Underrated Ideas Of Tips About Note Payable In Balance Sheet

More about notes payable.

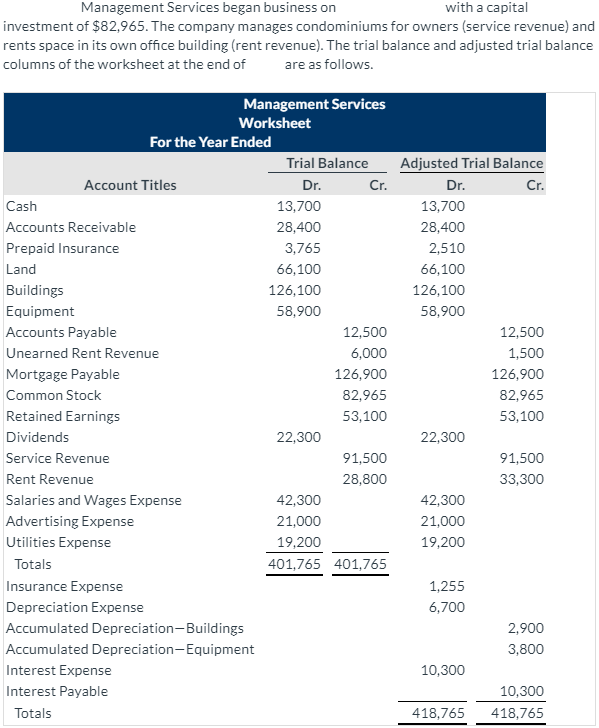

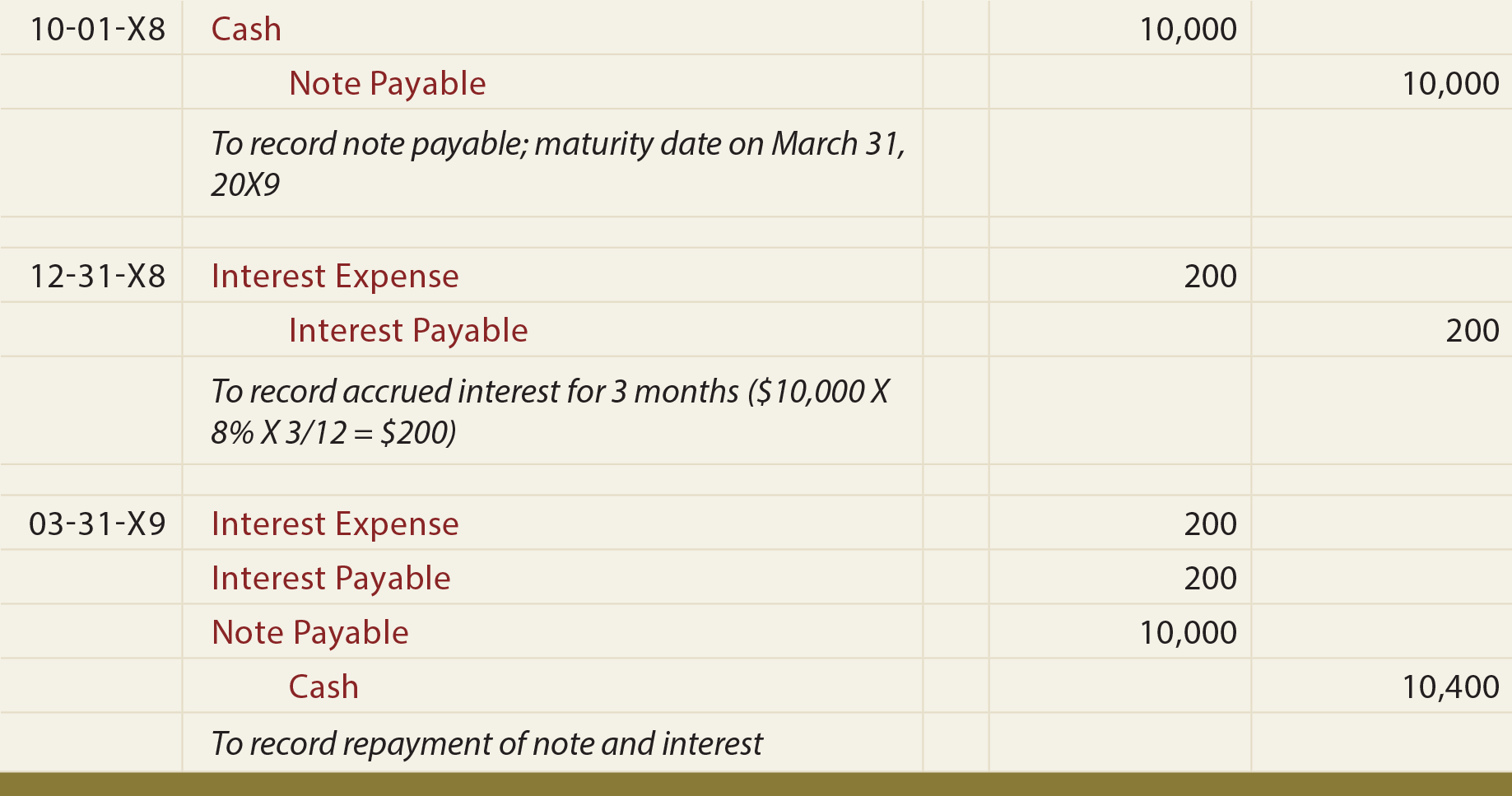

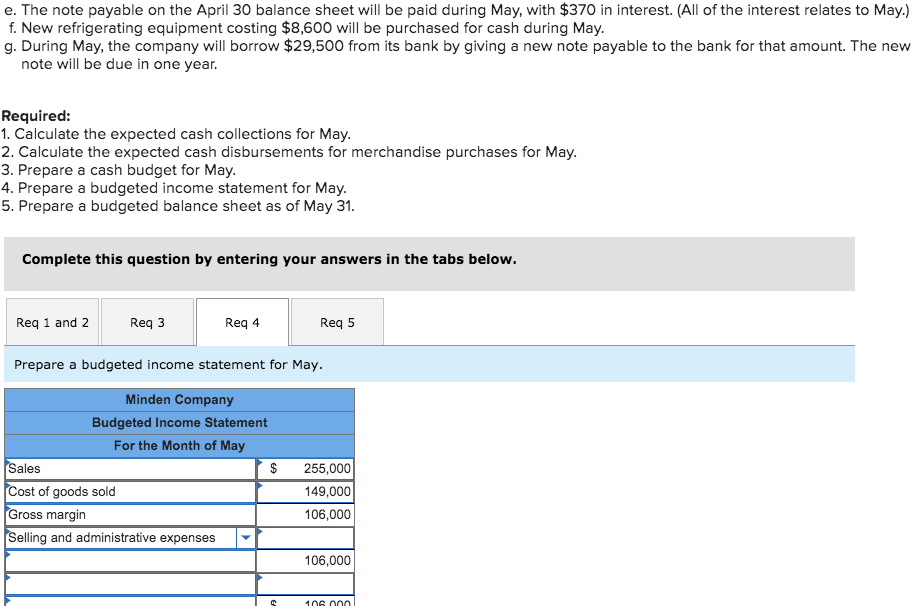

Note payable in balance sheet. 11.3 accounts and notes payable publication date: Recording a notes payable includes specifying details and terms of the agreement,. A note payable is a loan contract that specifies the.

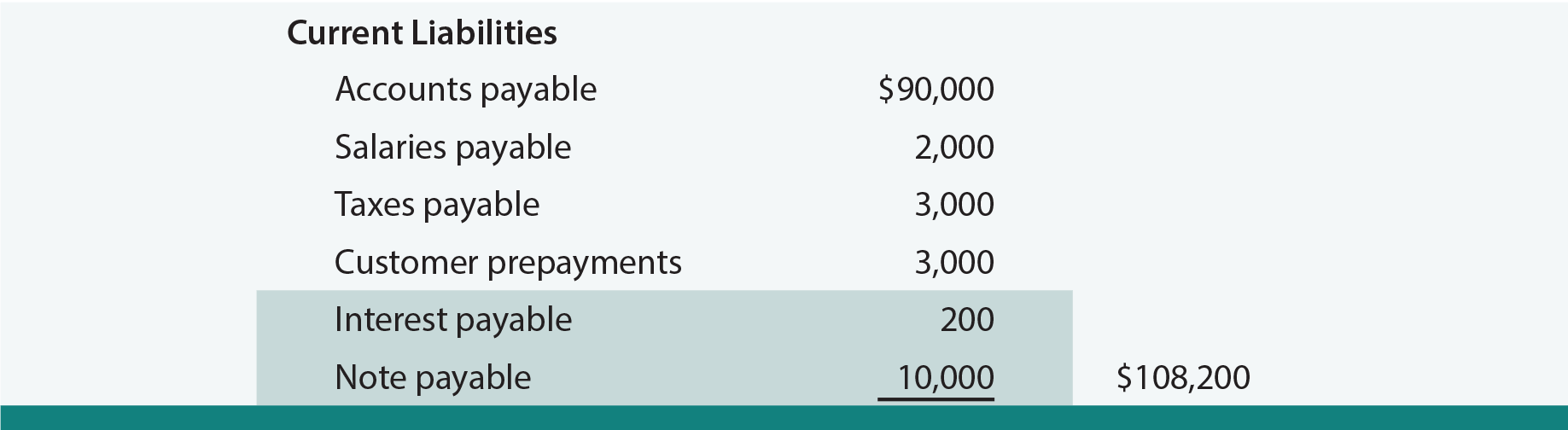

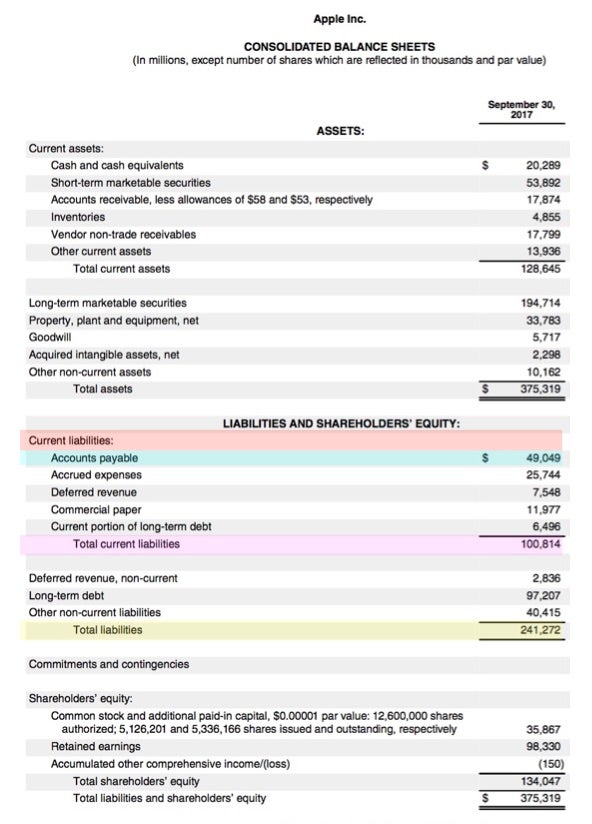

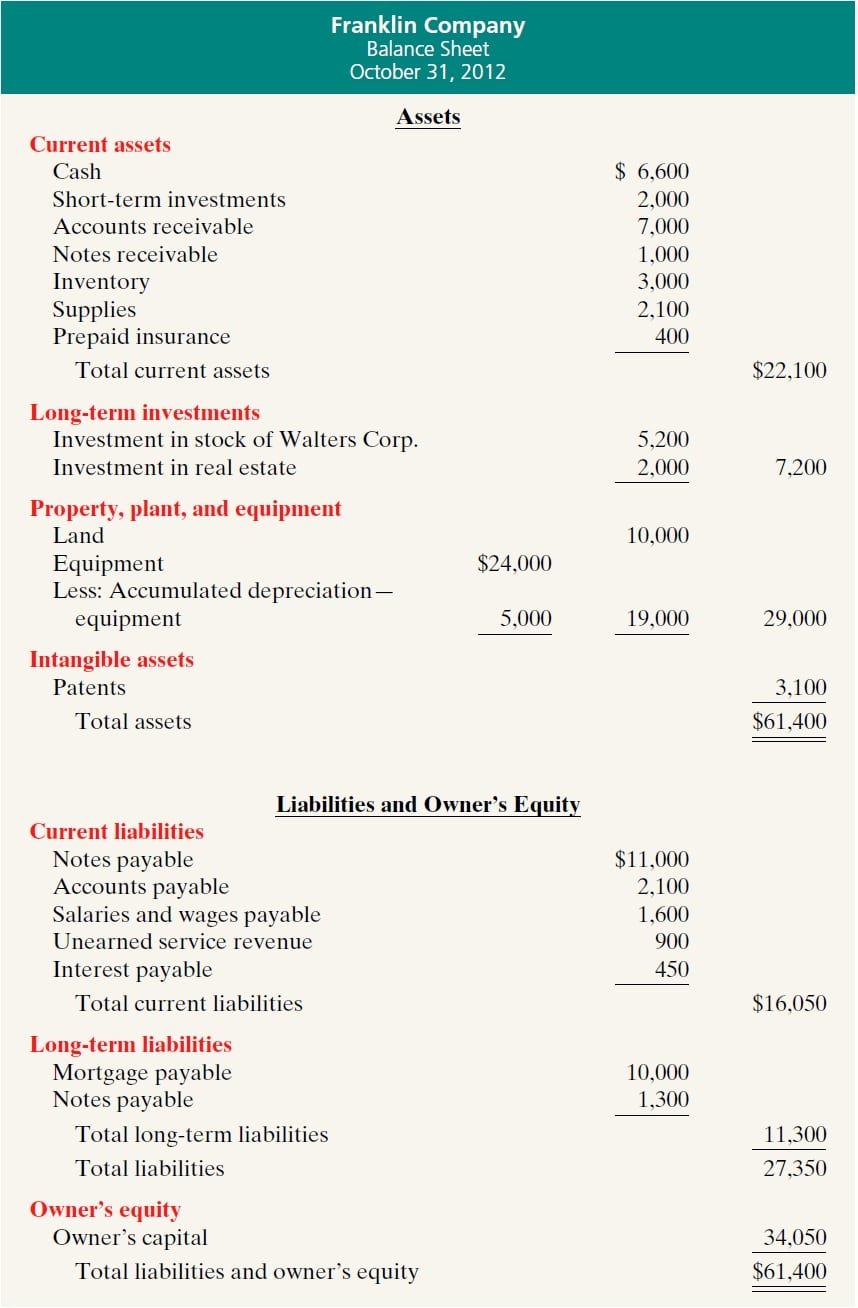

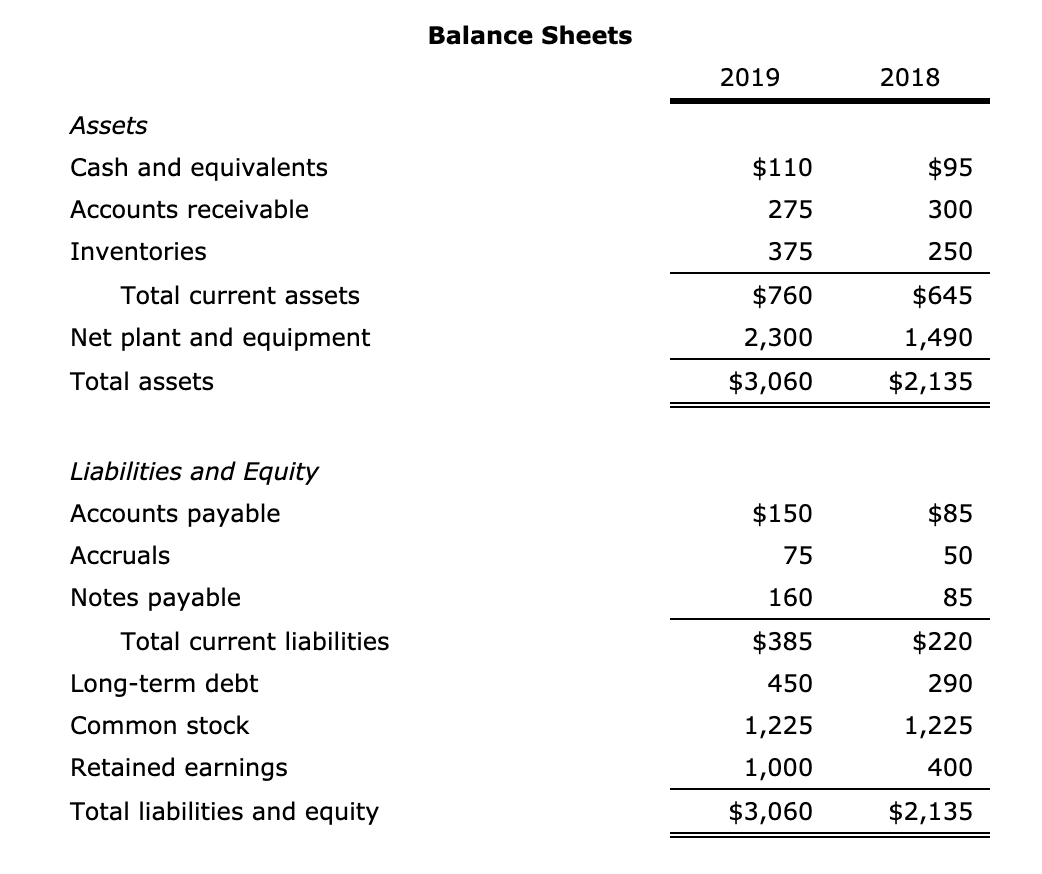

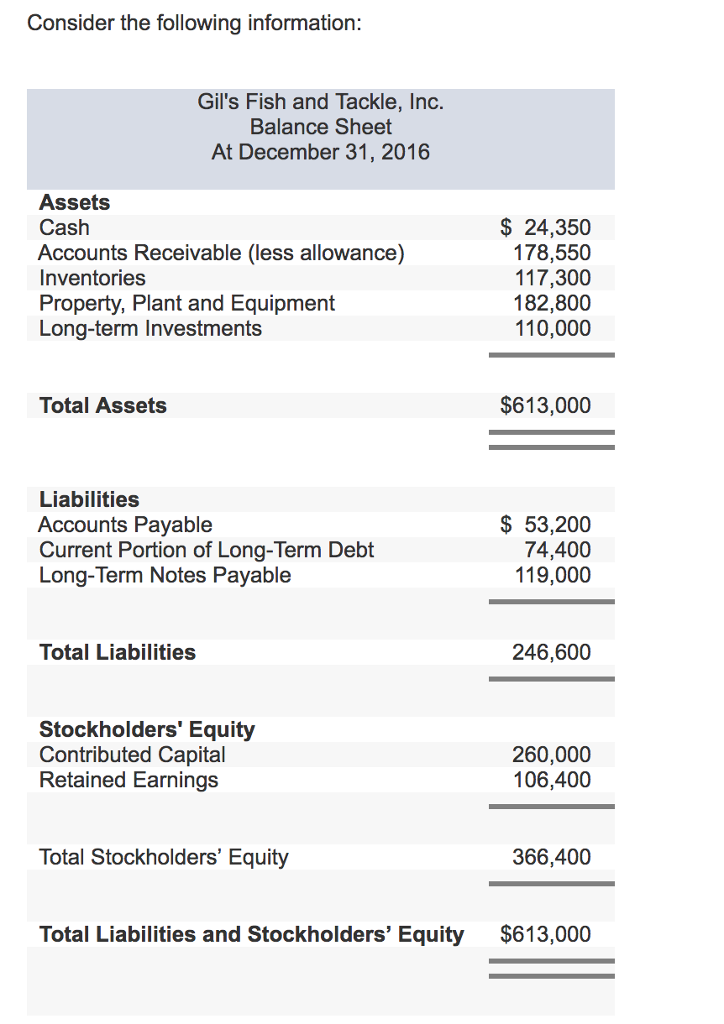

Steve signs the note payable and agrees to pay bob $60,000 two years later, or by the latest 31 january 2023. Notes payable appear as liabilities on a balance sheet. The balance sheet below shows that abc co.

When you record notes payable on balance sheet, use the following accounts: Notes payable is a formal agreement, or promissory note, between your business and a bank, financial institution, or other lender. Notes payable on balance sheet short term notes payable are due within one year from the balance sheet date and classified under current liabilities in the.

Notes payable is a written agreement in which a borrower promises to pay back an amount of money, usually with interest, to a lender within a certain time frame. A company’s notes payable amounts must be included on its balance sheet. Cash interest expense interest payable notes payable if your company.

Typically, businesses record notes payable under the liabilities section of the balance sheet. The maker then records the loan as a note payable on the balance sheet. In addition, steve also agrees to pay all bob a 20% interest rate.

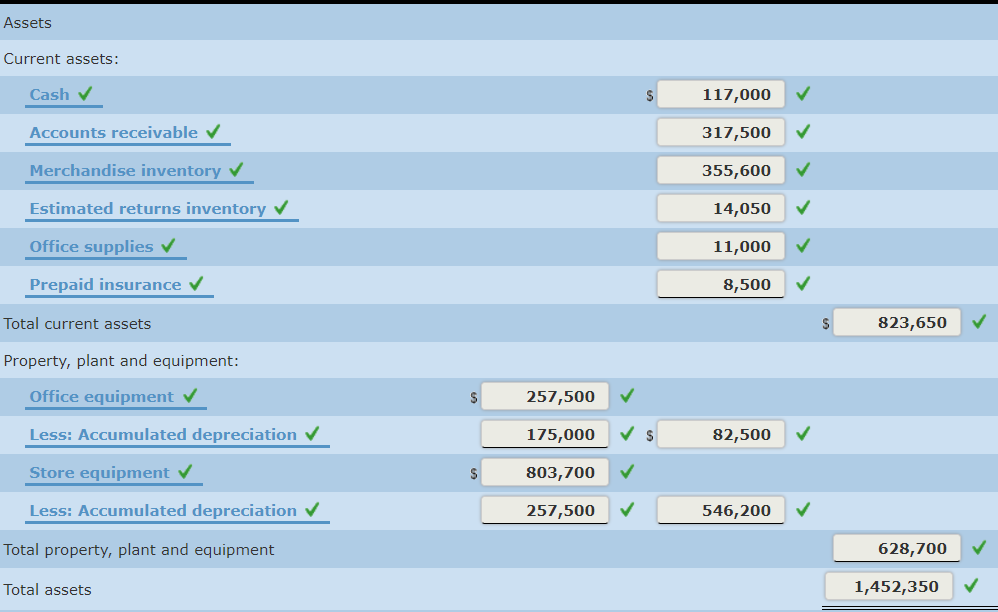

Likewise, the company needs to make the notes. Accounting document from ivy tech community college, indianapolis, 1 page, part c balance sheet assets liabilities cash. A note payable is an agreement between a borrower and a lender, usually in the form of a promissory note, that outlines the terms of repaying a loan.

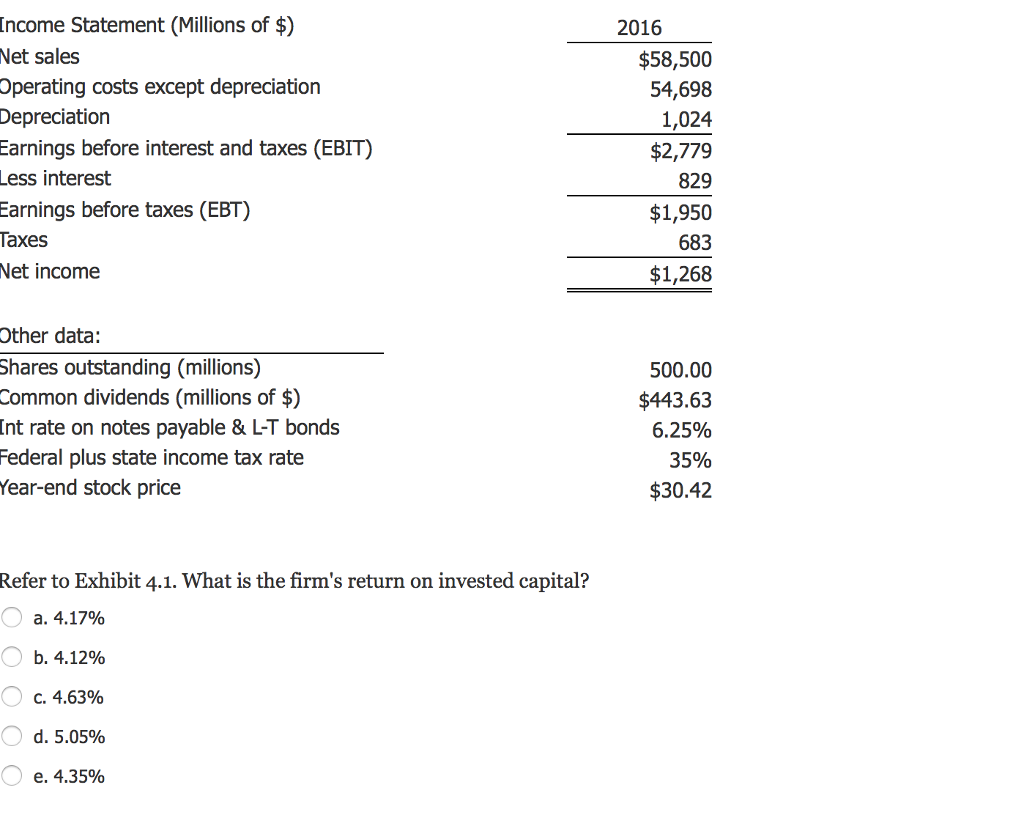

If you look at a few years’ worth of balance sheets, you can calculate and track certain ratios to get an. The liabilities section generally comes after the assets section on a balance. It can also be referred to as a statement of net worth.

Additionally, they are classified as current liabilities when the amounts are due within a year. In accounting, notes payable is a general ledger liability account in which a company records the face amounts of the promissory notes that it has issued. These borrowings are reflected in the liabilities section of the balance sheet in.

Each of these balance sheet components can tell a story.