Fabulous Tips About Irs Audit Bank Statements

The irs routinely seeks banking and account information from both domestic and overseas institutions.

Irs audit bank statements. This difference could potentially lead. Under the revised proposal, banks would have to report only on accounts with at least $10,000 in annual deposits or withdrawals, not counting deposits from. Irs statement — updated irs audit numbers pdf may 26, 2022 — today’s data book release contains important statistics about the nature of the irs’s enforcement activities.

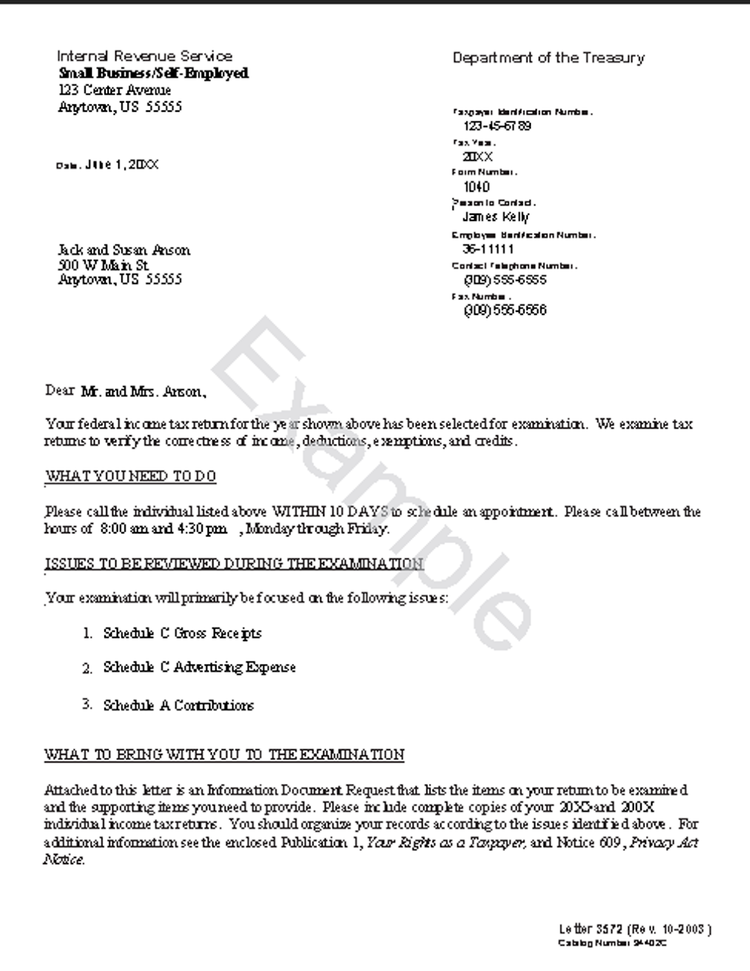

When it comes to income, the auditor asks for all of your bank statements from all accounts. The bank will report the $1,000,000, exposing the difference between the original deposit and the amount the sbo reported; 4.8/5 ( 31 votes ) the short answer:

The irs will request you to provide the bank statements for the audit; If you do not, they will issue a subpoena to your bank to acquire them. The tax gap has widened, and this partly reflects less rigorous enforcement by the irs in recent years.

The irs probably already knows about many of your financial accounts, and the irs can get. They will match bank deposits to income declared on the tax return. They will match bank deposits to income declared on the tax return.

The responsibility to prove entries, deductions, and statements made on your tax returns is known as the burden of proof. After pausing during the pandemic, the irs is sending out lt38 notices for the first time in two years. Claiming too many deductions can trigger an audit.

You may also have to argue against penalties during the audit by providing facts on how you made your best effort to comply. Trump’s civil fraud trial as soon as friday, the former president. The irs and most states can audit tax returns for three years from the filing date, so your bank statements need to be accessible for at least that long.

Every audit focuses on certain aspects of a return, but the kinds of records we request will most likely be on the. Does irs audit look at bank statements? When a new york judge delivers a final ruling in donald j.

When it comes to income, the auditor asks for all of your bank statements from all accounts. 16, 2024 updated 9:59 a.m. Story by susan tompor, usa today • 1h.

If the irs disagrees, you can appeal the decision. Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit. The irs probably already knows about many of your financial accounts, and the irs can get information on how much is there.

You must be able to prove (substantiate). Your return could become flagged if you claim more deductions than is typical or if. Examples of records we might request.