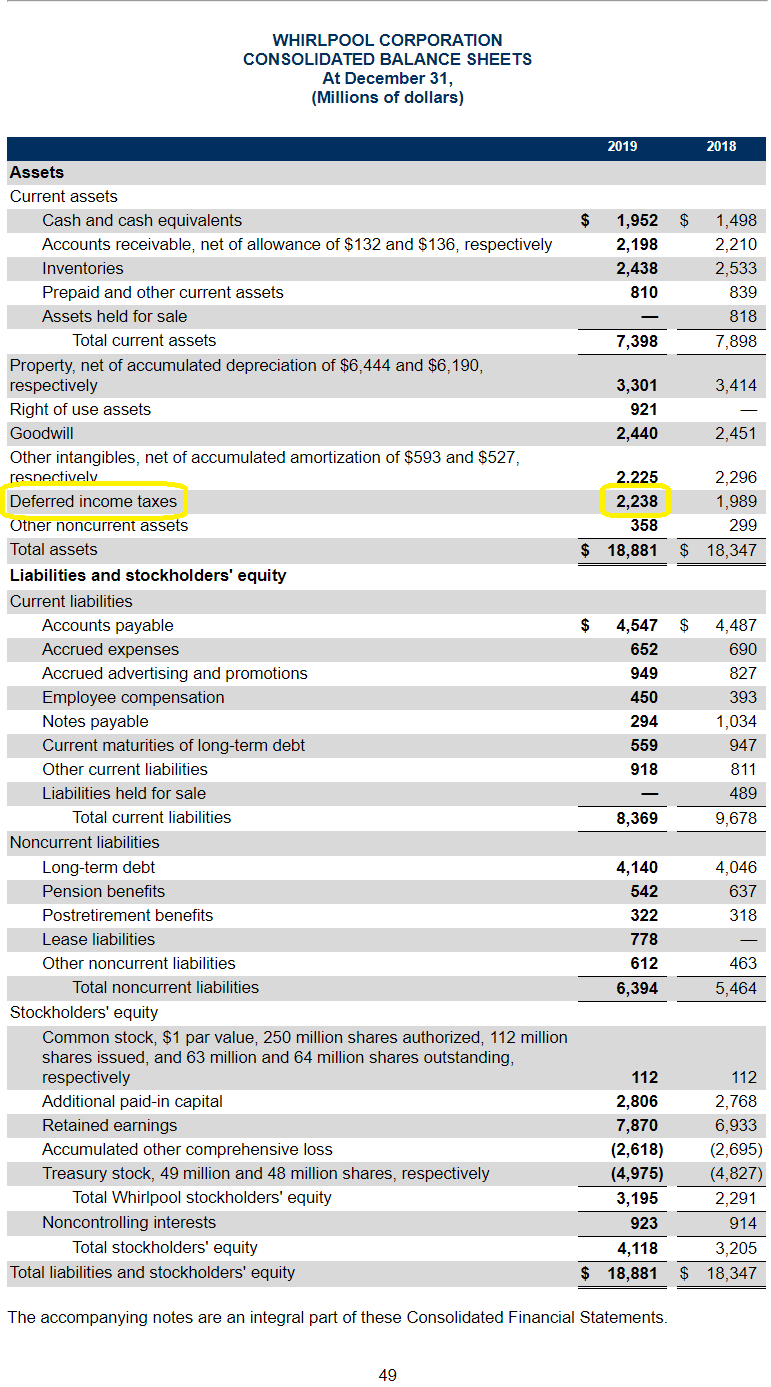

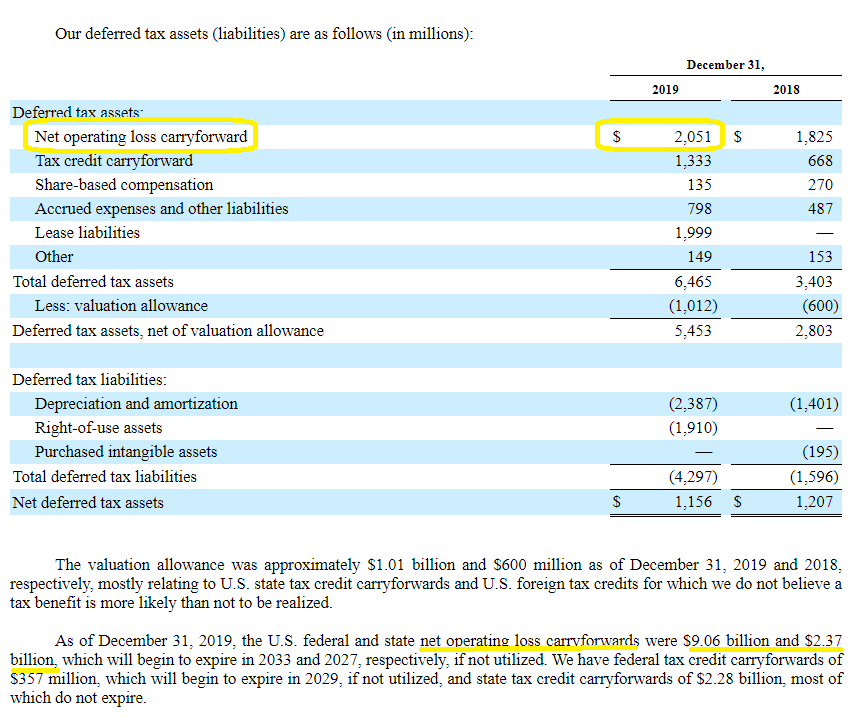

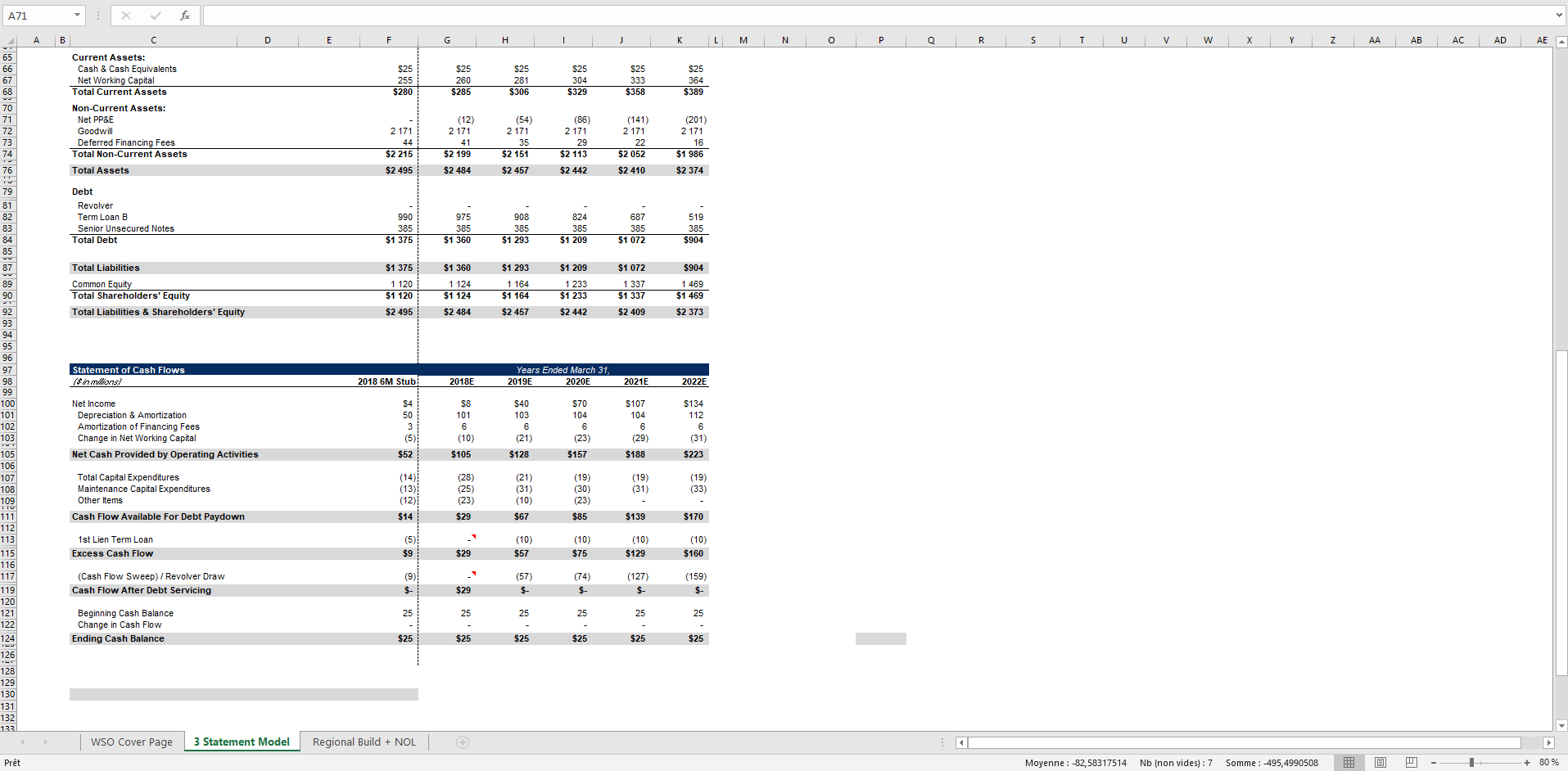

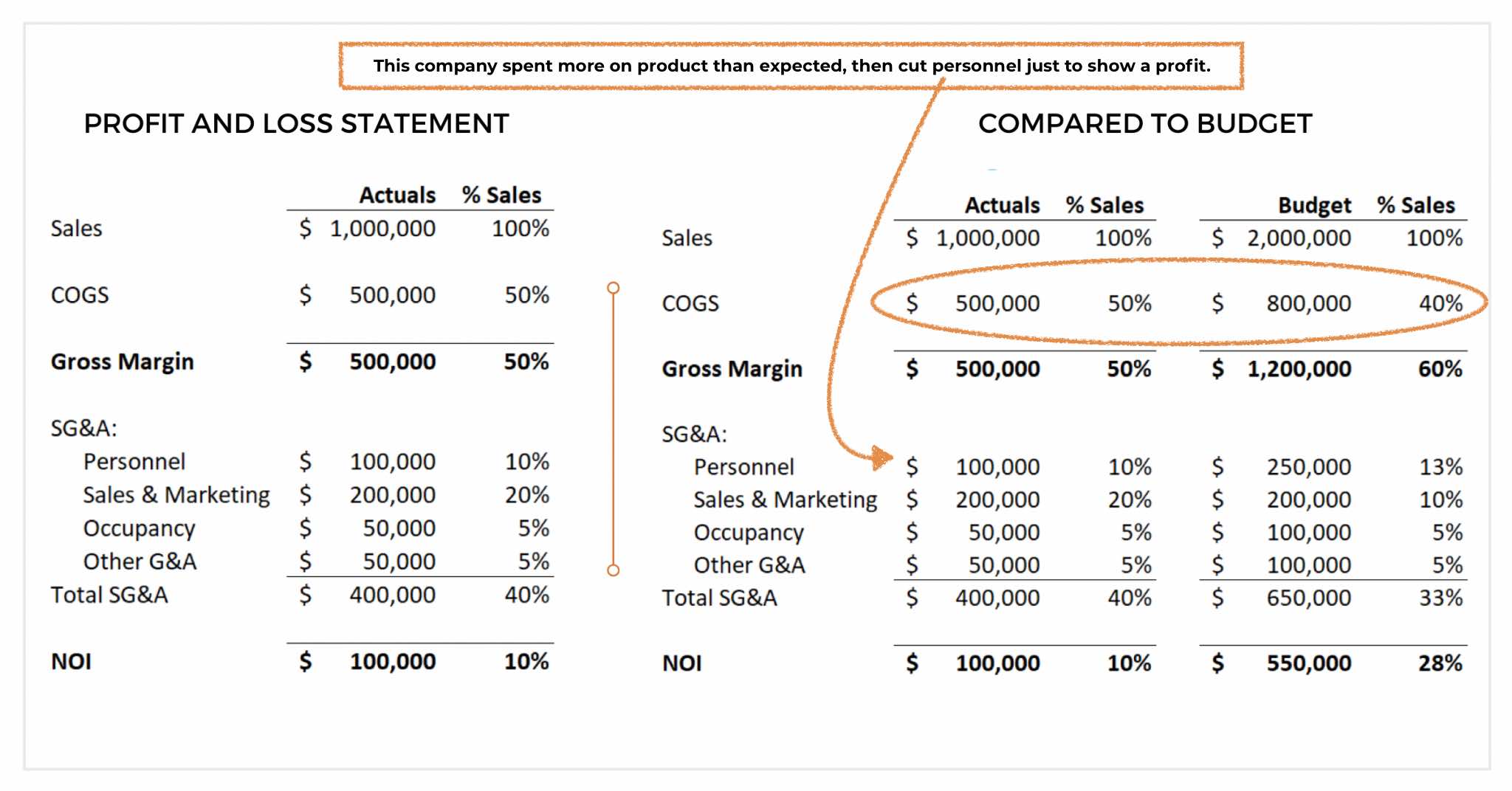

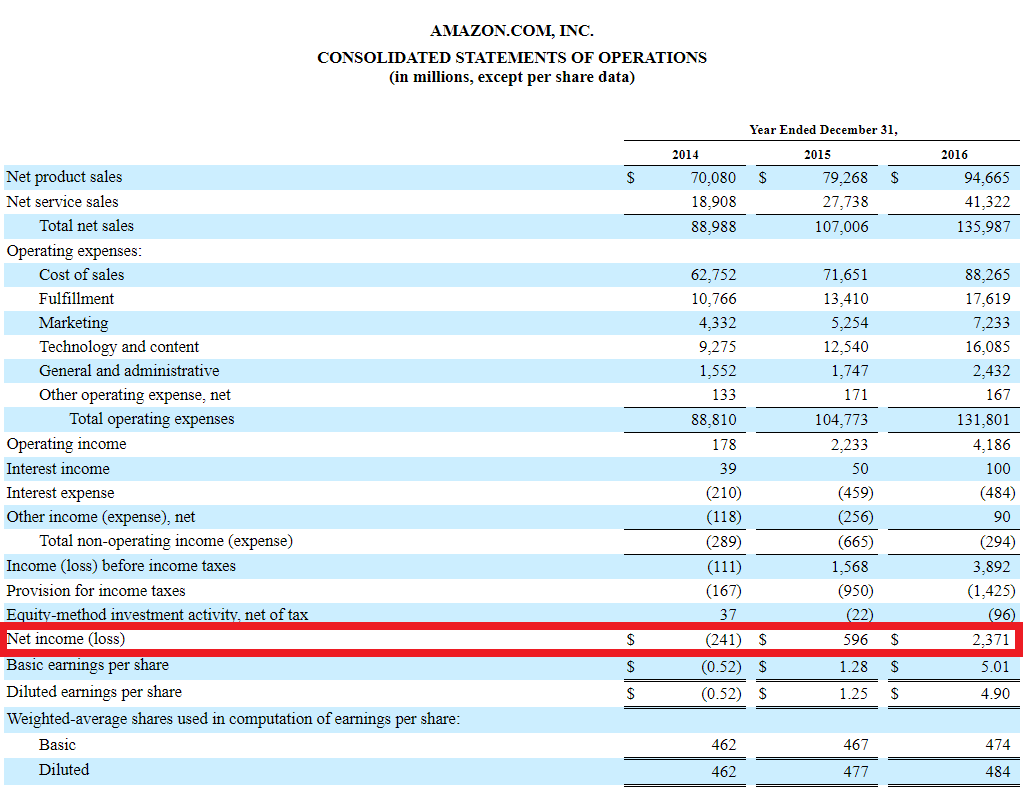

Dtas are created to offset a firm’s net income in future years, also known as an nol carryforward. If the company becomes profitable later down the road, the nols can be “carried forward” to reduce the tax burden in upcoming profitable periods. An nol year is the year in which an nol occurs.

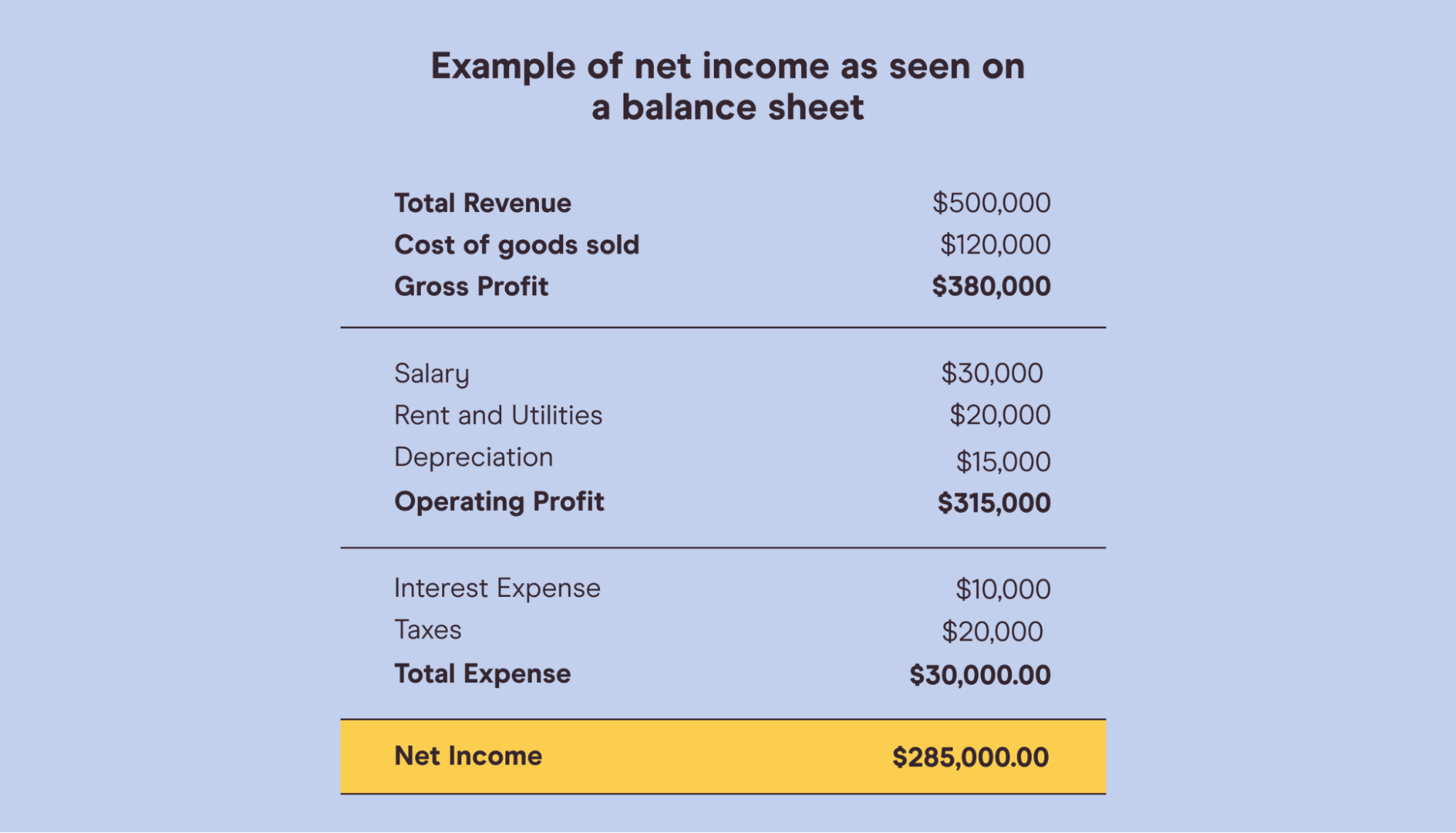

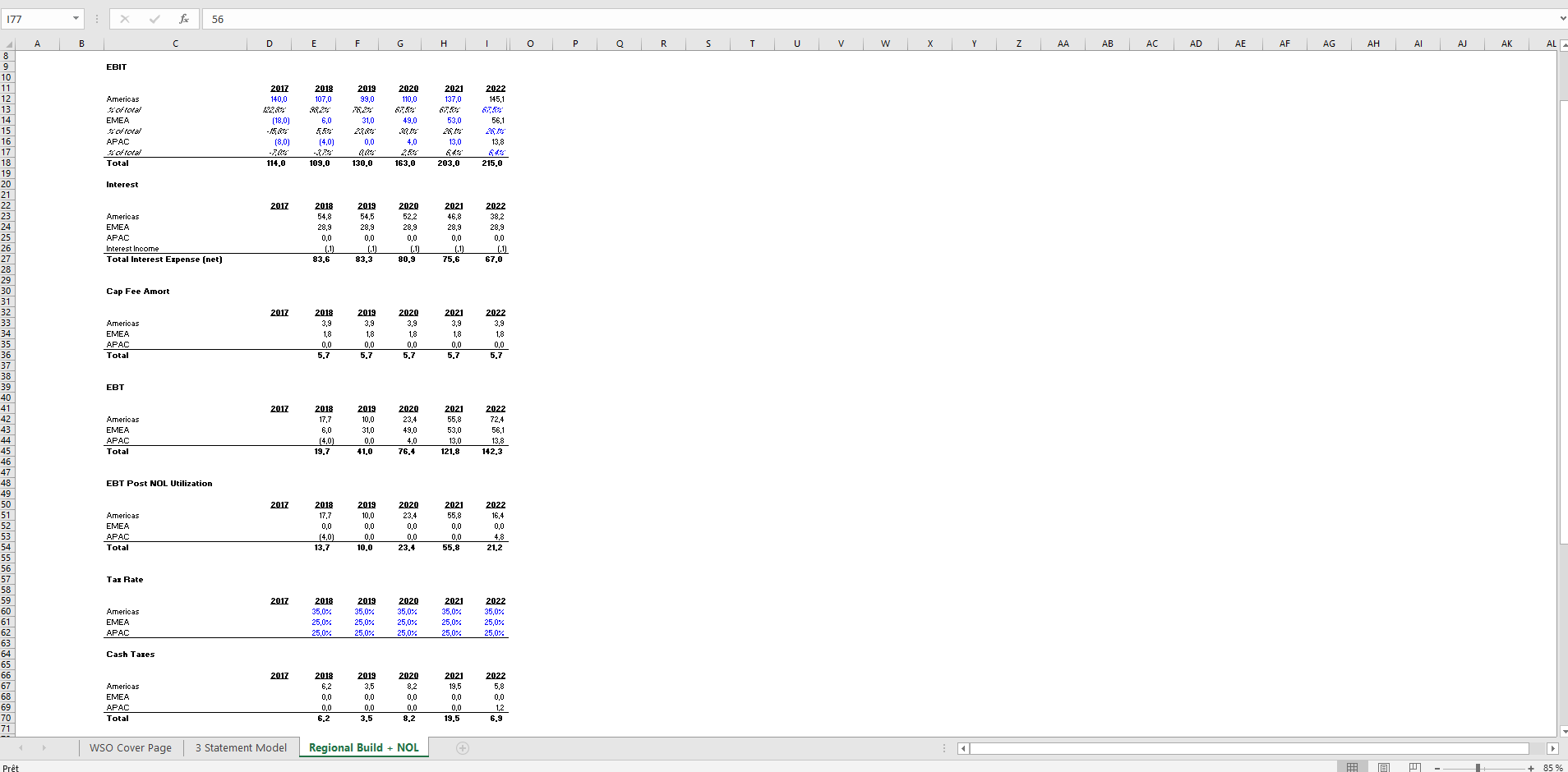

Calculating the net operating loss for your business is as simple as subtracting your tax deductions from the taxable income for the year. They’re recognized as “deferred tax assets” (dtas). Consolidated ebit (reported) amounted to € 4,603 million (2022:

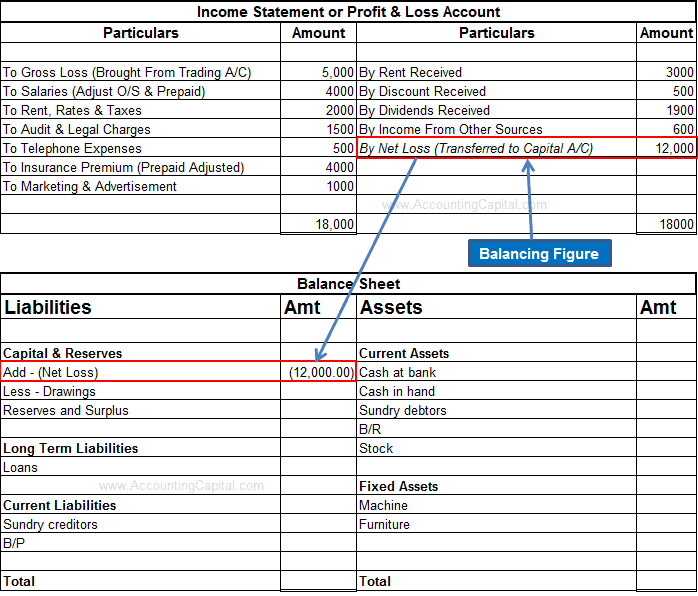

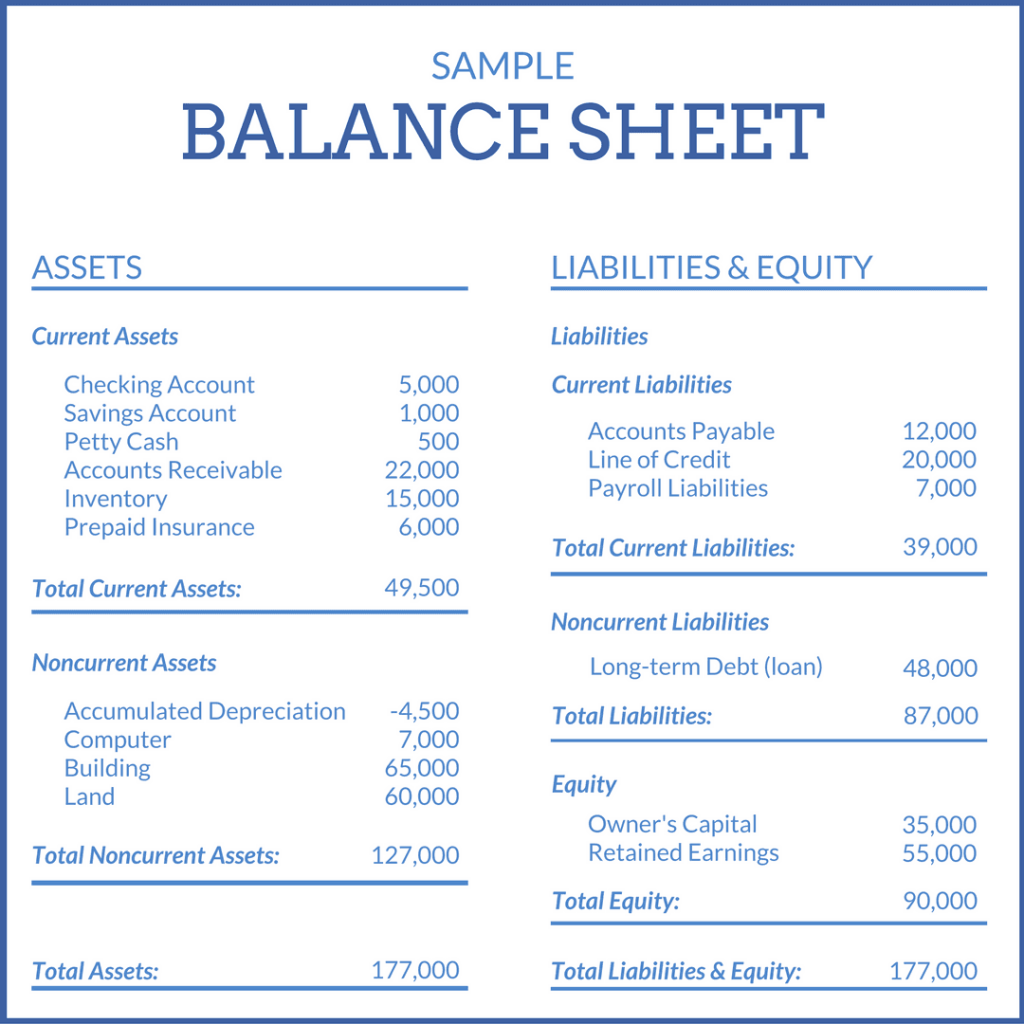

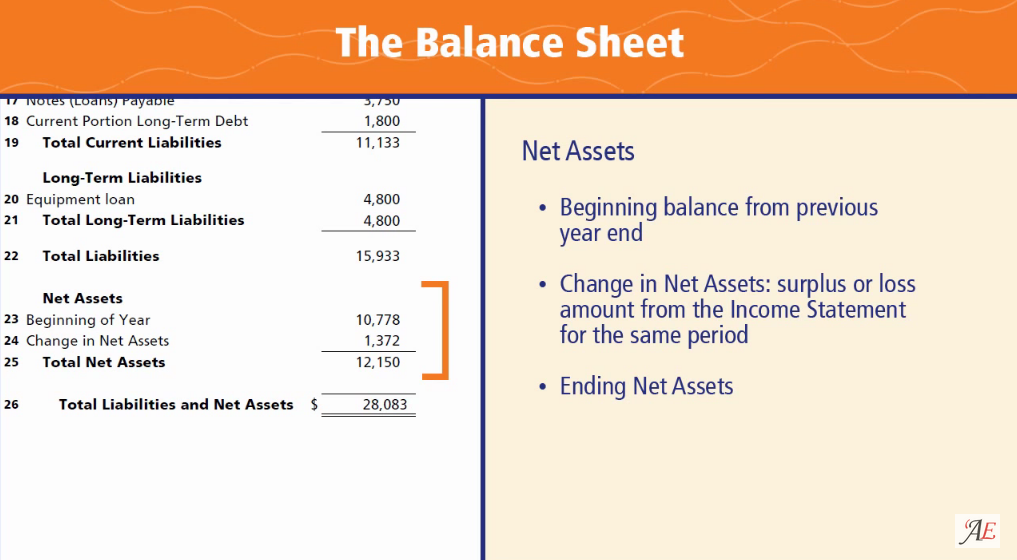

The losses will be classified in your accounting balance sheet as noncurrent assets. it's important that you calculate nol accurately because it can provide future tax relief for your business. Net operating losses (nols) that can be “carried” to offset future tax burdens are valuable assets to a company. Net operating loss formula.

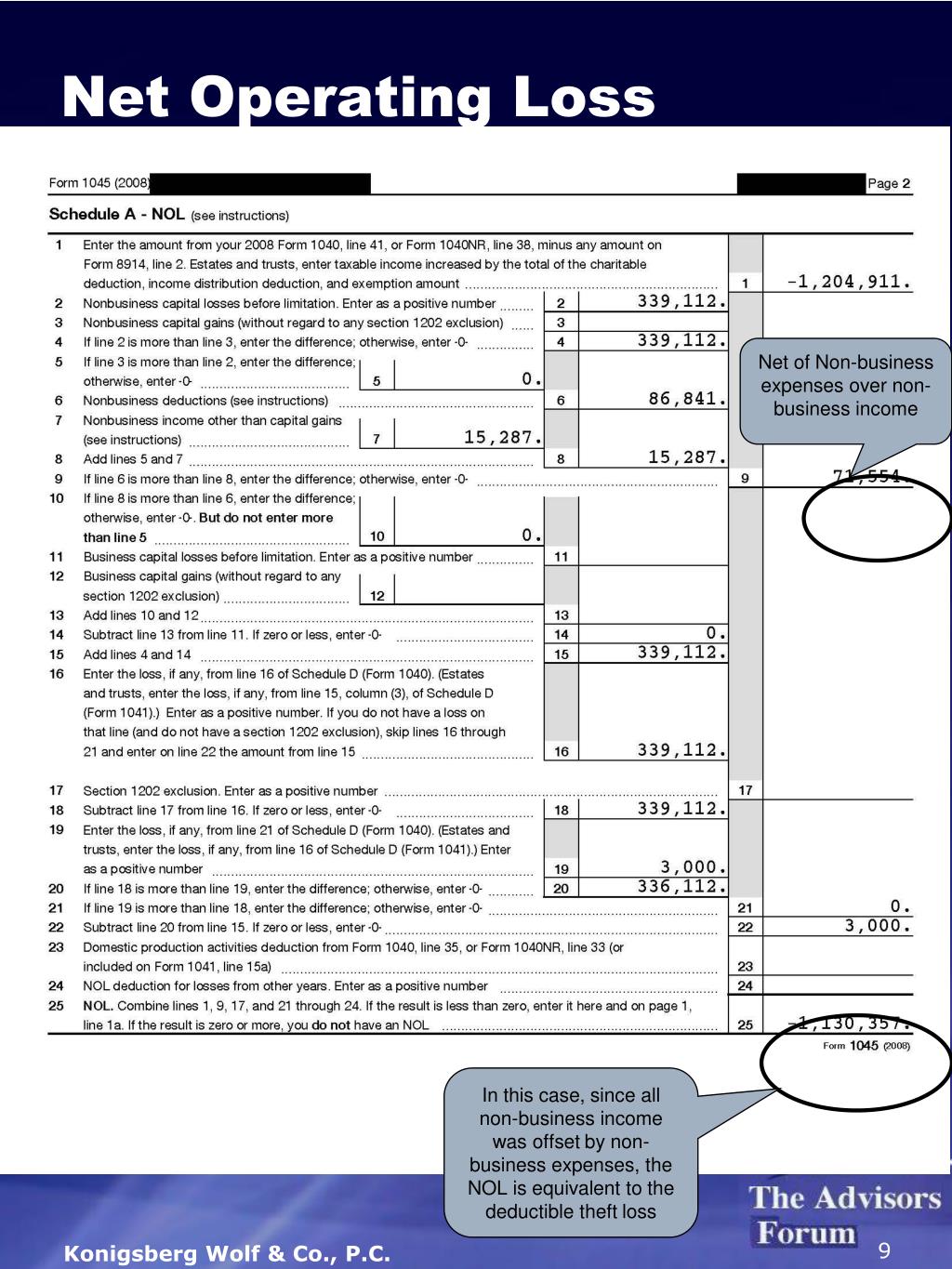

A net operating loss for a taxable year is equal to the excess of deductions over gross income, computed with certain modifications. The dta account of the balance sheet will go down each year as a company utilizes the benefits for tax relief. The net operating assets (noa) of a company equal the value of all assets directly tied to core operations minus all operational liabilities.

A net operating loss (nol) for income tax purposes is when a company’s allowable deductions exceed the taxable income in a tax period. Operating liability → if a certain liability is necessary. Try macabacus for 10x productivity

The item is displayed on line 41 on form 1040, u.s. If you haven’t done so, you may want to review our primer on nol before proceeding with this step. The owner may be able to use this loss to offset other income on their personal tax return, reducing the owner's total tax bill.

How to calculate net operating loss? We explain more about using this process, called carryback or carryforward, for your net operating loss below. If your deductions for the year are more than your income for the year, you may have a net operating loss (nol).

You can use an nol by deducting it from your income in another year or years. A net loss is when total expenses (including taxes, fees, interest, and depreciation) exceed the income or revenue produced. Brown investopedia / madelyn goodnight what is net loss?

A net operating loss (nol) or tax loss carryforward is a tax provision that allows firms to carry forward losses from prior years to offset future profits, and, therefore, lower future income taxes. Net operating losses (“nol”) are generated when taxable income is negative, and may be used to offset positive taxable income, thereby reducing taxes payable. The nol can generally be used to offset a company’s tax payments in other.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)