First Class Info About Disclaimer Of Opinion Going Concern

14, 2024 updated 7:32 p.m.

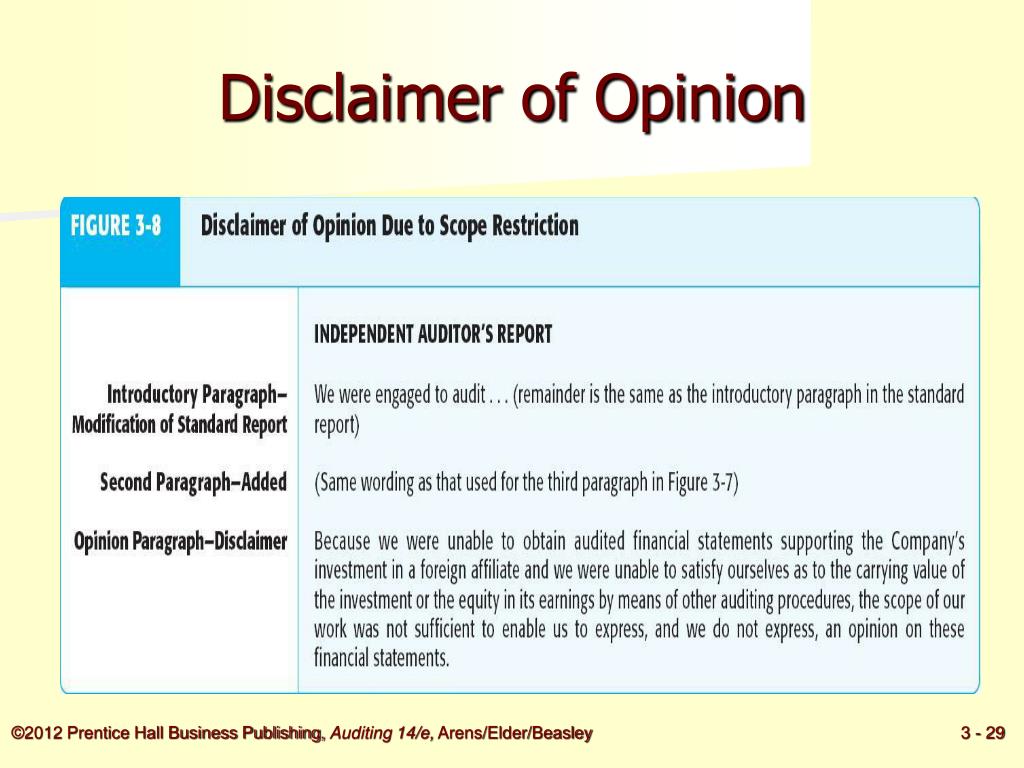

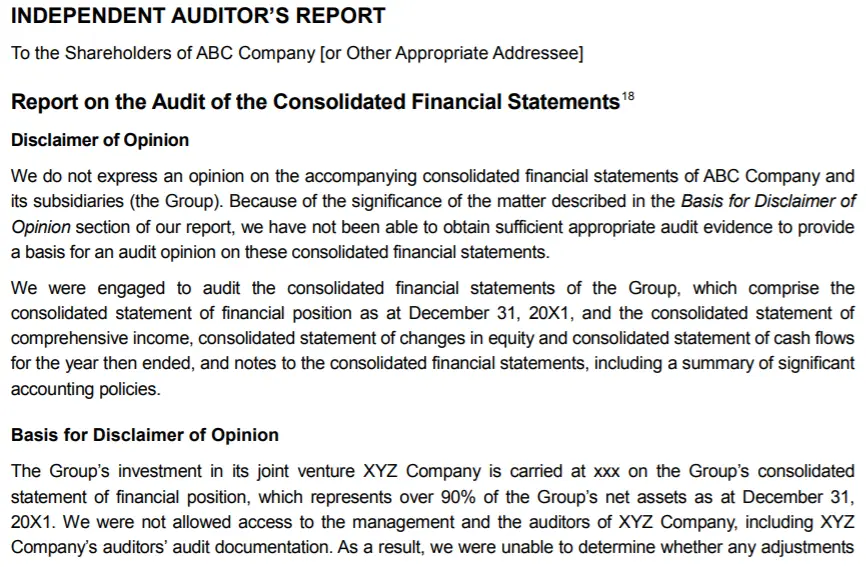

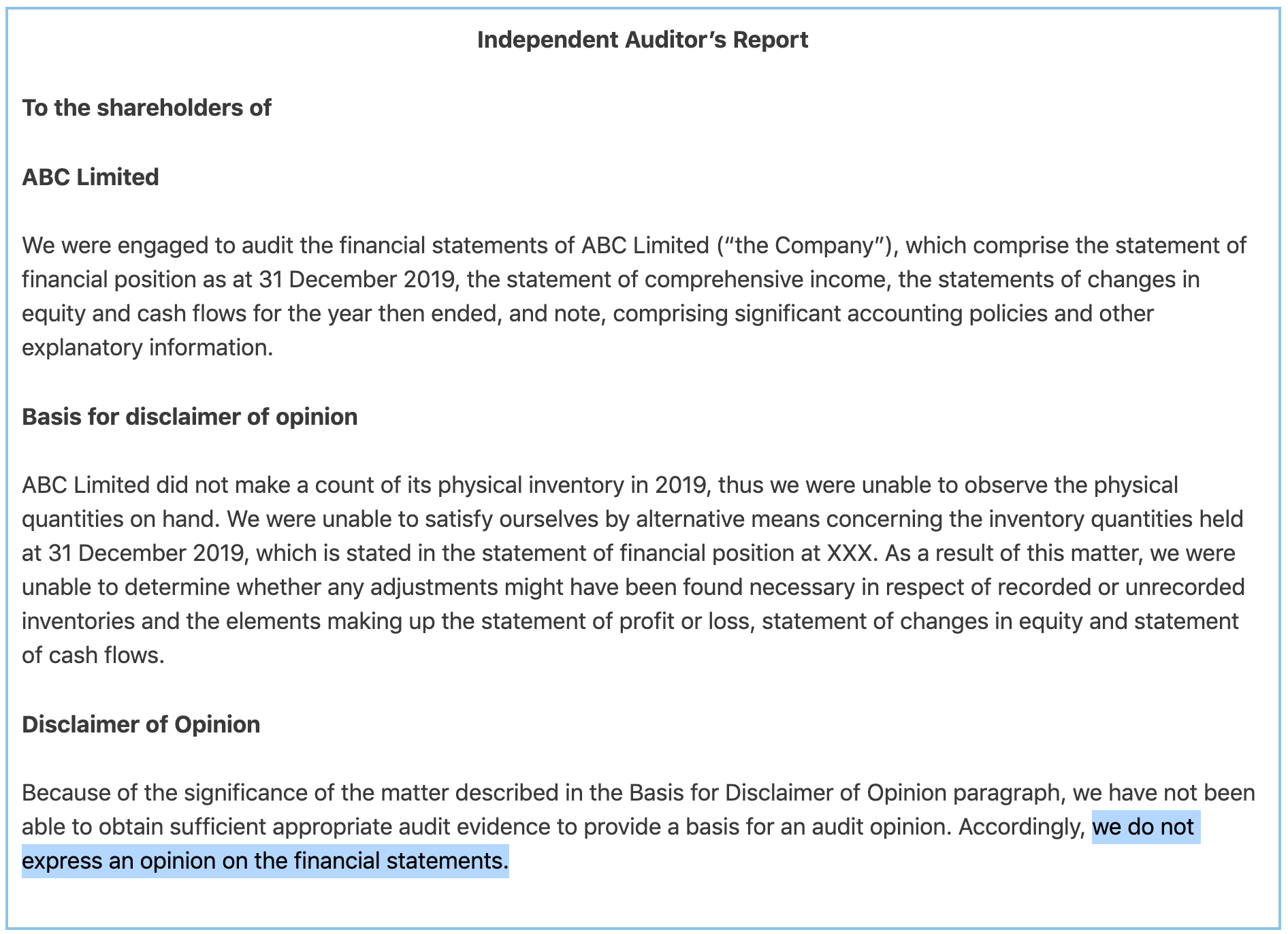

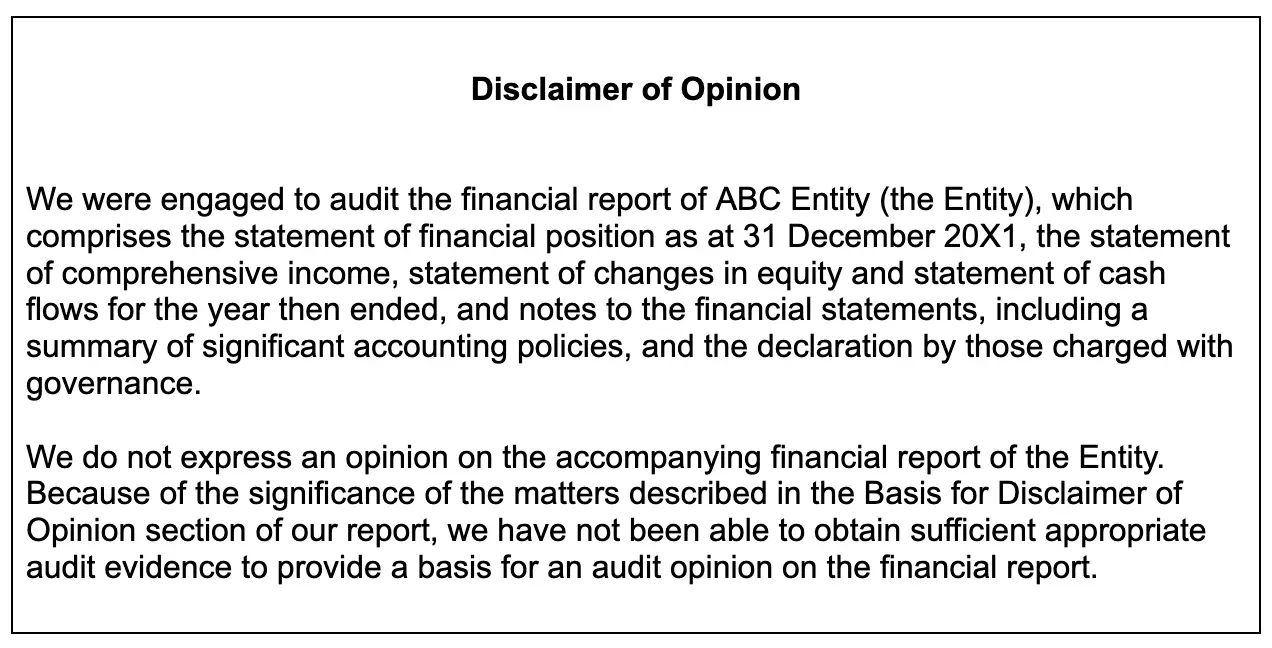

Disclaimer of opinion going concern. A1) going concern basis of accounting 2. Disclaimer of opinion. A disclaimer of opinion states that the auditor does not express an opinion on the financial statements.

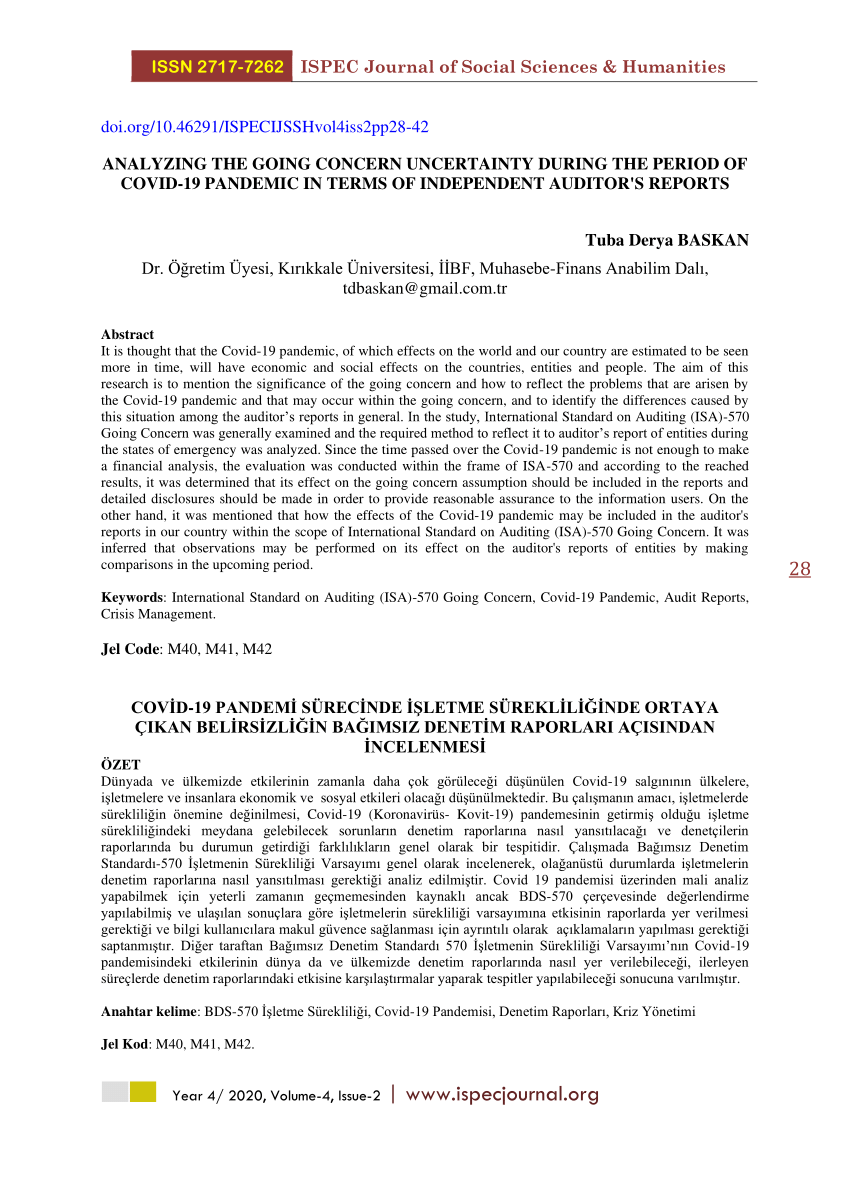

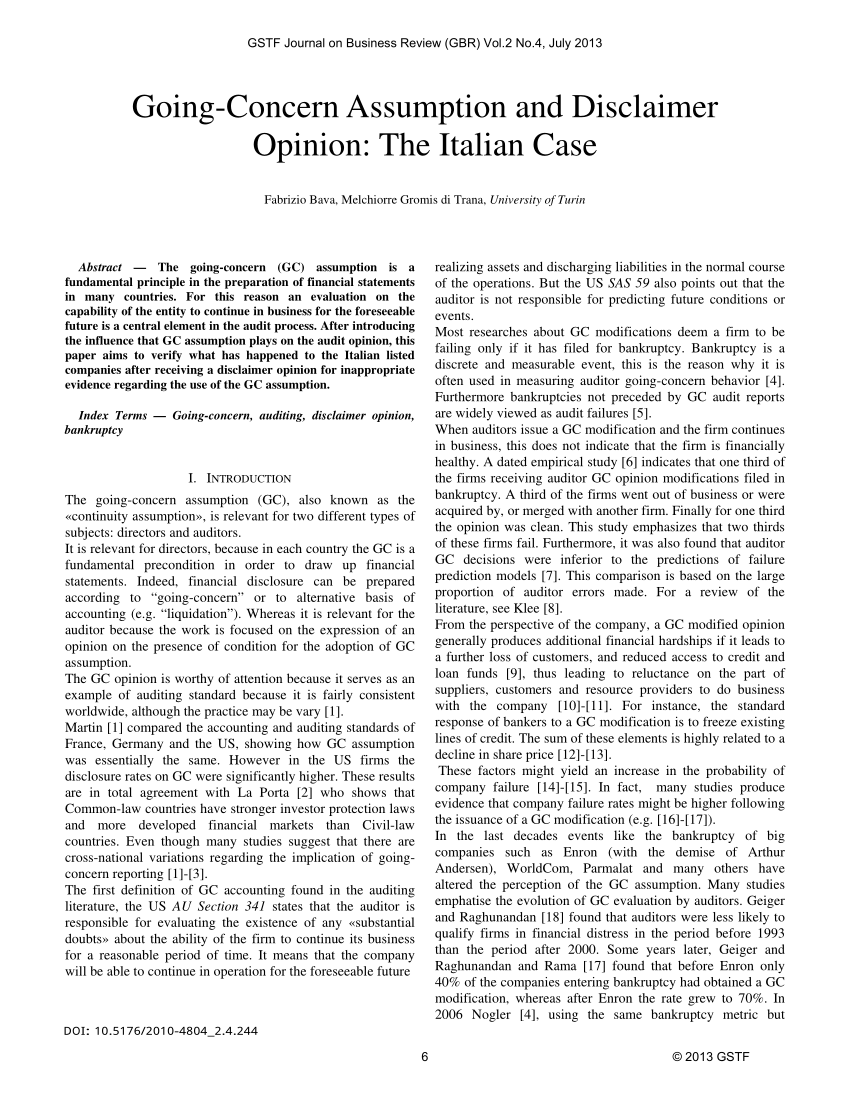

The going concern is defined as the continuation of a firm in the near future by its ability to operate its assets and pay its dues for the purpose of walking its. The group's investment in associate company ooway technology; Basis for disclaimer of opinion use of the going concern assumption the group’s results for the fi nancial year were adversely aff ected by the continuing.

A disclaimer of opinion is issued when the auditor is “ unable to obtain sufficient appropriate audit evidence on which to base the opinion, and the auditor. Basis for disclaimer of opinion going concern during the financial year ended 31 december 2020, the group incurred a net loss of s$7.7 million (2019: A1) going concern basis of accounting 2.

Asiatic group said on wednesday that independent auditor ernst & young has included a disclaimer of opinion in the group's audited financial statements for the. 4 paragraph 19 of isas 570 (revised) requires the auditor to consider whether the financial statements (a) adequately disclose the principal events or conditions that may cast. Other considerations relating to an adverse opinion or disclaimer of opinion (ref:

Financial statements relating to going concern and the implications for the auditor’s report. Question 1 what is the purpose of murgc and kam sections and eom paragraphs in the auditor’s report? Adverse opinion vs disclaimer of opinion;

Financial statements relating to going concern and the implications for the auditor’s report. Shares of discover are down 1.7% lower for. Under the going concern basis.

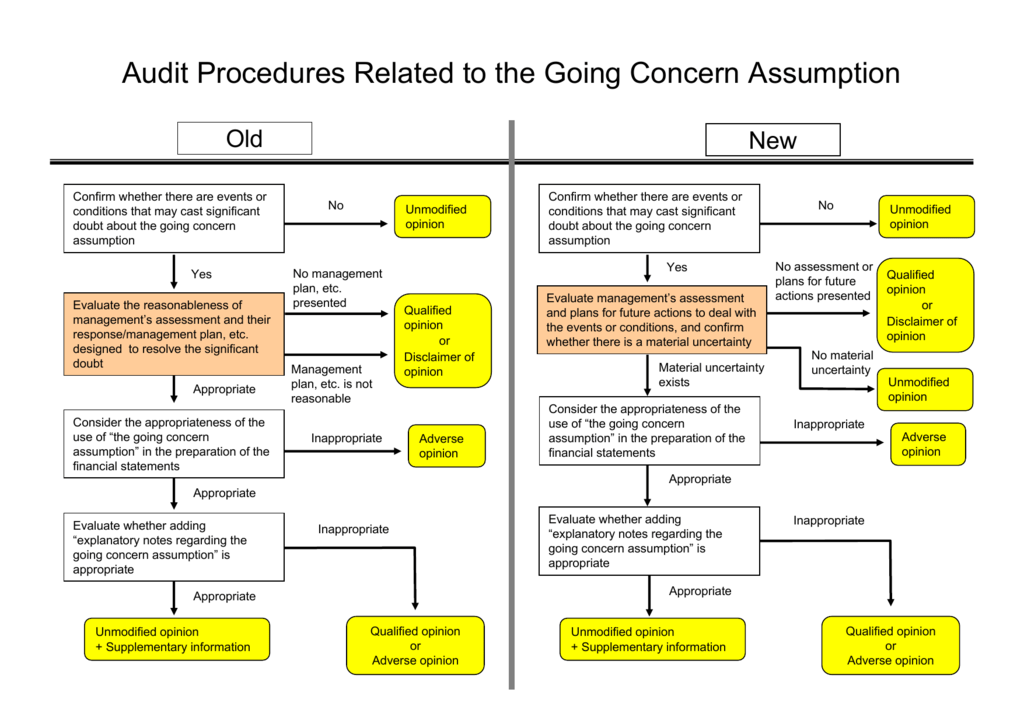

The flowchart in the joint aasb/auasb going concern guidance indicates that in usual circumstances, the auditor gives a disclaimer of opinion if management is. A disclaimer of opinion, except for opinion, or an adverse opinion resulting from going concern matters is permitted by as 2415, but none of these types. Conclusions relating to going concern as the auditor has identified an issue that is so pervasive and is therefore unable to conclude on the financial statements as a.

.15).a18 the following are examples of reporting circumstances that would. Kitchen culture holdings ltd. Pursuant to rule 704(4) and paragraph 3a of appendix 7c of the catalist listing rules, the board wishes to update the shareholders on its responses to the key bases for the.

Auditors are permitted to issue either an unqualified opinion with modified wording or a disclaimer of opinion for entities with substantial doubt about their ability to. The table below provides an overview of the purpose of material. The audit disclaimer of opinion flagged going concern matters;

Auditors obtained sufficient appropriate audit evidence to conclude that financial. If he disclaims an opinion, the uncertainties and their possible effects on the financial statements should be disclosed in an appropriate manner (see paragraph.10), and the.