Formidable Info About Difference Of Income Statement And Balance Sheet

A balance sheet and an income statement are different in the main components they measure, the time frames they cover, the analysis they offer, and how they are used.

Difference of income statement and balance sheet. The balance sheet and the income statement are monetary reports organisations create toward the end of. The income statement, balance sheet, and statement of cash flows are required financial statements. Components the components of a balance sheet vs.

The three core financial statements are 1) the income statement, 2) the balance sheet, and 3) the cash flow statement. What is the difference between a balance sheet and an income statement? These three financial statements are intricately linked.

Difference between income statement and balance sheet. The income statement was first since net income (or loss) is a required figure in preparing the balance sheet. Accounting what is the difference between income statement, balance sheet, and cash flow?

Income statements, balance sheets, and cash flow statements are all financial reports that detail how money enters and departs a company. Difference between balance sheet and income statement abstract: Income statement provides financial information.

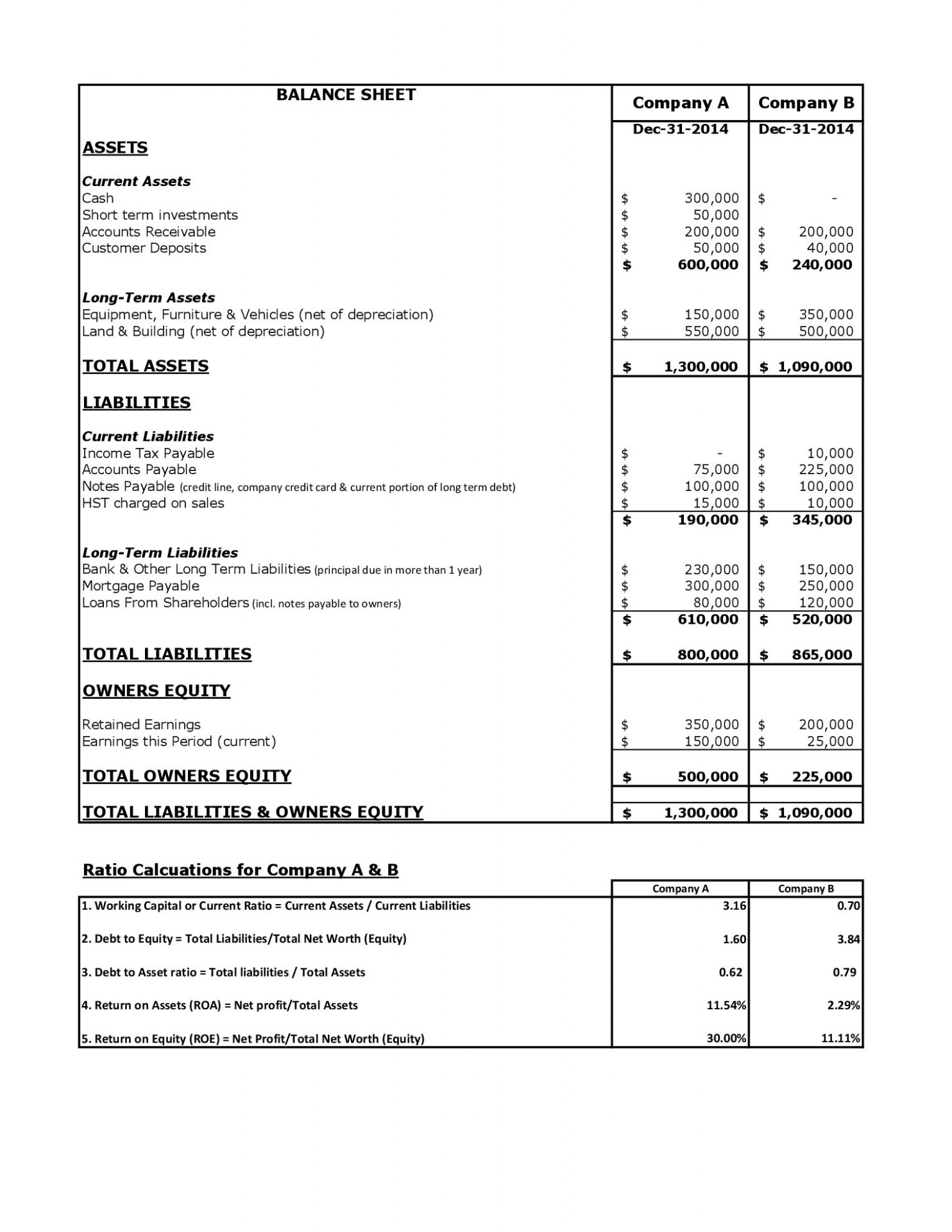

During the period close process, all temporary. You can learn about the health. The balance sheet includes things owned (assets) and things owed (liabilities).

An income statement shows the ability of a company to generate profit while a balance statement shows a business’s assets and liabilities. Together, they tell a more complete story. The income statement shows you how profitable your business is over a given time period.

4 rows what are the differences between a balance sheet and income statement? Assets minus liabilities equals owners’ equity. The main difference between an income statement vs balance sheet is that the income.

(1) reporting periods (most income statements come out quarterly, whereas balance. The income statement, often called the profit and loss statement, shows the revenues, costs, and. The balance sheet and income statement highlight different aspects of your business’s financial history.

An income statement, also called a profit and loss statement, reports a company's financial performance over a particular period of time. This difference represents the book value of the stockholders' stake in. And the balance sheet gives you a snapshot of your assets and liabilities.

It summarizes the revenues, expenses, and profits of an organization over a set period of time. Those of an income statement is a key differentiator between the two documents. Income statement vs balance sheet sayantan mukhopadhyay ashish kumar srivastav dheeraj vaidya, cfa, frm income statement and balance sheet differences.

.png)