Stunning Tips About Prepare An Income Statement Balance Sheet Format Tally

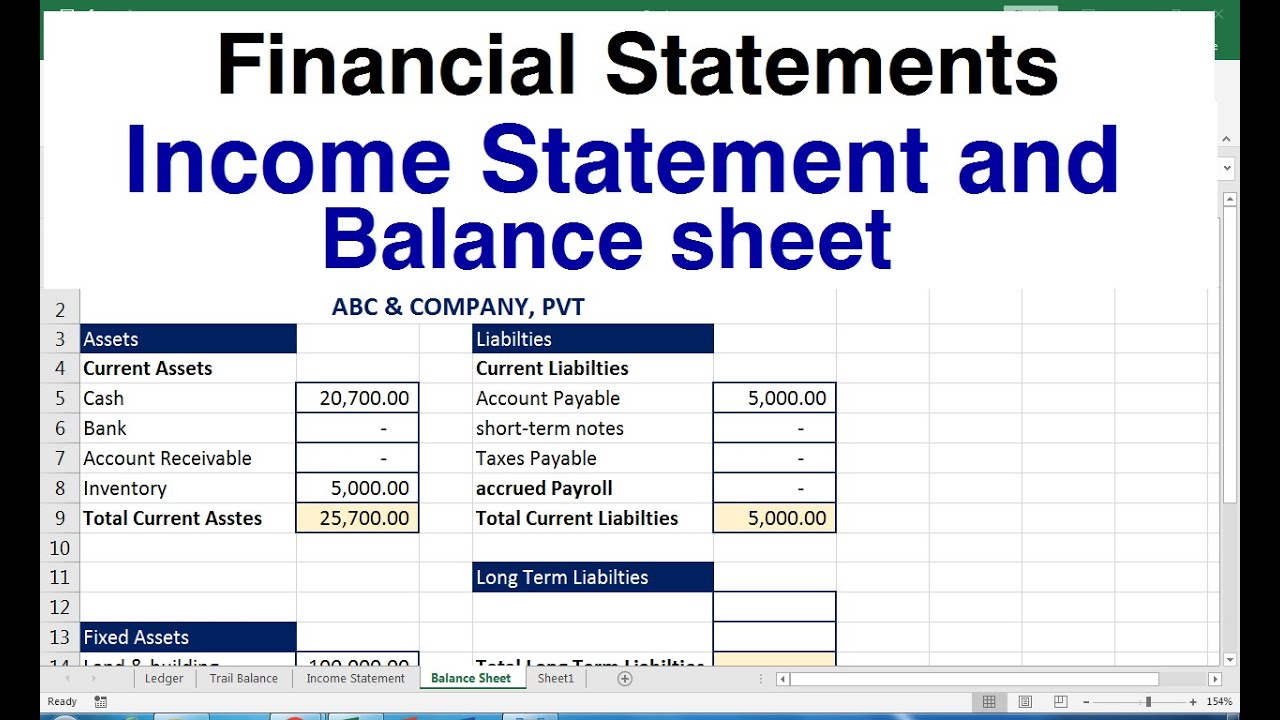

You can see the liabilities for your company on the left and the assets on the right.

Prepare an income statement balance sheet format tally. There are three sections in this section. It provides insights into your business liquidity, efficiency, and leverage. To see more balance sheet samples, head to freshbooks.

How to prepare an income statement: If you have more sections then add them here. Tallyprime simplifies the process of generating accounting reports, allowing you to easily create reports such as the balance sheet, profit and loss a/c, receivables and payables, cash flow statement, and more.

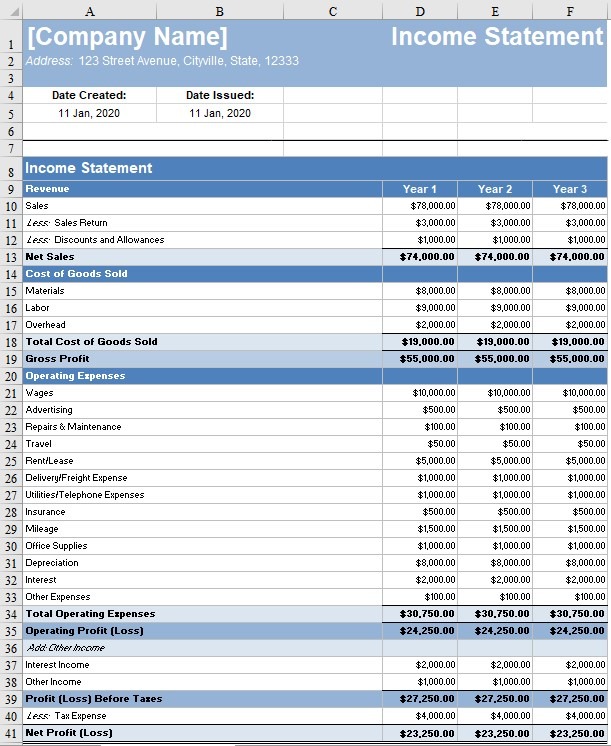

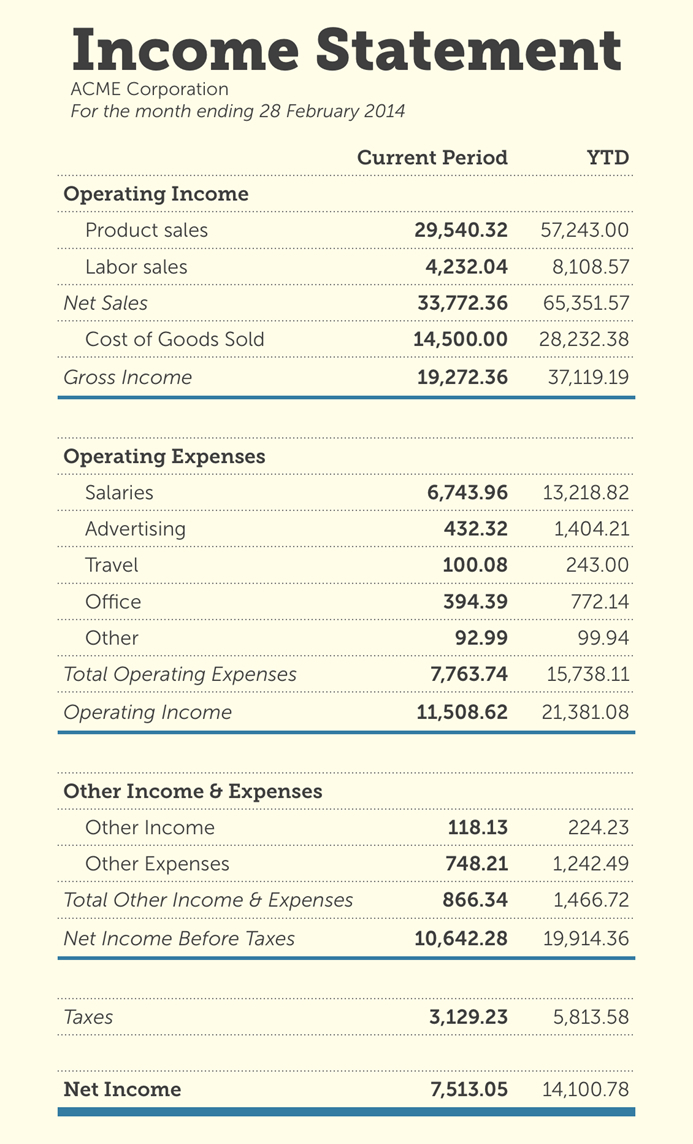

How much money a business took in during a reporting period; Depicting your total assets, liabilities, and net worth, this document offers a quick look into your financial health and can help inform lenders, investors, or. Costs of goods sold (cogs):

The best tally balance sheet format by vyapar gives a snapshot of the financial health of your business, and you can understand the relationship between different accounts. A balance sheet is one of the three financial statements that businesses need to prepare. Alternatively, go to gateway of tally > balance sheet.

First we have exported the trial balance from tally 2. Ideally, you should add business assets to your balance sheet in the order in which they could be liquidated. The total costs associated with component parts of whatever product or service a company makes and.

How much money a business spent during a reporting period; In the process of preparing the balance sheet, the maker needs to prepare other financial statements which will help gather the accounting data. The ascent explains what a balance sheet reveals about your business.

The balance sheet and the income statement provide distinct yet interconnected perspectives on a company’s financial standing. Posting of accounting records from journal books to individual ledge accounts On the other hand, the income statement offers a.

This sample income statement from accounting coach shows the different figures used to calculate net income, the layout of the report and how it differs from a balance sheet: In the balance sheet , the common base item to which other line items are expressed is total assets, while in the income statement, it is total revenues. Add up all your gains then deduct your losses.

First, we’ll calculate the total liabilities amount. Add up the income tax for the reporting period and the interest incurred for debt during that time. The technique can be used to analyse the three primary financial statements, i.e., balance sheet, income statement and cash flow statement.

Check out balance sheet format & company balance sheet format, its components and explanation with example. Thereby, a consolidated balance sheet is readily available when required. As a result, businesses have automated the task of consolidating financial information using accounting software.