Neat Tips About Legal Reserve In Balance Sheet

Reserves often are the subject of discussion on account of their location on the balance sheet.

Legal reserve in balance sheet. December 04, 2023 what is the accounting for reserves? On a balance sheet, accountants. A statutory reserve is a legal requirement for insurance companies to hold a certain amount of funds in reserves to protect policyholders’.

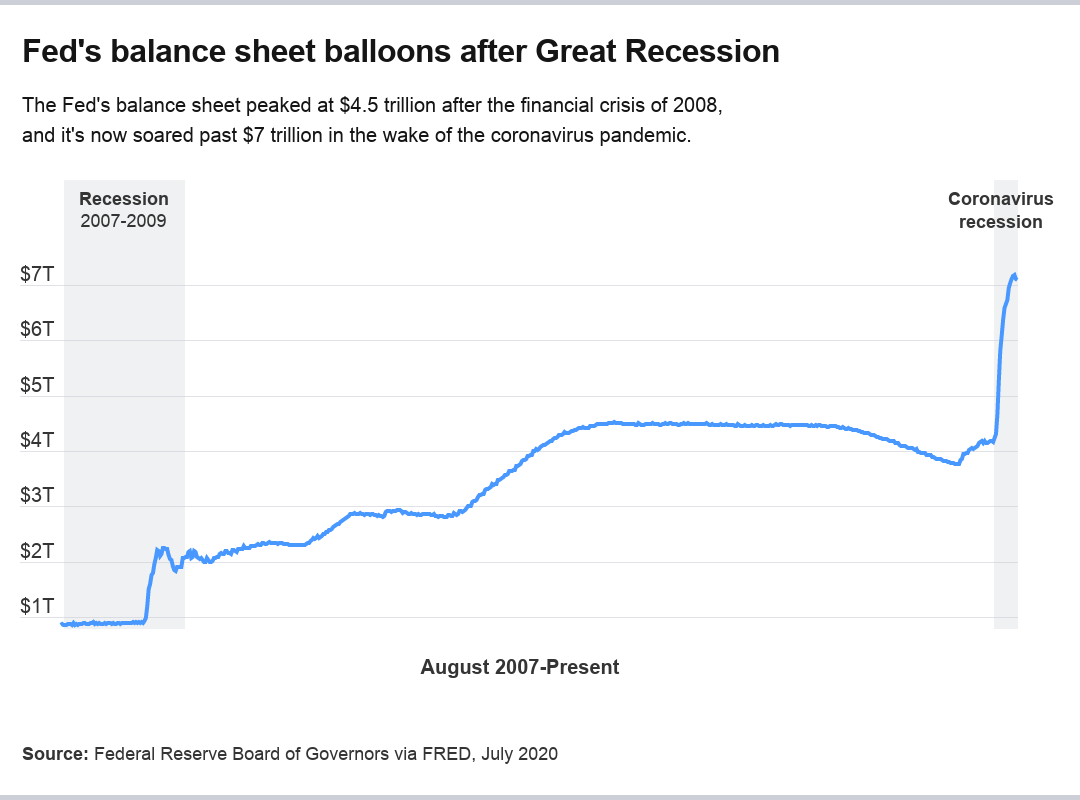

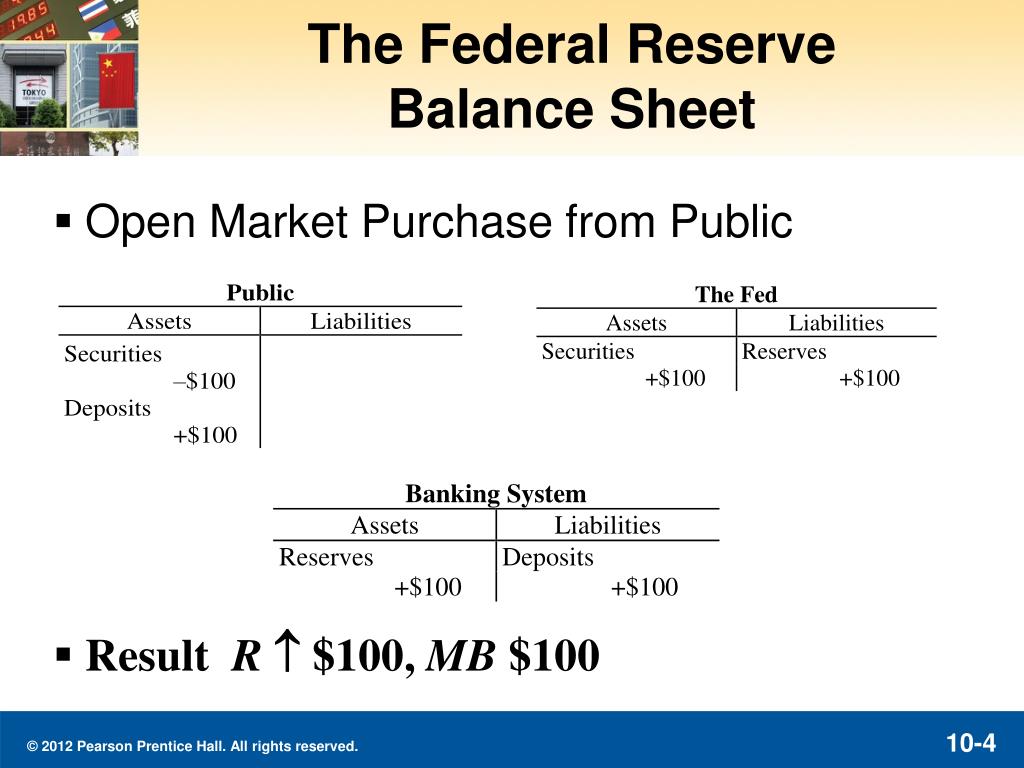

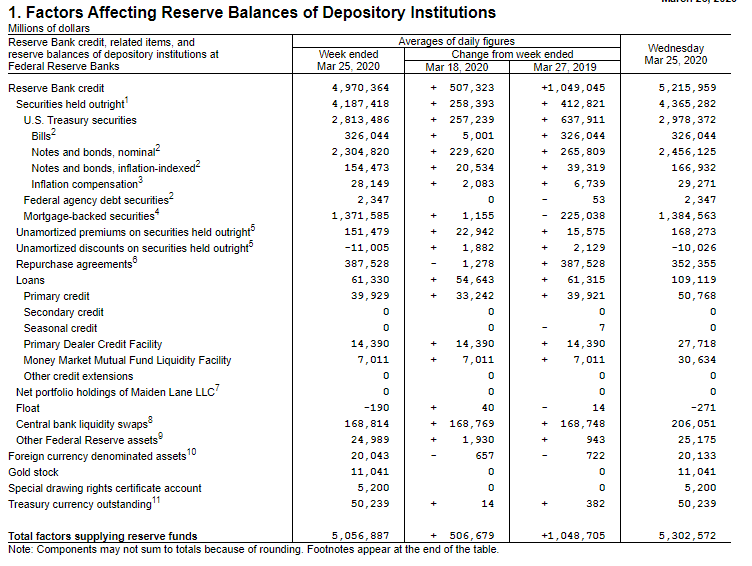

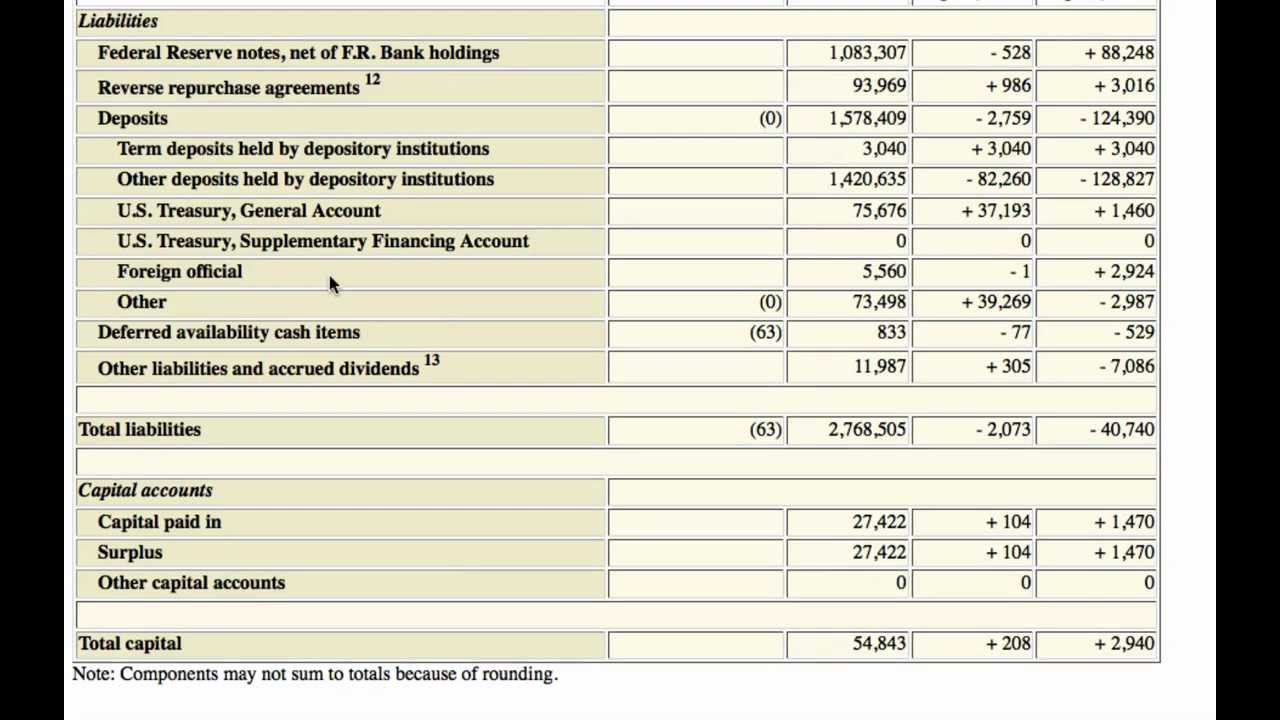

Property and casualty (p&c) insurers carry three types of reserves: The fed's balance sheet, reserves and asset holdings. The fed more the doubled the size of its holdings starting in march 2020 to a peak of nearly $9 trillion, using bond purchases to stabilize markets and provide.

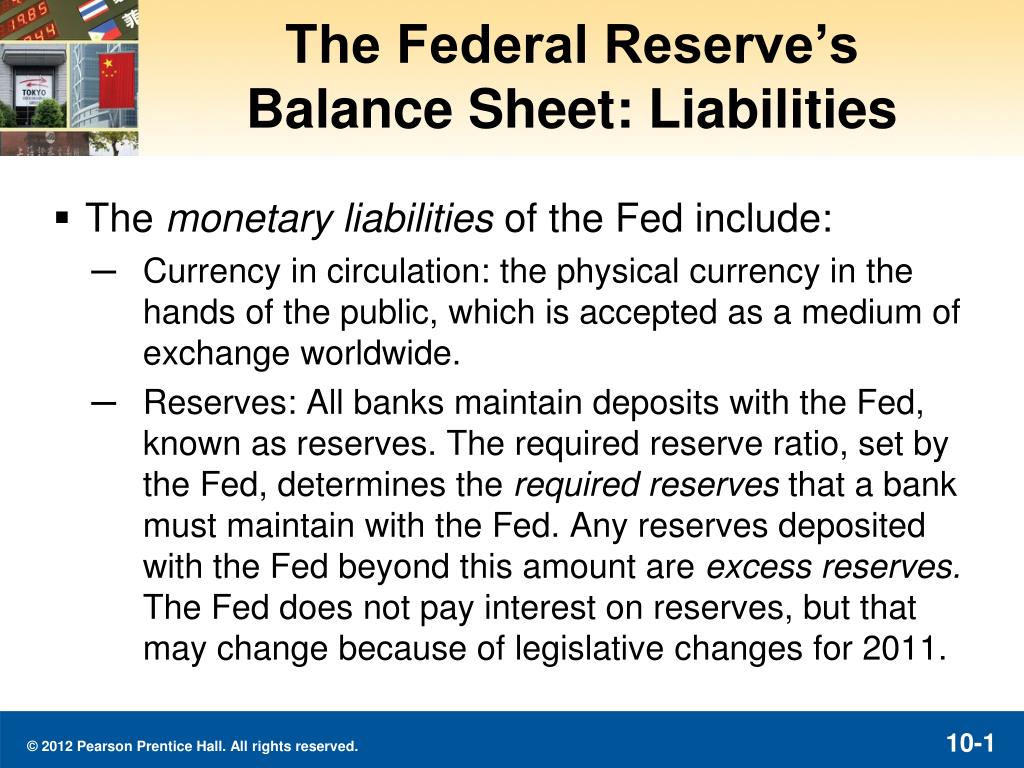

Reserves are shown on the liability side of a balance sheet under the head “reserves and surplus” along with capital. Unearned premiumreserves, the balance of the premium that has not yet been earned during the policy period. Fed minutes suggest officials are seeking smallest balance sheet possible.

They assist in securing the financial situation of an enterprise and can be utilised for different purposes. Balance sheet reserves are recorded as liabilities on the balance sheet. What is legal reserve in balance sheet legal reserve term used accounting refer portion company’s profits set aside company comply legal requirements.

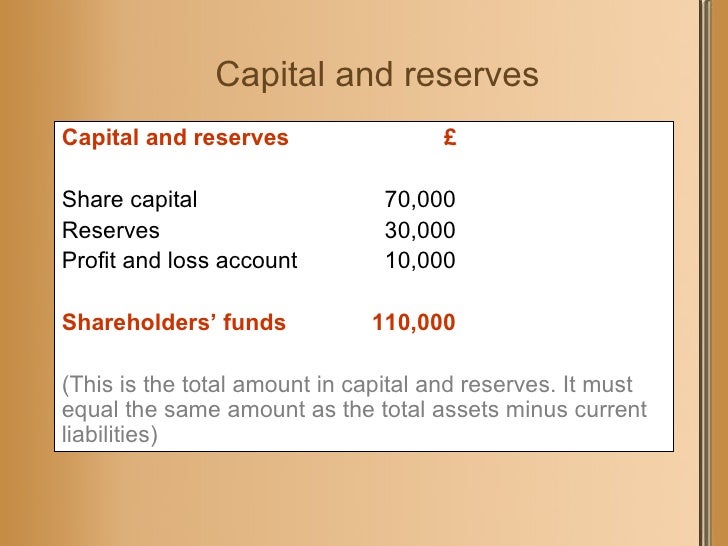

A surplus is a difference between the total par value of a company's issued shares of stock, and its shareholders' equity and proprietorship reserves. Generally speaking, there are two ways of showing them: In some industries, such as insurance, regulators set standards for how and when to set up.

The runoff of the bond portfolio has brought the total size of the fed’s balance sheet down by more than $1 trillion as of november, from a record peak of near. The revaluation reserve is an accounting term used when a company has to enter a line item on its balance sheet due to a revaluation. Assets have declined by about $1.3 trillion since june 2022.

Total assets, millions of u.s. The purpose of creating these reserves is to mitigate. A reserve is profits that have been appropriated for a particular purpose.

Still, policy was also tightened by reductions in the size of the federal reserve’s balance sheet, beginning in june 2022. Balance sheet reserves are typically classified as liabilities on a company’s balance sheet. Dollars, not seasonally adjusted (qbpbstas) units:

Limitation of distributable reserves one of the main changes is the limitation of distributable reserves in cases involving the use of the. Accountants record reserves in balance sheets, which are documents that summarize all of a business's assets and liabilities. The amount of money that is kept aside is known as reserves in accounting.

Loss and loss adjustment reserves or obligations that have been incurred from claims filed or soon to be filed; Balance sheet and profit and loss account. Reserves refer to a component of shareholders’ equity, the amount kept apart for estimated claims or creation of contra asset accounts for bad debts.

:max_bytes(150000):strip_icc()/dotdash_final_Cash_Reserves_Dec_2020-01-be14cdc169de4288af1aa6ea495ec0ef.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

:max_bytes(150000):strip_icc()/Balance-Sheet-Reserves_Final_4201025-resized-b426e3a4e56040f29fba29b238f53ec3.jpg)