Impressive Tips About Salaries And Wages Expense On Balance Sheet

In summary, the accrual of wages expense increases the accrued wages payable liability on the balance sheet and decreases the retained earnings in the equity.

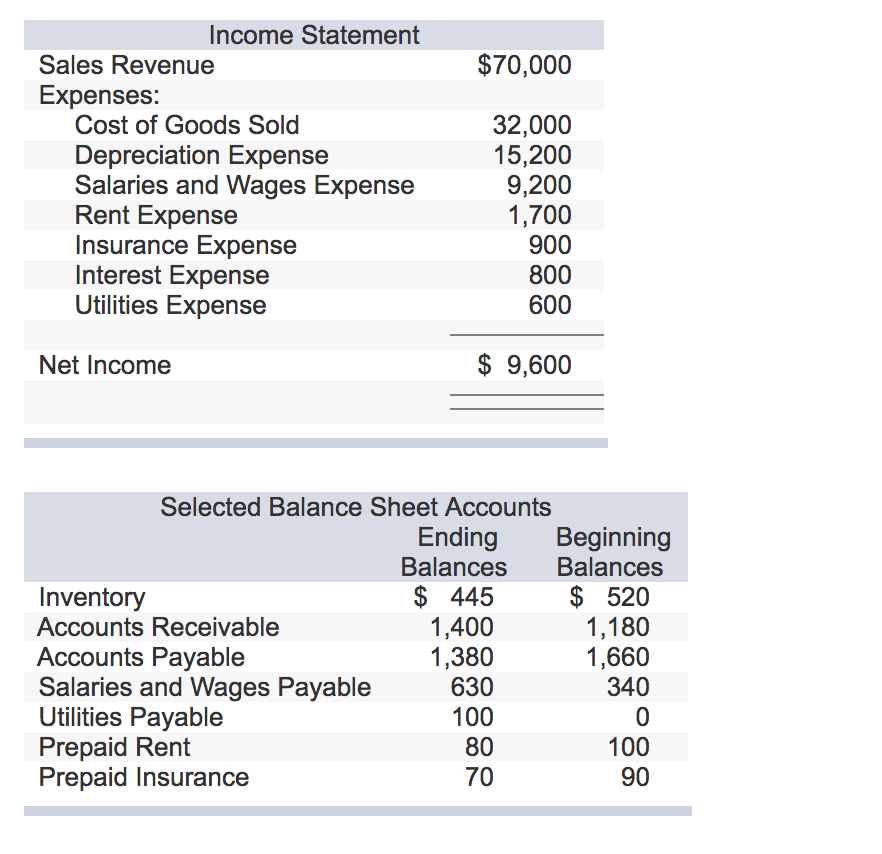

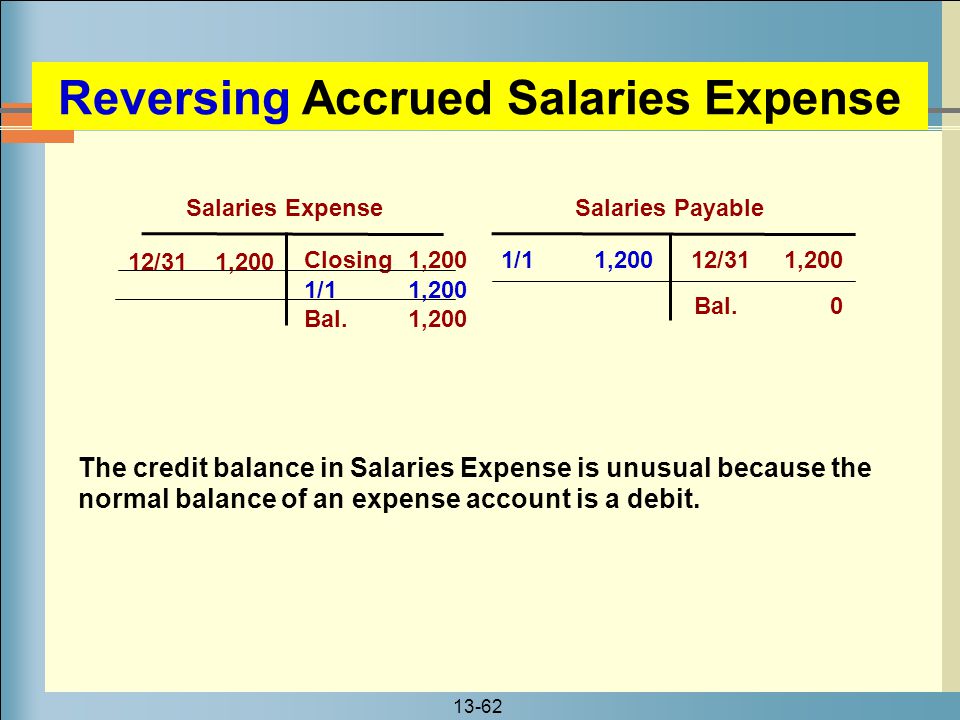

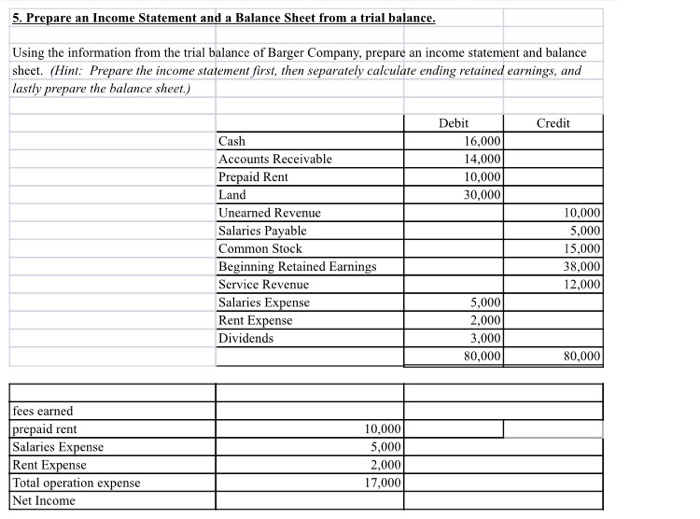

Salaries and wages expense on balance sheet. The statement of retained earnings will include beginning retained earnings, any net income (loss) (found on the income statement), and dividends. An accrued salary expense is likely to affect both the income statement and the company’s balance sheet. Salaries payable and salaries expense are similar concepts, but they have distinct roles in accounting.

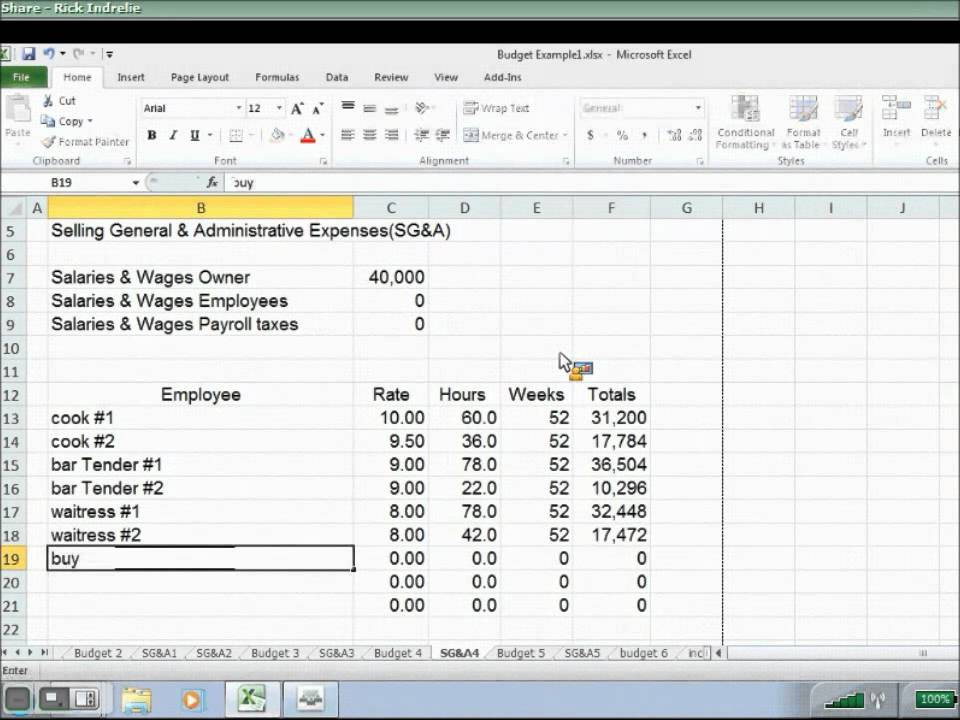

The account wages and salaries expense (or separate accounts such as wages expense or salaries expense) are used to record. This adjusting entry increases both the payroll expenses reported on the income statement and the accrued payroll expenses that appear as a liability on the. The balance of unfulfilled payroll expenses.

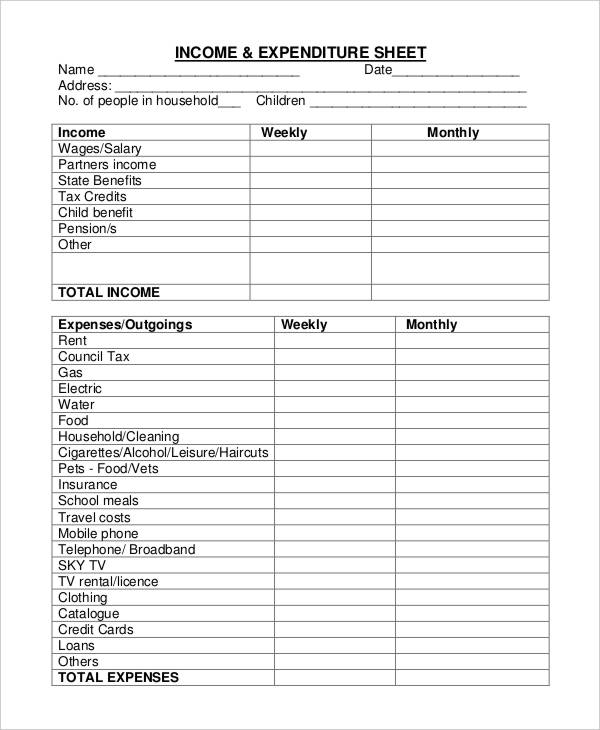

Payroll taxes withheld from employees' gross pay. By mark kennan published on 26 sep 2017 balance sheets function like a snapshot of the financial state of the company at a given point in time. How does an expense affect the balance sheet?

Salaries and wages payable is a balance sheet account that increases the total liabilities of a business. Salaries, wages and expenses on a balance sheet income statement vs. Under the accrual method of accounting, the account salaries expense reports the salaries that employees have earned during the period indicated in.

An expense is a cost that has been used up, expired, or is directly related to the earning of revenues. Accrued wages represent the unmet employee compensation remaining at the end of a reporting period, i.e. Assets = liabilities + equity.

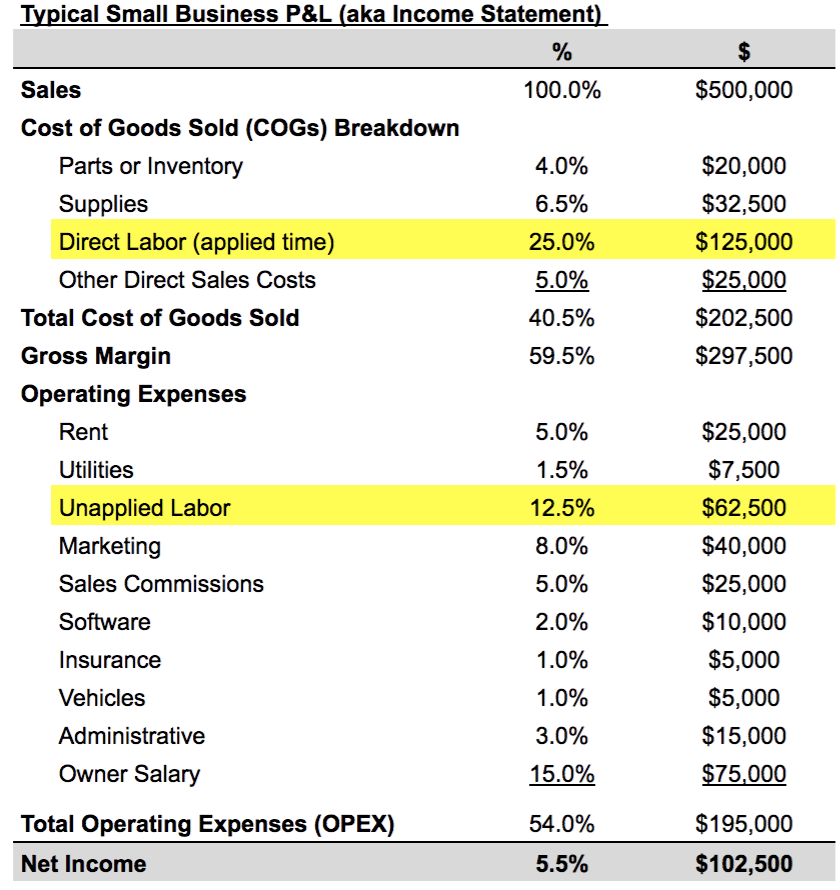

For the most part, the more your. Salaries, wages and expenses are vital components of your income statement, which. Income, expenses, and profit/loss.

This statement is a great place to begin a financial model, as it requires the least amount of information from the balance sheet and cash. Wage expense is typically combined with other expenses on the. There are three main types of wage expenses:

Salaries expense is how much an employee earned in. Payroll taxes that are not withheld from employees and are. Definition of wages and salaries expense.

This is because an accrued salary expense affects both the expense. Why are salaries and wages payable important? The balance sheet follows a basic accounting equation:

(1) times wages, (2) piece wages, and (3) contract wages. This equation ensures that the balance sheet remains in balance, as the total. When the products are sold, the costs assigned to those products (including the manufacturing salaries and wages) are included in the cost of goods sold, which is.

![[Solved] statement and balance sheet excerp SolutionInn](https://s3.amazonaws.com/si.question.images/images/question_images/1543/4/8/9/0145bffc5f6069c91543471535041.jpg)