Here’s A Quick Way To Solve A Tips About Statement Of Cash Flows From Operating Activities

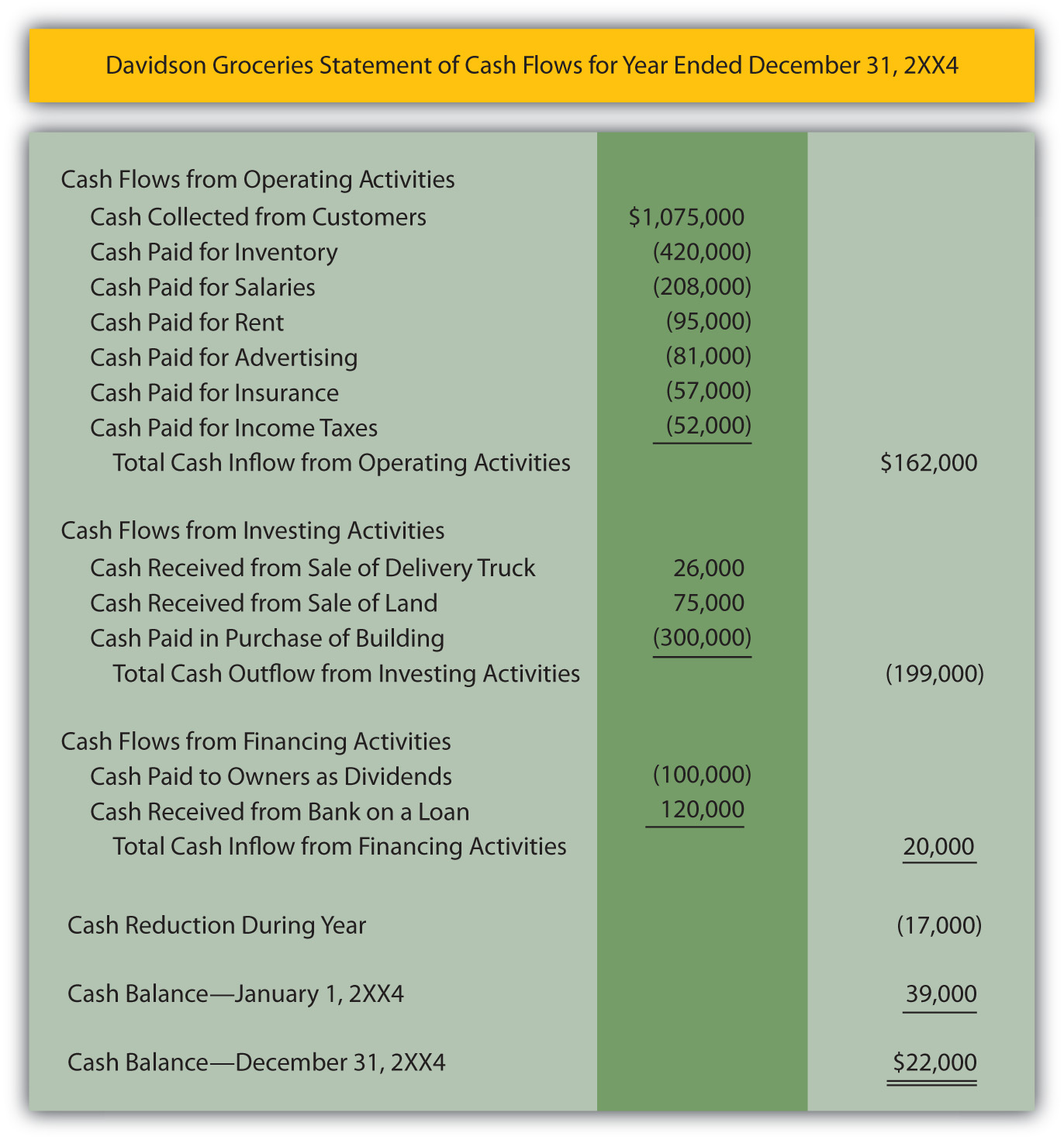

Operating activities include generating revenue, paying expenses, and funding working capital.

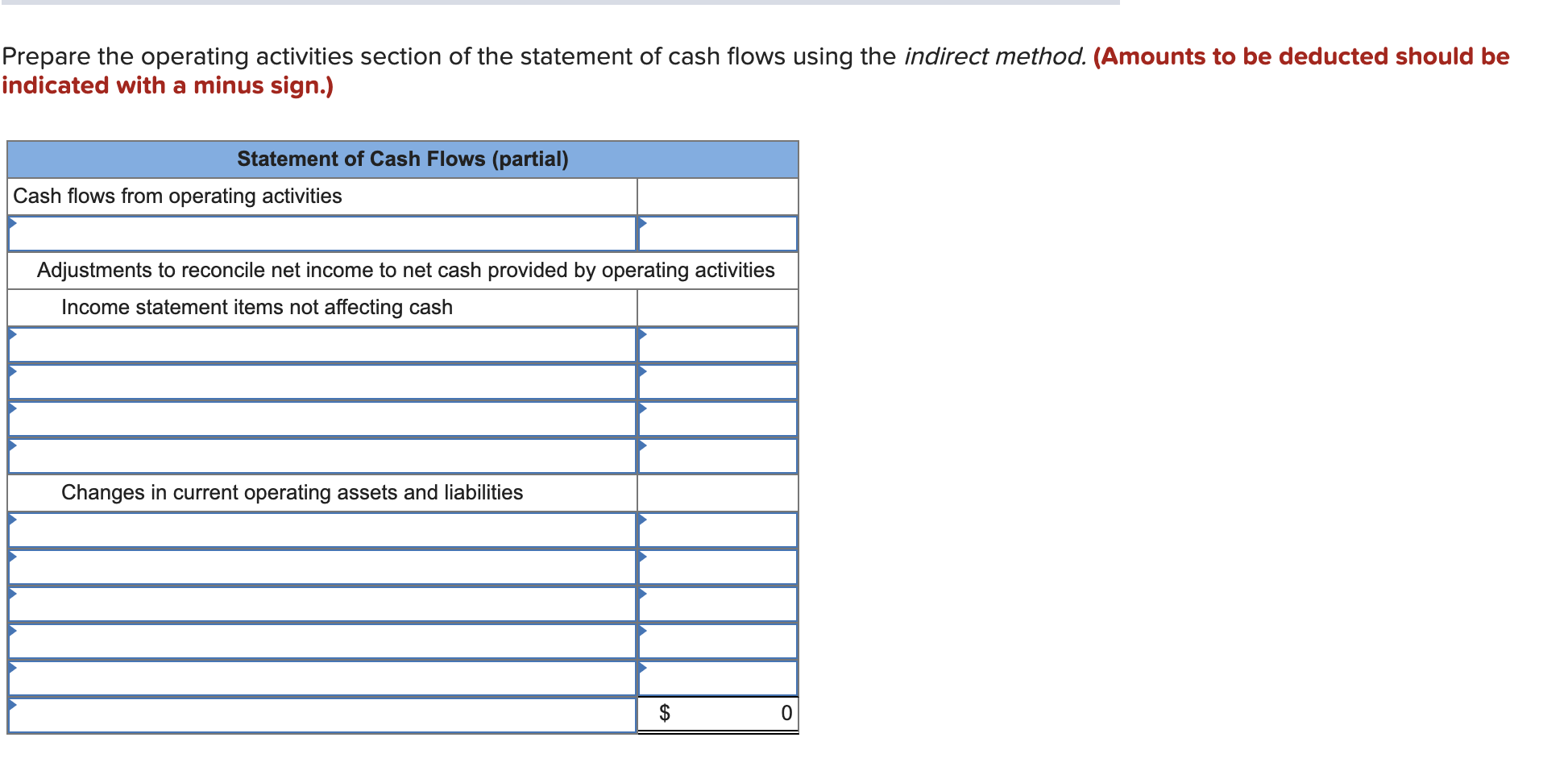

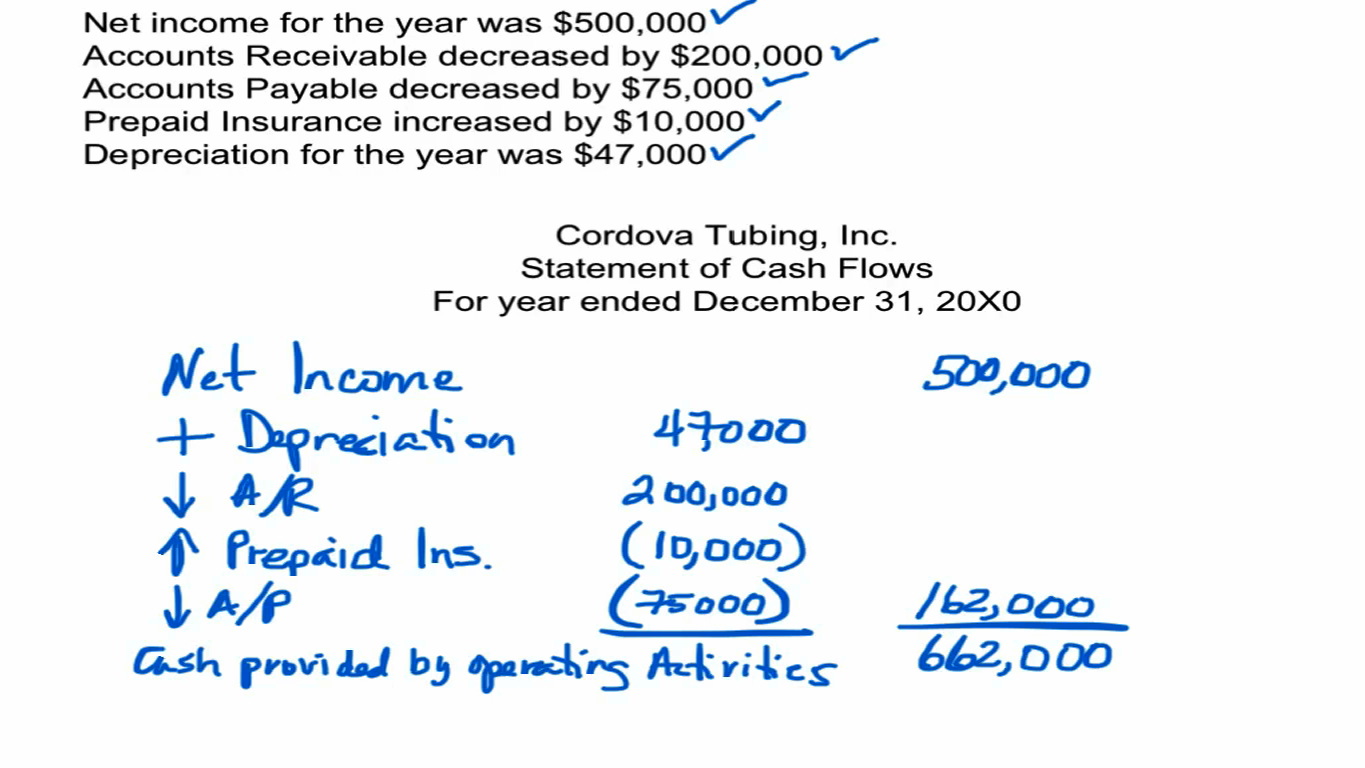

Statement of cash flows from operating activities. Cash flow from operations is the section of a company’s cash flow statement that represents the amount of cash a company generates (or consumes) from carrying out its operating activities over a period of time. Then, you’ll break down any adjustments you’ve made to reconcile net income to net cash from operating activities. A cash flow statement tells you how much cash is entering and leaving your business in a given period.

Cash flow is calculated using the direct (drawing on income statement data using cash receipts and disbursements from operating activities) or the indirect method (starts with net income,. Cash flows from financing activities. Although $238,000 of merchandise was acquired, only $229,000 in cash payments were made ($238,000 less $9,000).

Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. The economic decisions that are taken by users require an. Ias 7 prefers the direct method to be used, but it permits the use of the indirect.

Cash flows from operations can be found in the first section of a cash flow statement, which breaks down a company's cash inflow and outflow into three categories: Cash receipts from fees, royalties, commissions, and other revenue. [ias 7.1] the statement of cash flows analyses changes in cash and cash equivalents during a period.

Operating cash flow indicates whether a company is able to. Operating activities, investing activities, and financing activities. Some of the cash flows arising from operating activities are as follows:

$405,200.00 adjustments to reconcile net income to net cash flows from (used for) operating activities: Operating activities include cash received from sales, cash expenses paid for direct costs as well as payment is done for funding working capital. Cash flow from operations is the first of the three parts of the cash flow statement that shows the cash inflows and outflows from core operating the business in an accounting year;

The only difference between the two is how cash flows from operating activities is presented. For the year ended december 31, 2021 cash flow from operating activities: Cash payments to suppliers for goods and services.

Cash flow from investing activities: $81,750.00 loss on disposal of equipment: Items related to investing or financing activities.

Cash flows from investing activities, and. The two methods of calculating cash flow are the direct. The remaining sections and all other parts are the same.

+23.6% organic recurring operating income: Add back noncash expenses, such as depreciation, amortization, and depletion. $22,300.00 changes in current operating assets and liabilities:

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)