Looking Good Info About Bad Debts In Cash Flow Statement

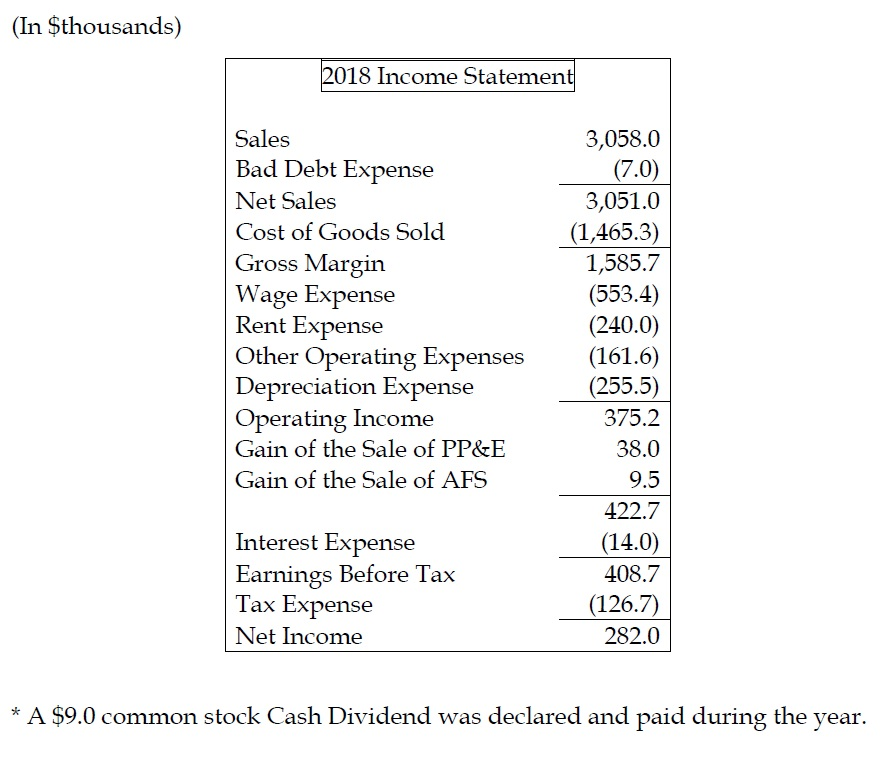

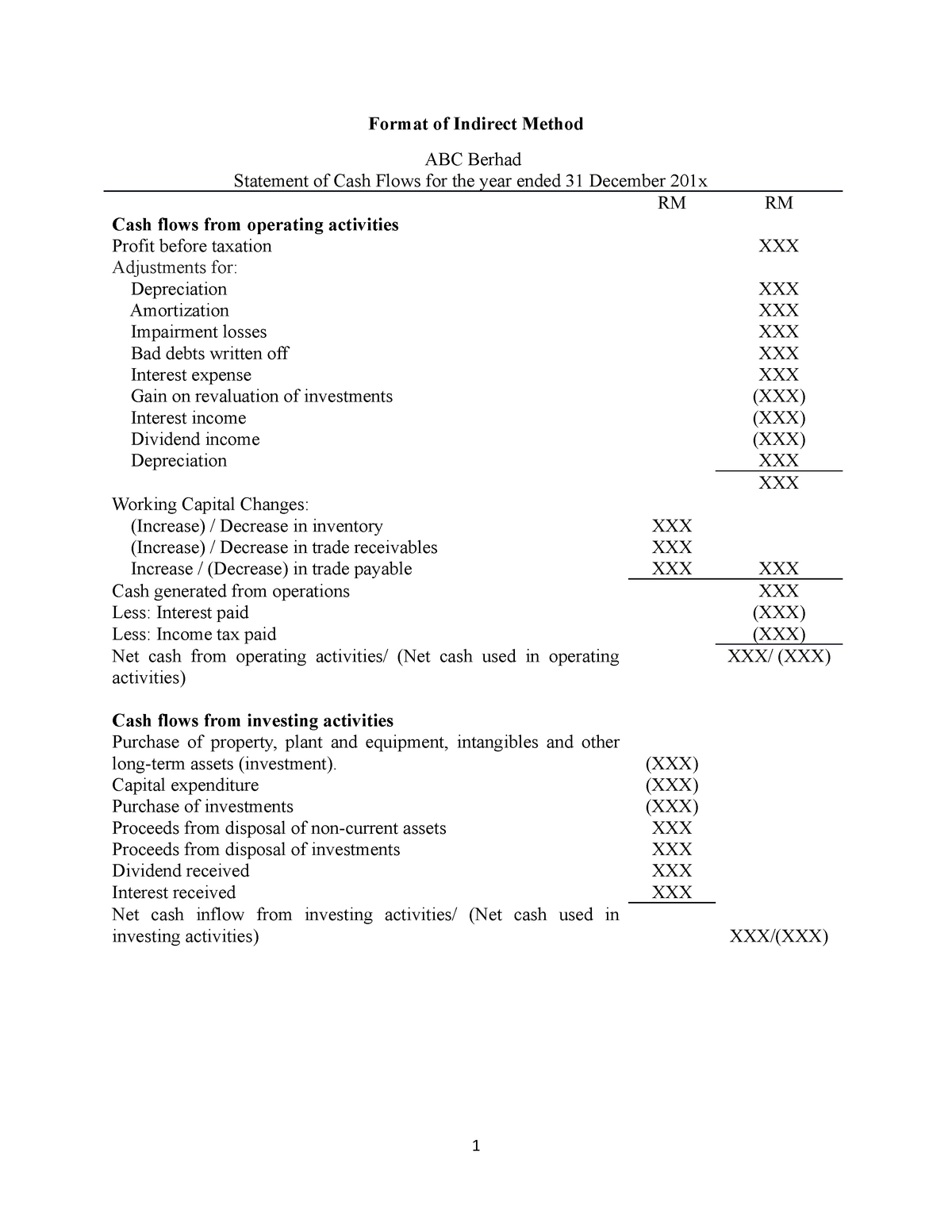

This process is critical when reporting cash flows under the indirect method of.

Bad debts in cash flow statement. Classification of a bad debt expense as a cash flow revenue recognition. Because you set it up ahead of time, your allowance for bad debts will always be an estimate. The cash flow statement is typically broken into three sections:

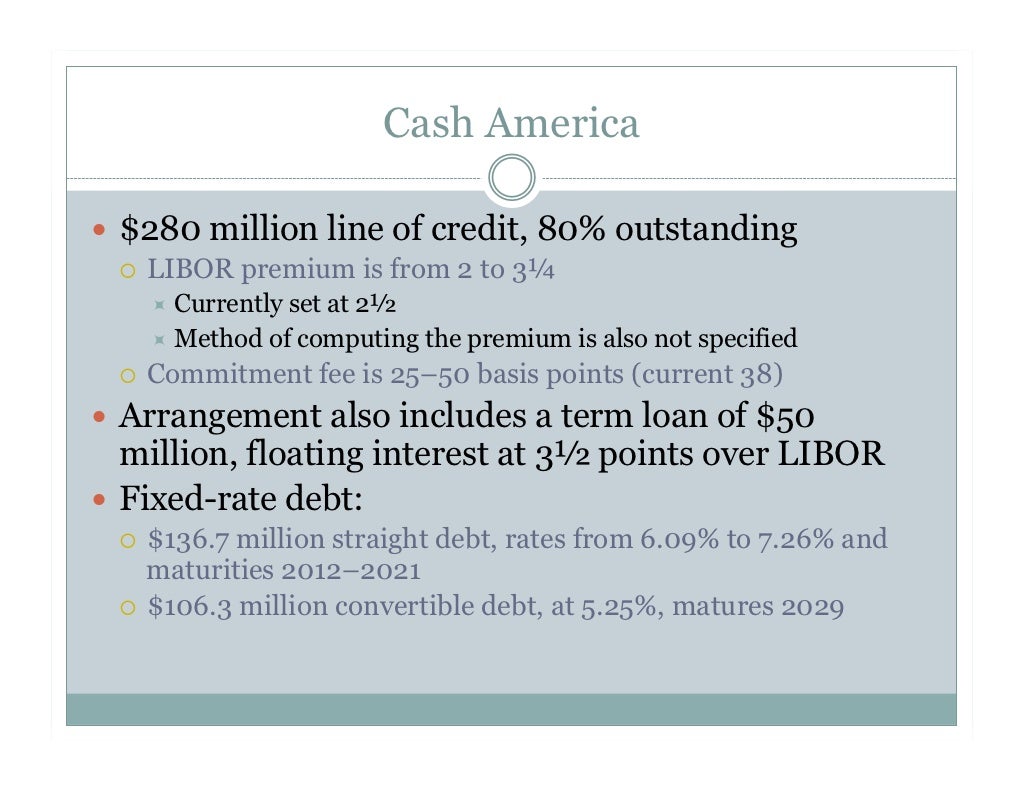

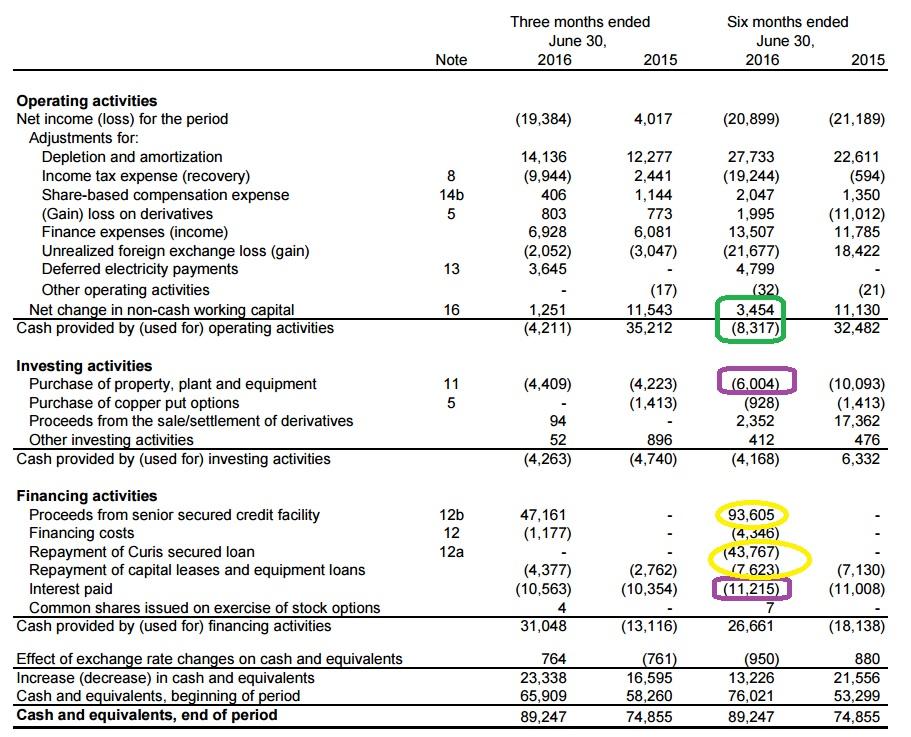

The lecturer says it is not included because it doesn’t affect. The third section of the cash flow statement examines cash inflows and outflows related to financing activities. A cash flow statement is one of the quarterly financial reports publicly traded companies are required to disclose to the u.s.

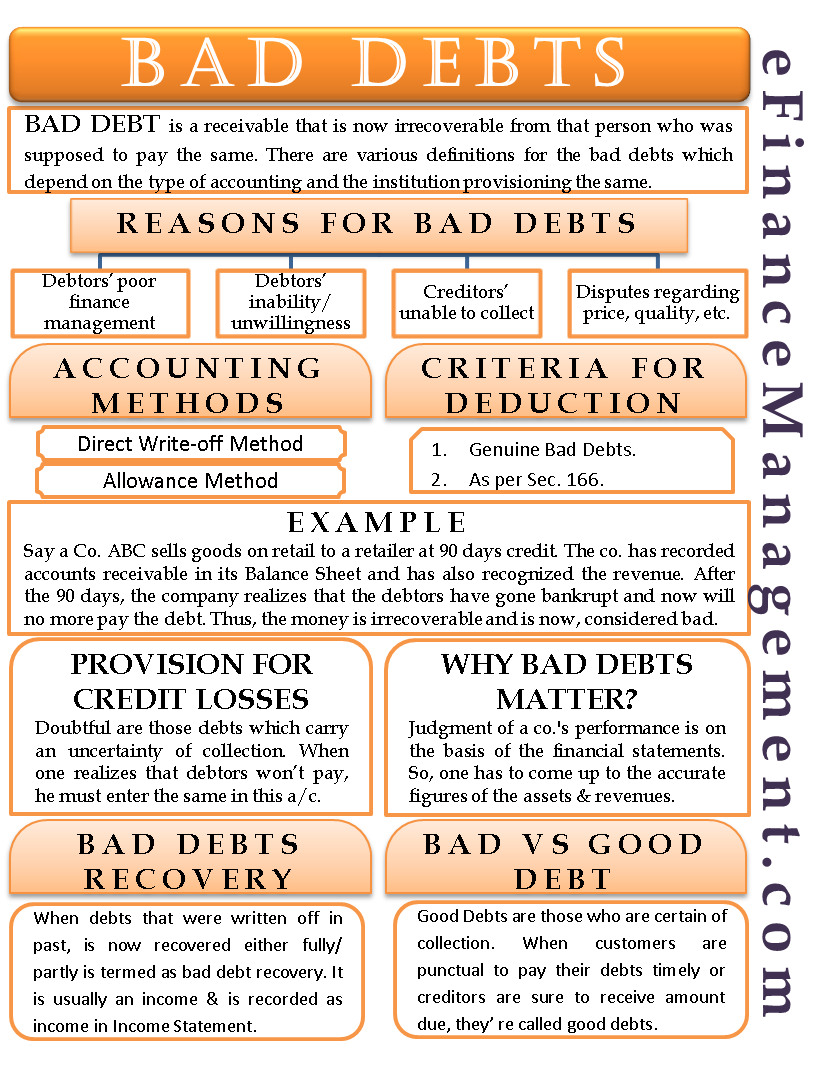

You see, bad debts are not an actual flow of cash. Learns that a customer with $5,000 in unpaid invoices has filed bankruptcy. The operating section of your cash flow statement records.

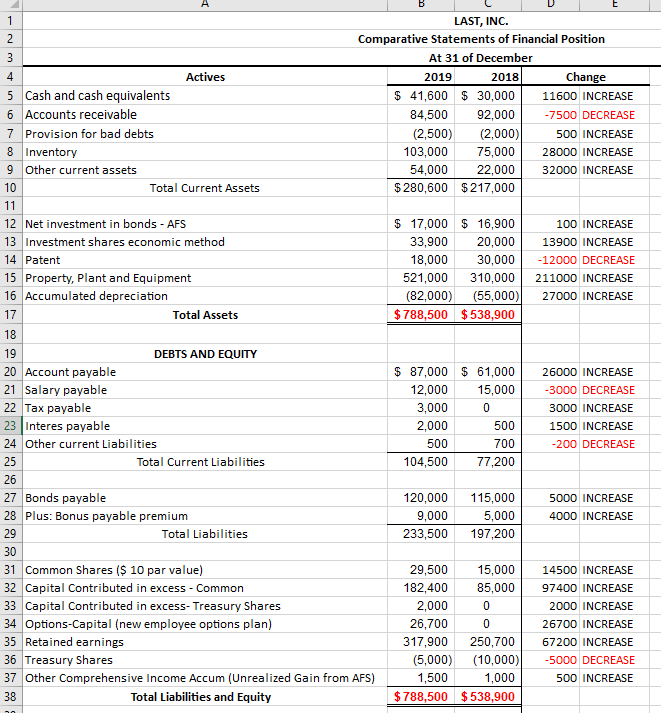

Operating activities investing activities financing activities operating activities detail cash flow. When your cash flow statement shows a negative number at the bottom, that means you lost cash during the accounting period—you have negative cash flow. The scf reports the cash inflows and cash outflows that occurred during the same time interval as the income statement.

For example, if in 2021 i had receivables of £500,000 with bad debts of £10,000 and allowance for receivables of £50,000, then we are left with an end balance. You don't care about accounts receivable, only about money actually received. Hi katrien, that's kind of a trick question.

Planning for this possibility by estimating the amount of uncollectible loans is called bad debt provision and can enable companies to measure, communicate, and. The time interval (period of time) covered in the scf. Begin with net income from the income statement.

Remove the effect of gains and/or losses from. Examples of financing cash flows include the cash received from new borrowings or the cash repayment of debt as well as the cash flows with shareholders in the form of cash. Calculate cash flow from financing activity.

It took me a while to understand why bad debt is not included in the statement in the same manner as depreciation. Cash flow statement: When a business is owed money, the obligation must derive from some sort of transaction with.

The bad debt provision isn't an issue with the direct method. Estimating your bad debts usually involves some form of the percentage of. Add back noncash expenses, such as depreciation, amortization, and depletion.

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)