Casual Info About Preparation Of A Trial Balance Is The First Step

Here is the process to prepare trial balances in your business:

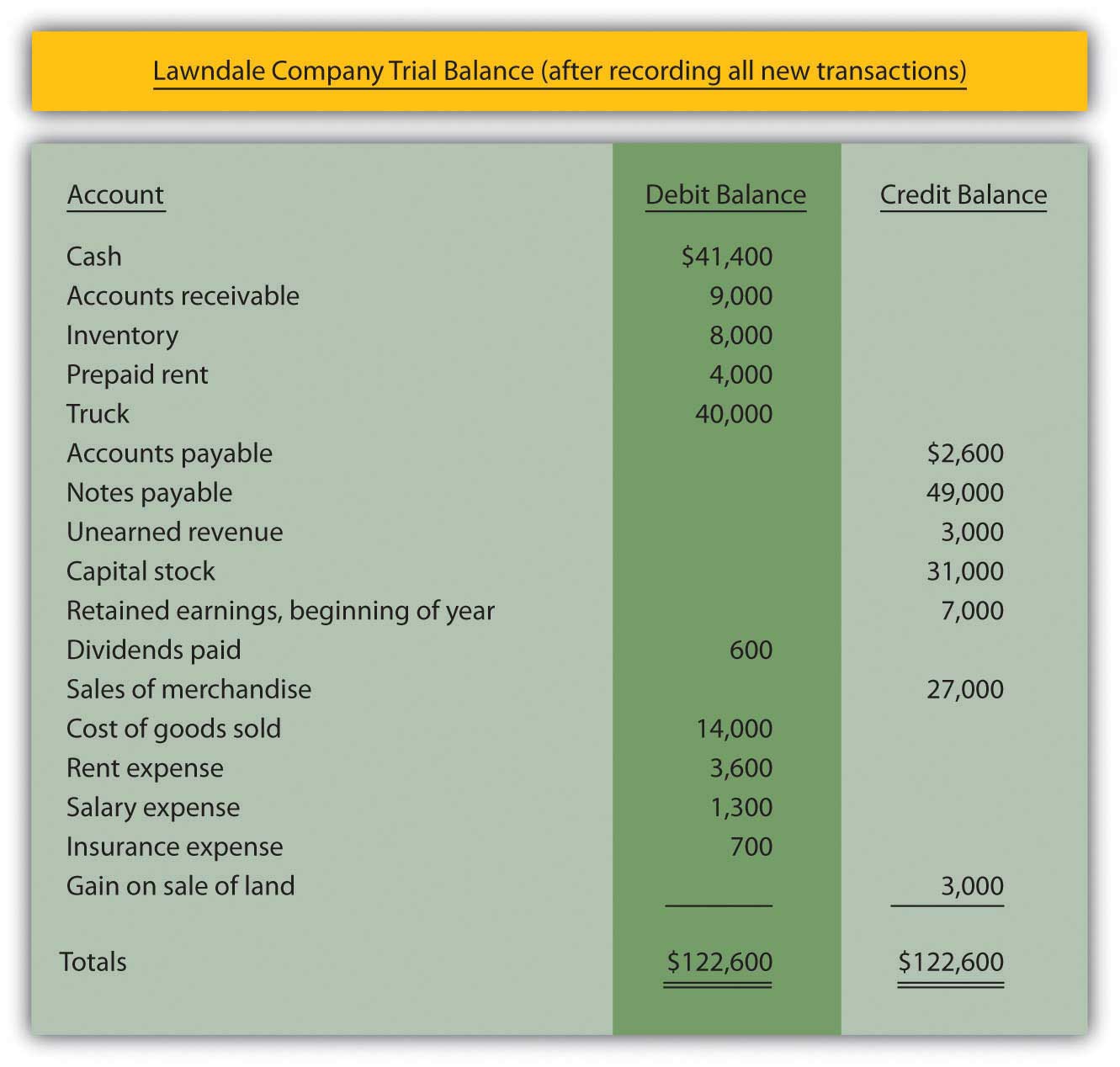

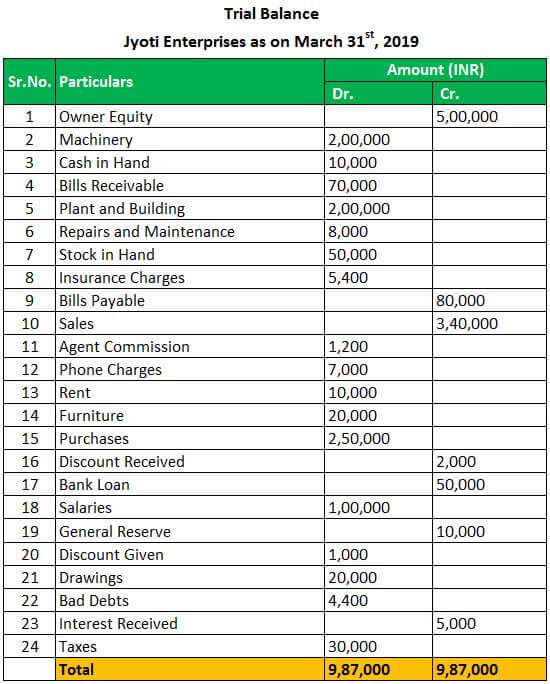

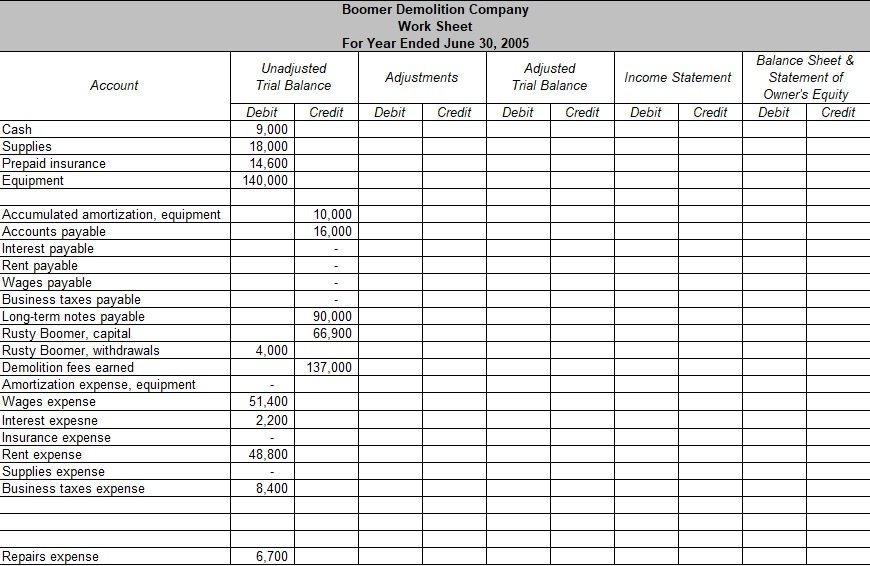

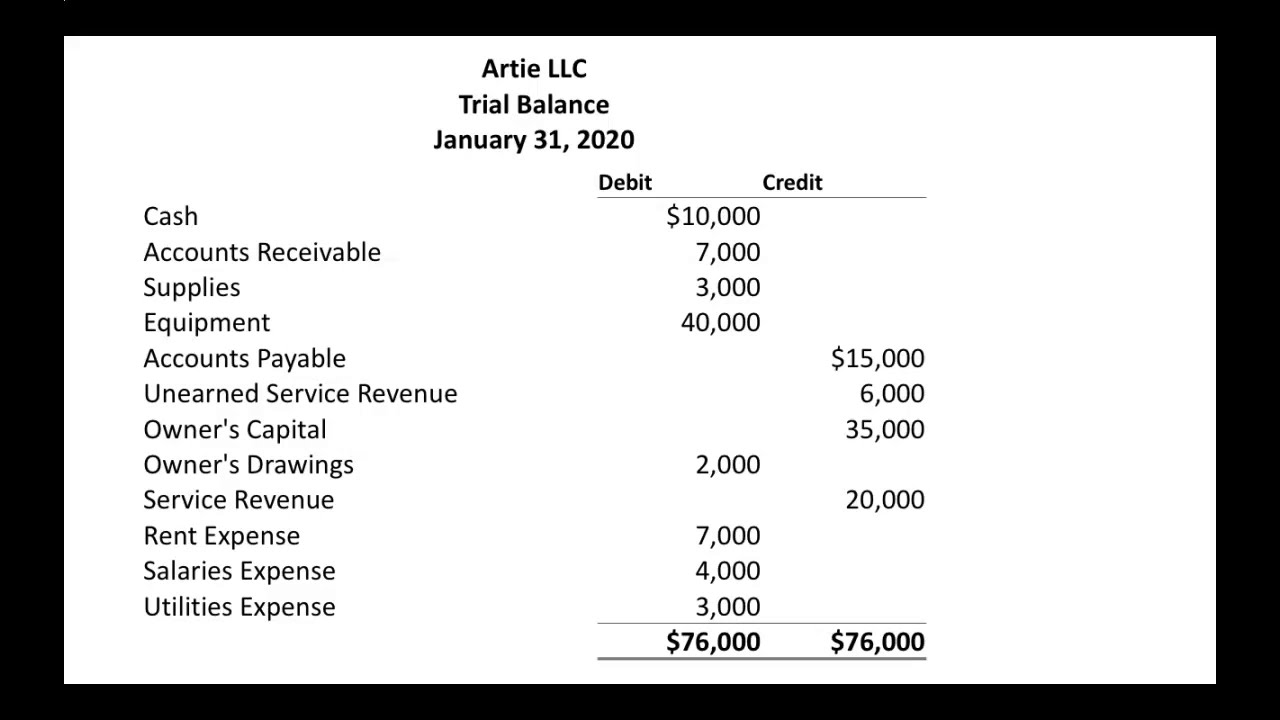

Preparation of a trial balance is the first step. To prepare a trial balance, you will need the closing balances of the general ledger accounts. Note that for this step,. The initial trial balance is prepared to detect any mathematical errors before you make adjusting entries or start closing your books for the accounting period.

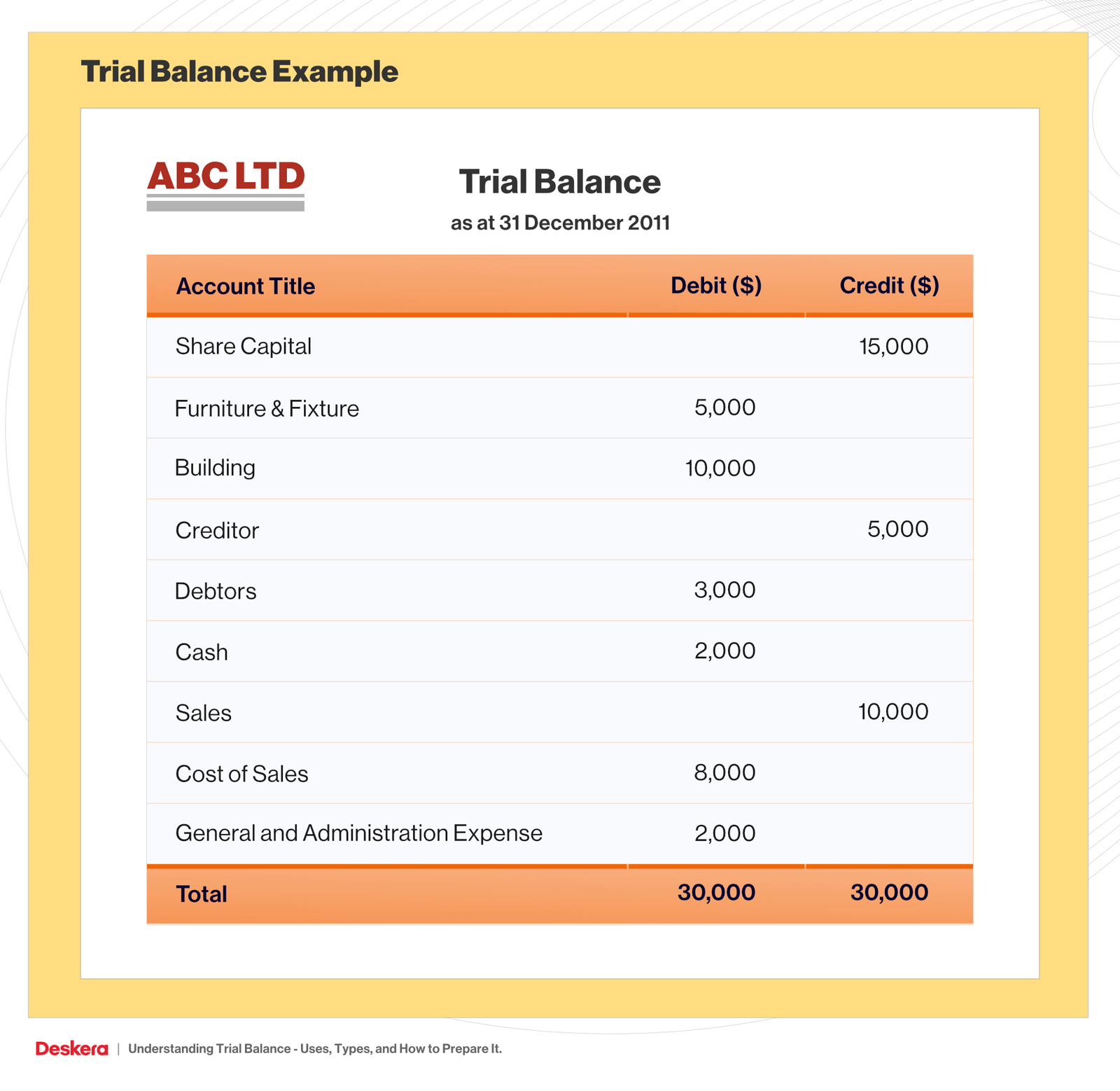

Trial balance is a list of closing balances of ledger accounts on a certain date and is the first step towards the preparation of. Preparing a trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle. The accounting tutor.

Although you can prepare a trial balance at any time, you would typically prepare a trial balance before preparing the financial statements. On the trial balance the accounts. The trial balance is prepared after posting all financial transactions to the journals and summarizing them on the ledger statements.

The difference between debit and credit sums gives you the. The first four steps in the accounting cycle are (1) identify and analyze transactions, (2) record transactions to a journal, (3) post journal information to a ledger, and (4) prepare. Updated february 17, 2024 what is trial balance?

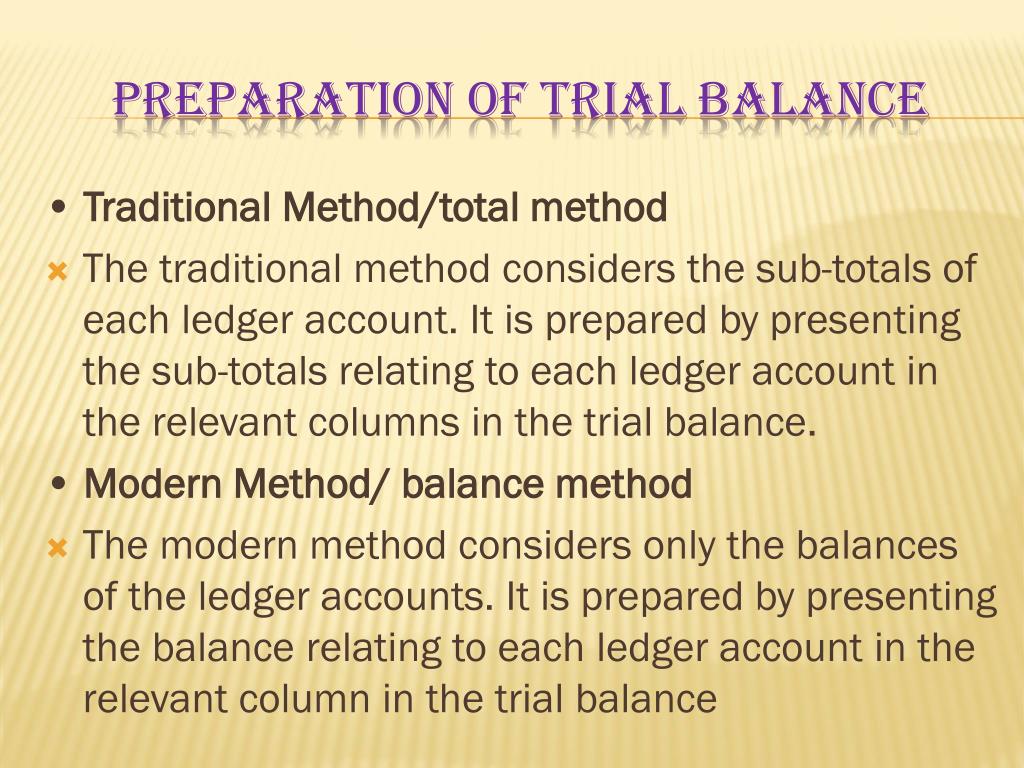

Accounting student accelerator! From this information, the company will begin constructing each of. April 14, 2022 preparation of trial balance following steps are involved in the preparation of a trial balance:

The first step in preparing a trial balance is to complete the heading. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle. It is important for you as a business to tally your trial balance sheet.

Journal entries are posted to the ledger: Trial balance is prepared after the transactions are first recorded in the journal and then subsequently posted in the general ledger. The trial balance is made to ensure that the debits equal the credits in the chart of.

Steps for preparing the trial balance are: It is prepared at the end of the year of an. How to prepare a trial balance?

Although you can prepare a trial balance at any time, you would typically prepare a trial balance before preparing the financial statements. To prepare the financial statements, a company will look at the adjusted trial balance for account information. The first step is to make sure that all the ledger accounts are balanced.

The trial balance is, as the name suggests, is a table where we lay out all our debit accounts and all our credit. How to prepare a trial balance. The heading should show the company name, the statement name, and the date of the trial balance.