Who Else Wants Tips About Complex Income Statement

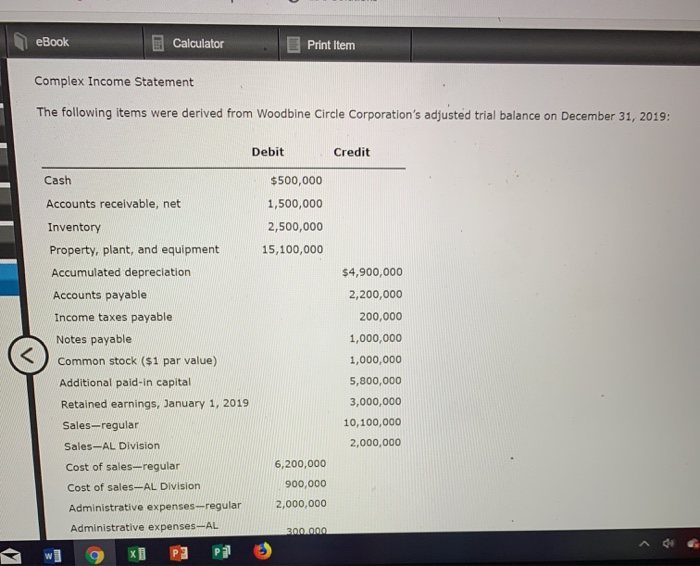

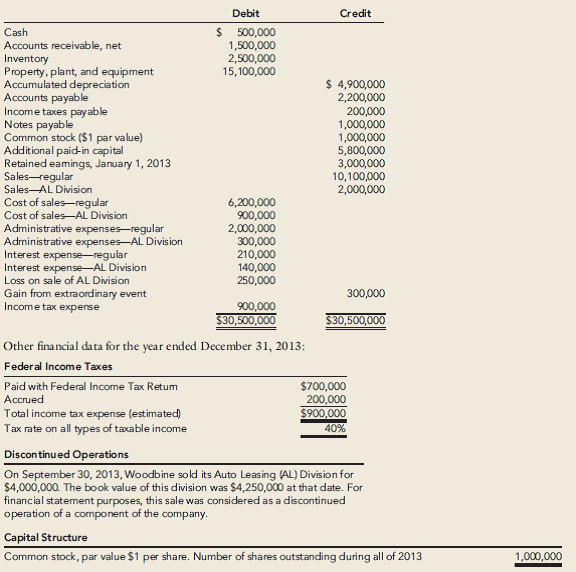

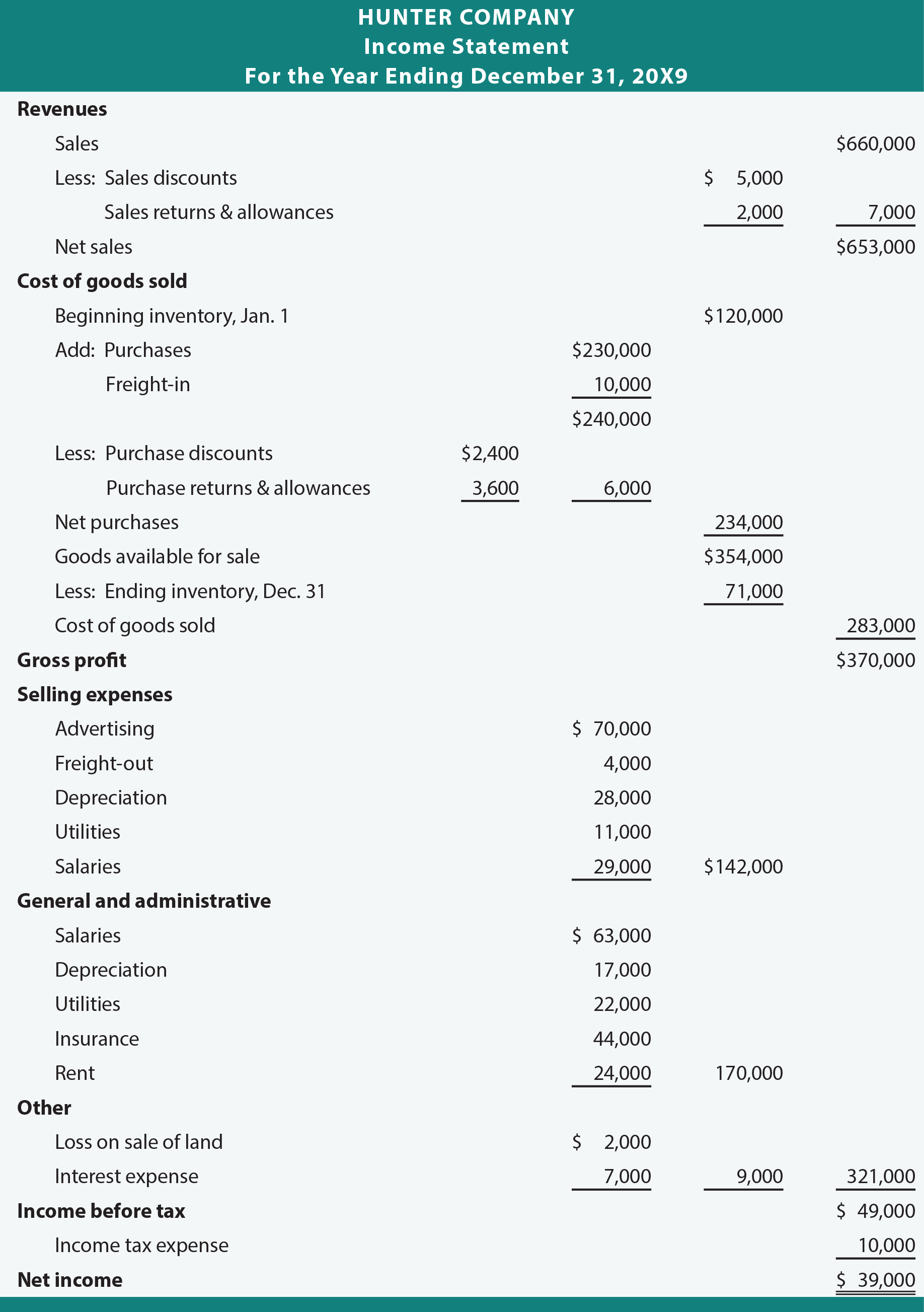

Since income statements for manufacturing companies tend to be more complex than for service or merchandising companies, we devote this section to income statements for manufacturing companies.

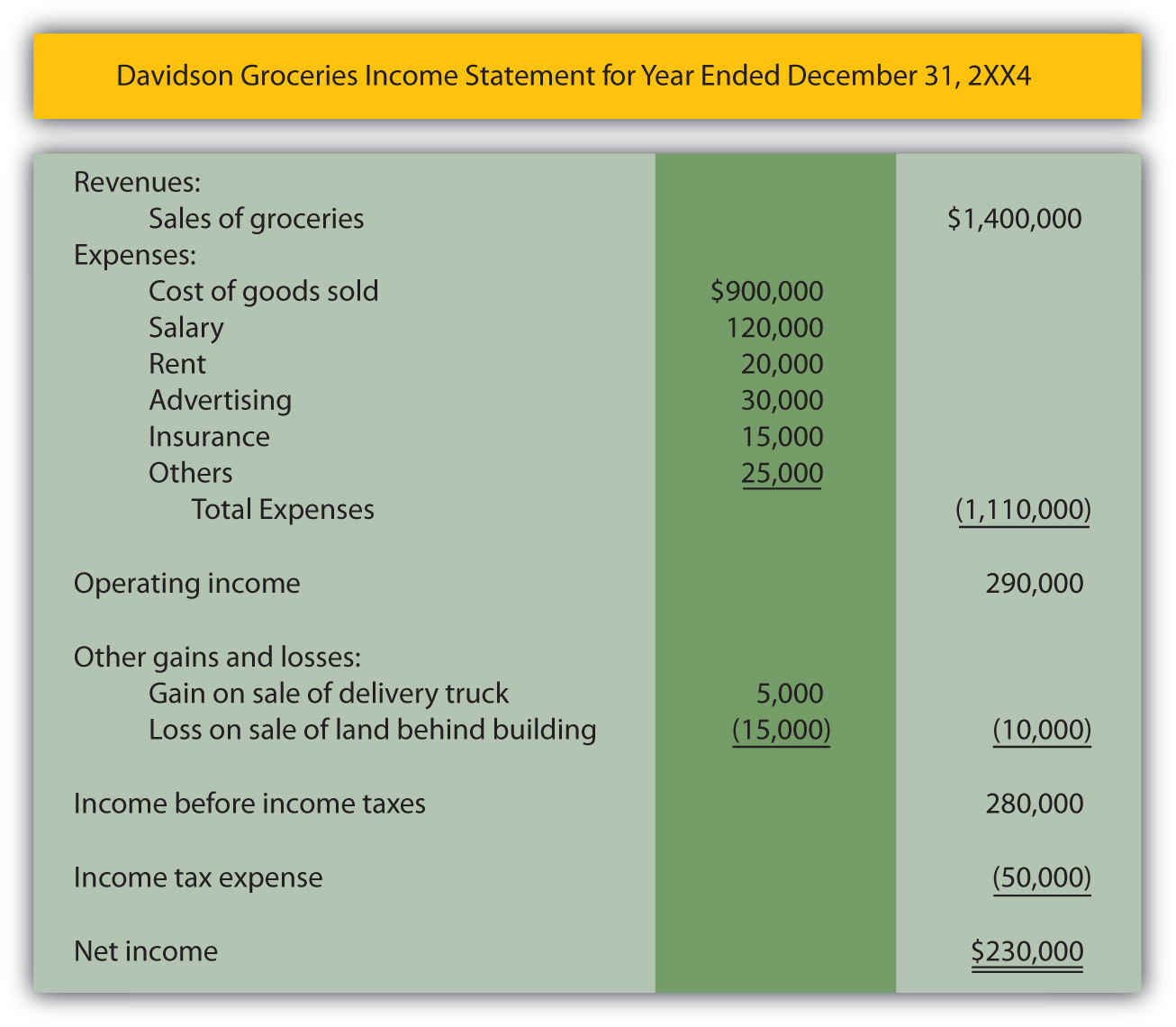

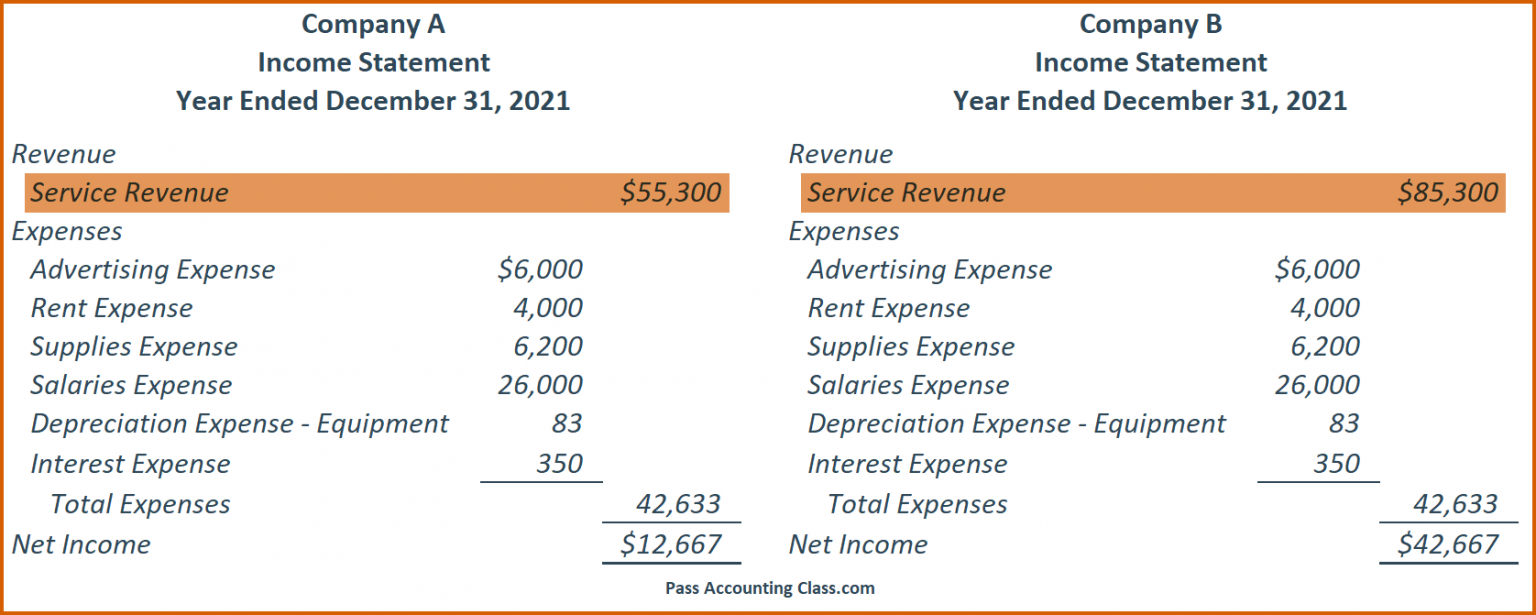

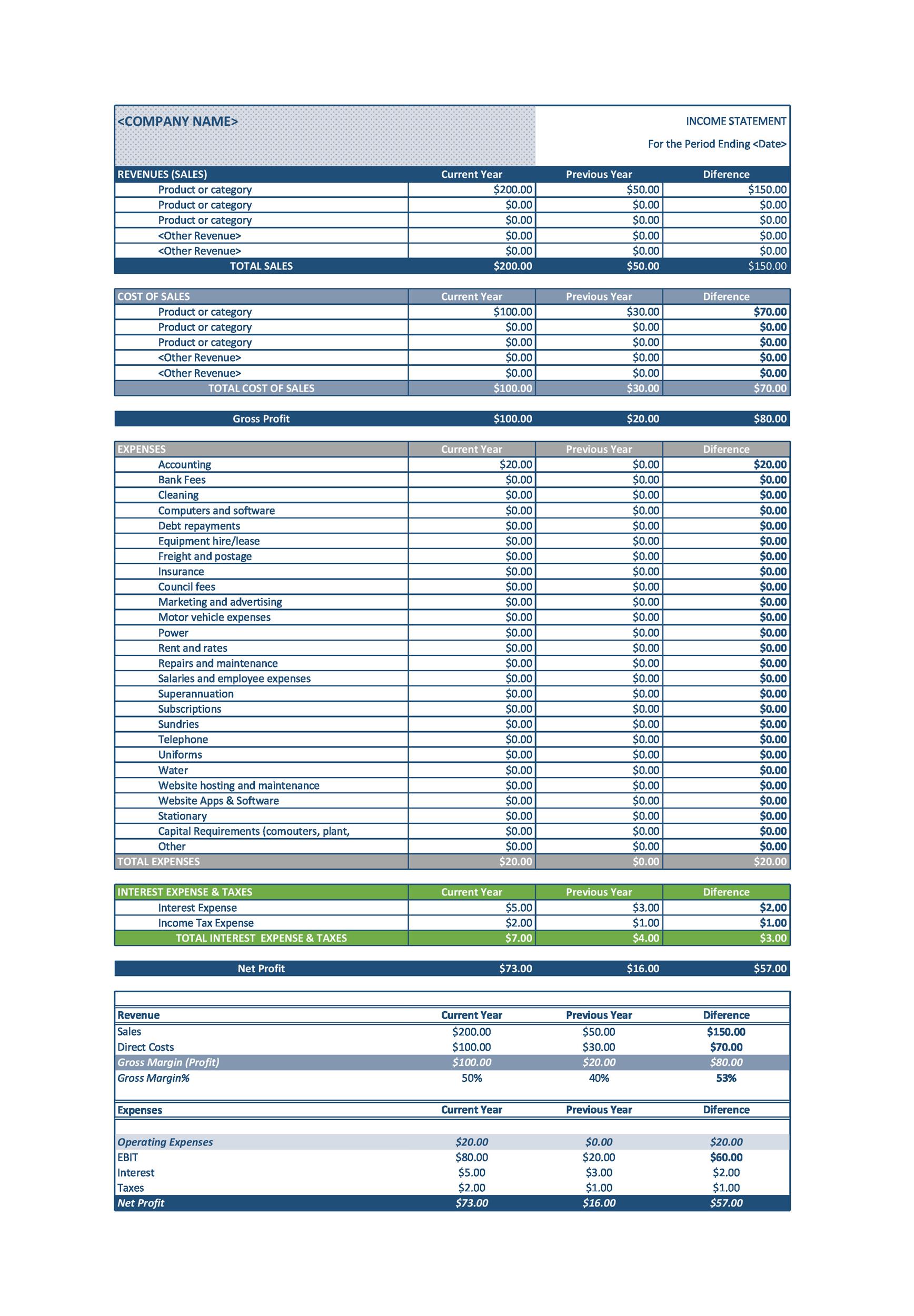

Complex income statement. If you are filing a joint return with a. While income statements can be very complex, the example below illustrates the basic principles manufacturers must follow to create this crucial document. Steps to prepare an income statement.

There are two types of income statement: After a long period of high inflation following the covid‑19 pandemic, many canadians are feeling financial strain. What is the income statement?

Income from operations of $652 million; Revenue, expenses, gains, and losses. The income statement focuses on four key items:

It is also known as the profit and loss (p&l) statement, where profit or loss is determined by subtracting all expenses from the revenues of a company. Which reporting period is right for you depends on your goals. An income statement is a financial document that showcases a company's revenues, expenses, and profits over a specific period.

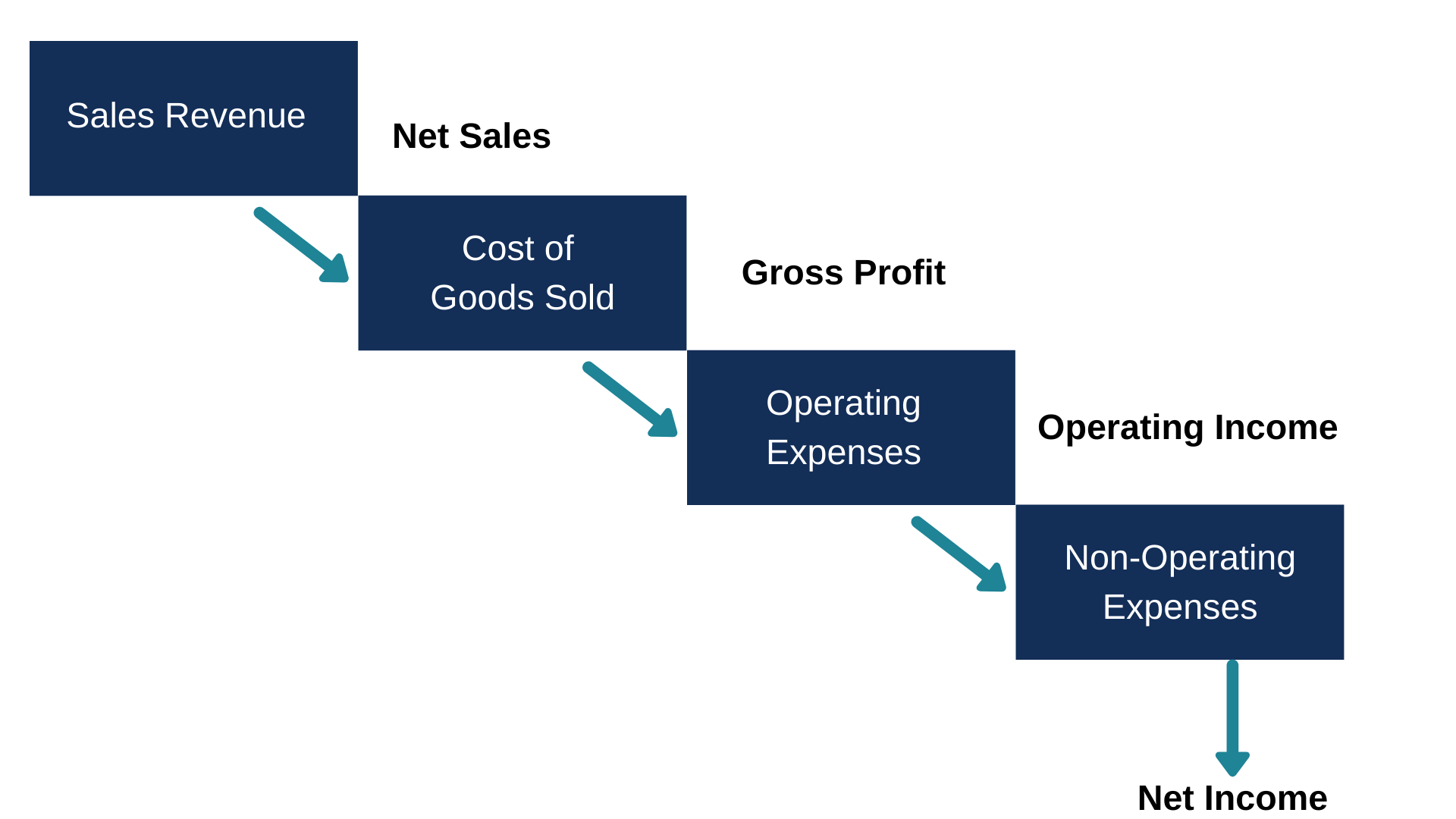

The income statement format is then represented as follows. The income statement, also known as the profit and loss (p&l) statement, is the financial statement that depicts the revenues, expenses and net income generated by an organization over a specific. Understanding the complexity beyond each business’s income statement.

Cost of goods sold $20,000,00: However, it provides greater details on what occurred during the stated time period, especially regarding specific income types and expense transactions. This year, the process of filing an income tax and benefit return may feel particularly daunting.

You will need to file a return for the 2024 tax year: * constant currency (c.c.) adjusts prior year for movements in currencies. An income statement shows how effective the strategies set by the management at the beginning of an accounting period are.

Written by tim vipond reviewed by jeff schmidt guide to financial statement analysis one of the main tasks of an analyst is to perform an extensive analysis of financial statements. Commonly referred to as the profit and loss statement, or s tatement of comprehensive income , it focuses on revenues, expenses, gains, and losses. In such a stressful economic environment, the last thing anyone.

This calculation shows investors and creditors the overall profitability of the company as well as how efficiently the company is at generating profits from total revenues. The single step income statement totals revenues, then subtracts all expenses to find the bottom line. Sales on credit) or cash vs.

Your reporting period is the specific timeframe the income statement covers. The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time. In this free guide, we will break down the most important types and techniques of financial statement analysis.