Painstaking Lessons Of Info About Cash Basis P&l

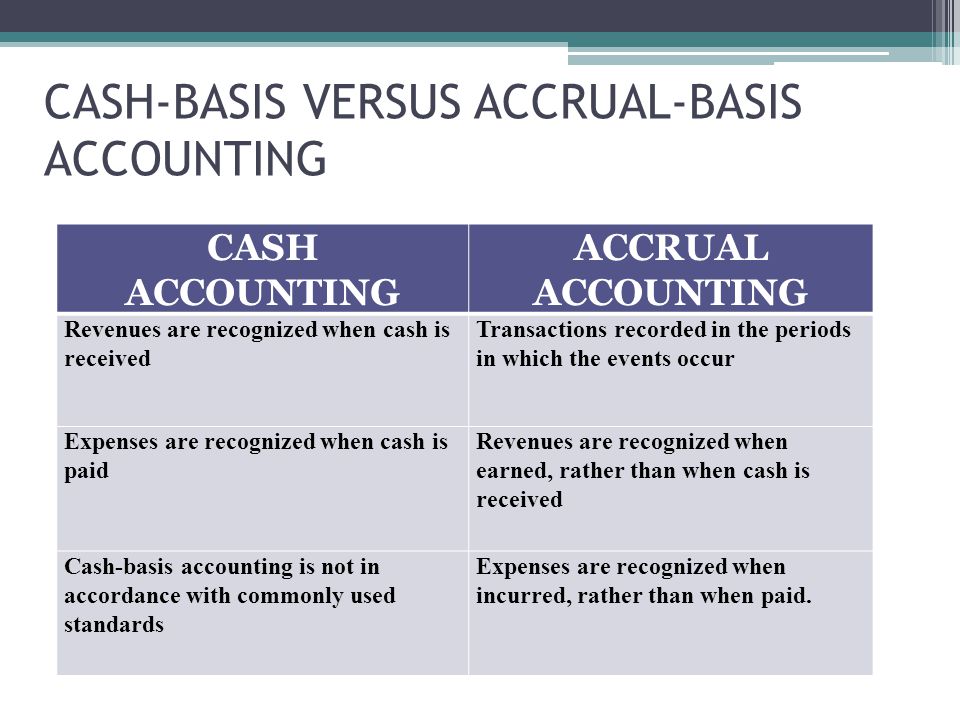

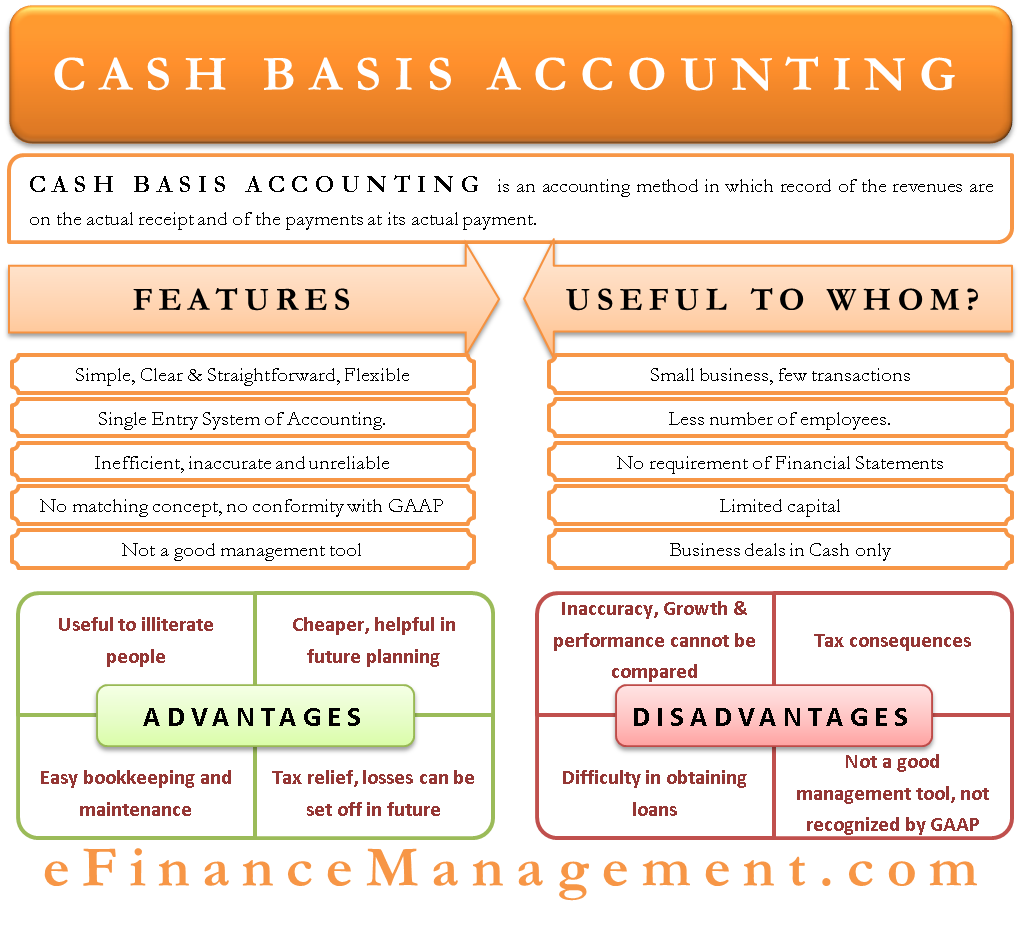

A cash basis income statement is an income statement that only contains revenues for which cash has been received from customers, and expenses.

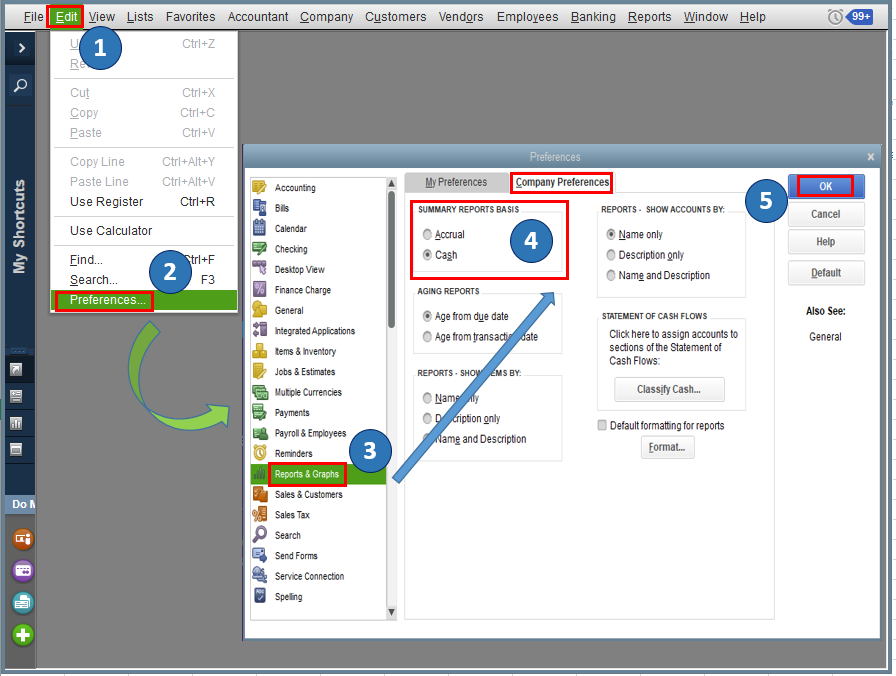

Cash basis p&l. Go to solution july 2017 i use the discounts given column on a sales payment receipt to record the paypal fees that have been deducted when a customer pays for an. Updated november 28, 2023 reviewed by andy smith fact checked by michael rosenston accrual accounting vs. Trump's stake in the parent of his social media app truth social is worth about $4.

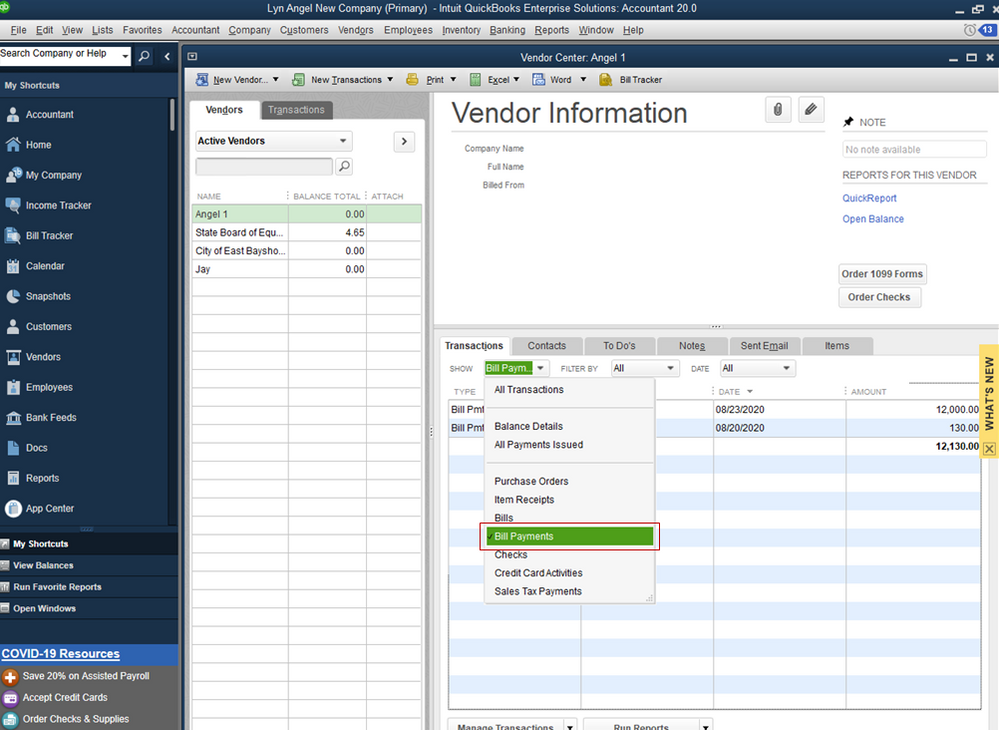

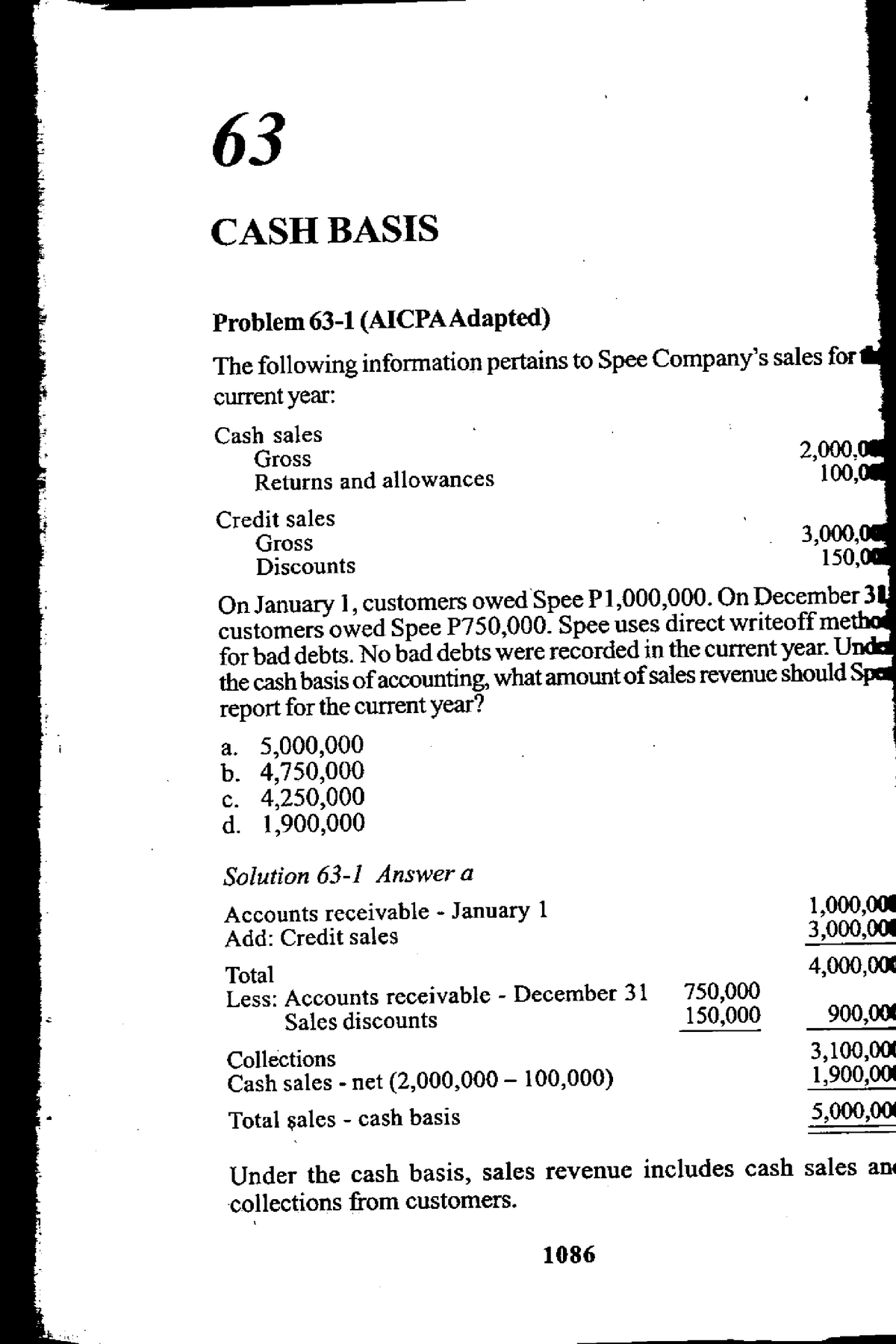

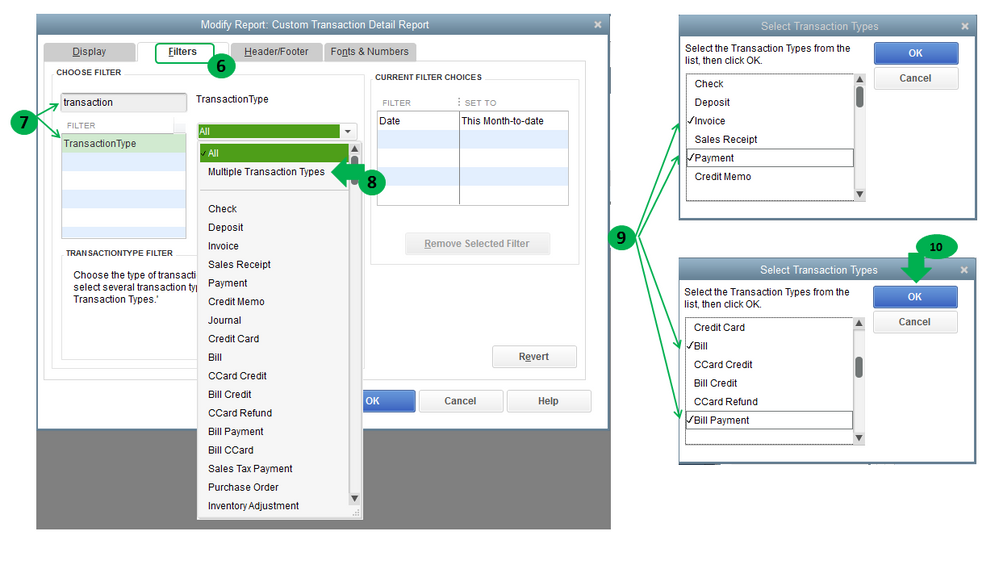

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a. My cash basis p&l report is including partial amounts from unpaid invoices. Laura italiano and jacob shamsian.

Willis, and the special prosecutor she hired to handle the election interference. If he chooses to file a bond, he will likely. The cash method or the accrual method.

Example of a p&l statement. P&l statements tend to follow a standard format: Trump claimed under oath last year that he was sitting on more than $400 million in cash, but between justice engoron’s $355 million punishment, the interest mr.

Trump testified in a deposition last year that he had roughly $400 million in cash. A p&l statement can be prepared in two main ways: An overview the main difference.

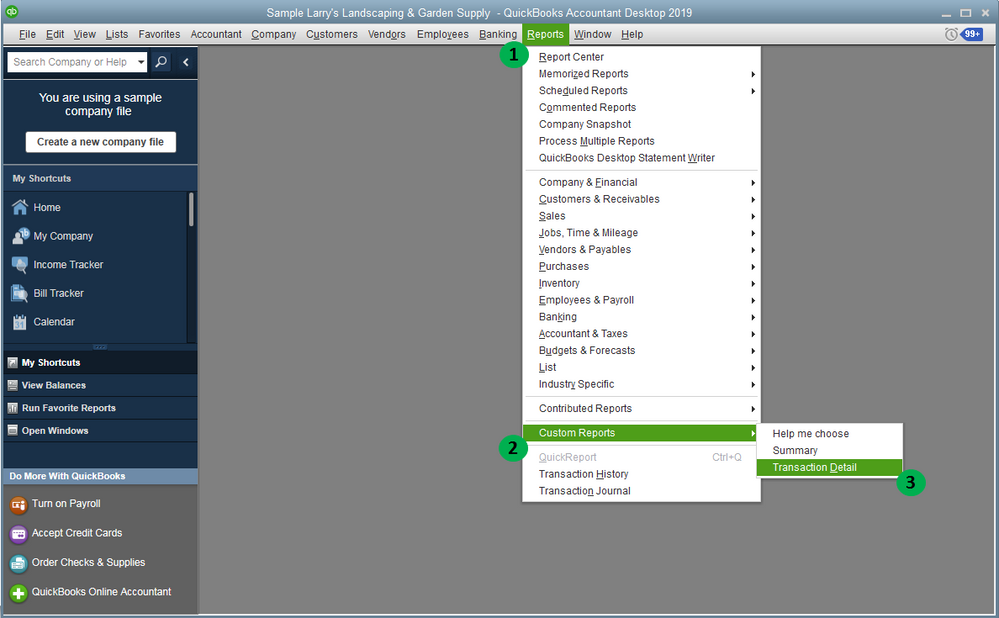

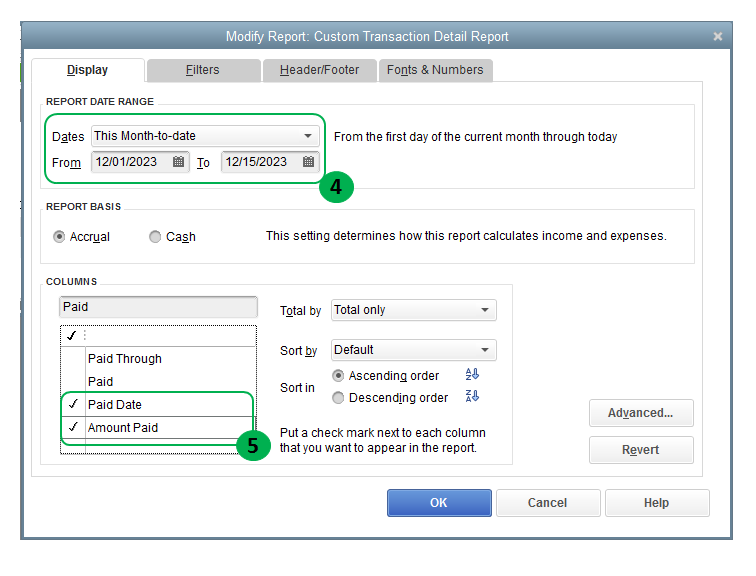

The reason it doesn't show on your cash basis p&l in december is that a bill payment creates a journal entry that debits a/p and credits your bank account,. Cash basis p&l report includes parital amounts from unpaid invoices. Cash basis refers to a major accounting method that recognizes revenues and expenses at the time cash is received or paid out.

Your p&l statement shows your. Defense lawyers argue a romance between the fulton county district attorney, fani t. Here's what the ruling means.

26 verdict to either pay cash into the court’s escrow or get a bond while he appeals. The balance sheet reports the assets, liabilities and shareholder equity at a specific point in time, while a p&l statement summarizes a. Here's the main one:

Under this method, the p&l statement only accounts for. Typically, cash basis p&l reports reflect invoices with applied discounts because it's a reduction to your gross sales.