Recommendation Tips About Preparing Financial Statements In Accordance With Gaap

This means financial statements must include every piece of.

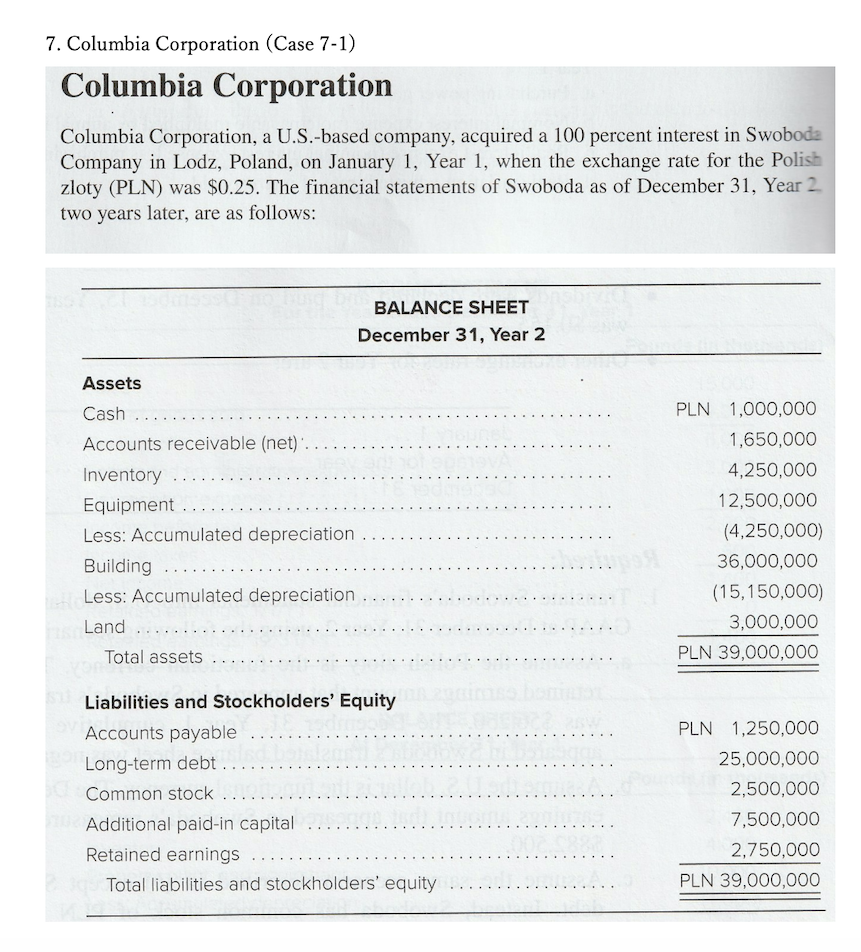

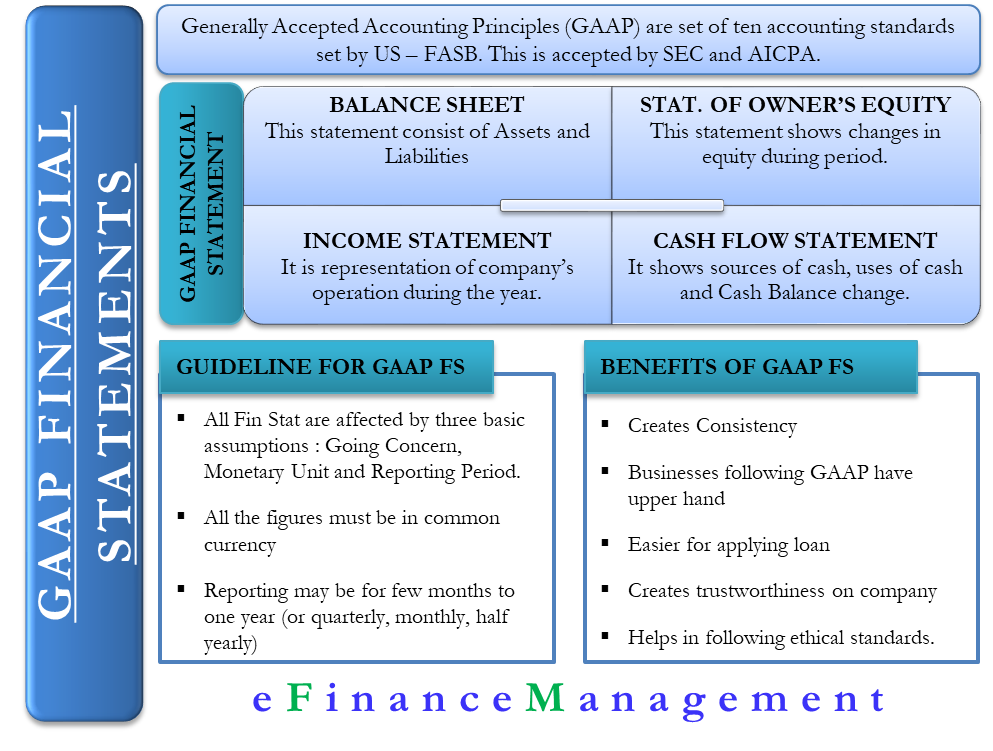

Preparing financial statements in accordance with gaap. Financial statements must be prepared according to the gaap full disclosure principle. Purpose financial statements in accordance with international financial reporting standards (ifrss). The first is consolidated financial statements.

Preparation of financial statements in accordance with gaap. Companies prepare their financial statements in accordance with a framework of generally accepted accounting principles (gaap) relevant to their country, also referred. Preparing financial statements in accordance with gaap is an example of a.

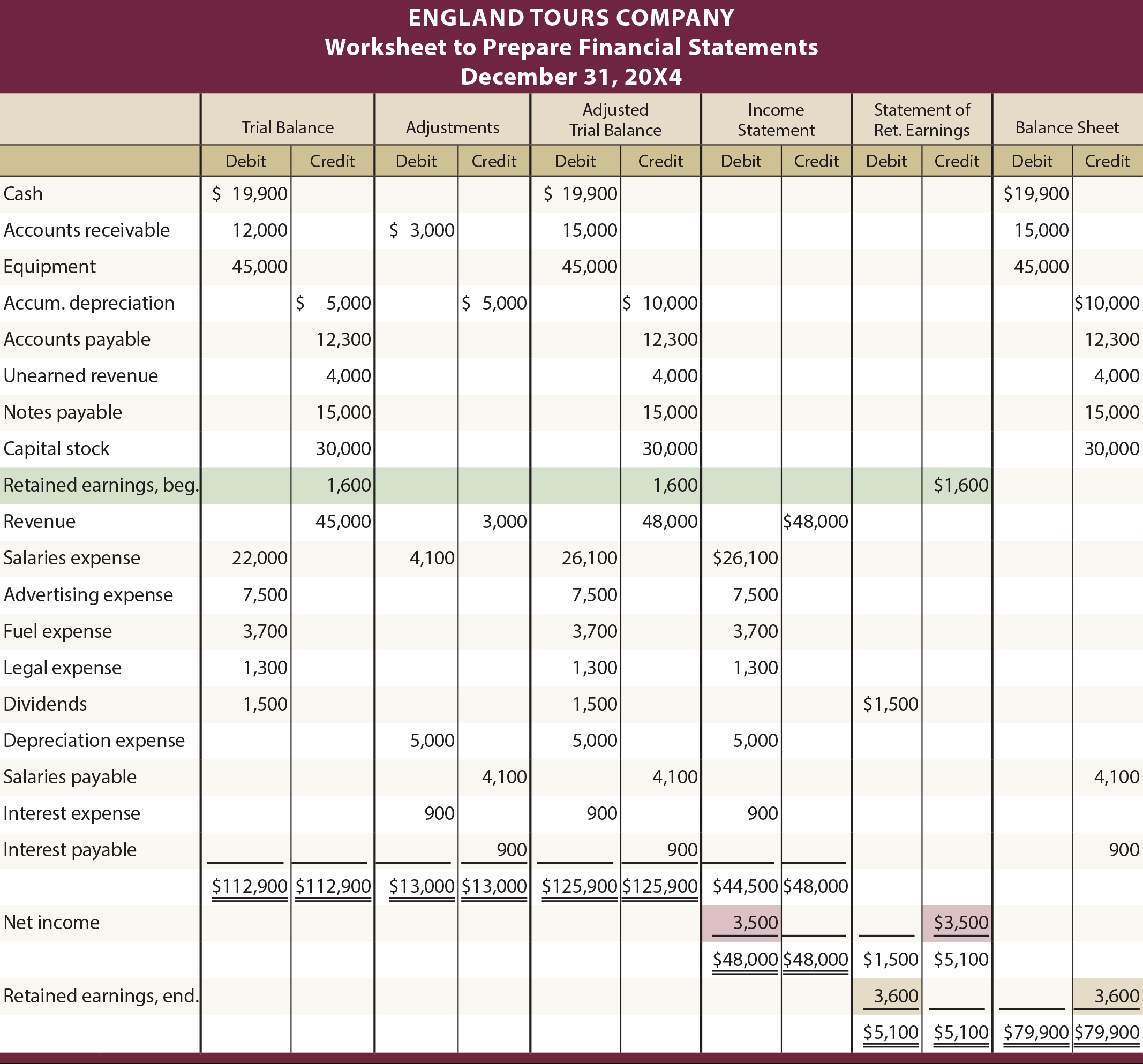

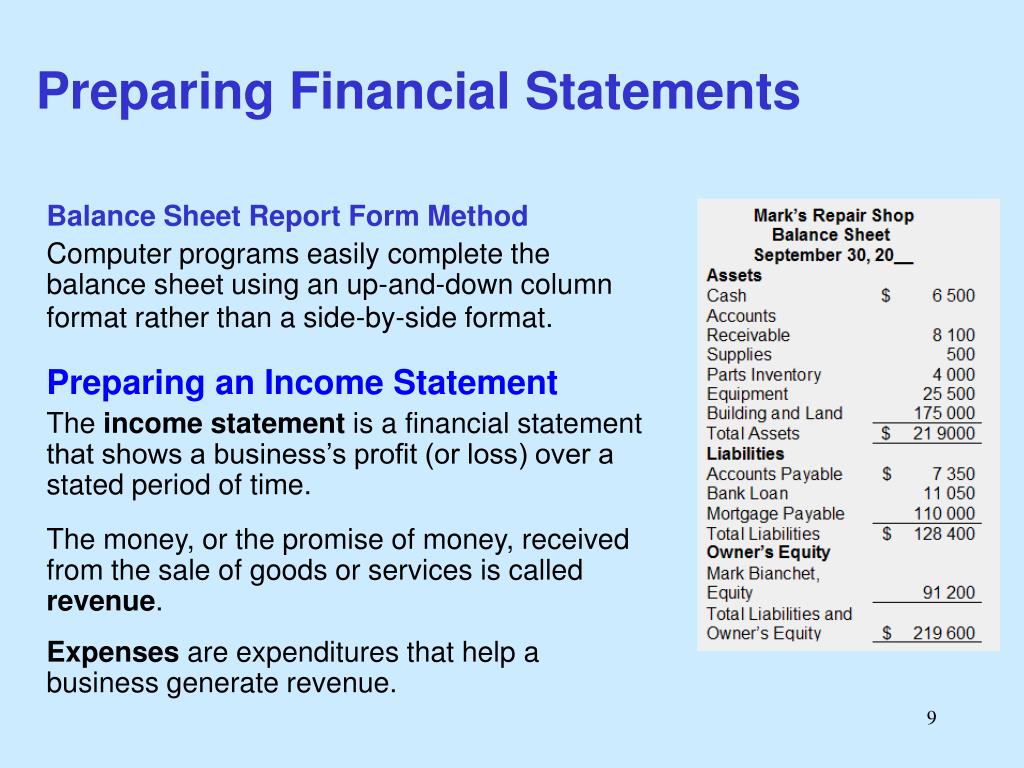

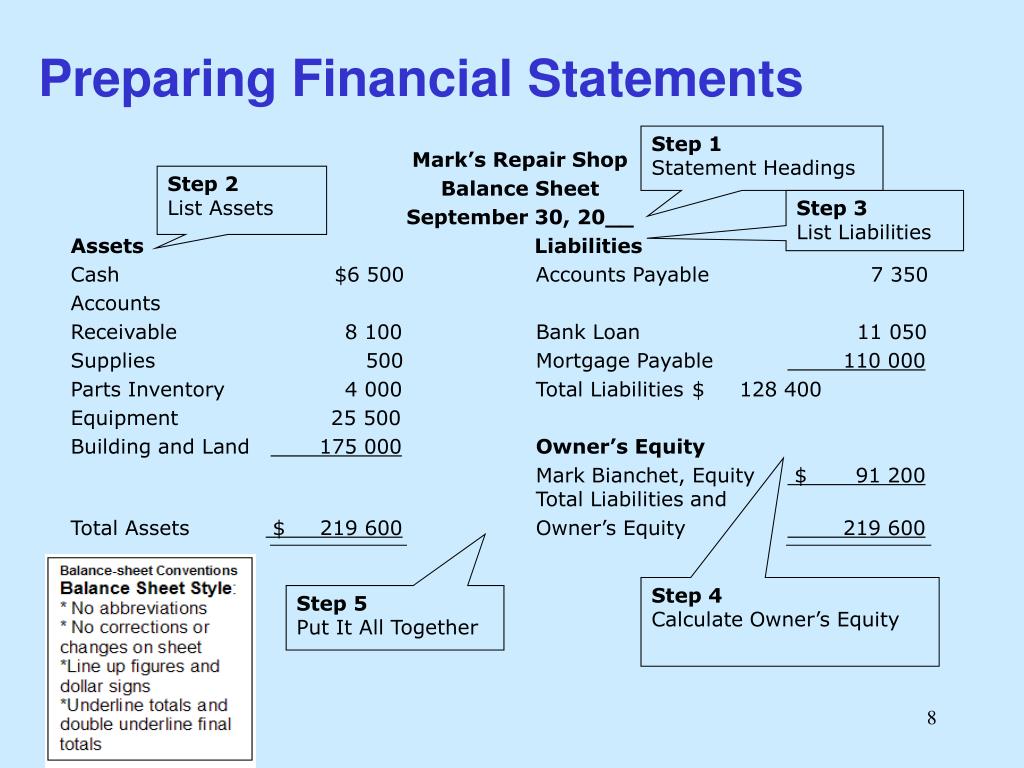

The income statement, the balance sheet, and the cash flow statement. Companies are compiling and reporting clear and consistent financial information. Other ifrss set out the recognition, measurement and disclosure.

Ias 1 presentation of financial statements sets out the overall requirements for financial statements, including how they should be structured, the minimum requirements for. This problem has been solved! Prepare at least 2014 and 2013 financial.

This is because auditors can also audit these financial statements. The following three major financial statements are required under gaap: Financial statements prepared in accordance with gaap standards are more reliable.

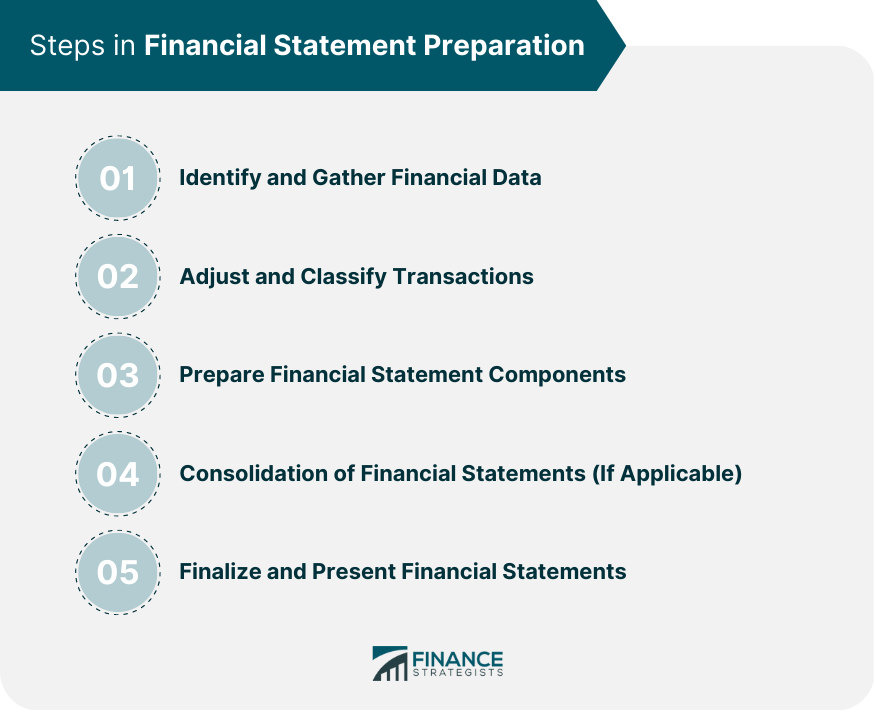

When it comes to your reporting, there are two options available. Asc 205, presentation of financial statements, provides the baseline authoritative guidance for presentation of financial statements for all us gaap reporting entities. In the financial statement process, considerable time is devoted to determining what items get recorded and how to account for them, but the critical final mile is determining how.

Gaap requirements for consolidated financial statements. Gaap is a set of detailed accounting guidelines and standards meant to ensure publicly traded u.s. Additionally, the revised version of swiss gaap fer 30 ‘consolidated financial statements’ came into effect on 1 january 2024.

Preparing financial statements when applying the cash‐ or tax‐basis of accounting general‐ ly is less costly than preparing gaap financial. The seller shall maintain adequate books, accounts and records, and prepare all annual,. Companies are required to apply ifrs 1 when they prepare their first ifrs financial statements, including when they transition from their previous gaap to ifrs.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)